Altrady Blog

Stay ahead of the curve with Altrady's cryptocurrency trading blogs!

Category List

Crypto Trading Tools

Crypto Trading ToolsCrypto Arbitrage Explained: How It Works, Best Apps, Benefits & Risks (2026 Guide)

The concept of crypto arbitrage is pretty self-explanatory. It is all about benefiting from the market inefficiencies by purchasing the asset in one market and then immediately selling it to another market at a higher rate.

04 May 20236 min read Crypto Trading Tools

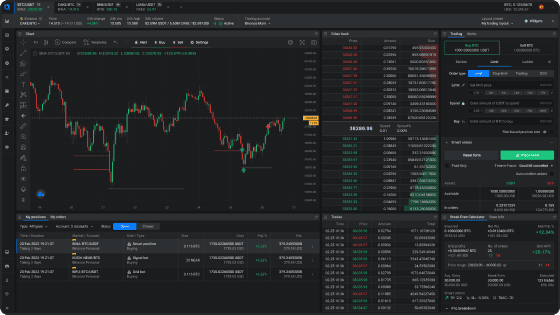

Crypto Trading ToolsThe Best Cryptocurrency Charting and Trading Software and Tools

When it comes to mastering advanced technical analysis in the world of cryptocurrency trading, having the right software and tools at your disposal is crucial. The dynamic and volatile nature of the crypto market demands advanced charting capabilities and in-depth analysis. In this article, we will explore the best cryptocurrency charting and trading software and tools available, designed specifically for advanced technical analysis.

18 May 202312 min read Crypto Trading Tools

Crypto Trading ToolsCrypto Trading Charts: A Comprehensive Guide for Traders | Altrady

Cryptocurrency trading charts are vital in analyzing market trends, identifying patterns, and making informed trading decisions. Understanding how to read and interpret these charts is essential for traders navigating the volatile world of cryptocurrencies.

18 May 20233 min read Crypto Trading Tools

Crypto Trading ToolsHow to use Crypto Trading Tools to improve your trading

25 Aug 202311 min read Crypto Trading Tools

Crypto Trading ToolsKraken vs. Binance: Which one is a better exchange

Compare Kraken vs. Binance. The ultimate guide to the best cryptocurrency exchange. We will help you decide which is the best cryptocurrency exchange for you. Read more here.

28 Nov 202314 min read Crypto Trading Tools

Crypto Trading ToolsUnlocking the Potential: A Deep Dive into Crypto.com Exchange

A comprehensive review of Crypto.com is essential for those seeking more than just crypto trading features. With its competitively low fees and an extensive array of products, it presents an enticing proposition for any investor. Furthermore, it is a prime illustration of seamlessly incorporating cryptocurrency into everyday purchases.

28 Nov 202313 min read Crypto Trading Tools

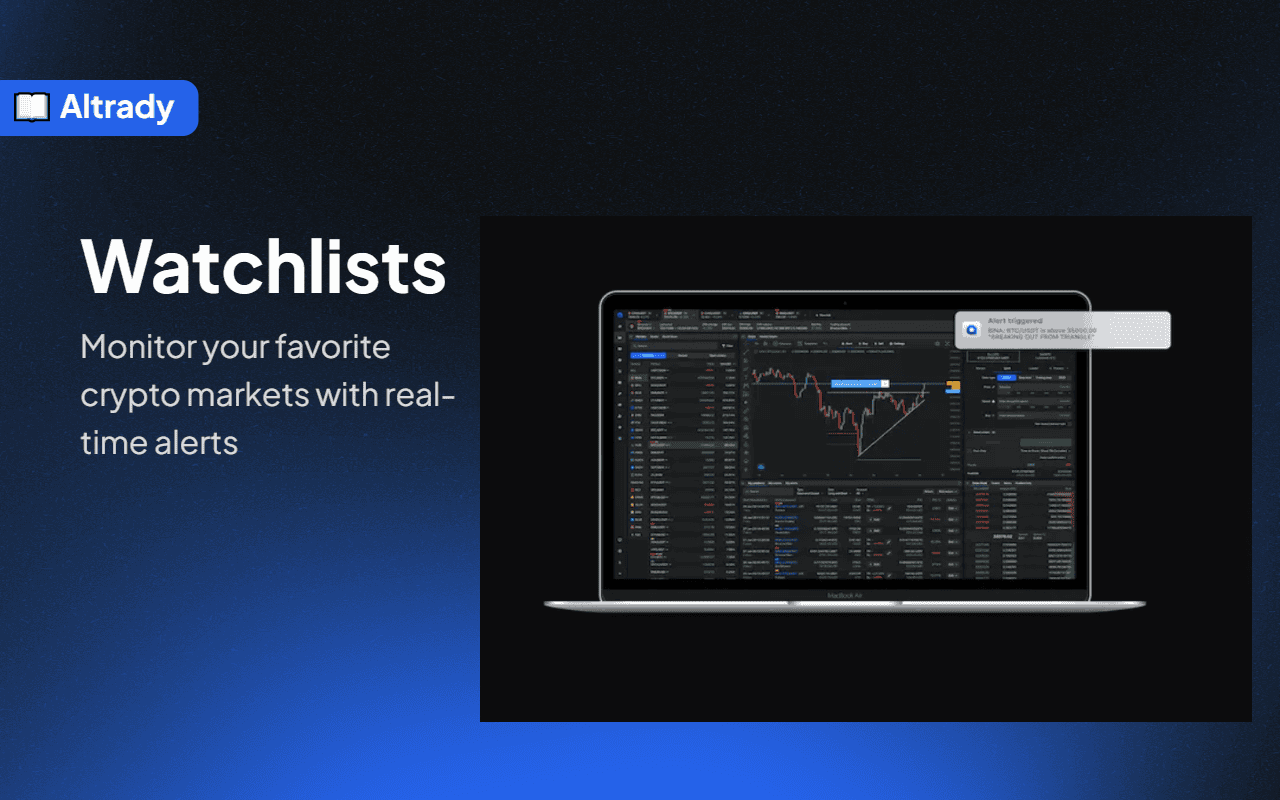

Crypto Trading ToolsUse Watchlists and Crypto Alerts For Faster and More Effective Trading Decisions

Prices can go up or down in minutes, and opportunities can be missed or created in seconds. That's why it's important to have tools that can help you monitor the crypto market and make informed decisions quickly.

13 Dec 20234 min read Crypto Trading Tools

Crypto Trading ToolsEmpty Charts vs. Charting Tools: Which One to Choose

In crypto trading as in other trading fields, traders rely on charts to identify trends, potential entry and exit points, and make informed decisions.

26 Jun 202412 min read Crypto Trading Tools

Crypto Trading ToolsAltrady 5 Year Anniversary | Win a Lifetime Subscription

As we're celebrating 5 years, we're offering our users some amazing gifts. Showcase your trading achievements and you can win a lifetime subscription.

01 Jul 20242 min read Crypto Trading Tools

Crypto Trading ToolsMastering RSI: Advanced Techniques for Reversals and Trend Confirmation

RSI has gained popularity because of its capacity to detect divergences alongside overbought and oversold levels. However, in a challenging environment like the crypto market, bearing a diverse set of techniques to read the price and analyze charts on distinct methods is something every trader should consider on their way to professional crypto trading.

24 Sep 20245 min read Crypto Trading Tools

Crypto Trading ToolsWhat is a Crypto Trading Platform?

One fundamental situation beginner traders may face when picking a crypto solution is grasping what a trading platform is and which is better. With the rapid growth and evolution of this side of the cryptocurrency industry, even experienced traders could not be able to answer such a question. After all, crypto exchanges have played a central role in developing trading platforms, but today, there are countless trading alternatives at our fingertips. So, what is a crypto trading platform? This article will serve as a guide for readers to answer that question.

23 Dec 20240 min read Crypto Trading Tools

Crypto Trading ToolsHow Does a Crypto Trading Platform Work?

Since the rise of cryptocurrency trading, exchanges offered trading platforms to trade in basic and advanced modes. As the industry evolved, numerous trading methods emerged, from typical trading by manual management to automated trading through algorithms or bots. Given this reality, multiple crypto trading platforms arose aside from exchanges, offering specialized and general services. In the face of all this, one central question takes protagonism: How does a crypto trading platform work? This article contains a seamless answer by exploring key components and basics versus advanced features.

23 Dec 20245 min read