.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

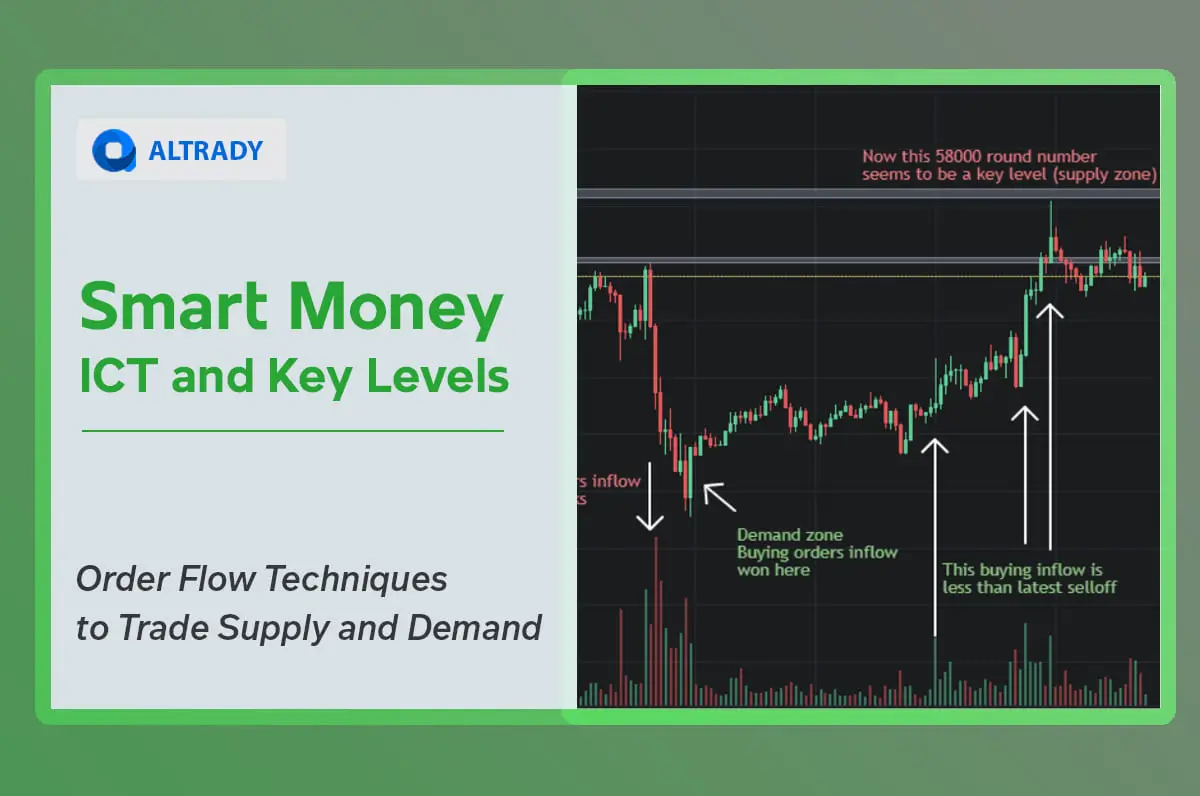

ICT - Order Flow Techniques to Trade Supply and Demand

In the dynamic world of the crypto markets, trading on a reliable conceptual basis is not a minor thing. ICT (Inner Circle Trading) and SMC (Smart Money Concepts) are trading frameworks that provide traders with conceptual tools to comprehend and take advantage of the different market stages and price movements.

Both methods work independently of traditional technical indicators and instead aim to decipher the forces behind the market dynamics, like institutional activity.

In this guide, we will delve deeply into the analysis of key levels such as supply and demand zones, and how order flow techniques can help traders examine their underlying dynamics.

ICT And SMC Overview

If we compare ICT vs. SMC, we find that ICT crafts a more personalized approach with unique terminology and tools to seize specific price movements. On the other hand, SMC proposes a broader scheme to create strategies focusing on the market structure analysis and the causes affecting it.

ICT, for example, assembles its custom indicators, such as:

- Fair Value Gaps (FVG).

- Order Blocks.

- Equal Low/Highs.

- Swing Points.

SMC, instead, leverages a set of existing concepts, such as:

- Distribution/accumulation theory.

- Supply and demand zones.

- Order Flow analysis.

- Market psychology and price action.

Both trading methods present all-out systems to address all-out market opportunities. Likewise, both aim to take advantage of human behavior in front of the institutional manipulation activity.

What Are Key Levels For ICT And SMC?

Key levels are highly correlated to support and resistance notions. However, these specific levels refer to actual supply and demand, as not all support and resistance zones represent the same amount of selling or buying pressure.

For example, by using ICTs equals lows/highs, traders can detect areas where the price cannot break through. Although these areas may halt the price trajectory, they do not necessarily imply a strong reversal move.

We can imagine a range-bound market where equal lows (the support at the low end) push the price up and equal highs (the resistance at the high end) push the price down, but the price is still unable to break out of the range.

However, a typical situation that can cause the price to break out of the range may present itself as the following:

- Institutions induce a false breakout at the low end on a liquidity sweep movement (manipulation) necessary for them to fill their large orders.

- Once institutions accomplish the false breakout, the large orders positioned make the price rise toward the range again, but this time, the demand is enough for the movement to break through the high end.

- That strong movement leaves a footprint that SMC traders can use later as a demand zone, while ICT traders can spot it as an Order Block or FVG that the market should fill in a forthcoming move.

If this potential demand zone, order block, or FVG supports the price for a prolonged time, traders can refer to it as a key level. Correspondingly, on the contrary case of the example exposed previously, that would be a supply zone.

Order Flow And Key Levels: How Do Supply and Demand Work?

By understanding that key levels denote robust supply and demand zones, traders can also assume that an important underlying order flow rests in those zones.

The order flow analysis in this case represents an advanced approach and an incredible smart money concept tool to unveil the dynamic of supply and demand forces. It can reveal how many of the total orders strengthen the support of a demand zone or the resistance of a supply zone.

This type of analysis at key levels can also suggest how effective those zones may be in the short and long term. Traders should consider two norms when gauging such effectiveness:

- For the demand to surpass the supply: The buying orders inflow must be significantly higher than the selling inflow

- For the supply to surpass the demand: The selling orders inflow must be meaningfully higher than the buying inflow.

Traders can analyze the order book and market depth to check how much quantity is

being traded.

Trading Supply And Demand With Order Flow

To trade supply and demand zones with order flow analysis, traders can utilize three methods as tools inherent to the market:

- Order Book.

- Bid and Ask.

- Market Depth.

Order Book Analysis

By analyzing the order book, traders can assess executed and resting orders that can influence the strength of supply or demand zones.

For instance, when a demand zone is absorbing a large number of executed sell orders, it indicates a strong level of support.

But what are these types of orders? Let's briefly define them:

- Executed Orders: These are orders that have been filled and represent actual trades that are taking action in the market.

- Resting Orders: These orders are currently waiting to be executed, for example, limit orders. They can reveal the underlying demand or supply at a particular price level.

Bid vs. Ask Analysis

Through the analysis of the bid and ask spreads, traders can evaluate the liquidity of a market and identify potential areas of congestion, leading to the following conclusions:

- A narrow bid-ask spread indicates a liquid market.

- A wider spread may suggest a lack of liquidity.

What are bid and ask?

- Bid: The highest price a buyer will pay for a trading position.

- Ask: The lowest price a seller will accept for a trading position.

Market Depth Analysis

The Market Depth shows the number of buy and sell orders at different price levels. Additionally, market depth can help estimate the liquidity of a market.

When analyzing market depth, traders can find hidden areas of concentration (supply and demand areas) in the order book. Such areas may represent key support or resistance levels.

Conclusion

Smart Money Concepts and Inner Circle Trading together present a powerful strategic approach to identifying key levels and trading them by implementing basic order flow techniques.

Supply and demand zones with order blocks and FVG indicators establish an assertive correlation to this matter. Traders can confirm the reliability of these SMC and ICT indicators by analyzing order books, bid and ask, as well as the market depth.

Traders from all levels can start seizing this type of technique through paper trading in Altrady, which offers a wide range of features and technical tools that may complement SMC and ICT strategies. Enroll in a free trial account now.