Category List

Al Brooks Trading Strategy | Key Techniques

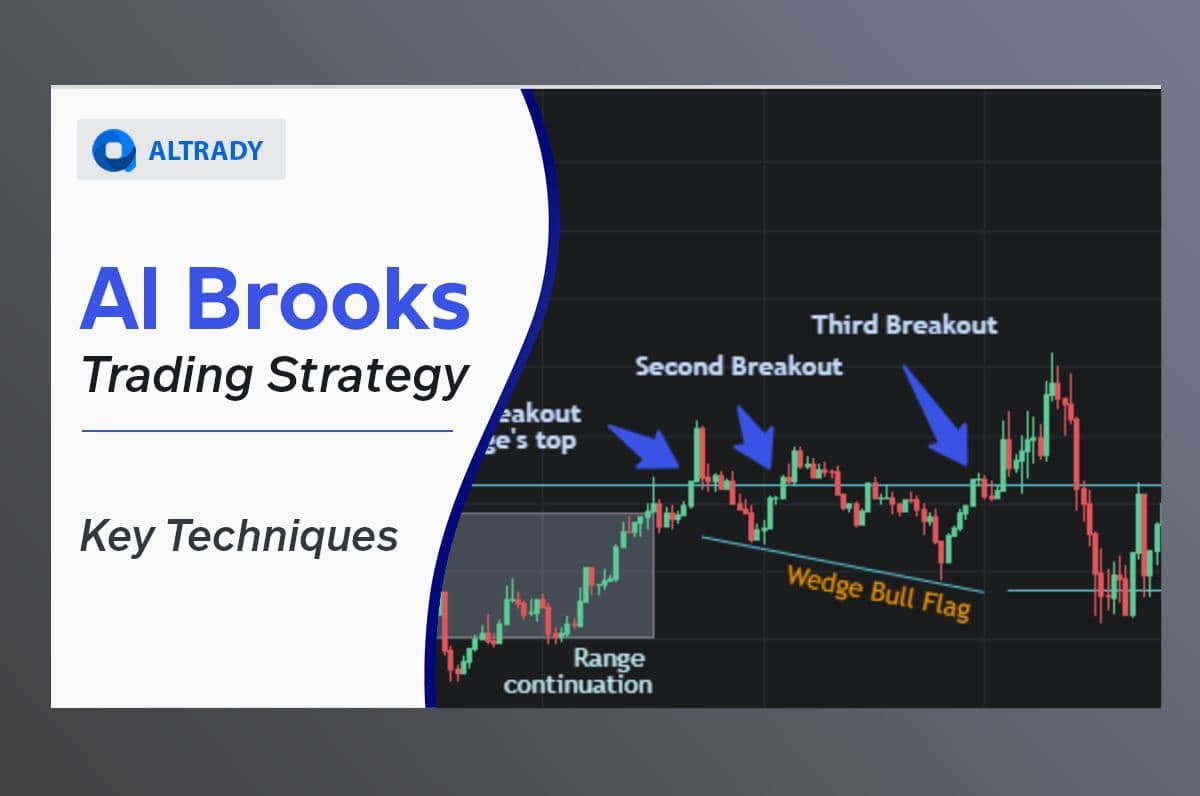

Al Brooks presents plenty of techniques based on price action concepts that improve the performance of day trading, swing trading, and scalping methods. For cryptocurrencies, these techniques convey a structured approach, allowing an edge over the intraday market movements.

Market Cycle And Context

One of the primary concepts that settles the ground for Al Brooks' trading strategy is the market cycle. A market cycle is a stage where the price action moves clearly and allows traders to perceive the temporary direction that an asset follows.

The market cycle could be a range or a trend. By determining the correct cycle, traders can decide if they should be bullish or bearish, strive to follow a trend, or trade sideways within a range.

When analyzing the conjunct of the market, context also plays a crucial role in Al Brooks' strategy. By contextualizing the price action in the chart, traders can pinpoint where the asset is, whether at the top or bottom of a channel or about to cause a breakout.

Following the identification of the market cycle and appropriate context, traders can proceed to set up a trade, structure an entry, and consider the risk management exigencies. This process can also help traders determine if it would be more suitable to scalp a movement or seek a swing trade.

Scalping Vs. Swing Trading Intraday

Deciding to scalp or swing is vital if we understand the benefits of scaling a trade during a range or while following a trend. According to Al Brooks, a swing trade is one where the reward is at least twice the risk assumed.

By assuming such a definition for a swing trade, we can examine some techniques to trade different scenarios in the intraday price movements.

Scalping A Breakout

When the price breaks out of a range or a trend line, there is a probability the price will return to the breaking point for two reasons:

- It is a false breakout, meaning the price will continue the previous trend or range.

- The price will test the breaking point to confirm the movement by establishing a new support or resistance zone according to the direction of the breakout.

An experienced scalper can seize this opportunity by entering and exiting quickly from a trade. However, for beginners, it can result in a tremendous psychological and emotional effort.

Al Brooks himself says he likes to trade strong breakouts, which means that to avoid a false breakout, he strives for a high-probability setup trade.

Identifying a high-probability setup requires experience, but today's trading allows beginners to paper trade, which is a plus to spotting such a setup.

Swing Trade A Breakout

Another way to approach a breakout would be to wait for the test of the breaking zone. Similarly, as exposed previously, it implies the following:

- The price will break out a trend line or a range.

- The price will return to the breaking point to confirm the movement.

When the price tests the zone, a new support or resistance will take place in that zone. It may be an opportunity for a swing trade to seize a trend reversal or a continuation after a range.

However, there is still a chance for that zone to fail. In that case, traders could be in front of a good risk-reward trade at the cost of a low probability.

Analyze how probabilities play before an actual move out of the range

The same seen from a scalping perspective seems to be slightly different but suitable for high probabilities. Even if the breakouts fail for a swing trade, a scalper would seize that momentum opportunity.

Swing Trades At Reversals

A regular opportunity for a swing trade occurs during the first hours of the market opening. Typically, the price tends to move sharply for distinct reasons, such as:

- To target previous highs and lows.

- To make the high and low of the day.

These highs and lows become targets for breakout and reversal movements. These movements are decisive during the first hours, offering opportunities for a trend day, or what Al Brooks calls a Measured Movement (MM).

Reversal after a measured movement (MM) following the NY opening at 15:15-15:30.

Scalping Trends: Candle Patterns On Pullbacks

Another technique for scalping approaches implies identifying channels during trending markets. Traders can execute trades by seizing patterns on pullbacks in the following ways:

In a bearish trend

The price will move within the top and bottom of a decreasing channel.

- At the top, traders can spot the Evening Star, Three Black Soldiers, and Double Tops pattern.

- At the bottom, traders can look for strong breakout entries at the lows of the candles.

In a bullish trend

The price will move within the top and bottom of an increasing channel.

- At the top, traders can look for strong breakout entries following the highs of the candles.

- At the bottom, traders can spot the Morning Star, Hammers, Double Bottoms, and Wedge Bull Flags, as Al Brooks often points out.

Wedge Bull Flag between 15:15 and 15:30 (NY opening).

High Probability Setup Vs. Good Risk-Reward: 2 Ways To Manage Risk

Deciding between high probability and good risk-reward trade setups is crucial for proper risk management. It is an essential technique to preserve the capital, develop a plan, and achieve consistency.

For Al Brooks, traders can aggregate little profits with high-probability trades, while small-risk trades need to offset the low probability with a good reward.

For example:

- Swing trades are mathematically profitable since they strive for a 1:2 risk reward. As Al Brooks states, they just need to be at least twice the risk.

- Strong breakouts are high-probability trades where traders can make a quick profit.

Stop Orders Vs. Limit Orders

Al Brooks establishes an advantageous distinction for using stop orders since he believes this method guarantees to enter just right when the market momentum goes in the position's favor, making it more suitable for beginners.

Limit orders can enable experienced traders to fade breakouts during a range. These orders can also play well on pullbacks and breakout tests.

Conclusion

Al Brooks' vast realm of knowledge gives traders plenty of techniques for trading markets. This article addresses basic techniques for scalping and intraday swing on channels and breakouts by understanding trends and ranges as two crucial market cycles.

In Altrady, it is easy to trade crypto with these techniques alongside a wide range of features for proper risk management, as Al Brooks states. You can sign up for a free trial account now.