Chapters

Anatomy of an ICO: Token Creation and Distribution

If you’re thinking about launching a crypto project, one of the first hurdles you’ll face is figuring out how to create and distribute your token. This isn’t just a technical exercise, it’s a strategic play that can make or break your project. Get it right, and you’ve got a thriving ecosystem with real community buy-in. Get it wrong, and you risk ending up with a dead token nobody wants to hold.

In this guide, we’ll walk through the general process of token creation and distribution step by step. Whether you’re planning a fungible token for DeFi, an NFT collection, or a hybrid approach, understanding the mechanics of token distribution is essential. Let’s break it down.

The Token Creation Process

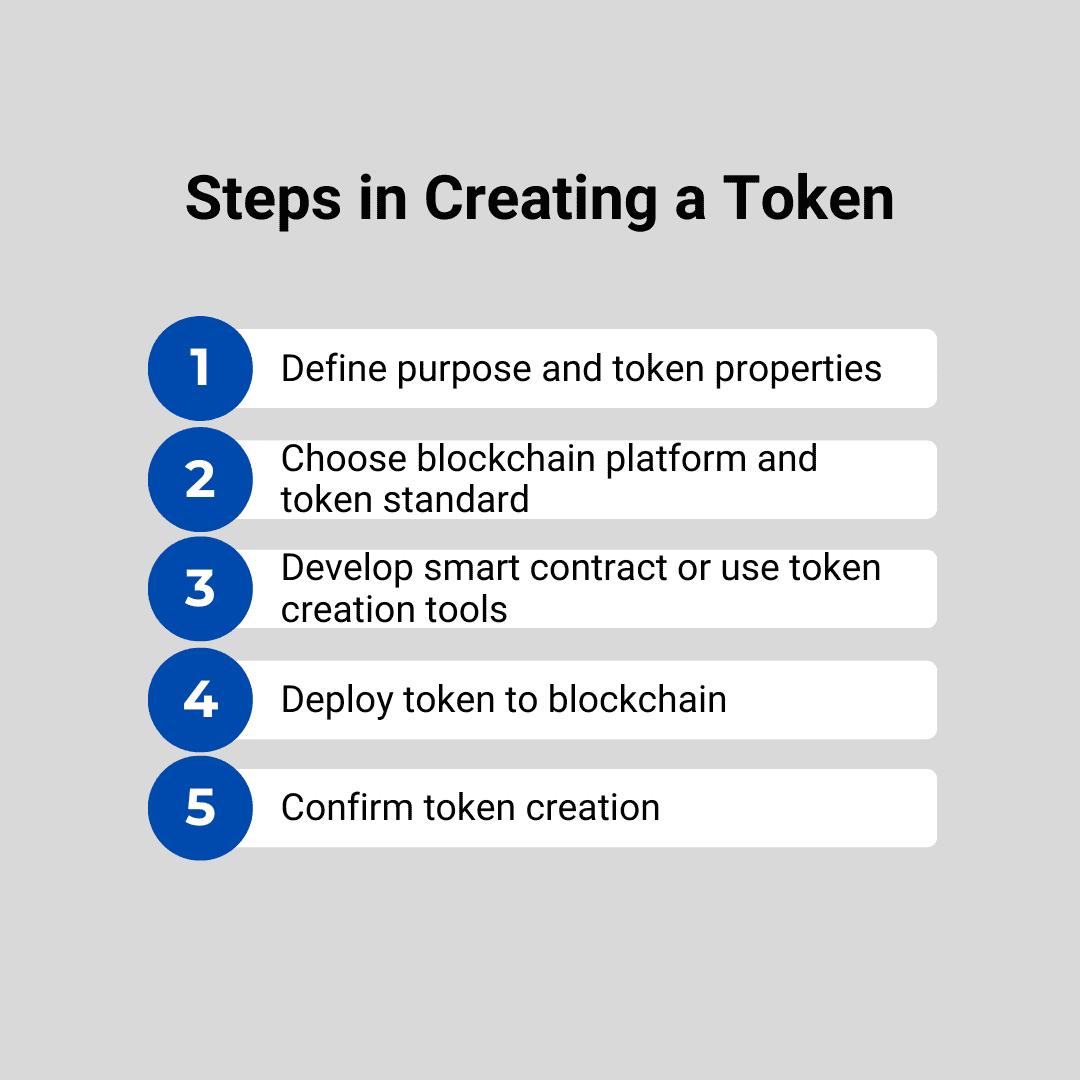

Before you can distribute tokens, you need to create them. This process usually follows five major steps:

1. Define Purpose and Token Properties

Every token starts with a purpose. Ask yourself:

- What role will this token play in my ecosystem?

- Is it a governance token, a utility token, or a store of value?

- Will it be fungible (like ERC-20 tokens) or non-fungible (like NFTs)?

- Once that’s nailed down, define the technical properties:

- Name and symbol (e.g., UNI for Uniswap, SOL for Solana)

- Decimals (how divisible the token is—usually 18 for ERC-20s)

- Initial supply and maximum supply

- Minting or burning rules (can more tokens be created or destroyed later?)

These properties aren’t just cosmetic—they directly affect the economics and appeal of your project.

2. Choose Blockchain Platform and Token Standard

The blockchain you pick determines a lot about your token’s usability.

Ethereum: The OG choice. Huge ecosystem, high security, but higher gas fees.

Binance Smart Chain (BSC): Cheaper fees, fast transactions, and strong DeFi adoption.

Solana: High throughput, low cost, but more centralized compared to Ethereum.

Polygon, Avalanche, Arbitrum, Optimism: Popular scaling options if you want lower fees while still tapping into Ethereum’s ecosystem.

On top of that, you’ll need to select a token standard:

- ERC-20 for fungible tokens.

- ERC-721 for NFTs.

- ERC-1155 for hybrid assets.

The choice of standard ensures your token works smoothly with wallets, exchanges, and dApps.

3. Develop Smart Contract or Use Token Creation Tools

Now it’s time to mint. You’ve got two paths:

- Write your own smart contract: If you’ve got dev chops, you can customize the token logic yourself. This gives you full flexibility over rules like staking mechanics, vesting, or deflationary burns.

- No-code token creation tools: Platforms like OpenZeppelin, Moralis, or third-party launchpads let you spin up a token without deep technical knowledge. Handy for startups moving fast.

Smart contracts are the brain of your token. They enforce supply, ownership, and transfer rules automatically – no human middleman is required.

4. Deploy Token to Blockchain

Deployment means submitting your token’s contract to the chosen blockchain. This step requires:

- Paying gas fees (ETH, BNB, SOL, etc., depending on the chain)

- Waiting for confirmation from the network

Once deployed, your token exists permanently on-chain. There’s no undo button, so double-check the code before you hit deploy.

5. Confirm Token Creation

The final step is to verify your token. On Ethereum, that means checking Etherscan to confirm your contract details, supply, and token ID. Other chains have their own explorers (BscScan, Solscan, etc.).

You’ll also want to:

- Verify the contract source code (boosts transparency).

- Publish token details on aggregators like CoinGecko or CoinMarketCap.

Congratulations, you’ve now got a live token. But a token without distribution is just numbers on-chain. The real challenge begins now.

The Token Distribution Process

Token creation is the easy part. Token distribution is where strategy meets execution. This is how you actually get tokens into the hands of users, investors, and your community.

Here’s the process:

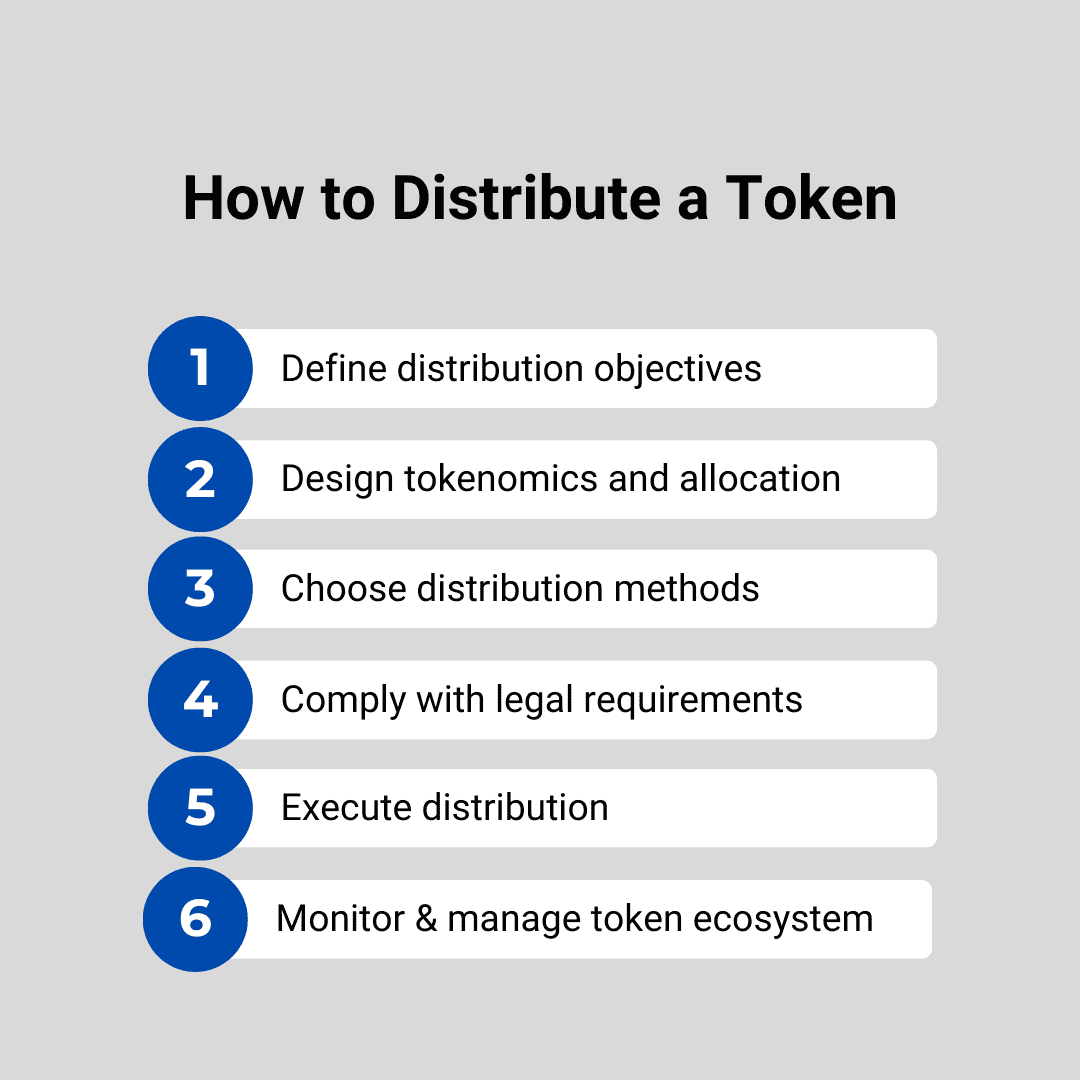

1. Define Distribution Objectives

Why are you distributing tokens in the first place? Common objectives include:

- Fundraising: Selling tokens to raise capital.

- Community building: Rewarding early adopters, ambassadors, or contributors.

- Ecosystem incentivization: Driving liquidity, staking, or governance participation.

Being clear about your goals helps shape your token distribution model.

2. Design Tokenomics and Allocation

Tokenomics is the backbone of your project. It’s about defining who gets what, and when.

Key allocations often include:

- Team and advisors: Usually locked with a vesting schedule to prevent dumping.

- Investors: Early backers often get a portion at discounted rates.

- Community and ecosystem: Airdrops, liquidity mining, staking rewards.

- Reserves: Held for future growth, partnerships, or emergency funding.

Vesting schedules are crucial. They stop large holders from crashing your token price by dumping early. Typical structures might include a 6-12 month cliff followed by gradual unlocks.

3. Choose Distribution Methods

There’s no one-size-fits-all approach to token distribution. Common methods include:

- Initial Coin Offerings (ICOs): The classic fundraising model, though heavily scrutinized by regulators.

- Initial Exchange Offerings (IEOs): Tokens are sold via centralized exchanges, adding credibility and access to existing user bases.

- Initial DEX Offerings (IDOs): Launching directly on a decentralized exchange like Uniswap or PancakeSwap.

- Airdrops: Free token distributions to wallets—great for bootstrapping community engagement.

Staking rewards and liquidity mining: Users earn tokens by locking liquidity or staking assets. This aligns long-term participation with token distribution.

The method you choose depends on your target audience and regulatory comfort zone.

4. Comply with Legal and Regulatory Requirements

The least sexy but most important part: compliance. Regulators worldwide are cracking down on token launches that blur the line with securities.

At a minimum, consider:

- KYC/AML requirements if you’re selling tokens.

- Securities regulations in the U.S., EU, and other jurisdictions.

- Tax implications for both the project and token holders.

Many projects hire legal counsel or compliance specialists before launching. Skipping this step can tank your project overnight.

5. Execute Distribution

When it’s time to roll out tokens, execution matters. Smart contracts can automate distribution schedules, ensuring fairness and transparency. For example:

- Vesting contracts for team tokens.

- Liquidity pools for DEX launches.

- Automated airdrop tools to distribute tokens at scale.

Proper execution builds trust. Messy or unfair distribution? That’s a recipe for FUD and community backlash.

6. Monitor and Manage the Token Ecosystem

Distribution doesn’t end at launch. Ongoing management keeps your ecosystem healthy. This includes:

- Tracking liquidity levels on exchanges.

- Monitoring price stability and responding to volatility.

- Adjusting staking or reward incentives to balance supply and demand.

- Continuing community engagement to encourage token usage.

Projects that fail to nurture their ecosystem post-launch often fade into irrelevance. Active management is what separates sustainable tokens from pump-and-dump schemes.

Why Token Distribution Strategy Matters

A token’s success doesn’t revolve just around code or hype; it’s also about distribution. Even the most technically solid token will fail if it ends up concentrated in a few wallets or if incentives don’t align with long-term growth.

Poor token distribution leads to:

- Whale control (a few holders can dump and crash the market).

- Community disinterest (if users don’t feel included).

- Regulatory red flags (if it looks too much like an unregistered security).

A thoughtful, transparent, and well-executed token distribution strategy, on the other hand, sets your project up for sustainable adoption.

Bottom Line

Launching a token is exciting, but it’s not just about spinning up some code and throwing it out into the wild. From the first line of the smart contract to the last airdrop, every decision affects your token’s credibility and longevity.

The token creation process lays the technical foundation, while the token distribution process defines the real-world impact. Together, they shape whether your token becomes a thriving part of the crypto landscape or just another abandoned contract on-chain.

If you’re serious about building a project with staying power, treat token distribution as more than a marketing gimmick. Think of it as the heartbeat of your ecosystem. Done right, it’s what turns your idea into a community, your community into a market, and your market into something that lasts.

.svg)