Chapters

The Role of Miner Behavior in Crypto Price Trends

Few market forces are as influential, yet often overlooked, as the behavior of cryptocurrency miners. Their actions affect the supply of new coins and serve as real-time indicators of market confidence.

For savvy traders, understanding these signals can offer a competitive edge when navigating miner crypto price trends.

Supply and Sell Pressure: The Miner’s Dilemma

Miners play a pivotal role as the primary suppliers in crypto ecosystems like Bitcoin, Ethereum Classic, and Litecoin. Their behavior—whether they choose to hold or sell mined coins—can generate powerful waves across the price charts.

Miners as Key Suppliers

Miners introduce new coins into circulation by validating transactions and solving cryptographic puzzles.

When they sell rewards immediately, they increase the circulating supply and contribute to sell pressure. If they hold, they reduce available supply and support bullish sentiment.

Sell-Offs and Price Drops

Miners often sell coins to cover expenses like electricity and hardware maintenance. These bulk liquidations can have ripple effects:

- Price dip triggers: Large sell-offs, especially during weak demand, create downward pressure.

- Feedback loop risk: Falling prices lead to more selling, amplifying market volatility.

Recently, Bitcoin miners have faced production costs exceeding $70K per BTC—up from $64K in Q1 2025—which is squeezing margins and forcing some to liquidate.

Bulk selling by miners can trigger domino price drops, especially when broader demand is weak.

Holding and Price Support

- Restricted supply: Holding reduces immediate sell pressure, fostering potential price appreciation.

- Signal of confidence: Traders see miner holding as bullish behavior, reinforcing HODL sentiment.

In May–June 2025, miners were holding onto coins eagerly, reaching the lowest sell‑side pressure since 2024.

CryptoQuant reports ~4,000 BTC added to miner reserves since April – despite all‑time highs, signaling bullish long-term conviction.

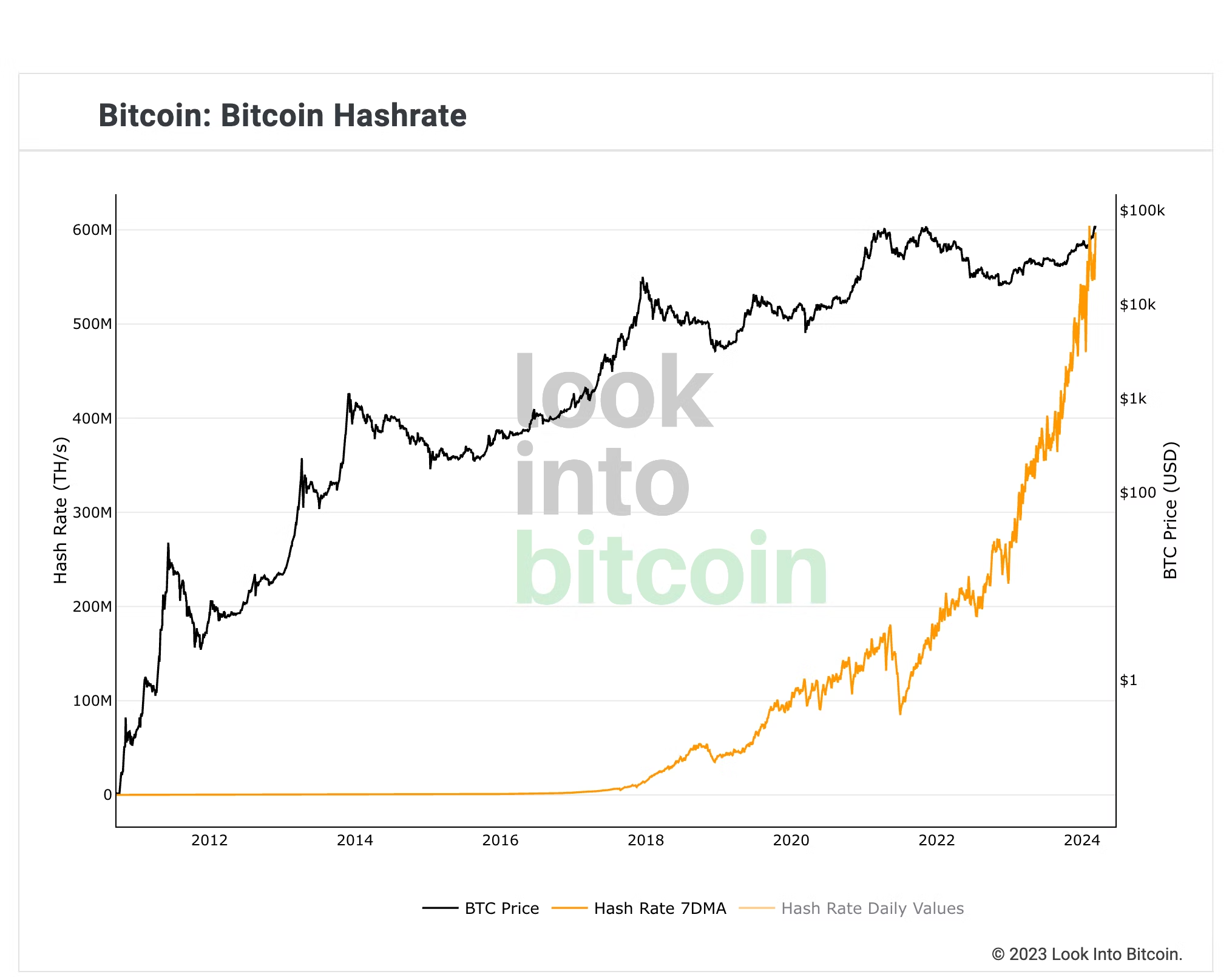

Hashrate and Profitability: A Sentiment Barometer

The total computing power used to mine cryptocurrency—the hashrate—functions as a proxy for miner optimism. Rising hashrate typically signals belief in future profits and network stability.

Bitcoin’s hashrate and difficulty surged to record highs in 2025 – over 913 EH/s—with costs over $70K per BTC.

Source: Swan Bitcoin

Hashrate as a Sentiment Indicator

Rising hashrate: Suggests increased investment in mining and bullish expectations.

Declining hashrate: This may indicate miners exiting due to low profitability or high costs.

Mining Costs and Price Floors

Operational costs influence miner decisions and act as a soft price floor:

Mining breakeven: If prices fall below production costs, miners pause selling.

Price stabilization: Reduced sell pressure can support recovery, especially during downturns.

Q1 2025 saw USD‑denominated hashprice drop ~11.5%—but BTC hashprice held steady.

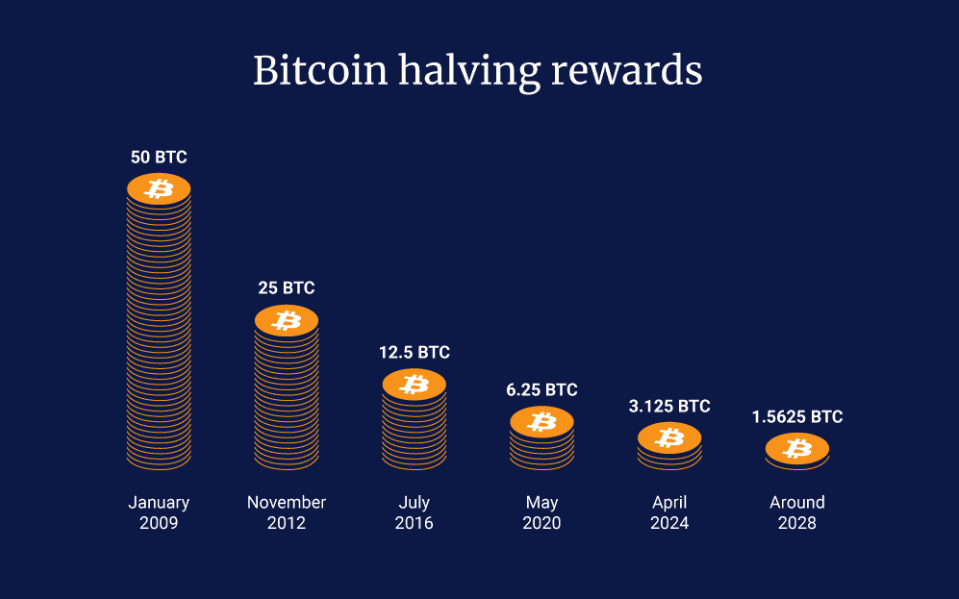

Halving Events and Supply Shocks

Cryptocurrency networks often undergo programmed “halving” events—moments when block rewards are slashed, reducing the rate of new coin issuance.

Reduced Block Rewards

- Halving effect: A 50% drop in block rewards immediately limits new supply.

- Historical pattern: Bitcoin halvings in 2012, 2016, and 2020 preceded major price rallies.

The fourth Bitcoin halving occurred on April 20, 2024, cutting block rewards from 6.25 BTC to 3.125 BTC. Next halving, projected for March 26, 2028, will reduce rewards to 1.5625 BTC.

Source: Independent Reserve

Market Anticipation

- Pre-halving accumulation: Miners may stockpile coins ahead of halvings to capitalize on future price growth.

- Supply suppression: This behavior tightens supply, often reinforcing bullish trends.

For instance, post-2024 halving, the miner sell pressure hit multi‑year lows, supporting stronger mid‑term price action.

Miner Capitulation and Market Bottom Signals

In bear markets, inefficient miners may struggle to break even, leading them to liquidate holdings or shut down operations.

Capitulation During Downturns

- Forced selling: Unprofitable miners often liquidate or power down, creating short‑term sell pressure and often marking local market bottoms.

- Weak hands exit: Many smaller operations have now exited post‑2024 halving, while larger firms consolidate.

Difficulty Adjustments

- When miners exit, networks automatically reduce mining difficulty:

- Boosts profitability: Remaining miners enjoy better reward conditions.

Encourages re-entry: This stabilizes the ecosystem and can lead to renewed price support.

Broader Market Effects

Miner activity doesn't just influence prices directly; it also sends shockwaves into peripheral markets and regulatory landscapes.

Equipment and Investment

- Hardware demand spikes: Mining booms drive GPU and ASIC prices sky-high.

- Attracts institutional interest: Big players enter the mining sector, fueling market confidence.

For instance, Mining-as-a-Service and hashrate derivatives (futures) have launched, turning hashrate into a financial asset.

And U.S.-listed miners (MARA, CLSK, RIOT) now command 31.5% of global hashrate, doubling their share YoY.

Regulatory and Environmental Factors

- Crackdowns: Countries like China and Kazakhstan have introduced bans or constraints on mining.

- Energy cost volatility: Surges in electricity prices can make mining unprofitable, affecting hash rate and sentiment.

U.S. SEC clarified in March 2025 that PoW mining isn’t regulated as a security, offering clarity. ESG matters are now non‑negotiable: mining firms report carbon use and adhere to environmental rules in key U.S. states.

Summary Table: Miner Behavior and Price Impact

Here’s a quick reference guide summarizing how different miner actions influence miner crypto price trends:

| Miner Behavior | Typical Price Impact | Explanation |

| Selling large rewards | Downward pressure | Increases circulating supply |

| Holding coins | Upward/supportive pressure | Restricts supply, signals market confidence |

| Rising hashrate | Bullish sentiment | Suggests optimism and investment in mining |

| Falling hashrate | Bearish sentiment | Indicates financial strain or exit |

| Halving event | Upward pressure (historical) | Cuts supply, often precedes rallies |

| Miner capitulation | Short-term drop, then rebound | Signals bottom as weak players exit |

Key Takeaway

Crypto miner behavior is a powerful driver of miner crypto price trends. From sell-offs and hash rate fluctuations to halving events and capitulation phases, these dynamics shape both short-term volatility and long-term value trajectories. For traders and investors, keeping a pulse on miner sentiment and network metrics offers critical foresight into market direction—and potentially, opportunity.

So next time you're charting candlesticks or scanning indicators, zoom out and ask: What are the miners doing? It might just reveal your next winning move.

.svg)