Chapters

The Role of Whitepapers and Project Documentation in Token Sales

Token sales can feel like a whirlwind: new projects popping up daily, promises flying, and hype building fast. But if you're serious about trading or investing in tokens, there's one thing you should never skip: the whitepaper.

A whitepaper is the backbone of any legitimate token sale. It’s the document that tells you what the project is really about, how the token works, and whether the team behind it knows what they’re doing. Think of it as your due diligence starter pack.

Let’s break down why whitepapers and project documentation matter so much and how they can make or break a token sale.

What Really Is a Whitepaper for Crypto Tokens

A whitepaper is the project's pitch deck, technical blueprint, and business plan rolled into one. It’s the first thing serious investors look at before deciding to put money into a token sale.

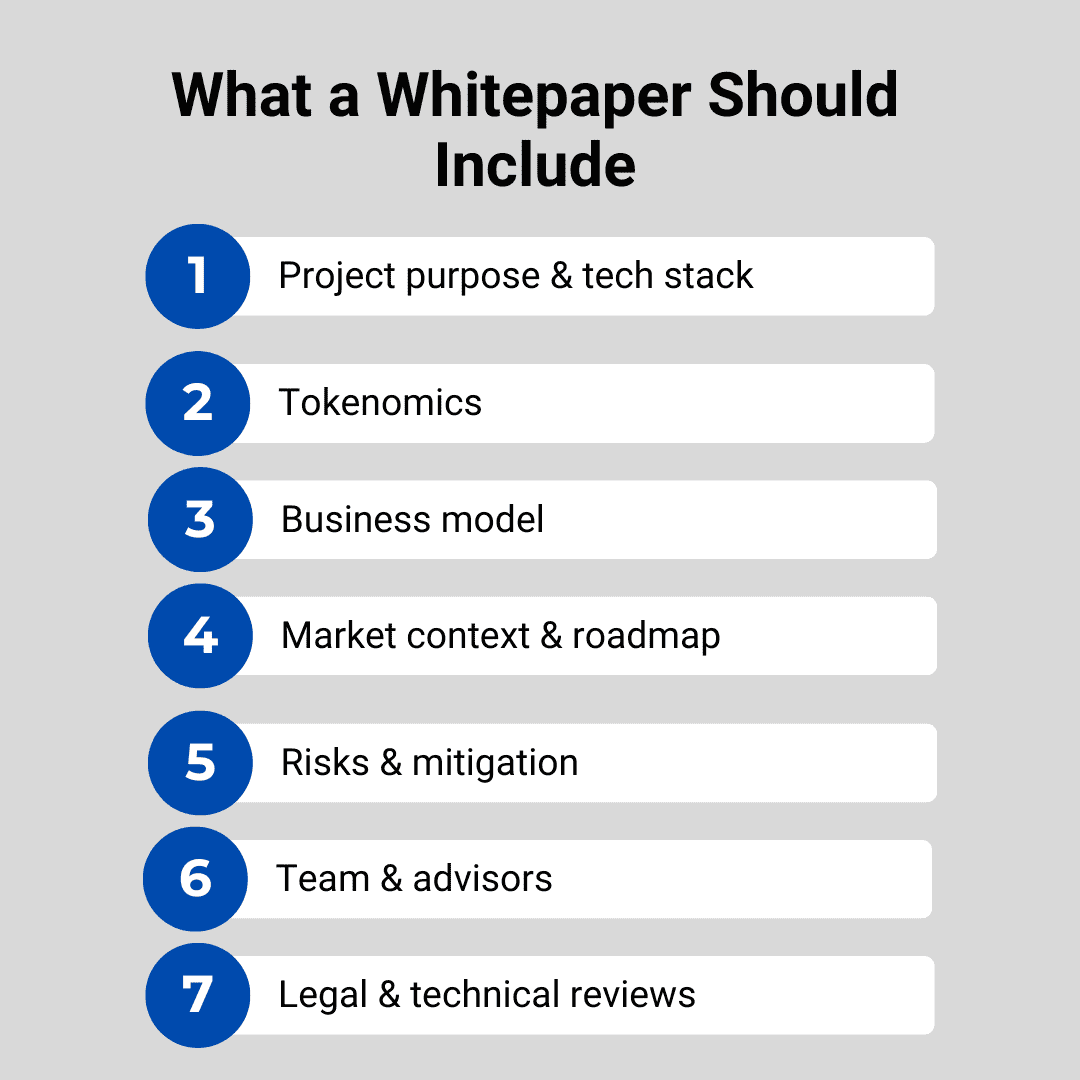

Here’s what a solid whitepaper should cover:

- Project Purpose & Tech Stack: What problem is the project solving? What technology powers it? Is it just another DeFi clone or something truly innovative?

- Tokenomics: How is the token structured? What’s the supply, distribution model, and utility within the ecosystem?

- Business Model: How does the project plan to make money—or at least sustain itself

- Market Context & Roadmap: Where does the project fit in the broader crypto landscape? What milestones are planned and when?

- Risks & Mitigation: Every project has risks. A good whitepaper acknowledges them and explains how they’ll be handled.

- Team & Advisors: Who’s behind the project? Are they experienced, doxed, and backed by credible partners?

- Legal & Technical Reviews: Bonus points if the whitepaper includes third-party audits or legal opinions.

In short, the whitepaper token is your window into the soul of the project. If it’s vague, overly hyped, or missing key info, take it as a red flag.

Examples of solid whitepapers:

Ethereum’s 2013 whitepaper laid the groundwork for a new era of blockchain innovation, introducing a programmable infrastructure capable of supporting advanced decentralized applications and smart contracts.

Polkadot’s 2016 whitepaper, penned by Dr. Gavin Wood, proposed a bold vision for blockchain scalability and cross-chain connectivity. It introduced a sharded multi-chain architecture designed to facilitate secure and seamless interaction between diverse blockchain systems.

Beyond the Whitepaper: Project Documentation That Matters

While the whitepaper gets most of the spotlight, it’s not the only document that matters. Serious projects also publish supporting documentation that adds legal and transactional clarity.

These include:

- Token Sale Agreement: This outlines the terms of the sale, including pricing, vesting schedules, and refund policies.

- Terms of Use: Covers how users can interact with the platform and what rights they have.

- Privacy Policy & KYC/AML Disclosures: Especially important for compliance in regulated markets.

- Third-Party Arrangements: If the project is working with exchanges, custodians, or other partners, this should be disclosed.

This matters because regulators are watching, and investors are smarter. Having proper documentation shows the project is serious, transparent, and ready to play by the rules.

Most legit projects publish all of this on their official website, often in a dedicated “Docs” section. If you can’t find it, ask yourself why.

How Whitepapers Impact Token Sale Success

Let’s talk results. Research shows that projects with well-written, informative whitepapers tend to raise more capital. It’s about looking professional but also about building trust.

Here’s why:

- Transparency Builds Confidence: Investors want to know where their money is going. A clear use-of-funds section can make all the difference.

- Technical Depth Signals Competence: A whitepaper that explains the tech in a digestible way shows the team knows their stuff.

- Clear Communication Wins: Overly technical whitepapers can alienate non-developer investors.

The best ones strike a balance: deep enough for experts, clear enough for everyone else.

But here’s the catch: more content isn’t always better. A 50-page whitepaper filled with jargon might look impressive, but if it doesn’t communicate the core value proposition clearly, it won’t convert readers into investors.

So if you’re launching a token, focus on clarity. And if you’re investing, read carefully.

What You Should Look for in a Crypto Token’s Whitepaper

If you’re a crypto trader scanning for promising token sales, here’s your checklist:

- Utility: Does the token actually do something within the ecosystem, or is it just a fundraising tool?

- Tokenomics: Is the supply capped? Are there lockups for the team and early investors?

- Roadmap: Are the milestones realistic? Is there a working product or just vaporware?

- Team Credibility: Are the founders public? Do they have a track record?

- Legal Clarity: Is the token classified as a utility, security, or something else? Are they compliant with local laws?

- Tech Explanation: Can you understand how the platform works without being a blockchain engineer?

If the whitepaper token checks these boxes, it’s worth a deeper look. If not, move on.

The Future of Whitepapers: Smarter, Leaner, More Interactive

As the crypto space matures, whitepapers are evolving too. We’re seeing:

- Interactive Docs: Some projects now use web-based whitepapers with clickable sections, embedded videos, and real-time updates.

- AI-Assisted Summaries: Tools that help investors digest complex whitepapers faster.

- Compliance-Ready Formats: Whitepapers designed to meet regulatory standards from day one.

This shift is great news for traders. It means less fluff, more substance, and easier access to the info you need to make smart decisions.

Compliance Is the New Alpha

In 2025, being compliant is about avoiding fines, but it’s also a competitive edge. Projects that embrace regulation early are:

- Gaining institutional trust

- Attracting serious capital

- Expanding into regulated markets

Whitepapers and supporting documentation play a huge role in this. They’re the first step in showing regulators and investors that the project is legit.

Groups like the Financial Action Task Force (FATF) are pushing for global standards, and frameworks like the EU’s MiCA and India’s VDA are setting the tone. If your favorite token sale isn’t aligned with these trends, it might be time to rethink.

Key Takeaways

Whether you’re an advanced crypto trader or just dipping your toes into token sales, the whitepaper token is your best friend. It’s a signal of seriousness, transparency, and long-term vision.

Before you invest, ask yourself:

- Have I read the whitepaper?

- Do I understand the token’s utility?

- Is the project backed by solid documentation?

If the answer is yes, you’re on the right track. If not, pause, research, and protect your capital.

Often, the whitepaper token is where the most important knowledge about crypto begins.

.svg)