.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

Crypto Trading Platforms with Leverage: What You Need to Know

Leveraging has emerged as a popular tool among crypto traders seeking higher returns. This financial instrument allows them to borrow capital, amplifying their potential gains by trading with more funds than they actually possess. However, while leveraging can increase profits, it also comes with significant risks. This article will study relevant aspects of crypto trading platforms with leverage and what you need to know to use them appropriately.

What is Leverage In Crypto Platforms?

One principal issue that most traders face when seeking to maximize profits is the lack of buying or selling power. From beginners to advanced traders, retailers, and professionals, leverage represents a critical matter in their trading systems before the chances of amplifying potential profits at the cost of higher risks of significant losses.

When traders leverage a trade position, they expect to multiply their potential rewards in case they are right about the next market move. In the contrary case, when the price of a crypto asset goes against a leveraged position, the potential losses also multiply.

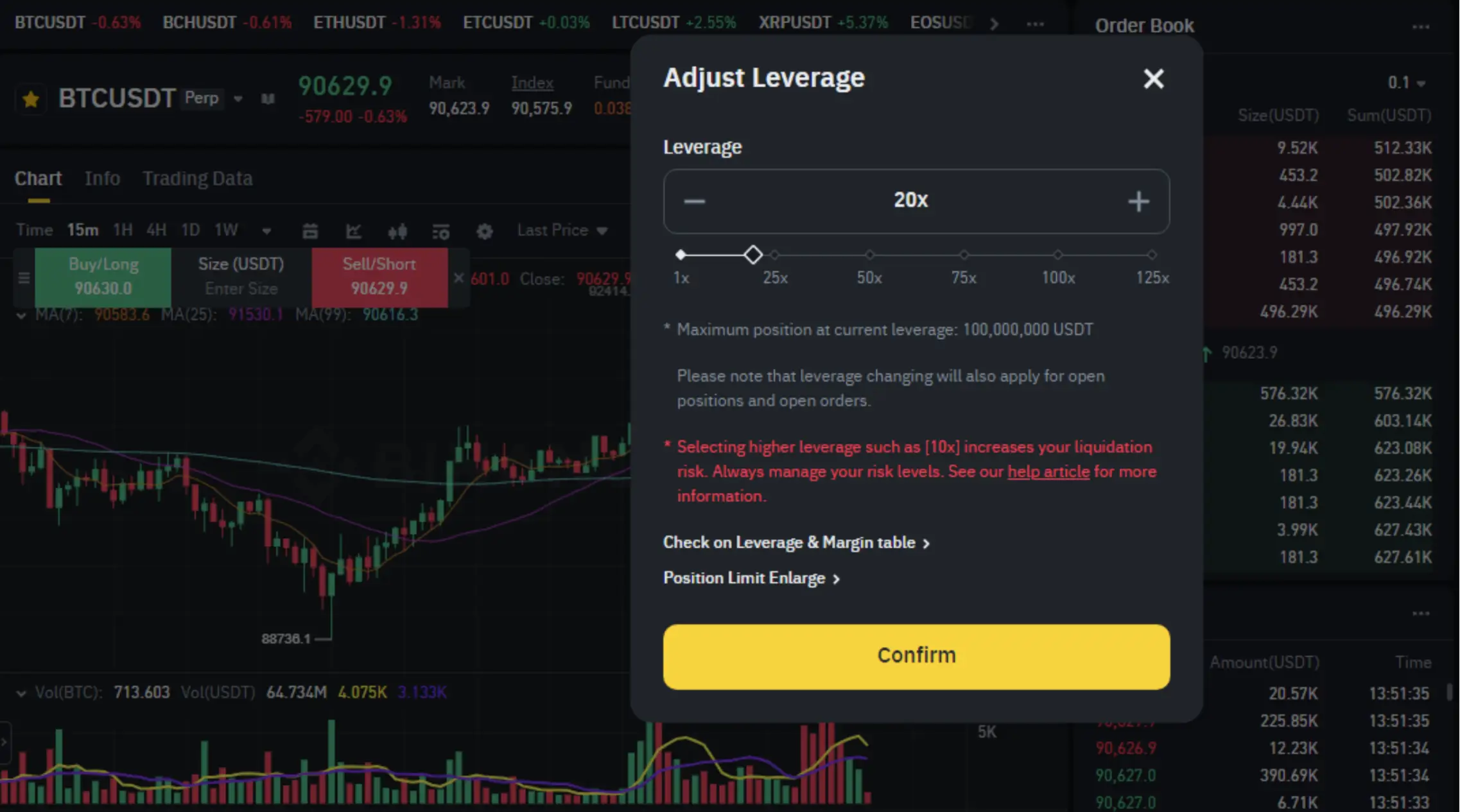

The multiplication factor of leveraging generally ranges from x2 to x100 in most crypto trading platforms. Essentially, that means that the buying or selling power of any initial available capital increases by the multiplication factor amount allowed by a platform.

Up to this point, the conclusion is that leverage is an advanced trading tool that involves higher risks and consists of multiplying the buying and selling power by borrowing capital from a platform to maximize the potential profits of a position in the market.

How Leverage Affects The Trading Experience

From the description planted above, we can infer that the first term affected by leverage is the position size. The higher the former, the bigger the latter.

The position size strictly correlates to risk management. Proper risk management depends on an appropriate position size per trade.

The way leveraging might affect the trading experience varies along the different skill levels of traders.

In the first place, the inexperience of beginners makes them seek the shortest price moves instead of trending movements in an attempt to obtain profits quickly.

Because of that, they tend to over leverage their position size as they lack enough capital to generate substantial returns in the shortest price moves and the skill to spot a trend and stay longer in a position. Beginners basically try scalping, which is a hard approach to trading markets.

Then, we have the case of advanced traders that strive for using leverage more wisely. These traders understand how leveraging affects the liquidation price of futures contracts and how this affects the risk-reward ratio.

Advanced traders know how to adjust the leverage according to market conditions. For example:

- During volatile markets, these traders use minimum leverage to reduce the position size as the market is likely to move harshly.

- In the case of less volatility, they may use high leverage since the price changes vary fewer distances.

Furthermore, professional traders understand the difference between leveraged positions of futures versus options contracts and develop hedge strategies to offset the risks amongst both markets.

Futures leverage vs Options leverage

The leverage in the futures market consists of multiplying an initial stake by a determined number.

If a trader has 1000 dollars to stake in a position, and this trader employs an x20 leverage, then that initial stake turns into 20000 dollars, increasing the position size and allowing to buy or sell contracts containing 20k worth of the underlying crypto.

The leverage of futures contracts is adjustable to the risk aversion of the trader.

In the options market, the leverage takes another way. This type of contract bears a fixed multiplicator, which is determined by the contract writer (seller). Generally speaking, options multiply by x10 the initial investment of the contract buyers.

Understanding the Risks of Leveraging

Leverage often encourages a mindset focused on short-term gains rather than long-term investment strategies. But, professional and successful trading is often dictated by strategic planning.

The temptation of high leverage can lead traders to make impulsive decisions based on market fluctuations, ultimately resulting in emotional trading that can compound losses and lead to bad financial decisions.

With leverage, a trader may only need a slight move in the market to trigger a liquidation price, which forces them to either deposit more funds or liquidate their positions.

Advantages of Trading Platforms with Leverage

- Increased Profit Potential: The primary allure of leverage is the opportunity to magnify profits. A well-timed trade that goes in favor of the trader can yield substantial returns on a relatively small initial capital outlay.

- Market Access: Leverage allows traders to access markets that may otherwise be out of reach. For instance, with limited capital, they can gain exposure to larger assets, diversifying their portfolios while maximizing potential returns.

- Variety of Strategies: Leveraged trading can facilitate a range of trading strategies, including hedging against losses in other positions or exploiting short-term market movements for quick gains. This flexibility can be beneficial for traders looking to implement sophisticated trading techniques.

- Liquidity: Many leveraged platforms offer enhanced liquidity, allowing traders to enter and exit positions more easily. This is particularly advantageous in the crypto market, where price fluctuations can occur within seconds.

Disadvantages of Trading Platforms with Leverage

- Increased Exposure to Market Volatility: Cryptocurrencies are notably volatile. A small price movement can lead to substantial gains or significant losses.

- Cost of Leverage: Trading platforms offering leveraged options may charge significant fees or interest on the borrowed capital.

- Varying Degrees of Liquidity: High liquidity can facilitate quick trades, but during extremely volatile market movements, platforms can experience issues, making it challenging to close positions.

Conclusion

It is essential for crypto traders to approach leveraging with caution, ensuring they conduct thorough research and maintain a disciplined trading mindset. Adopting adequate strategies and remaining aware of the inherent dangers will guarantee healthier trading practices and improved long-term outcomes when using leverage.

Altrady is a crypto trading platform with multi-exchange integration features where beginners and professional investors manage assets across multiple accounts simultaneously, seizing algorithmic, automation, and bot functionalities. Sign up for a free trial account today.