Chapters

Significance and Impact of Token Sales on the Crypto Industry

You already know the phrase “token sales” carries a lot of weight. They’ve been a game-changer in how blockchain projects and tech startups raise capital. Forget waiting on a VC firm’s approval or spending years chasing an IPO, token sales blew the doors wide open, creating a new model for funding that feels faster, more global, and way more community-driven.

But beyond the hype, what’s the real impact of token sales? Let’s break it down into the key ways they’ve reshaped the industry, why traders love them, and what they mean for the future of decentralized finance.

The Impact of Token Sales

Liquidity: Fast Exits for Investors

In traditional venture capital, liquidity is a patience game. You invest in a startup and sit tight, sometimes for 7–10 years, until there’s an IPO or an acquisition. With token sales, that timeline gets slashed.

When a project launches a token sale, those tokens usually hit secondary markets like Binance, Coinbase, or Uniswap soon after. For investors, this means one thing: early liquidity. You can trade your position almost immediately instead of waiting years for a payout.

Take Polkadot as an example. Early investors who got in during the project’s token sale didn’t have to wait for some corporate exit strategy. As soon as DOT listed, they could lock in returns or keep stacking, depending on their risk appetite. That flexibility is rare in private equity and has made token sales hugely attractive to crypto traders who thrive on market movement.

For traders, liquidity equals opportunity. Whether you’re flipping short-term or holding long-term, token sales provide a dynamic entry point into new ecosystems with tradable assets from day one.

Global Accessibility and Democratization

The impact of token sales isn’t just about returns, but also about access. Traditional funding models tend to favor startups from Silicon Valley, London, or other financial hubs, and they rely on connections with well-placed venture capitalists. Token sales flipped the script.

Anyone with an internet connection and a crypto wallet can participate. This opens the door for investors in places like Southeast Asia, Africa, or Latin America to get exposure to projects that would’ve been impossible to access a decade ago. For startups, especially those outside the usual tech centers, this is revolutionary. Suddenly, raising capital isn’t about geography—it’s about community.

Financial inclusion is a buzzword, but token sales actually put it into practice. They don’t just create investment opportunities for wealthy insiders—they make them accessible to everyday traders and communities across the globe.

Of course, regulation plays a role here, and some jurisdictions have clamped down. But even with restrictions, the core innovation stands: token sales have democratized investing in a way that traditional finance simply couldn’t.

Community-Driven Growth and Innovation

One of the coolest things about token sales revolves around raising money and building a community from the ground up.

When a project launches a token sale, it doesn’t just create investors. It creates stakeholders. Token holders often become active participants in the ecosystem, whether through governance votes, liquidity provision, or simply using the platform. This level of community involvement drives innovation in ways that top-down funding models can’t replicate.

Think about decentralized autonomous organizations (DAOs). Many of them were born from token sales. Holders get a say in proposals, treasury allocation, and platform direction. Instead of a boardroom deciding the future of a project, you have a global community shaping it. That’s powerful.

And from a trader’s perspective, this community aspect adds another layer of value. A strong, engaged token community can directly influence adoption, market sentiment, and ultimately token price.

A Real Alternative to Traditional Fundraising

Beyond creating a new funding model, token sales also created an alternative financial system.

Startups used to have to go through endless rounds of pitching, networking, and waiting on gatekeepers. Token sales bypass that. A project with a solid vision, a whitepaper, and a bit of community buzz can raise millions in a fraction of the time it would take to secure traditional financing.

This speed is one of the reasons crypto projects scale so fast. Instead of being bogged down by red tape, they can focus on building. For traders, that translates into a constant pipeline of new opportunities—from DeFi protocols to NFT platforms to blockchain infrastructure plays.

It’s not all perfect, of course. We’ve seen plenty of rug pulls and poorly executed token sales. But that’s where due diligence and smarter investing come in. The underlying mechanism, a decentralized, inclusive, and rapid way of raising funds, is here to stay.

The Bigger Picture: Shaping the Future of DeFi

Zoom out, and the impact of token sales is about more than just liquidity or accessibility. They’ve laid the foundation for the broader decentralized finance (DeFi) movement.

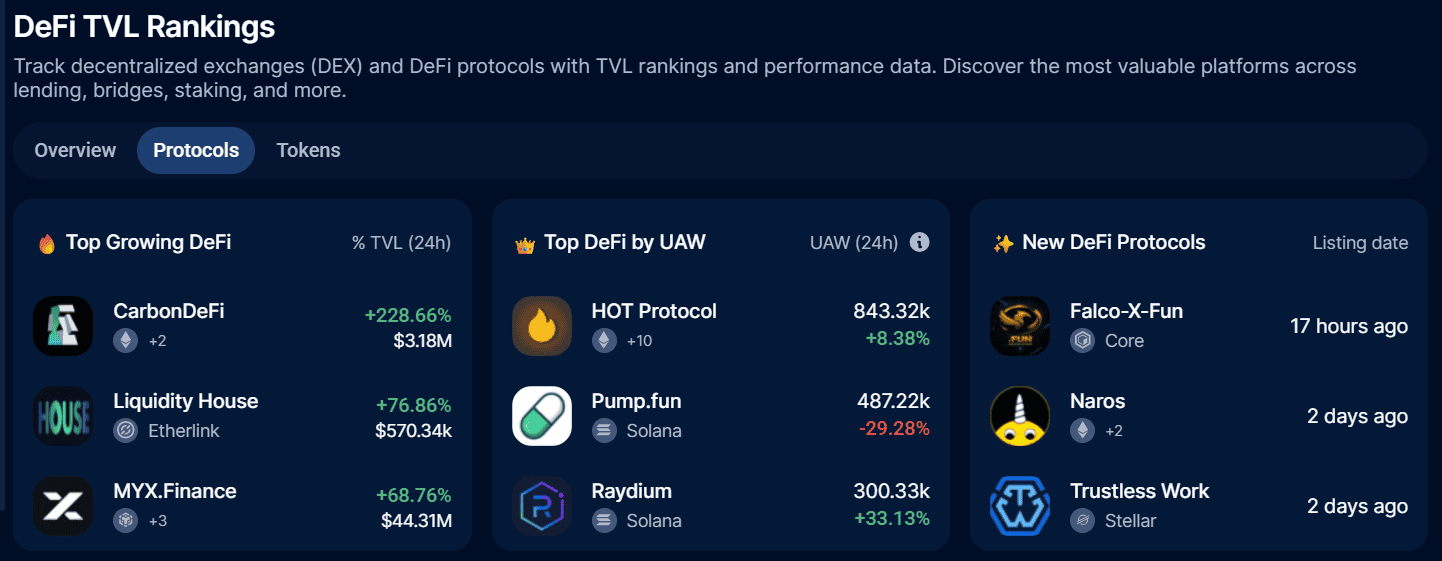

By proving that you can raise and distribute capital without centralized intermediaries, token sales set the stage for the explosion of DeFi protocols we see today. Everything from yield farming to decentralized exchanges owes something to the token sale model.

For traders, this means the game keeps evolving. Token sales aren’t just entry points into individual projects—they’re stepping stones to entirely new ecosystems. Each sale can spark innovation that ripples across the crypto market.

The Risks You Can’t Ignore

Let’s be real: token sales aren’t all upside. The same openness that makes them exciting also makes them risky. Anyone can launch a token sale, which means scams and poorly planned projects are part of the territory.

Liquidity can cut both ways too. Just because you can sell doesn’t mean you’ll always sell at a profit. Market volatility is intense, and early hype can fade fast.

For traders, the takeaway is simple: do your homework. Research the team, the tokenomics, the roadmap, and the community. The impact of token sales is huge, but so is the responsibility to navigate them smartly.

Bottom Line

The impact of token sales on the crypto industry has been massive:

- They’ve created liquidity where none existed.

- They’ve opened global access to investment opportunities.

- They’ve turned investors into active community members.

And they’ve provided startups with a faster, more inclusive way to raise capital.

Sure, they come with risks, but so does every market worth trading. What sets token sales apart is their ability to combine fundraising, liquidity, and community into a single mechanism that reshaped crypto from the ground up.

For traders, token sales aren’t just a chance to get in early; they’re a front-row seat to the future of decentralized finance. And if history is any guide, that’s an opportunity worth paying attention to.

.svg)