Chapters

Case Studies of Successful and Failed ICOs

Initial Coin Offerings (ICOs) were the wild west of crypto fundraising. Between 2013 and 2018, thousands of projects raised billions of dollars from eager investors looking for the next Bitcoin. Some of those ICOs became game-changers, delivering massive returns and building real products. Others crashed hard, some due to poor execution, others because they were outright scams.

Understanding the difference between a successful ICO and a failed one is less about learning a history lesson and more about being strategic with your investments. The same patterns of vision, timing, execution, and hype that shaped ICO outcomes still matter today for token launches, IDOs, and beyond.

Let’s break down three of the biggest success stories and two of the most infamous failures, and see what lessons they hold for crypto traders who want to separate solid plays from vaporware.

Examples of Successful ICOs

1. Filecoin (FIL): $233 Million Raised, Still Relevant Today

Filecoin’s 2017 ICO was legendary. It pulled in $233 million, making it one of the largest fundraising events of the ICO era. And unlike many hype-fueled projects of the time, Filecoin actually delivered.

The Big Idea: Filecoin built on top of IPFS (InterPlanetary File System) and pitched a decentralized storage market. Instead of relying on centralized providers like Amazon or Google, users could rent out unused hard drive space and get rewarded in FIL tokens. The concept solved a clear problem: centralized control of data storage and fit perfectly with the Web3 ethos of decentralization.

Investor Confidence: Filecoin wasn’t just a retail craze. Before the public ICO, it raised $52 million from top VCs like Andreessen Horowitz, Sequoia, and Union Square Ventures. When the public sale went live, demand went through the roof: $188 million was raised in just one hour.

Source: TechCrunch

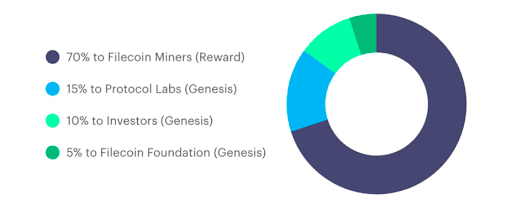

Smart Tokenomics: Early investors got discounted tokens locked with vesting periods, ensuring long-term alignment. While some criticized the uneven pricing, this structure secured early capital and reduced the risk of mass dumping.

Regulatory Savvy: Filecoin only accepted accredited U.S. investors, aligning with SEC rules. This move helped it avoid the legal nightmares that crushed other ICOs.

Perfect Timing: The launch happened right at the peak of the 2017 bull run, when ICO mania was in full swing. Combine hype with a credible product and heavyweight backers, and you have the recipe for a monster ICO.

Why it worked: Filecoin wasn’t just hype; it addressed a real-world demand with strong execution, institutional backing, and a regulatory-compliant launch. Today, it remains one of the cornerstones of decentralized infrastructure.

2. NXT: The Tiny ICO That Made Millionaires

Back in 2013, long before ICOs became a buzzword, NXT quietly raised just $16,800 worth of Bitcoin. The token’s initial price was a laughable $0.0000168. At its peak, NXT hit $2.15, an insane 1,477,000% ROI.

First-Mover Advantage: NXT wasn’t a Bitcoin clone. It was one of the first blockchains built completely from scratch. That gave it a unique identity and tech credibility when most “altcoins” were little more than forks.

Proof-of-Stake Innovation: Long before Ethereum even considered moving to PoS, NXT went all-in with a pure Proof-of-Stake system. At a time when Bitcoin was being criticized for energy consumption, NXT showed that a greener, more efficient alternative was possible.

Feature-Rich Ecosystem: NXT was more than a token as it came with a decentralized asset exchange, a voting system, and messaging features. These were groundbreaking in 2013 and helped prove that blockchains could be more than just money.

Community Power: Despite raising almost nothing, NXT had a passionate community that contributed to development and spread the word. In the early days of crypto, that kind of grassroots energy was priceless.

Timing: In 2013, Bitcoin was still the dominant narrative, and there weren’t many alternative platforms. NXT’s novelty made it stand out as one of the first “platform” coins.

Why it worked: NXT proved that success isn’t about how much you raise, but whether you can bring true innovation and build a dedicated community.

3. ARK: From $0.04 to $11

In 2016, ARK held its ICO at $0.04 per token. Within a year, it skyrocketed to nearly $11, giving early backers a massive 35,000% return.

Clear Value Prop: ARK focused on blockchain interoperability, introducing the idea of “SmartBridges” to let different blockchains communicate. At the time, most networks were siloed, so this vision of connecting chains was bold and appealing.

Solid Tech Base: ARK was built on a modified version of Lisk’s code and used Delegated Proof-of-Stake (DPoS) for scalability and efficiency. The technical foundation was credible and practical.

Community Engagement: ARK stood out for its transparency. The team constantly updated the community, kept communication open, and focused on building trust. This was in sharp contrast to the many opaque projects of the ICO boom.

Good Timing: The ICO launched just before the explosive 2017 bull market. ARK benefited from the massive wave of investor interest but had already positioned itself with a strong pitch.

Focus on Usability: ARK wasn’t just for crypto insiders. It wanted to make blockchain easier for developers and businesses, with push-button blockchain creation and user-friendly wallets.

Why it worked: ARK combined technical credibility, community trust, and a forward-looking vision of blockchain interoperability – elements that made it stand out from the thousands of “me too” ICOs.

Examples of Failed ICOs

Of course, for every Filecoin or ARK, there were dozens of disasters. Some were scams from the start, others collapsed under their own weight. Let’s look at two notorious failures.

1. OneCoin: The Scam to End All Scams

If Filecoin was the poster child for ICO success, OneCoin was the exact opposite. It didn’t just fail, but it also scammed investors out of an estimated $350 million (some reports put the number in the billions).

The Pitch: OneCoin marketed itself as the “Bitcoin killer” and sold tokens through a multi-level marketing (MLM) scheme.

The Reality: There was no blockchain. No real coin. No product. It was just a Ponzi scheme dressed up in crypto branding.

The Fallout: Once authorities caught on, arrests followed. The founder, Ruja Ignatova, famously disappeared and is still on the FBI’s most wanted list.

Lesson: If there’s no working product, no blockchain, and the marketing looks more like a pyramid scheme than a tech project, it’s probably a scam.

2. Tezos: Raised Big, Crashed Hard

Unlike OneCoin, Tezos wasn’t a scam. It had real tech ambitions. In fact, it raised a record-breaking $232 million in its 2017 ICO. But things unraveled quickly.

The Idea: Tezos pitched itself as a self-amending blockchain with on-chain governance, a way to upgrade protocols without hard forks. The concept was strong and attracted massive funding.

The Problem: Internal conflict. After the ICO, the team became mired in power struggles and lawsuits. Development slowed, confidence tanked, and within hours of its token hitting the market, the price dropped 75%.

The Aftermath: Tezos eventually launched and is still around today, but it never lived up to its massive hype. Legal troubles and early dysfunction scarred its reputation permanently.

Lesson: Even legit projects can implode without strong governance and aligned leadership. Raising huge sums can amplify problems instead of solving them.

Takeaways for Crypto Traders

Looking at both winners and losers, a few patterns stand out:

- Real utility wins: Filecoin, NXT, and ARK all solved actual problems—storage, energy efficiency, interoperability. The failed ones either had no product (OneCoin) or failed to execute (Tezos).

- Timing matters: The biggest ICO winners rode bull market waves. Filecoin and ARK both launched at peak hype, but with strong fundamentals.

- Community and transparency: Projects that kept their communities engaged (NXT, ARK) built lasting trust. Secrecy or opaque leadership usually spells doom.

- Governance is key: Even legit projects can crumble under mismanagement. Traders should pay as much attention to team dynamics as they do to tokenomics.

- Don’t chase hype blindly: ICO mania was fueled by FOMO. The ones who made real money backed projects with clear value—not just slick marketing.

Bottom Line

ICOs may have faded, replaced by IDOs, IEOs, and other fundraising models, but the lessons remain timeless. As a trader, spotting the difference between Filecoin-level vision and OneCoin-level BS can mean the difference between life-changing gains and catastrophic losses.

At the end of the day, history shows us this: great ideas, strong teams, and real utility create lasting value.

.svg)