Chapters

The Pros and Cons of IEOs

When the ICO craze of 2017 went wild, the crypto world quickly realized it had a problem: scams, rug pulls, and projects that never delivered. Enter Initial Exchange Offerings (IEOs) – the next evolution in fundraising. On paper, IEOs promised to fix a lot of what went wrong with ICOs. Instead of shady projects taking your ETH straight to a cold wallet, exchanges stepped in to handle the process, adding a layer of trust and accountability.

But let’s be real: IEOs aren’t some magical solution. They come with perks, pitfalls, and risks traders need to weigh carefully. If you’ve ever considered jumping into an IEO, this breakdown of advantages and disadvantages will give you a sharper view before putting your capital on the line.

Why IEOs (Initial Exchange Offerings) Took Off

The crypto market thrives on narratives. After ICOs got a bad rep, exchanges saw an opportunity: they could leverage their reputation to vet projects, manage the token sale, and act as middleman investors they could actually trust. Traders loved the convenience, and projects loved the exposure.

That’s the appeal in a nutshell. IEOs are like ICOs but with training wheels as exchanges provide structure, security, and built-in marketing muscle. Sounds like a win-win, right? Let’s unpack the good side first.

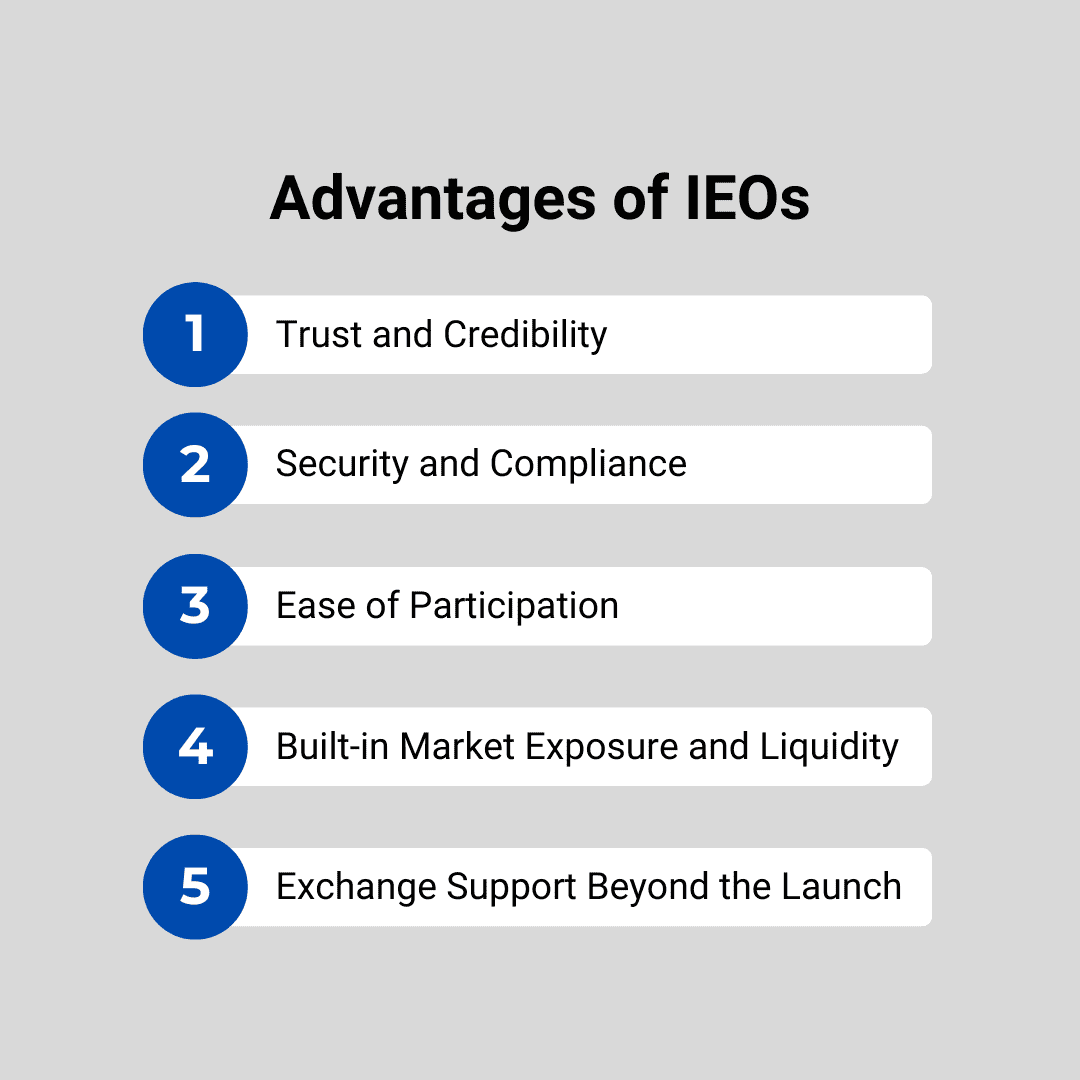

The Pros of IEOs

1. Trust and Credibility

One of the biggest selling points of IEOs is the credibility boost. Projects don’t just waltz onto a major exchange. They’re screened, vetted, and (at least in theory) filtered for quality. Exchanges put their reputation on the line when they host an IEO, so they have every incentive to avoid shady projects.

For traders, this translates into a level of confidence you simply don’t get with a random ICO website. You’re not just trusting some anonymous team; you’re trusting an established exchange that’s been around the block.

2. Security and Compliance

Exchanges handle the heavy lifting when it comes to smart contracts, KYC, and AML checks. That means fewer phishing risks, fewer chances of sending funds to the wrong address, and a more secure overall process.

For investors, this reduces headaches. Instead of scrambling to vet the legitimacy of a project’s contract or worrying about regulators, you know that the exchange is doing at least some due diligence for you.

3. Ease of Participation

If you’ve ever gone through a clunky ICO process: switching wallets, manually sending tokens, praying you didn’t copy-paste the wrong address, you’ll appreciate the simplicity of IEOs.

On an IEO platform, you usually just log in, pass KYC, and click a few buttons to participate. The exchange handles the technical backend. This “plug-and-play” style makes IEOs way more accessible, especially for newer traders.

4. Built-In Market Exposure and Liquidity

This is a huge one. Projects launching via IEO instantly get access to the exchange’s user base and reputation. That means more eyeballs, more liquidity, and faster trading action once the token lists.

For projects, this is golden because it’s like launching a product with a major retailer instead of trying to sell it out of your garage. For traders, it means you don’t have to wait months for listings; liquidity is usually there from day one.

5. Exchange Support Beyond the Launch

Some exchanges don’t just host the sale. They also support marketing, development, and ongoing community building. This can help projects gain traction and avoid the common pitfalls of post-sale silence.

For traders, that backing can signal a smoother ride (though not guaranteed).

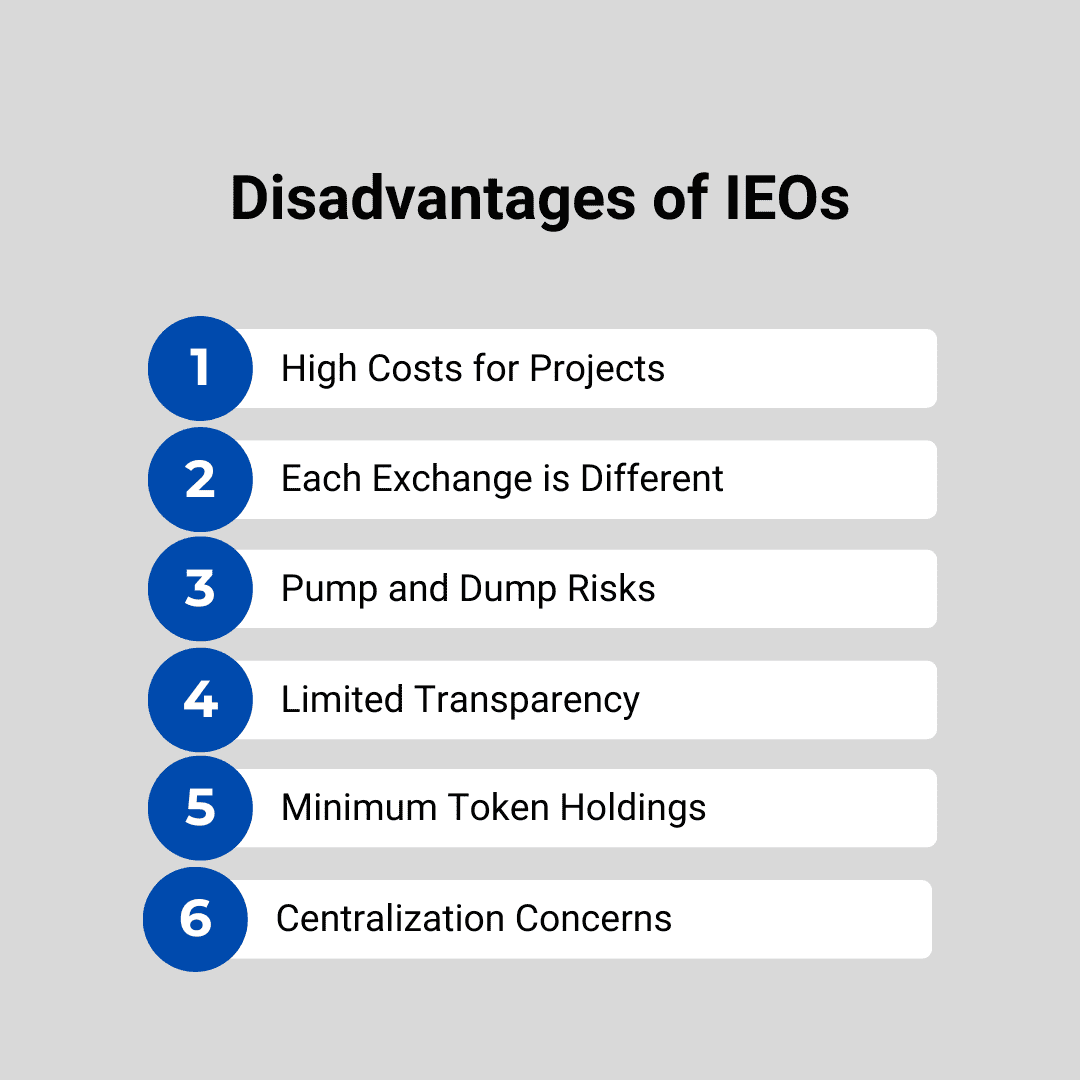

The Cons of IEOs

Now, let’s not sugarcoat it. IEOs may solve some problems, but they introduce new ones, too. Here’s where things get messy.

1. High Costs for Projects

Exchanges don’t do this out of kindness. Projects have to cough up steep listing fees and often hand over a chunk of their token supply as commission. Depending on the exchange, this can run into the millions.

On one hand, this means only serious projects step up. On the other, it raises the question: are smaller but promising teams getting priced out? And do high costs pressure projects into pumping their token price quickly just to recoup expenses?

2. Not All Exchanges Are Created Equal

Binance Launchpad IEO ≠ random no-name exchange IEO. The quality of vetting varies massively between platforms. Some exchanges take security and due diligence seriously; others… not so much.

This creates a trust spectrum. Just because a project is doing an IEO doesn’t automatically mean it’s safe. The exchange matters a lot.

3. Pump and Dump Risks

If you’ve been in crypto for more than a week, you know the drill. Token launches can turn into pump-and-dump playgrounds. Even with exchange vetting, nothing stops whales or coordinated groups from artificially pumping the price at launch and then dumping on retail traders.

The exchange can’t (and often won’t) prevent this. For traders, the risk is real: you might FOMO in at launch only to watch the chart nosedive.

4. Limited Transparency

Exchanges do vet projects, but here’s the catch: they don’t usually share the full details. What exactly was checked? What standards were applied? How deep was the due diligence? Investors are often left in the dark.

This means you still need to DYOR (Do Your Own Research). An IEO might give you a head start, but it’s not a free pass to skip due diligence.

5. Minimum Token Holdings

Want in on a hot IEO? Sometimes you’ll need to hold a hefty bag of the exchange’s native token just to qualify.

This requirement can artificially pump the exchange token’s value while locking out smaller investors. For example, if you need thousands of dollars’ worth of a token just to participate, the playing field isn’t exactly level.

6. Centralization Concerns

At the end of the day, IEOs rely on centralized exchanges. That rubs some traders the wrong way since it clashes with crypto’s core ethos of decentralization.

If you’re a die-hard decentralization purist, trusting exchanges with this much power might feel like a compromise. And given how exchanges have failed or been hacked in the past, it’s not an unfounded concern.

Balancing the Trade-Offs

So, where does that leave us?

IEOs offer a safer, smoother experience than the wild west of ICOs. They give traders easier access, more trust, and often better liquidity. But they’re far from perfect. High costs, centralization, and pump-and-dump risks are still on the table.

For traders, the best approach is a measured one:

- Pick your exchange wisely. Binance Launchpad ≠ random offshore exchange.

- Don’t skip your own research. Exchange vetting helps, but it’s not bulletproof.

- Be wary of launch hype. Price action can be brutal in the first hours or days.

Watch the requirements. Holding large amounts of exchange tokens just to participate may not always be worth it.

Bottom Line

Initial Exchange Offerings aren’t the end-all, be-all of fundraising models. They’re one step in crypto’s constant experiment with how to launch projects fairly and securely. For traders, they present opportunities, sometimes huge ones, but also risks that shouldn’t be ignored.

Think of IEOs as a trade-off between convenience and cost, security and centralization, hype and reality. If you play them smart, they can be a powerful part of your trading strategy. If you rush in blindly, you could end up exiting liquidity for someone else’s pump.

The key takeaways: respect the risks, do your homework, and never let the shiny promise of an exchange-backed launch blind you to the fundamentals.

.svg)