Chapters

Historical Perspective and Evolution of Token Sales

Crypto has always been about breaking molds. From day one, blockchain promised a world where money, ownership, and even companies themselves could be run differently. And as you probably already know, one of the wildest experiments in this space has been token sales.

What started as a fringe fundraising method has grown into a multi-billion-dollar industry, complete with regulations, compliance checks, and institutional money flowing in. But it wasn’t always this polished. Token sales went through a rollercoaster of hype, scams, and innovation to get where they are today.

Let’s rewind the tape and walk through how token sales evolved: from the anarchic ICO days to the more mature structures we see now.

The Birth of Token Sales: Early Experiments

The first real token sale most people point to happened in 2013 with Mastercoin. The idea was simple but radical: instead of begging banks, VCs, or angel investors for funding, why not sell tokens directly to the public on the blockchain?

Mastercoin raised about $500,000 worth of Bitcoin—tiny compared to today’s standards, but it set the stage. The real breakthrough came a year later, in 2014, when Ethereum launched its ICO. That raise brought in over $18 million, which at the time felt massive. More importantly, it proved that blockchain-based fundraising could work at scale.

This was the start of a new era. Suddenly, projects realized they didn’t need Wall Street, venture capital firms, or intermediaries. All they needed was a whitepaper, some buzz, and a token sale.

The ICO Boom: The Wild West of Fundraising

Fast forward to 2017. Ethereum was live, and building a token on its network was as easy as spinning up an ERC-20 smart contract. That year, the floodgates opened: billions of dollars poured into ICOs.

Anyone with an idea could raise money by selling tokens. Investors from all over the world could buy in directly with ETH or BTC. There were no banks, no brokers, no gatekeepers.

It was crypto anarchy, and traders loved it.

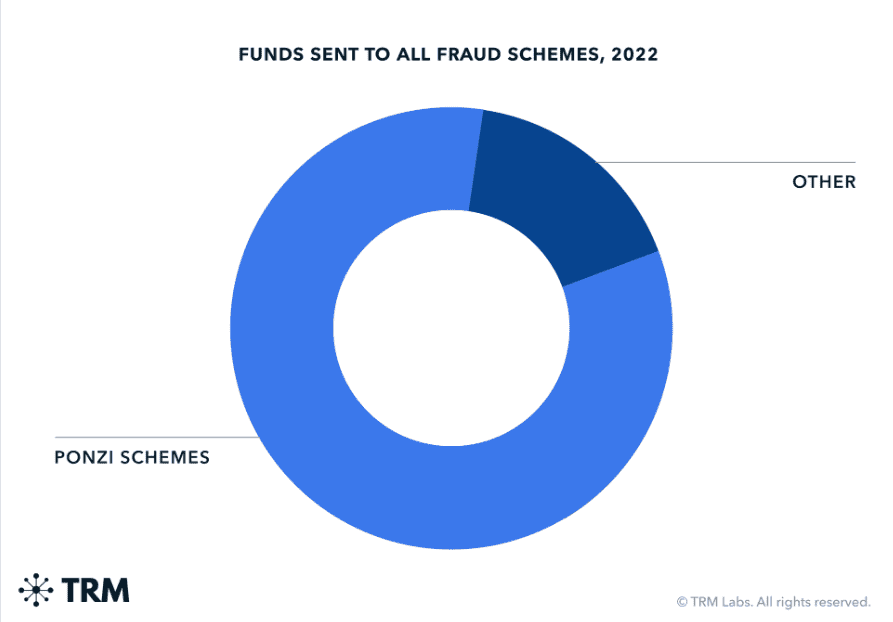

But with freedom came chaos. Alongside legit projects like Filecoin and Tezos, a tidal wave of scams and vaporware popped up. Some ICOs were straight-up Ponzi schemes. Others raised millions and then ghosted their communities.

Source: TRM Labs

The ICO boom of 2017–2018 is remembered as both a golden age of innovation and a crash course in what happens when hype meets zero oversight. Investors learned painful lessons about doing due diligence, while regulators started sharpening their knives.

The Regulatory Crackdown

Governments don’t like chaos, especially when retail investors are losing billions. By late 2017, regulators from the U.S. SEC to Asian financial watchdogs started issuing warnings and shutting down shady ICOs.

The main problem was that most of these token sales looked an awful lot, like unregistered securities offerings. Selling tokens that promised future profits without regulation was basically illegal in many jurisdictions.

This crackdown forced the industry to rethink its approach. The “raise first, build later” model was no longer going to fly. If token sales wanted to survive, they had to grow up.

STOs: The Compliance-First Era

The first attempt at maturing the model was the Security Token Offering (STO). Unlike ICOs, STOs openly admitted their tokens were securities and followed existing regulations.

That meant:

- KYC and AML checks for all investors.

- Registration with relevant authorities.

- Tokens representing real-world assets like equity, bonds, or real estate.

STOs brought a level of legitimacy but also killed some of the “borderless” magic. They catered more to accredited investors than retail traders, limiting accessibility. For institutions, though, STOs made tokenized fundraising look less like a scam and more like a regulated financial product.

IEOs: Exchanges Step In

While STOs leaned heavily into regulation, another model gained traction: the Initial Exchange Offering (IEO).

Here, crypto exchanges acted as intermediaries. Instead of projects running their own token sales, they partnered with exchanges like Binance or Huobi. The exchange handled KYC, promoted the sale, and offered instant listing once the token launched.

This solved several problems:

- Gave investors more trust (exchanges had reputations to protect).

- Made token sales accessible through platforms people were already using.

- Reduced scams (at least on paper).

IEOs didn’t remove all risks, but they professionalized the process and helped rebuild confidence after the ICO hangover.

The State of Token Sales Today

Token sales today look very different from the ICO free-for-all. While decentralization is still the ethos, compliance and investor protection are non-negotiable.

Modern token sales typically involve:

- Strict KYC/AML protocols to filter out bad actors.

- Comprehensive whitepapers detailing tokenomics, roadmaps, and legal disclaimers.

- Smart contracts that automate distribution and reduce human error.

- Regulatory oversight, especially in markets like the U.S. and EU.

Even decentralized platforms like DAOs or launchpads have learned to incorporate safeguards. Instead of chaos, token sales are becoming structured, reliable, and attractive to a wider range of investors, from retail traders to institutions.

The Pros and Cons of This Evolution

The Good:

- More trust: Scams are harder to pull off with regulations and intermediaries in place.

- Institutional buy-in: Compliance has opened the door to bigger investors.

- Better transparency: Whitepapers and audits keep teams accountable.

The Trade-offs:

- Less open: Retail investors are often gated out by accreditation rules.

- More bureaucracy: Token sales now look a lot like traditional fundraising.

- Costs: Compliance and legal work make token sales expensive for startups.

The irony is that the original dream of cutting out middlemen has slowly given way to a world where intermediaries (like exchanges or regulators) are back in play. But this balance may be necessary for mass adoption.

What’s Next for Token Sales?

Token sales continue to evolve. Several trends are shaping the future of fundraising in crypto:

- Decentralized Launchpads: Platforms like Polkastarter or DAO Maker aim to combine accessibility with safeguards.

- NFT-Based Fundraising: Projects experimenting with NFTs as a fundraising mechanism rather than fungible tokens.

- Hybrid Models: Combining STO-level compliance with IEO-style accessibility.

- Global Regulatory Clarity: As laws stabilize, token sales could become a mainstream fundraising option, not just a crypto-native one.

The next wave could be about striking the perfect balance: keeping token sales decentralized enough to honor blockchain’s ethos, but structured enough to keep regulators and investors happy.

Conclusion

Token sales have gone from a wild, unregulated playground to a structured, semi-regulated industry. The journey is a reflection of crypto itself: bold, chaotic, and constantly reinventing itself.

- In 2013, Mastercoin showed the world it was possible.

- In 2014, Ethereum proved it could scale.

- In 2017, ICOs exploded into mainstream awareness (and infamy).

- STOs and IEOs brought order after the storm.

Today, token sales are mature enough to attract serious money while still carrying the DNA of crypto’s decentralized roots.

For traders, the lesson is clear: token sales are no longer the free-for-all they once were, but they’re far from irrelevant. Understanding how they’ve evolved and where they might go next can give you an edge in spotting legit opportunities while avoiding the pitfalls of hype.

Crypto never sits still, and neither do token sales. Strap in, because the next chapter is still being written.

.svg)