Chapters

The Role of the Federal Reserve & Central Banks in Crypto Liquidity

Crypto markets may run on code and decentralization, but they still flinch every time the Fed clears its throat. Whether it's a rate hike or a hawkish press conference, traders know: liquidity can dry up or flood in based on central bank signals.

Still, central banks remain shadow influencers, pulling levers that ripple through Bitcoin, altcoins, and DeFi.

Find more below on how policy decisions from the Fed and other central banks shape crypto liquidity, and why smart traders are watching the macro game as closely as the charts.

Federal Reserve’s Banking Access and Crypto Regulation

The Federal Reserve now allows traditional banks to serve crypto clients if they manage associated risks, removing "reputational risk" barriers to master account access. This improves crypto-fiat payment rails, stablecoin reserve management, and settlement efficiency by enabling reliable banking relationships.

The shift eliminates the long-standing “reputational risk” justification that had kept many crypto firms from accessing master accounts. As a result, crypto companies can now establish more stable, direct relationships with banks, strengthening fiat on- and off-ramps, improving stablecoin reserve backing, and streamlining settlements.

In the past, the Federal Reserve typically took a conservative approach, frequently pointing to potential market instability and broader financial system threats as reasons for restraint. Since it now permits regulated institutions to engage with crypto clients under clear guidelines, the Federal Reserve acknowledges the growing presence of digital assets in the broader financial system without compromising its oversight.

Improved banking access means crypto firms can hold cash reserves more securely and facilitate faster, more compliant transactions. For example, stablecoin issuers may now have greater transparency and security in managing fiat reserves, which could lead to broader adoption and regulatory trust.

Furthermore, this shift encourages banks to build crypto-specific compliance protocols rather than outright denying services. It opens the door for future collaboration between the crypto sector and central banking infrastructure.

Monetary Policy Impact

Interest rate decisions by the Federal Reserve significantly influence crypto demand. When rates are low, investors often shift capital toward riskier assets like Bitcoin and other cryptocurrencies, seeking higher returns in a low-yield environment. This behavior boosts liquidity in crypto markets, increases trading activity, and supports price growth.

Conversely, when the Fed raises interest rates to combat inflation or cool economic overheating, yield-bearing traditional assets like bonds and savings accounts become more attractive. As a result, investor appetite for volatile assets like crypto tends to decline. Higher borrowing costs and tighter financial conditions can also dampen institutional interest in crypto ventures, reducing capital inflow and slowing market momentum.

The evolving relationship between the Federal Reserve and crypto becomes especially clear during periods of aggressive monetary tightening or easing. For instance, during the pandemic-era low interest rates, crypto markets surged as investors poured into digital assets. But when the Fed began its rate-hike cycle in 2022, the crypto market saw a significant contraction, illustrating just how sensitive it is to central bank policy.

Source: Federal Reserve Bank of St.Louis

Moreover, the Federal Reserve’s messaging, through tools like the Federal Open Market Committee (FOMC) statements, can trigger immediate reactions in crypto markets, underscoring the sector's growing entanglement with traditional macroeconomic forces. As crypto matures, its correlation with Fed-driven economic cycles suggests that policymakers and crypto investors alike must closely monitor this dynamic.

The Federal Reserve and crypto may operate in different arenas, but their interactions are increasingly shaping investment flows and market behavior across both worlds.

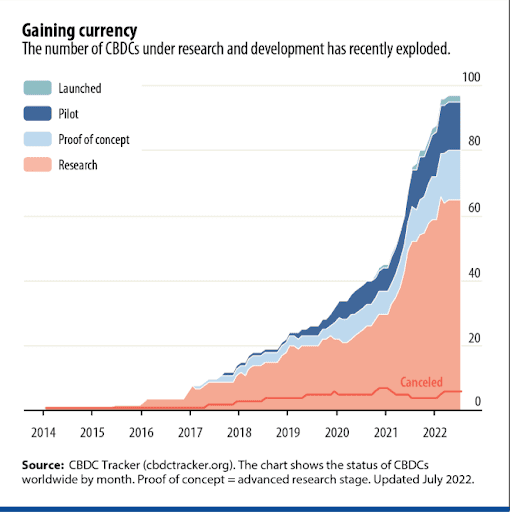

CBDC Development

Central banks worldwide are actively evaluating both retail and wholesale central bank digital currencies (CBDCs), and the Federal Reserve is no exception. Retail CBDCs—digital versions of cash held directly by the public—could fundamentally alter the financial landscape. They offer a government-backed alternative to commercial bank deposits, and may shift how liquidity flows through the banking system, potentially reducing banks' role in deposit-taking and lending.

Wholesale CBDCs, on the other hand, are designed for institutional use and could revolutionize interbank settlements. AS CBDCs leverage distributed ledger technology (DLT), they promise faster, more transparent transactions between financial institutions, increasing efficiency and reducing settlement risk.

The Federal Reserve and crypto industry are watching each other closely as CBDC development progresses. While the Fed remains cautious, it has acknowledged the need to explore a digital dollar that balances innovation with privacy, security, and financial stability. Its 2022 discussion paper marked a notable step toward public engagement, highlighting the potential benefits and risks of a U.S. CBDC.

Source: International Monetary Fund

From the crypto perspective, CBDCs present both a challenge and an opportunity. On one hand, a Fed-issued digital dollar could compete with stablecoins in payments and remittances.

On the other, CBDCs’ infrastructure might integrate with blockchain-based systems, creating interoperability between centralized monetary policy tools and decentralized finance (DeFi) ecosystems.

Ultimately, the intersection of the Federal Reserve and crypto in the context of CBDCs will help shape the future of money, determining whether these systems coexist, compete, or converge in the evolving digital economy.

Crypto Strategic Reserves (Proposed)

Some economists and policy thinkers have proposed that the Federal Reserve could one day manage a strategic Bitcoin reserve, similar to how it holds gold or oversees the Strategic Petroleum Reserve. This concept envisions Bitcoin as a potential hedge against economic instability or currency devaluation, particularly during times of geopolitical stress or systemic financial shocks.

In theory, holding a crypto reserve could give the Fed a new tool to influence digital asset markets, stabilize liquidity during crises, and even shape global attitudes toward decentralized currencies. As other nations experiment with crypto-backed reserves or integrate digital assets into their monetary frameworks, the Federal Reserve and crypto may find themselves increasingly intertwined on a geopolitical level.

Such a move would signal a dramatic shift in how the Fed views digital assets, not just as speculative instruments, but as potential components of sovereign strategy. While the idea remains theoretical, it reflects growing interest in how the Federal Reserve and crypto could interact in more proactive and strategic ways, especially as the digital asset space continues to mature and gain legitimacy on the global financial stage.

Current Limitations

Despite growing interest in digital assets, central banks, including the Federal Reserve, don’t currently hold cryptocurrencies like Bitcoin in their official reserves. Yet, El Salvador seems to be the only exception thus far.

The primary reason is crypto’s limited and volatile role within the global monetary system. Unlike gold or foreign currency reserves, crypto assets lack a long-term track record of stability, liquidity, and broad acceptance in sovereign finance.

The Federal Reserve and crypto remain distant in this respect, as the Fed maintains its focus on traditional reserve assets that support monetary policy objectives, international trade, and financial system stability. The unpredictable pricing, unclear regulations, and absence of central oversight make it difficult to integrate crypto into formal financial statements.

Additionally, the decentralized nature of cryptocurrencies conflicts with the Fed’s need for control and predictability in monetary operations. Holding such assets could introduce unwanted volatility or undermine confidence in the Fed’s reserve management.

Still, as the crypto market matures and digital assets become more integrated with traditional finance, the conversation may evolve. For now, however, the gap between the Federal Reserve and crypto remains clear: while engagement through regulation and research continues, formal reserve adoption is not on the immediate horizon.

Key Takeaways

The relationship between the Federal Reserve and crypto is shifting from cautious distance to measured engagement. From regulatory adjustments enabling banking access for crypto firms, to growing awareness of how interest rates impact digital asset markets, the Fed is increasingly involved, directly or indirectly, in shaping the crypto landscape.

Its exploration of CBDCs, though still in the research phase, suggests that the Fed recognizes the need to modernize monetary tools without undermining financial stability. Meanwhile, proposals to hold crypto in strategic reserves remain speculative but reflect a broader global conversation about digital assets as part of sovereign policy.

While the Federal Reserve does not yet hold crypto in its reserves and continues to highlight the risks of volatility and limited adoption, it’s clear that digital assets are no longer fringe. As crypto becomes more entwined with traditional finance, the Fed's policies, research, and regulatory stance will play a defining role in how this integration unfolds.

For crypto investors, builders, and institutions, staying attuned to the actions of the Federal Reserve is no longer optional, it’s essential to understanding the future direction of the digital asset economy.

.svg)