.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

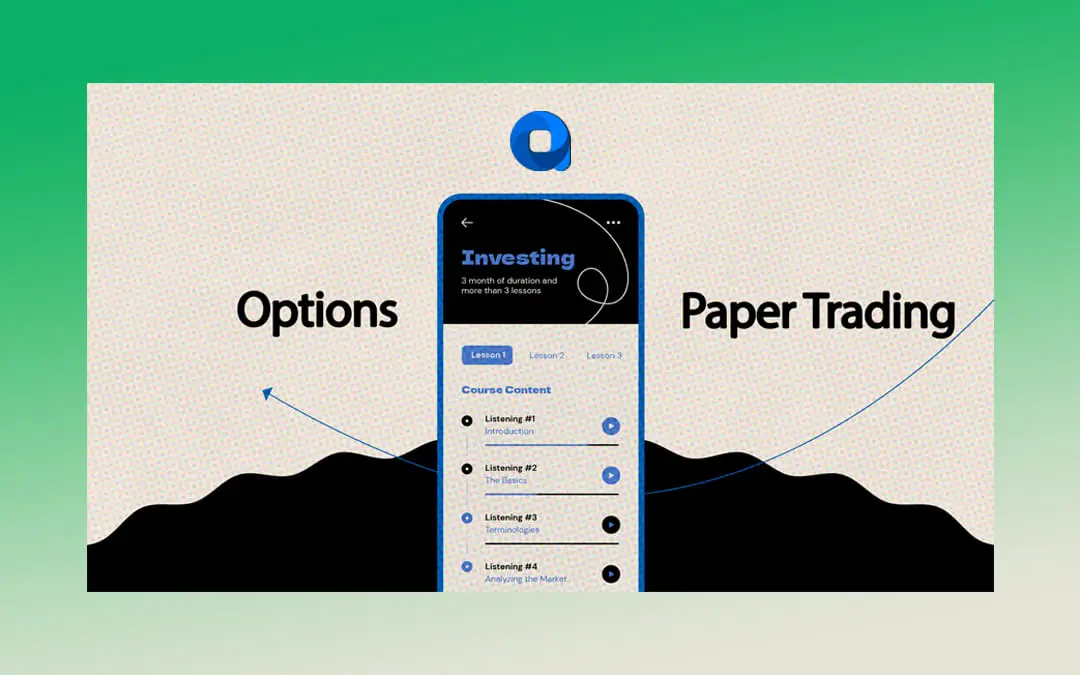

How to Practice Crypto Options Trading with Paper Trading

Options trading is a lucrative yet very risky trading form. It allows traders to predict price movements and then buy options contracts to earn profit in the future. These contracts let them sell or purchase a chosen asset at the decided price.

Options trading is not for everyone due to the huge risk involved in it. You need to be very careful and skillful to try your luck at it.

People new in trading can gain the required experience through options paper trading. It will allow them to exercise trading without committing real money.

Key Takeaways

- Traders can earn a huge profit from options trading due to price movements in assets. They can also lose a lot of money by making a minor mistake or wrong decision.

- It is best to first try paper trading. Move to real trading after getting enough experience and knowledge. Paper trading lets people try-out different trading strategies without risking real money.

- It is important to choose the right platform for options paper trading. A platform that offers advanced trading features and a free trading account is worth trying. You must compare multiple platforms before selecting one for learning purposes.

Understanding Options Trading

Options trading means buying contracts that allow users to purchase or sell an asset at a fixed price and chosen time.

The contract owner has the right to use the contract but he/she is not bound by law to do it. If he/she plans to not exercise the contract, he/she loses the money used to buy it.

Options have two types – call options and put options.

- Call option: This means you will purchase an asset at a certain rate and time.

- Put option: It means you will sell an asset at a set rate.

- Strike price: The fixed price at which traders sell or purchase an asset.

- Expiration date: Each contract has an expiry date. If you do not exercise your option before it, your contract expires and becomes useless.

The Importance of Paper Trading for Options

Options paper trading comes with a plethora of benefits, such as:

- You can try a very risky kind of trading in a totally risk-free environment.

- You can familiarize yourself with how options trading works. Learn how to buy and manage options without investing real cash.

- You can test numerous trading strategies. Figure out what works for you and suits your trading style. You can learn from your mistakes and improve your strategy before using it in a live market.

- While practicing options, you do not experience fear of financial damage as no real money is involved in simulated trading. It allows you to focus more on the important stuff and worry less about your financial status.

Choosing a Platform for Options Paper Trading

While numerous crypto trading platforms offer options paper trading, not all of them are created equal. Some are better than others, but how do you choose a better platform?

Well, here are the top 8 things you must look for in a platform before selecting it.

- Realistic market conditions

- Free trial versions

- Real-time data availability

- Complete analytics

- Advanced trading tools

- Automated trading

- User-friendly interface

- Good customer service

Starting Your Paper Trading Journey

Are you planning to start paper trading? Take these steps to create a paper account successfully.

- Choose a platform offering options paper trading.

- Register your account.

- Activate the paper trading mode.

- Get started.

Now that you have created an account, start practicing options trading. Keep these tips in mind to make the most of your options paper trading.

- Set clear objectives and take action accordingly. Create an executable plan using various strategies to achieve your goal.

- Try to evoke the emotions you would feel while investing your hard-earned money.

- Do not make reckless decisions. Analyze the changing marketing conditions carefully and then make an informed decision accordingly.

- Track your gains and losses. Note down what made you earn or lose virtual money. Learn from your mistakes so that you do not repeat them.

Look at These Options Trading Strategies Tested on Paper Accounts

| Strategy | Success Rate | Notes |

|---|---|---|

| Covered Call | 75% | Low risk, moderate return |

| Protective Put | 60% | Protection against a decline |

| Iron Condor | 80% | Limited risk with non-volatile stocks |

| Straddle | 70% | Profit from high volatility |

Conclusion

Gain hands-on experience in trading options with the help of paper trading. In case you are interested in practicing crypto trading then you must check out Altrady is the best option in the market.

Test your techniques without spending real cash. Stay patient and keep upgrading your knowledge when you are practicing with paper trading.

Shift from paper trading to live trading after getting enough knowledge, experience, and skills.