Chapters

Oil Prices, Inflation, and Their Relationship with Crypto Volatility

When oil prices spike and inflation starts climbing, most investors brace for impact, tightening their wallets, rebalancing their portfolios, and watching traditional markets react in predictable ways. But what about crypto?

Unlike stocks or bonds, digital assets don’t play by the old rules. Sometimes they mirror global trends; other times, they chart their own chaotic path. As energy costs rise and monetary policy shifts, the question grows louder: how do oil and inflation shape the stormy seas of crypto volatility, and can traders use these signals to their advantage?

Find the answer below.

What Happened to Oil Prices and Inflation when Bitcoin Was Born

When Bitcoin first hit the scene in 2009, oil prices and inflation didn’t flinch. At that point, Bitcoin was more of a nerdy experiment than a financial disruptor. But fast forward to the mid-2010s, and things start to shift. By 2017, Bitcoin was making headlines with its meteoric rise to nearly $20,000. That’s when it began to sneak into mainstream financial conversations—and spook a few markets.

While Bitcoin isn’t directly tied to oil or consumer prices, it managed to mess up with investor behavior. As people started pouring cash into Bitcoin hoping for big returns, some money that might’ve gone into commodities like oil took a detour. That created small but noticeable ripples.

Oil saw price swings, partly because of shifting demand in futures markets, as more traders started speculating on crypto instead.

At the same time, central banks began paying closer attention. Bitcoin was built as a hedge against inflation, especially in countries with unstable currencies. Take Venezuela: while inflation was spiraling out of control, people were trading bolívars for Bitcoin just to preserve value. That added pressure on local economies and showed that Bitcoin could act like digital gold.

When and How Cryptocurrencies Started to Impact Oil Prices and Inflation

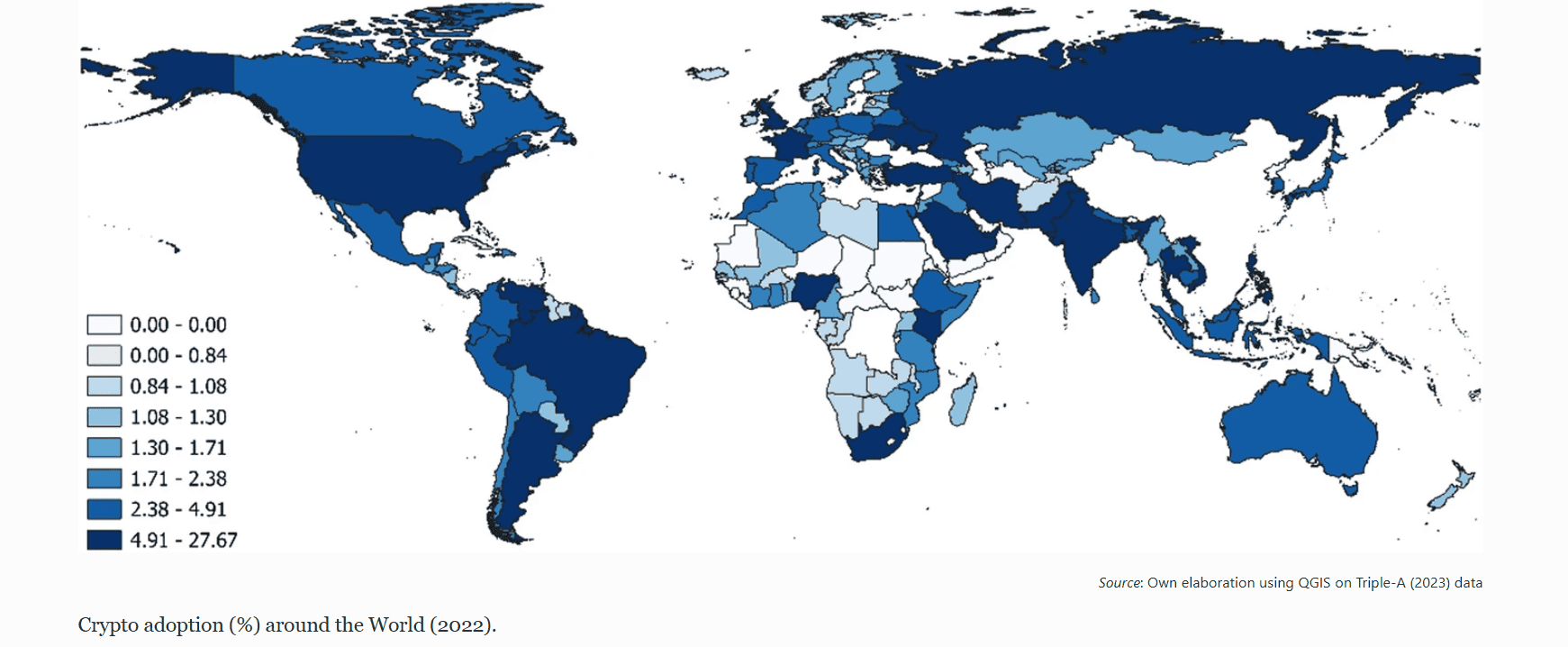

Cryptocurrencies started throwing real weight around in global markets around 2020, and that’s when their volatility began to noticeably impact oil prices and inflation dynamics. The trigger? A massive surge in crypto adoption during the COVID-19 pandemic, paired with a global liquidity flood. As governments pumped trillions into the economy through stimulus packages, a lot of that cash found its way into speculative assets, especially Bitcoin and other cryptos.

Source: SpringerOpen

Studies indicate that while short-term correlations were weak, long-term cointegration between major cryptocurrencies like Bitcoin and Ethereum and oil benchmarks became more significant over time.

In early 2021, Bitcoin skyrocketed past $60,000. Ethereum and other altcoins followed. This surge triggered a psychological shift: crypto wasn’t just a fringe asset anymore. It was being treated like a new store of value, an inflation hedge, and even a safe haven – at least in theory. Institutional investors jumped in, and that meant crypto started competing directly with traditional hedges like oil, gold, and even fiat currencies.

Now, here’s where it gets interesting. Whenever crypto prices took a dive, which they often did, thanks to tweets, regulations, or exchange meltdowns, risk sentiment in markets shifted fast.

For example, in May 2021, after China cracked down on mining and Elon Musk backtracked on Bitcoin, crypto markets lost over $800 billion in value in a matter of weeks. That crash sparked broader market pullbacks, including in commodities like oil, as traders fled riskier assets across the board.

This volatility affected inflation indirectly too. In places like Turkey or Argentina, where local currencies were unstable, crypto adoption surged as a hedge. That drove up demand for imported energy, often paid in dollars, adding to inflationary pressure. Meanwhile, central banks in major economies started watching crypto more closely, knowing that retail investors’ spending behavior and inflation expectations were now partially tied to what Bitcoin was doing.

The introduction of Bitcoin futures helped reshape market behavior, impacting how investors approached risk and strategy.

By 2024, studies showed that swings in crypto prices could stir up volatility in traditional markets like oil and equities, especially in areas such as the Gulf Cooperation Council (GCC). Even so, cryptocurrencies mostly moved independently of other assets, making them a useful tool for portfolio diversification.

So while crypto isn’t moving oil prices the way OPEC or geopolitical tensions do, it is a volatility engine. It plays with investor psychology, affects flows of capital, and increasingly, it’s part of the inflation conversation, whether central bankers like it or not.

The Relationship Between Bitcoin Mining and Energy Costs

Bitcoin mining is tightly linked to energy expenses, and swings in oil prices can seriously affect profitability.

Because mining demands immense computing power, it consumes a lot of electricity. In areas where power is generated mainly from fossil fuels, especially oil, coal, or natural gas, rising oil prices push energy costs higher. This eats into miners' margins, making it more expensive to secure the blockchain and process transactions.

Key factors in this equation include:

- Energy source dependence: many mining operations are located in regions powered by fossil fuels. As oil prices rise, so do electricity rates, driving up mining costs.

- Profit margins under pressure: profitability hinges on Bitcoin’s market price, power costs, and hardware efficiency. When energy gets pricier, older or less efficient mining rigs may no longer break even.

- Regional disparities: areas rich in renewables or hydroelectric power are shielded from oil price spikes. In contrast, places with oil-heavy grids are hit harder.

- Operational shifts: miners often adapt by upgrading equipment, relocating to cheaper energy zones, or temporarily scaling back production during high-cost periods.

This link between oil prices and Bitcoin mining reveals just how closely crypto infrastructure is tied to the broader energy economy. While a shift toward renewables is underway, for now, oil remains a major influence on mining viability.

Bitcoin mining costs can also directly impact Bitcoin’s price. When oil prices rise, electricity costs follow suit, making mining more expensive, ultimately increasing market supply and potentially triggering price drops. Conversely, lower oil prices can make mining more cost-effective, encouraging more miners to participate.

Final Thoughts

Initially, Bitcoin didn’t cause inflation or make oil prices spike, but it disrupted the usual flow of money. It added a new layer to the global economy – one that central banks, oil traders, and investors could no longer ignore.

As crypto adoption surged post-2020, its volatility began to echo through traditional markets. Sharp price swings in Bitcoin now move billions, sometimes dragging oil prices and inflation expectations with them.

At the same time, the energy demands of Bitcoin mining have tethered it to fossil fuel markets. Oil price spikes don’t just affect gas pumps—they squeeze mining profits and shift the economics of blockchain security. In this way, oil, inflation, and crypto have become part of a new financial feedback loop.

Crypto may never replace oil as a core economic driver, but its role in shaping risk, energy consumption, and inflation narratives is only growing.

.svg)