Chapters

The Future of Bitcoin Mining: Renewable Energy & Carbon Footprint Debate

Bitcoin mining has a power problem. The process that fuels the world’s biggest cryptocurrency also consumes more electricity than some countries. As climate concerns intensify, Bitcoin’s carbon footprint is under fire from regulators, investors, and environmentalists alike.

But there’s a shift underway. A growing number of mining operations are turning to renewable energy, not just to cut emissions, but to stay profitable and future-proof in a changing world.

Read below to understand more about the start of a cleaner crypto era.

Bitcoin Mining – Past and Present

Origins and the Dawn of Bitcoin Mining (2009–2010)

Bitcoin mining officially started on January 3, 2009, when Bitcoin’s creator – an anonymous figure using the name Satoshi Nakamoto, generated the very first block on the blockchain, now known as the genesis block. This block came with a reward of 50 bitcoins. It also included a now-famous line from The Times: “Chancellor on brink of second bailout for banks.” The message was both a timestamp and a statement on the instability of traditional finance.

At the time, mining was done solely with ordinary computer CPUs. Anyone with a basic PC could participate. It was an open, low-barrier system, consistent with Nakamoto’s goal of decentralized control. The mining difficulty was extremely low, allowing early users to collect thousands of bitcoins with little technical effort. Satoshi himself is believed to have mined around 1 million bitcoins during this period.

How Early Mining Worked

The process of mining looked something like this:

- Unconfirmed transactions were pulled from the mempool (Bitcoin’s waiting area for transactions).

- These transactions were bundled into a potential new block.

- A Merkle root—one hash that summarizes all the transactions—was computed.

- A block header was built, including the previous block’s hash, the Merkle root, a timestamp, a target difficulty, and a nonce.

Miners then repeatedly hashed this header using SHA-256, tweaking the nonce until the resulting hash met the network’s difficulty requirement.

The first miner to solve this cryptographic puzzle would publish the block, collect the 50 BTC reward, and earn any included transaction fees.

Early Bitcoin network and first transactions

The initial open-source Bitcoin software was released on January 9, 2009. Just days later, on January 12, Nakamoto sent 10 BTC to Hal Finney, a noted cryptographer, in the first recorded Bitcoin transaction (block 170). Other early contributors included Wei Dai, known for b-money, and Nick Szabo, creator of Bit Gold, both of whom shaped Bitcoin’s philosophical and technical foundations.

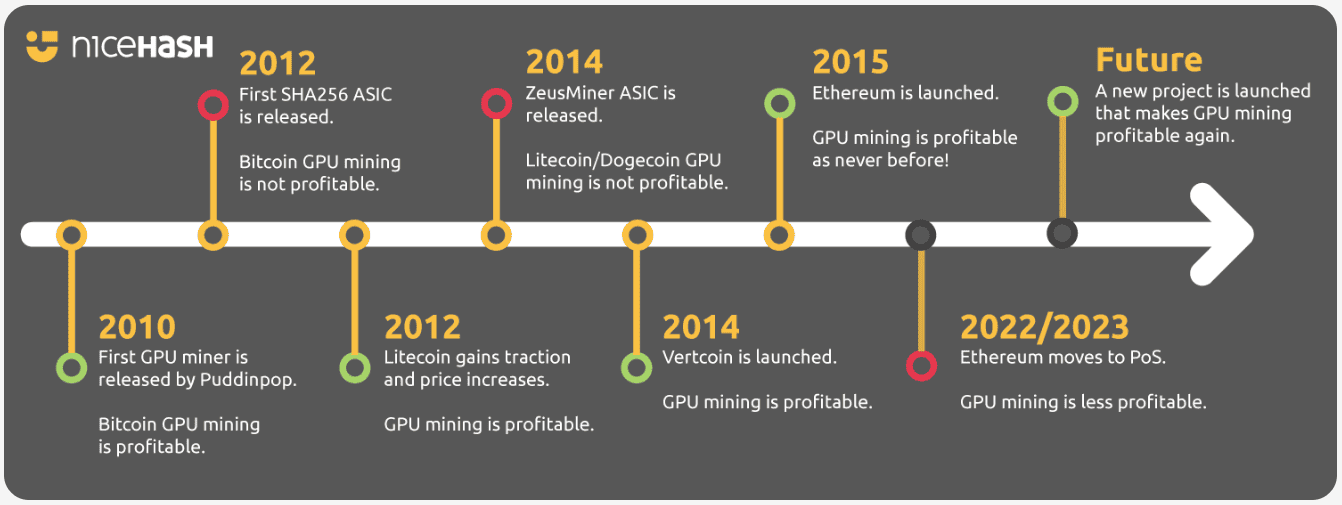

The Shift to GPUs

As more users joined the network, the system automatically increased mining difficulty to keep block times consistent. Around late 2010, miners discovered that GPUs (graphics processing units) could outperform CPUs by a wide margin when running the SHA-256 algorithm. This leap in efficiency kicked off a race toward increasingly specialized hardware, but during Bitcoin’s first two years, CPUs still ruled the landscape.

Source: Nicehash.com

Early mining economics

Each block in this period yielded 50 BTC, with new blocks created roughly every 10 minutes. With hardly any competition and negligible electricity costs, early miners earned large rewards with modest setups. Bitcoin didn’t even have a market price until October 2009, when 5,050 BTC were exchanged for $5.02 – putting each bitcoin at a fraction of a cent.

Closing the CPU Era

This initial chapter ended as Bitcoin’s popularity surged, mining difficulty climbed, and new hardware like GPUs—and eventually FPGAs and ASICs—hit the scene. CPU mining quickly became obsolete, giving way to pooled mining and the rise of industrial-scale operations.

| Feature | Early Bitcoin Mining (2009–2010) |

| Hardware | CPUs (standard personal computers) |

| Mining type | Solo mining |

| Block Reward | 50 BTC |

| Difficulty | Very low, adjusted as more miners joined |

| Accessibility | Open to anyone with a PC |

| Notable events | Genesis block, first transaction (scientist Hal Finney) |

| Transition | Shift to GPU mining (2010-2011) |

Bitcoin Mining in 2025

In 2025, Bitcoin mining has evolved into a full-scale global industry. It’s a high-stakes game powered by custom-built machines, vast data centers, and a relentless drive for lower power costs and maximum efficiency.

Verifying transactions & building blocks

Miners scan the mempool—the pool of pending transactions—and select those offering the highest fees. These are packaged into a candidate block, with priority given to transactions that pay more per byte of data.

Proof of Work (PoW)

To add a block to the blockchain, miners compete to solve a cryptographic puzzle. Using SHA-256, they repeatedly change a number called the nonce and hash the block’s data, hoping to produce a hash that meets the network’s difficulty requirement. This demands extreme computing power and massive energy use.

Winning the race

Once a miner lands on a valid hash, they broadcast the block to the network. If accepted, they’re rewarded with the current block subsidy—3.125 BTC in 2025—plus transaction fees from the included transactions.

Difficulty retargeting

Every 2,016 blocks (roughly every two weeks), the protocol adjusts the mining difficulty. This keeps block times close to the 10-minute average, even as global mining power fluctuates.

The tools of the trade

General-purpose hardware is long obsolete. Today’s miners use ASICs (Application-Specific Integrated Circuits) built solely for mining Bitcoin. These chips deliver unprecedented speed and efficiency.

Top machines of 2025

Some of the top-performing rigs this year include:

- Bitmain Antminer S21e XP Hyd 3U: 860 TH/s, 11,180W

- Bitmain Antminer S21 XP+ Hyd: 500 TH/s, 5,500W

- Auradine Teraflux AH3880: 600 TH/s, 8,700W

All feature cutting-edge hydrocooling systems to manage heat and boost energy efficiency.

High-end ASICs retail for $8,000 to $17,000 each. Major mining farms often run thousands of units, representing millions in hardware investment.

Economics & Strategy

Mining at home is effectively over. Most hashing power comes from large-scale farms or mining pools, often based in regions with cheap or renewable power like hydro or geothermal.

What drives profitability? Key variables include:

- Bitcoin’s market price

- Mining difficulty

- Machine efficiency

- Electricity rates

- Local laws and regulations

Small shifts in any of these can make or break profitability.

Energy & Environment

Bitcoin’s power usage continues to attract scrutiny. As a result, many operations are turning to greener energy sources to cut costs and appease regulators.

Current Trends

-

Mining Pools Dominate

Because solo mining has become a long shot, most miners join pools to pool resources and earn more stable returns. -

The Halving Effect

The block reward was cut to 3.125 BTC in the latest halving. The next halving, due in 2028, will reduce it again to 1.5625 BTC—further tightening margins for miners. - Regulation Shapes the Map

Some governments have cracked down on mining entirely, while others roll out incentives to attract miners. This patchwork of policies plays a major role in where operations are based.

What Will Happen with Bitcoin Mining in the Future

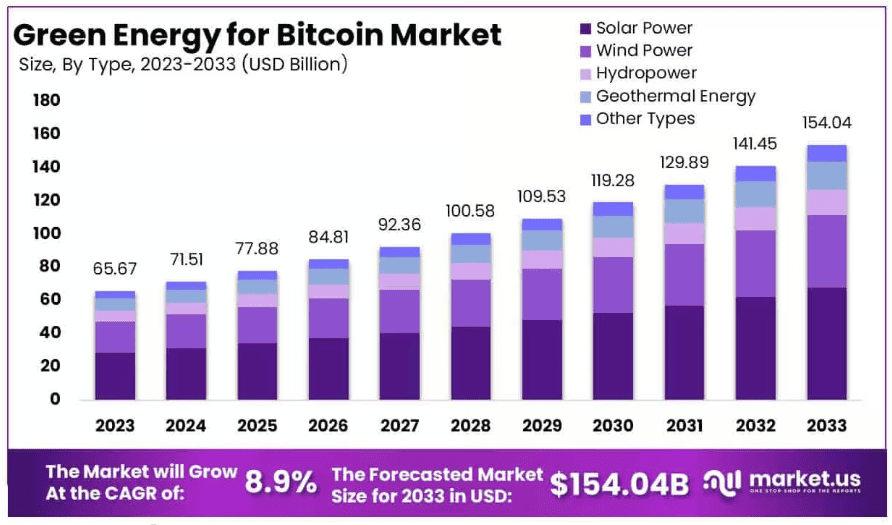

Bitcoin mining is steadily turning a corner on sustainability. Back in 2011, only about 20% of the energy used for mining came from renewable sources. By 2024, that number had climbed to 41%, and forecasts suggest it could hit 70% or more by 2030.

The momentum is being driven by a combination of cost savings, regulatory pressure, and technology improvements.

Why Miners Are Choosing Renewables

Cheaper power: renewables like hydro, wind, and solar often offer the lowest electricity rates—critical in a business where margins are thin.

Policy pressure: governments are pushing for cleaner energy. Incentives, carbon taxes, and outright bans on coal-based mining are reshaping the energy mix.

Better tech: mining hardware is becoming more energy-efficient, and renewables are getting more reliable and accessible.

Source: market.us

Wind and solar are gaining ground – by 2024, they made up 10.86% and 6.07% of the mining energy supply, respectively. Hydropower remains a major player, and even nuclear energy is entering the mix in some regions.

Coal’s Decline, Natural Gas in Transition

Coal’s grip on Bitcoin mining has weakened significantly. In 2011, it supplied 63% of mining energy. By 2024, that number had dropped to just 20%, and it’s still falling. Natural gas now leads among fossil fuels, but it, too, is slowly being phased out as renewables become more cost-effective and politically favored.

Environmental Impact: Still High, But Improving

Bitcoin’s energy appetite remains huge, but its carbon footprint is shrinking. If the clean energy shift continues, total emissions could fall sharply by 2030. Even with projected emissions hitting around 76.4 million tons of CO₂ that year, renewable growth and grid decarbonization are expected to offset a significant portion of the environmental cost.

A Role in the Clean Energy Economy

Mining is starting to play a supportive role in the broader energy transition:

- Absorbing excess power: miners can tap into surplus energy that would otherwise go unused, such as curtailed wind or solar, or remote hydro sites.

- Stabilizing the grid: some mining operations adjust power usage in real-time to help balance energy supply and demand.

- Boosting local economies: countries with abundant renewables, like Ethiopia with its Grand Renaissance Dam, are now earning revenue by hosting low-emission mining operations.

Challenges Ahead

- Rising demand: As Bitcoin grows, total energy use may climb—even if the energy mix gets cleaner.

- PoW debate: The Proof of Work model still draws criticism for its high energy demands. Alternatives like Proof of Stake are gaining attention.

- Regulatory uncertainty: Energy sourcing and mining location decisions remain heavily influenced by evolving laws and regional policies.

Final Thoughts

Bitcoin mining is predicted to become substantially greener by 2030, with renewable energy powering the majority of operations and a declining carbon footprint. This transition is fueled by economic, technological, and policy factors, and positions Bitcoin mining as a potential ally in the global clean energy shift, despite ongoing challenges related to energy consumption and environmental impact.

.svg)