Category List

Crypto Trading Charts: A Comprehensive Guide for Traders | Altrady

Cryptocurrency trading charts are vital in analyzing market trends, identifying patterns, and making informed trading decisions. Understanding how to read and interpret these charts is essential for traders navigating the volatile world of cryptocurrencies.

This comprehensive guide will delve into the fundamentals of crypto trading charts, explore various chart types and indicators, and introduce Altrady as the best platform for charting and trading.

Importance of Crypto Trading Charts

Crypto trading charts provide valuable insights into the price movements of cryptocurrencies over time. By examining historical data and patterns, traders can identify trends, support, and resistance levels, and potential trading opportunities. Charts help traders visualize market sentiment, volume, and price fluctuations, enabling them to make more informed decisions.

Common Types of Crypto Trading Charts

Line Charts

Line charts display the closing prices of a cryptocurrency over a specific period, offering a simplified view of price trends. They are ideal for quickly gauging the overall direction of the market.

Candlestick Charts

Candlestick charts provide a more detailed view of price movements. Each candlestick represents a specific time interval and displays the opening, closing, high, and low prices. Traders can identify patterns such as doji, hammer, and engulfing, which can signal potential market reversals or continuations.

Bar Charts

Bar charts display price information using vertical lines (bars) with horizontal lines extending from them. They show the opening, closing, high, and low prices for a specific time period, providing traders with a comprehensive overview of price movements.

Key Charting Indicators and Tools

Moving Averages

Moving averages smooth out price fluctuations and help identify trends. Traders commonly use the 50-day and 200-day moving averages to gauge long-term price direction.

Relative Strength Index (RSI)

RSI is a momentum oscillator that measures the speed and change of price movements. It helps traders identify overbought and oversold conditions, indicating potential reversals or continuations.

Bollinger Bands

Bollinger Bands consist of a moving average line and two bands representing standard deviations from the average. They help identify periods of high or low volatility, aiding traders in assessing potential price breakouts or reversals.

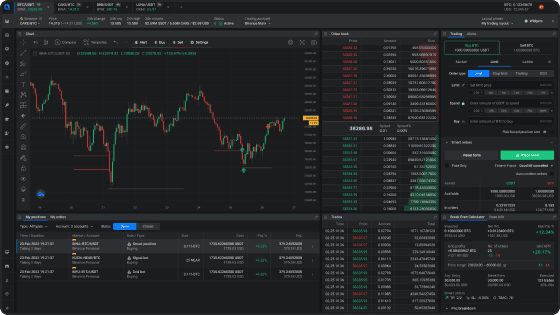

Introducing Altrady: The Best Platform for Crypto Trading Charts

Altrady is a leading cryptocurrency trading platform offering a comprehensive charting and trading tool suite. With Altrady, traders can access real-time market data, multi-charting features, and various technical indicators. In addition, the platform's intuitive interface simplifies the process of analyzing charts, enabling traders to make better-informed decisions.

Altrady provides seamless integration with multiple exchanges, including Binance, Kucoin, and ByBit, allowing traders to execute trades directly from the charting interface. Additionally, Altrady offers crypto portfolio features, trading bots, smart trading, trade analytics, and risk management tools, empowering traders with all the necessary resources to succeed in the crypto market.

Conclusion

Mastering crypto trading charts is a crucial skill for any trader looking to navigate the cryptocurrency market successfully. By understanding different chart types, indicators, and tools, traders can gain valuable insights and make informed trading decisions. With its robust charting capabilities and comprehensive trading features, Altrady stands out as the best platform for traders seeking a powerful, user-friendly.

Catalin is the co-founder of Altrady. With a background in Marketing, Business Development & Software Development. With more than 15 years of experience working in Startups or large corporations.

FREE PAPER TRADING PLAN FOREVER

Practice trading with no risk and no time limit!

Altrady's free forever paper trading plan is the perfect way to sharpen your skills and boost your confidence.

After the 14 days free trial, you will have unlimited access to the Free Paper Trading Plan.

Related Articles

Use Watchlists and Crypto Alerts For Faster and More Effective Trading Decisions

Scalping: Mastering the Art of Fast Profits in Trading

Crypto Day Trading: Maximizing Profits in the Fast-Paced Cryptocurrency Market

The Best Cryptocurrency Charting and Trading Software and Tools