Chapters

Key Players in the IEO Ecosystem

The IEO ecosystem has evolved into one of the most reliable and efficient fundraising models in the crypto world. It bridges the gap between projects seeking capital and investors looking for vetted opportunities. Unlike the chaotic ICO era, Initial Exchange Offerings (IEOs) bring structure, transparency, and trust – all thanks to the ecosystem’s main players: crypto exchanges, token issuers, and IEO service providers.

If you’re a trader, project founder, or just someone keeping tabs on token launches, understanding how this ecosystem works in 2025 can give you a serious edge.

The Core of the IEO Ecosystem

At its core, the IEO ecosystem operates as a collaborative network:

- Exchanges host the token sale and handle investor onboarding.

- Issuers (the startups or blockchain projects) create and offer their tokens.

- Service providers handle everything from smart contract development to marketing and compliance.

Each part of this system plays a critical role. Exchanges provide trust and visibility, projects supply innovation and community, and service firms handle the heavy lifting behind the scenes. Together, they create the engine that drives token launches forward.

Major IEO Exchanges: The Gatekeepers of Trust and Liquidity

When you think of IEOs, the first names that come to mind are the big exchanges — and for good reason. They’re the gatekeepers. They vet projects, manage KYC/AML, and make sure investors aren’t getting rugged.

Here are the top IEO platforms dominating 2025:

1. Binance Launchpad

Binance Launchpad remains the gold standard in the IEO ecosystem. With deep liquidity, massive user reach, and a solid reputation, it’s where many of the industry’s biggest names got their start — think Axie Infinity (AXS) and Polygon (MATIC).

For projects, getting listed on Launchpad means instant credibility. For traders, it’s a signal that a project has passed one of the toughest vetting processes in crypto. Binance’s marketing muscle also ensures token sales reach millions of potential investors instantly.

2. OKX Jumpstart

OKX Jumpstart is another powerhouse. Known for its liquidity infrastructure and flexible fundraising models, it attracts both retail and institutional investors. OKX supports multiple sale structures, allowing projects to tailor their IEO campaigns to match their community size and funding needs.

What makes Jumpstart appealing is OKX’s global reach — it connects projects with a broad audience across Asia, Europe, and beyond. It’s particularly popular with projects looking for multi-chain exposure and a fast route to exchange listings.

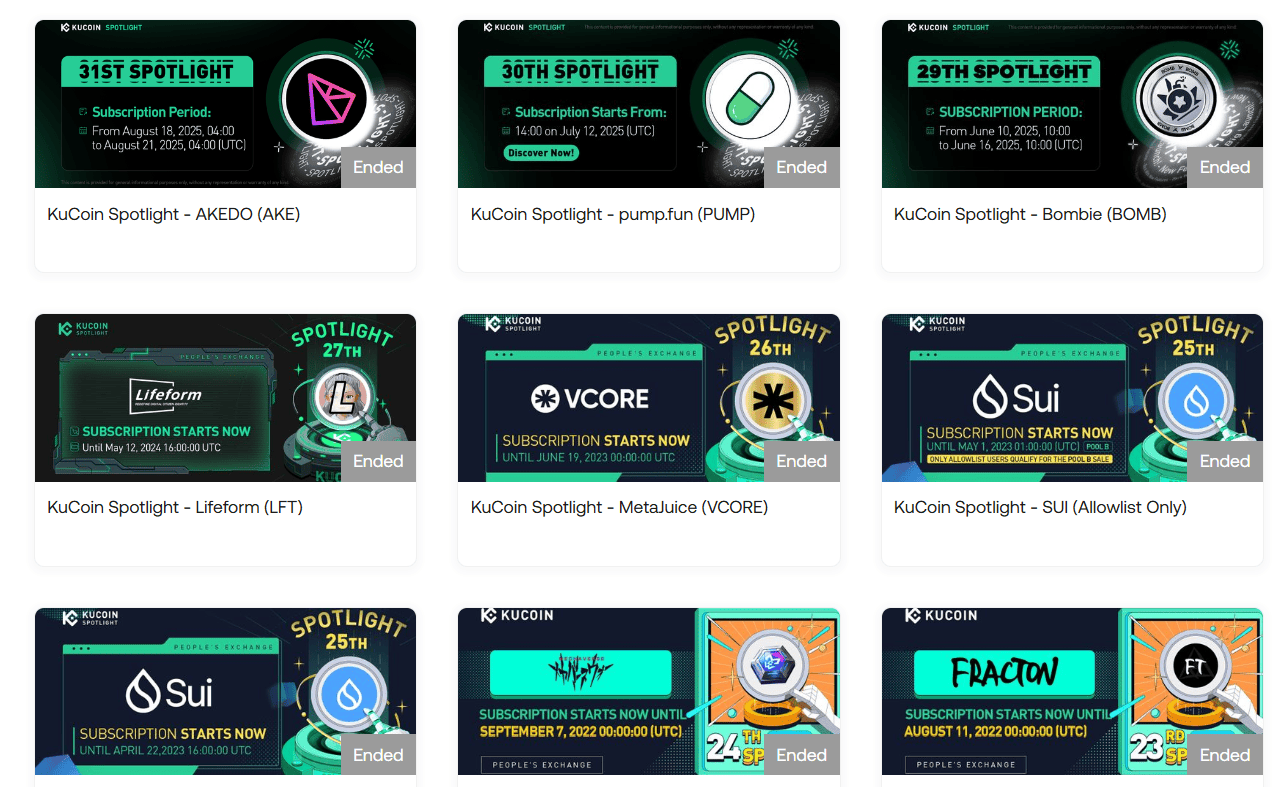

3. KuCoin Spotlight

With access to over 5 million active users, KuCoin Spotlight offers an immediate retail advantage. Projects that launch here gain traction quickly thanks to KuCoin’s engaged trading community and strong marketing integrations.

KuCoin also stands out for its inclusivity — it often supports smaller projects that might not yet meet the strict standards of Binance or OKX but still have solid fundamentals and community backing.

4. Gate.io Startup

Gate.io’s Startup platform is a favorite for projects targeting mass retail participation. It consistently ranks high in IEO volume, hosting dozens of token sales every year. Its user-friendly interface and rapid token distribution process make it attractive to both new investors and seasoned traders hunting early-stage opportunities.

5. Bybit Launchpad & Huobi Prime

Both Bybit and Huobi run reputable IEO programs, offering global exposure and secure participation processes. They cater to large trading communities and often partner with established projects looking to expand token liquidity post-launch.

Other Notables

Platforms like Bibox, ProBit Global, LBank, and AscendEX continue to fill vital niches in the IEO ecosystem, especially for regional projects and emerging blockchain sectors. While they might not have the volume of Binance or OKX, they offer flexibility and accessibility that appeal to smaller or early-stage ventures.

IEO Project Issuers: The Builders Behind the Tokens

Every successful Initial Exchange Offering starts with a project that has something worth backing. These are the issuers: startups or blockchain initiatives launching tokens to fund development, grow communities, and incentivize ecosystem participation.

Here’s what defines a successful IEO project in today’s market:

- Strong utility and tokenomics – Projects need a clear use case and a sustainable token model that rewards holders while fueling platform growth.

- Transparent teams – Exchanges are much stricter now about who they host. Fully doxxed teams with verifiable track records have a much higher chance of getting listed.

- Active communities – The IEO ecosystem thrives on engagement. A project with a passionate community is more likely to succeed both in fundraising and long-term adoption.

- Exchange alignment – The issuer’s vision must align with the exchange’s audience. Binance Launchpad tends to back scalable, high-quality infrastructure projects, while KuCoin often supports early-stage or community-driven initiatives.

When a project is selected for an IEO, it gains massive credibility and immediate exposure — but the competition is fierce. Exchanges might review hundreds of applications for a single launch slot, so only those with strong fundamentals and execution plans make it through.

IEO Service Providers: The Behind-the-Scenes Powerhouses

If exchanges are the front-end of the IEO world, service providers are the engine room. They handle everything technical, legal, and strategic that makes a token sale possible.

Let’s look at some of the top service providers shaping the IEO ecosystem today:

TokenMinds

TokenMinds is one of the best-known IEO marketing and consulting firms. They help projects with exchange listings, community building, and performance optimization. Their strength lies in bridging the gap between a project’s vision and the demands of major exchanges — ensuring everything from token metrics to PR strategy is dialed in before launch.

LeewayHertz

LeewayHertz brings heavy technical firepower. They specialize in smart contract development, custom token creation, whitepaper drafting, and regulatory compliance. For many projects, LeewayHertz acts as a one-stop shop — handling both the blockchain development and the documentation needed to pass exchange scrutiny.

NADCAP Labs

NADCAP Labs takes a full-stack approach, offering blockchain development, wallet integration, and targeted marketing. They’re known for helping projects not just launch but scale — with ongoing optimization and liquidity support after the token goes live.

INC4

INC4 focuses on long-term partnerships, blending consulting with deep technical expertise. They work closely with startups on dApp development, blockchain architecture, and IEO preparation. INC4’s value comes from aligning technology and strategy — ensuring the project can sustain growth beyond the initial fundraising phase.

These service providers form the connective tissue of the IEO ecosystem, making it possible for new projects to navigate the complex landscape of compliance, tech deployment, and market positioning.

Supporting Elements: The Glue That Holds It All Together

Beyond the big players, the IEO ecosystem relies on a few crucial elements that make token launches secure, transparent, and successful:

1. Smart Contracts and Blockchain Infrastructure

Smart contracts ensure the integrity of token sales — automating distribution, enforcing vesting, and providing transparency. They eliminate manual errors and reduce the risk of manipulation. Most IEOs now run on trusted blockchains like Ethereum, BNB Chain, or Solana, ensuring scalability and interoperability.

2. Marketing and Investor Relations

No IEO succeeds without visibility. Exchanges and service providers put serious effort into marketing — from AMA sessions and community campaigns to influencer partnerships and targeted ads. The best-performing IEOs are those that build momentum before the token sale even starts.

3. Compliance and Security

With tighter regulations in 2025, compliance is now a make-or-break factor. Exchanges require full KYC for participants and detailed legal reviews for issuers. This adds credibility to the ecosystem and helps attract institutional investors who were once wary of token sales.

The Evolving IEO Ecosystem in 2025

The IEO ecosystem today is far more mature than it was a few years ago. Exchanges have standardized their vetting processes, investors are better educated, and projects understand that transparency is non-negotiable.

Here’s what’s trending:

- Multi-chain IEOs: Projects are increasingly launching tokens that are compatible across several blockchains, giving investors more flexibility.

- AI-driven marketing: Service providers now use AI tools to analyze community engagement and optimize campaigns in real time.

- Stronger post-IEO support: Exchanges are extending their role beyond launch, helping projects with liquidity management, staking options, and secondary listings.

The outcome is a more robust, trustworthy environment for both investors and startups.

Key Takeaways

The Initial Exchange Offering ecosystem in 2025 stands as a testament to how far crypto fundraising has come. What began as a chaotic, unregulated space has matured into a structured system led by established exchanges, professional service firms, and innovative blockchain startups.

Binance Launchpad, OKX Jumpstart, KuCoin Spotlight, and Gate.io Startup dominate the platform side.

TokenMinds, LeewayHertz, NADCAP Labs, and INC4 ensure projects get the technical and strategic backing they need.

Smart contracts, marketing, and compliance frameworks tie everything together.

For traders, understanding this ecosystem is useful but also profitable. The better you know who’s behind an IEO and how the system works, the better your chances of spotting the next breakout project before it moons.

.svg)