Chapters

The Regulation Landscape and Challenges in Token Sales

The crypto world is no stranger to chaos. Volatility, innovation, and disruption are baked into its DNA. But if there’s one thing traders, builders, and investors are craving these days, it’s clarity, especially when it comes to regulations. Whether you're launching a token or just trying to stay compliant, the landscape is shifting fast.

Let’s break down the latest developments and the real-world challenges of token sales in today’s regulatory climate.

The Regulatory Labyrinth: Crypto's Biggest Challenge Yet

Today's crypto regulations are a work in progress, but we're seeing significant legislative efforts, particularly in the United States, that aim to bring much-needed clarity.

The Regulatory Push: U.S. Leads the Charge

In the United States, lawmakers are finally rolling up their sleeves and getting serious about crypto legislation. Two major bills are making waves:

1. Digital Asset Market Clarity Act of 2025 (CLARITY Act)

This bill aims to categorize digital assets into three buckets:

- Digital commodities (think Bitcoin)

- Investment contract assets (like most ICO tokens)

- Permitted stablecoins (those that meet specific criteria)

The goal is to clarify which agency (CFTC or SEC) has jurisdiction over what. This division is crucial because overlapping authority has created confusion and slowed innovation.

2. Responsible Financial Innovation Act of 2025 (RFIA)

RFIA complements the CLARITY Act by laying out rules for innovation while protecting consumers. It’s focused on:

- Encouraging responsible innovation

- Creating safe harbor provisions for startups

- Promoting transparency in token issuance

Together, these bills are designed to reduce uncertainty and give crypto businesses a clearer path forward. Both CLARITY Act and RFIA laws propose to categorize crypto assets into three distinct buckets: digital commodities, investment contract assets, and permitted stablecoins.

This categorization is crucial because it would finally delineate regulatory jurisdictions between the two main financial watchdogs in the US: the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC).

Imagine the relief! Instead of the current tug-of-war, we'd have a clear "who's in charge" for each type of crypto asset. This is designed to reduce uncertainty, protect investors, and foster innovation by giving startups and projects a clear path to compliance.

3. SEC’s “Project Crypto”

The SEC isn’t sitting idle. It’s launched Project Crypto, a regulatory initiative to:

- Define rules for token distributions

- Clarify custody standards

- Set trading guidelines

While some might see this as the SEC flexing its muscles, for many in the industry, it's a step toward the predictability and stability that's been missing. It signals a move away from enforcement-by-litigation to a more structured, rule-based approach.

A Global Web of Regulations

The U.S. isn't the only one taking action. Globally, regulatory bodies are racing to create their own frameworks. The European Union (EU) is a perfect example with its groundbreaking Markets in Crypto-Assets Regulation (MiCA). This framework is a huge deal because it aims to standardize regulations across all member states, ensuring market integrity and strong consumer protection. MiCA covers everything from licensing crypto service providers to rules for stablecoins and a clear regime for token offerings.

This global push toward regulation is a double-edged sword. On one hand, it's a sign of crypto's increasing mainstream acceptance. On the other, it creates a complex, fragmented landscape where a project might be compliant in one country but face legal trouble in another. This is especially challenging for global projects and token sales.

Token Sales: The Regulatory Minefield

Now let’s talk token sales – the lifeblood of many crypto projects and a magnet for regulatory scrutiny.

Classification Confusion

The biggest headache? Figuring out whether a token is a security, commodity, or something else entirely. Misclassification can lead to:

- SEC enforcement actions

- Trading bans

- Investor lawsuits

The Howey Test (yes, the one from 1946 about orange groves) is still being used to determine if a token is a security. That’s like using a rotary phone to regulate smartphones.

Projects must meticulously structure their token sales to avoid being classified as an unregistered securities offering, which can be a legal minefield.

Then there's the ever-present need for AML (Anti-Money Laundering) and KYC (Know-Your-Customer) compliance. These are standard practices in traditional finance, but they're still a significant hurdle for many crypto projects. Collecting and verifying the identity of thousands of participants in a global token sale is a logistical nightmare.

Startups need to invest heavily in technology and legal counsel to ensure they're not facilitating illicit activities. While crypto's pseudonymous nature is often touted, real-world regulatory requirements demand transparency.

In India, for example, crypto is treated as a Virtual Digital Asset (VDA) under the Income Tax Act, with strict AML oversight from multiple agencies.

Jurisdictional Complexity

Finally, the complexity of adhering to multiple jurisdictions' rules is a beast of its own. A token sale might attract participants from the U.S., the EU, Asia, and beyond. Each jurisdiction has its own set of rules, and they often conflict. This fragmented landscape creates significant hurdles, especially for smaller, resource-strapped startups. They might have to block participation from certain countries, which can limit their fundraising potential and audience reach.

Trends to Watch: Standardization & Strategic Compliance

While the challenges are real, the industry isn't standing still. We're seeing a move toward greater regulatory clarity and a more proactive approach to compliance. Some of the most promising trends:

Cross-Border Harmonization - countries are starting to align their rules.

The EU’s MiCA, India’s VDA framework, and the U.S. CLARITY Act all aim to:

- Define asset categories

- Set licensing requirements

- Promote transparency

This could lead to a global baseline for token sales, making it easier to launch compliant offerings worldwide.

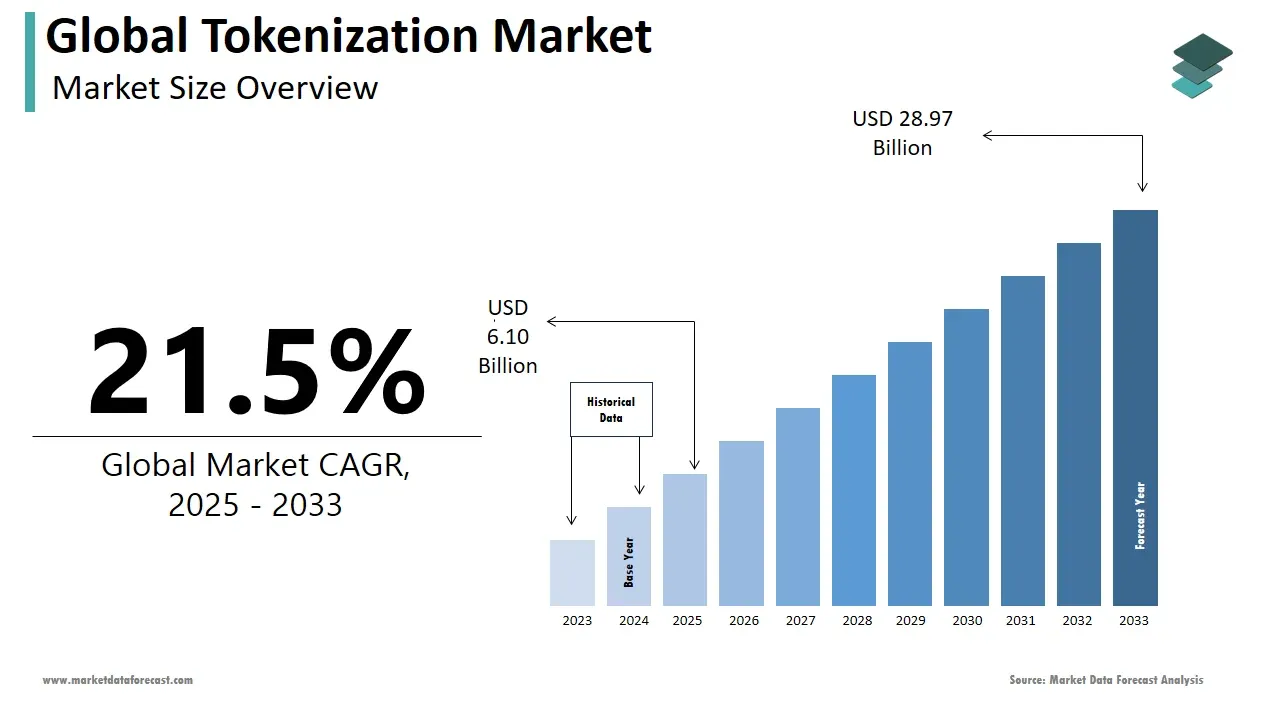

Source: Market Data Forecast

Compliance as a Competitive Edge

In 2025, being compliant is about avoiding fines but it’s also a business strategy. Projects that embrace regulation early are:

- Gaining investor trust

- Attracting institutional capital

- Expanding into regulated markets

Additionally, groups like the Financial Action Task Force (FATF) are working on global standards for virtual asset service providers, which could eventually lead to more harmonized rules and a less fragmented landscape.

Blockchain and AI Tech Coming to the Rescue

Technology is also stepping up to the plate. The very innovations that power crypto are now being used to solve its compliance problems. We’re seeing enhanced use of blockchain analytics and AI to improve compliance and transparency in token sales.

Tools like Chainalysis and TRM Labs can now trace transaction flows, identify suspicious activity, and automate KYC checks. This technological leap is making compliance more efficient and effective, turning what was once a manual, error-prone process into something that can be managed with greater precision. For traders, this means a more mature and secure ecosystem to operate in.

Bottom Line

In summary, the crypto regulatory landscape is maturing rapidly. While this journey is fraught with challenges, it's ultimately a positive development for the industry. Regulatory clarity is improving through legislative initiatives like the CLARITY Act and RFIA in the U.S. and frameworks like MiCA in the EU. Yet, for token sales, the hurdles of classification, compliance, and jurisdictional complexity remain a significant part of the game.

However, with the help of technological advancements and a growing push for global standardization, the future of crypto finance looks more robust than ever. This means a more stable market with a higher degree of trust and legitimacy. The days of unbridled experimentation may be fading, but they are being replaced by an era of maturity and sustainable growth.

.svg)