Black Friday is loading…

Get 40% off with Altrady’s yearly plan and take the lead.

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

In front of the rise of crypto trading platforms, deciding which is better for you as a trader at a certain skill level and specific needs and goals might be a tedious but necessary task.

The most popular WunderTrading alternatives you should consider are:

Instead of going into what each platform offers, this article delivers a guide on why you should look closely at Altrady to boost your trading performance and work more effectively as a professional.

Those who just entered the trading world may find themselves thrilled ahead of discovering specialized platforms regarding automation, copy trading, bot implementation, etc.

The term "all-in-one" may represent a smile on the face of those with already advanced experience who seek a multi-exchange integration for seamless cross-wallet management from a single interface.

Altrady is a perfect candidate for an all-in-one crypto trading platform that converges to a broader offering, passing through the features mentioned in the first paragraph and fulfilling the advanced necessities of the second one.

Moreover, this platform streamlines a trading terminal that does not lack anything compared to the first trading experience of most beginners when using exchanges directly to trade cryptocurrency markets.

Likewise, more experienced traders will find a vast range of tools to start treating their crypto trading as it should at such a level: a financial business that involves managing risks and rewards appropriately for it to be able to survive the market threats of ruin for the mid-term and long-term success.

In that sense, day traders, swing traders, and investment profiles find together a platform where the possibilities and mechanisms of making profits transcend further from simple automation-bot features, placing order settings, risk management, etc.

From the nucleus of Altrady, users can realize a genuine concern to enhance the ability to trade digital markets across all the styles pointed out above, especially from an intraday stance. Whether scalping or trend trading, day traders shape a central figure regarding the motives guiding the Altrady offerings.

Without leaving any trading style behind, the platform also conveys an attractiveness to the market participants who prefer a soft risk exposition in comparison to the styles formerly pinpointed but which demand advanced management over time. Those such as holders and even swing traders.

Either way, we can briefly draw up a list highlighting the relevant functionalities for each trading case, for example:

Altrady's trading proposal encourages traders to explore new methods to profit from crypto market fluctuations by employing diverse quantitative models and algorithmic orders.

Altrady delivers sophisticated features for this case, such as the following:

While swing traders look for mid-term trade positions lasting weeks to months, holders preach an investment philosophy that strives to hold cryptocurrencies for almost a lifetime.

Amid both styles emerges the profile of a portfolio manager who, unlike a swing trader who has primarily a speculative mindset, the manager looks for balanced growth over time through assets backed by solid fundamentals and, unlike the holder, who embarks on an investment expectancy for years, the manager offsets the assets and rebalance the portfolio if needed while realize profits in the mid-term.

Altrady delivers sophisticated features for this case, such as the following:

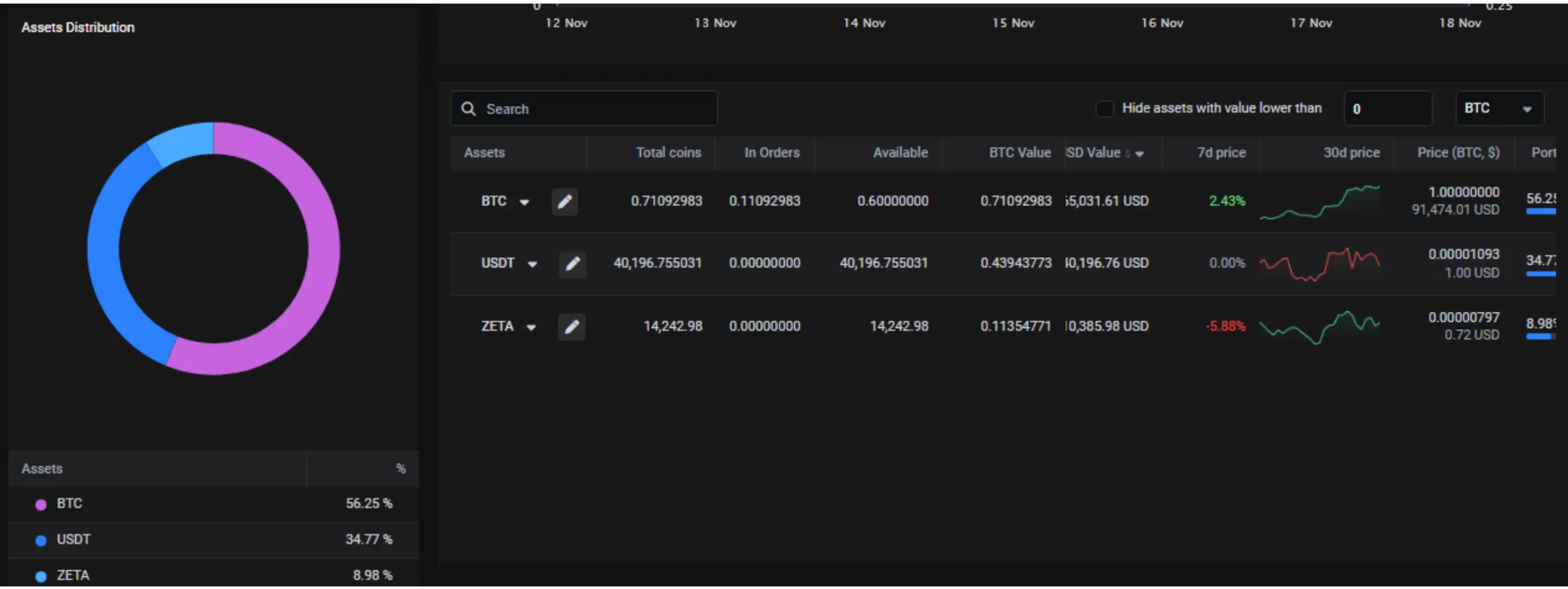

Altrady offerings cater to both novices and professional approaches. By attending to various needs, whether for mid-term and long-term or for day traders and scalpers, this platform optimizes a whole trading terminal to implement diverse strategies while leveraging automation and management features. This platform also offers seamless multi-exchange account integration. From a single interface, market participants can track all their crypto holdings with advanced analytics about all the crucial elements involved in trading performance.

Choosing the right crypto trading platform boils down to asses diverse features that can optimize the trading experience while enhancing efficiency. Navigating the market and seizing opportunities properly ranges from bearing day trading mindsets alongside scalping skills and mid-term to long-term approaches. In any case, Altradyy presents an all-in-one proposal that, ultimately, overrides the offerings of platforms like Wundertrading when seeking a professional trading objective is all about.

Altrady is a crypto trading platform with multi-exchange integration features where beginners and professional investors manage assets across multiple accounts simultaneously, seizing algorithmic, automation, and bot functionalities. Sign up for a free trial account today.