Chapters

Crypto Trading Regulations – What Traders Need to Know in 2025

The crypto world in 2025 isn’t what it used to be. Regulation has grown up, and so should your trading strategies.

Governments across the globe have tightened, clarified, or outright overhauled how digital assets are regulated. Whether you’re a day trader flipping altcoins or a fund manager allocating digital assets in a multi-million dollar portfolio, knowing the new rules isn't optional—it’s survival.

Here’s a breakdown of the most impactful regulatory shifts shaping crypto trading this year, what they mean for your wallet, and how to stay compliant without getting wrecked.

1. Stablecoins Finally Get Their Own Rulebook

Stablecoins—once seen as the “gray area” of crypto—are now front and center in global regulation. And the rules? They’re serious.

The U.S. Leads with Stablecoin Legislation

In the U.S., stablecoin issuers must now maintain 1:1 reserve backing, submit to independent audits, and report reserve composition regularly. These aren’t soft guidelines—they’re law. If a stablecoin doesn’t publish transparent, verified reports, it’s effectively off-limits for regulated entities.

And it’s not just startups anymore. Under new frameworks, licensed banks and fintech firms can issue their own stablecoins. But they need to hit strict consumer protection, solvency, and liquidity benchmarks. This shift is bringing legitimacy—but also complexity—to the stablecoin market.

International Alignments

Other jurisdictions, like the EU and parts of Asia, are enforcing similar rules. The takeaway? If a stablecoin isn’t backed, audited, and legally registered, you’re playing with fire.

Tip: Stick with stablecoins that show their books. Don’t just trust a website—look for audited reserve reports and legal registrations.

2. The U.S. Regulatory Shift: Less SEC, More Clarity

U.S. lawmakers finally delivered what traders and developers have demanded for years: regulatory clarity.

Meet the CLARITY Act and GENIUS Act

These two landmark bills redefined how digital assets are classified in the U.S. Under the new framework:

- Most tokens are now “digital commodities”, not securities.

- Only tokens issued by large, mature blockchain systems face additional scrutiny.

- DeFi protocols are mostly exempt, though this remains controversial and under ongoing review.

This has been a game-changer, reducing the SEC’s chokehold on the market. But there’s nuance.

Executive Order: The Hands-Off Approach

The White House’s latest executive order leans toward innovation over enforcement. It bans any retail central bank digital currency (CBDC)—a big win for privacy advocates—and promotes private dollar-backed stablecoins as preferred digital cash options.

A new digital asset working group has been formed to monitor industry practices without heavy-handed interference.

States Still Call the Shots

Despite federal reforms, individual U.S. states remain aggressive. Most require:

Licensing for crypto platforms.

- AML/CFT compliance programs.

- Full KYC (Know Your Customer) verification, even for non-custodial services.

That means you might be fine in one state, and non-compliant in another.

Tip: Check your exchange’s state-level compliance. If you’re using a DEX or wallet service, be ready for KYC—even if it’s inconvenient.

3. Europe Tightens the Screws with MiCA

The EU’s Markets in Crypto-Assets (MiCA) regulation, effective since late 2024, is now fully enforced. It’s one of the most comprehensive crypto frameworks globally.

What MiCA Requires:

- Full licensing for exchanges, custodians, and asset issuers.

- Capital and reserve requirements for platforms.

- Segregated client accounts to protect user funds.

- Transparent marketing standards to eliminate misleading hype.

- AML, KYC, and transaction reporting obligations that rival traditional finance.

There’s also a new requirement for platforms to support transaction phase reporting—basically a way for regulators to monitor order book behavior, trading phases, and auction events. It's surveillance-grade stuff.

Tip: If you’re trading in the EU, assume everything is being logged and analyzed. Choose platforms that are MiCA-compliant and avoid unlicensed operations.

4. Asia-Pacific: No-Nonsense Compliance

Asia’s top financial hubs—Hong Kong and Singapore—have taken a more controlled but open-minded route. Crypto is welcome, but only if it follows strict rules.

Key Changes:

- Licensing is mandatory for any exchange or broker.

- Wallet-level KYC is enforced. Yes, even self-custody users may face ID verification.

- Capital requirements have increased to reduce counterparty risk.

- Stablecoin issuers must operate under tight reporting and audit standards—often with local financial partners.

These rules are designed to encourage responsible crypto growth while cracking down on rogue platforms and capital flight.

Tip: If you’re using a platform in Asia, expect to verify your ID and prove source of funds even for small transactions.

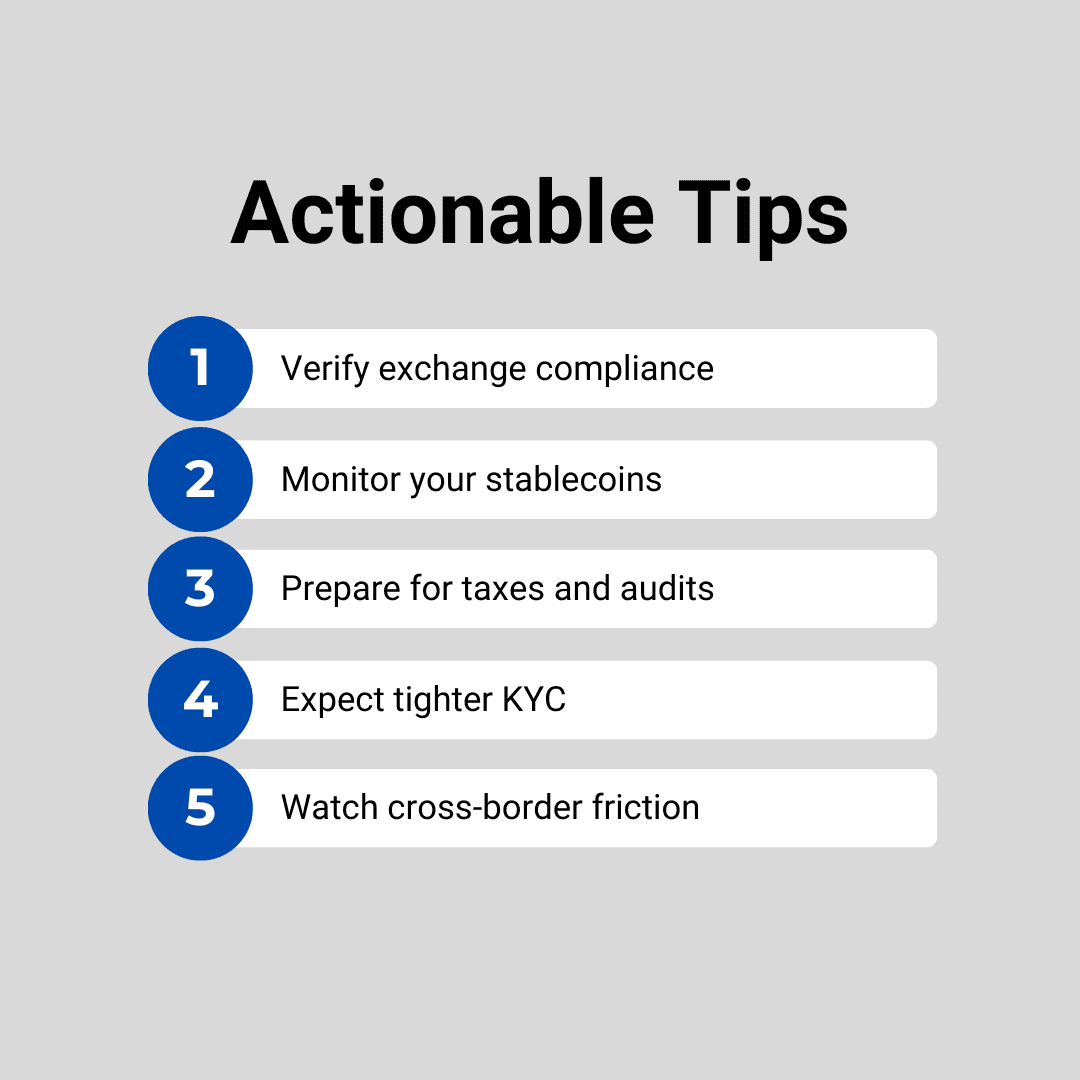

Actionable Takeaways for Traders in 2025

Regulation isn’t just something developers or CEOs have to care about. As a trader, your funds and access to markets now depend on staying informed. Here’s what you need to do:

1. Verify Exchange Compliance

Make sure the exchange you’re using:

- Holds proper licensing in your region.

- Publishes regular proof-of-reserves.

- Offers third-party audit transparency.

If your platform can’t show this, consider switching. Regulators are now shutting down or limiting non-compliant operations with little warning.

2. Monitor Your Stablecoins

Treat stablecoins like fiat now. You need to know:

- Is the coin backed 1:1?

- Are the reserves audited and disclosed?

- Is the issuer licensed in a major jurisdiction?

Stick with coins that can answer all three with a clear “yes.”

3. Prepare for Taxes and Audits

In many countries, crypto is now subject to fair-value accounting. That means:

- Gains and losses must be reported in real-time.

- You may be liable for taxes on unrealized gains.

- Detailed trade logs and wallet movements are mandatory for audits.

Don’t rely on exchange summaries. Use a professional crypto tax tool or accountant to keep your records airtight.

4. Expect Tighter KYC

Wallet-level KYC is the new normal. Whether it’s to off-ramp to fiat, stake a stablecoin, or even use a DEX, be ready to provide:

- Government-issued ID.

- Proof of address.

- Source-of-funds documentation.

Privacy wallets may still work—but they’ll likely be geofenced, delisted, or flagged in reports. Know what’s at risk.

5. Watch Cross-Border Friction

Tokens might be legal in one country and banned in another. That’s no longer a theoretical risk—it’s playing out daily. If you operate across jurisdictions:

- Track how each country classifies your holdings.

- Store compliance records for each regulatory environment.

- Don’t assume global access—regional blocks and wallet freezes are real threats.

Final Thoughts

Crypto in 2025 isn’t the Wild West anymore. The sheriffs have arrived, the rules are set, and the risks of ignoring them are higher than ever.

But this isn't all bad news. Regulation is also unlocking new possibilities: institutionally-backed stablecoins, fully licensed DeFi interfaces, and stronger protections against fraud.

If you adapt, the opportunities are still massive. So, stay informed, compliant, and keep trading sharp!

.svg)