Chapters

Regulatory Considerations in IEOs

When it comes to crypto fundraising, Initial Exchange Offerings (IEOs) have become one of the go-to methods for projects looking to raise capital and for traders hoping to get in early on the next big thing. But as with most things in crypto, there’s more beneath the surface.

The legal and regulatory side of IEOs is the foundation that determines whether a project can legally operate or end up on a regulator’s hit list.

If you’re trading or investing in IEOs, understanding the IEO regulation landscape isn’t optional. It’s how you protect yourself, avoid risky projects, and spot which exchanges actually play by the rules.

Let’s break down the key regulatory angles every crypto trader should know before jumping into an IEO.

Securities Laws Compliance: The Big One

Here’s the hard truth: a lot of Initial Exchange Offering tokens look, smell, and act like securities. And under U.S. law, that means they fall under federal securities regulations.

The Howey Test, an old-school legal test from the 1940s, still drives this point home. If a token involves an investment of money in a common enterprise with an expectation of profit, primarily from the efforts of others…it’s probably a security.

That means the IEO issuer and the exchange facilitating it may need to register with the SEC or qualify for an exemption. If they don’t, the offering could be illegal, even if it’s happening overseas but marketed to U.S. investors.

For traders, this matters because investing in an unregistered security can come with serious consequences. The SEC has cracked down on multiple projects that launched IEOs without proper filings, forcing refunds, penalties, and even bans.

In short: if an IEO sounds too good to be true and there’s no mention of securities law compliance, it’s a red flag.

Investor Protections: Transparency Is Non-Negotiable

Regulators like the SEC, FINRA, and others aren’t just enforcing rules for fun; they’re trying to protect investors from getting burned. And with the number of scams, rug pulls, and failed token launches over the years, it’s easy to see why.

That’s why investor protections are a big part of the regulation IEO picture. Many countries now require that Initial Exchange Offering platforms implement safeguards, such as:

- Transparent documentation about the project, its founders, and how funds will be used.

- Disclosures outlining token rights, vesting schedules, and potential risks.

- Due diligence checks by the exchange to ensure the project isn’t a fraud or a copy-paste scam.

The SEC even issues Investor Alerts specifically warning about IEOs that promise guaranteed returns or use vague legal language.

If a platform is serious about compliance, it’ll show. Legit exchanges often have visible sections explaining their IEO vetting process, KYC requirements, and regulatory partnerships.

Pro tip: always read the project’s whitepaper, but don’t stop there; check how transparent the exchange is about compliance. A transparent exchange is usually a safer one.

KYC and AML: The Compliance Backbone

No one loves paperwork, but Know Your Customer (KYC) and Anti-Money Laundering (AML) processes are the backbone of legal crypto trading. Every reputable IEO platform will require them.

Here’s why it matters: regulators want to make sure that token sales aren’t used for money laundering, fraud, or terrorist financing. That means exchanges need to:

- Verify user identities through official documentation.

- Monitor transactions for suspicious activity.

- Report large or unusual trades to relevant authorities.

If a platform skips or downplays KYC/AML, that’s a huge warning sign. It’s not just about legality; platforms with weak compliance are prime targets for regulatory shutdowns.

Plus, strong KYC systems add a layer of protection for you as an investor. If something goes wrong, at least you know the exchange isn’t operating in total anonymity.

Global Regulatory Variability: One Size Doesn’t Fit All

Crypto is global, but regulation isn’t. Every jurisdiction has its own rules, and that’s what makes the IEO regulation space such a complex landscape.

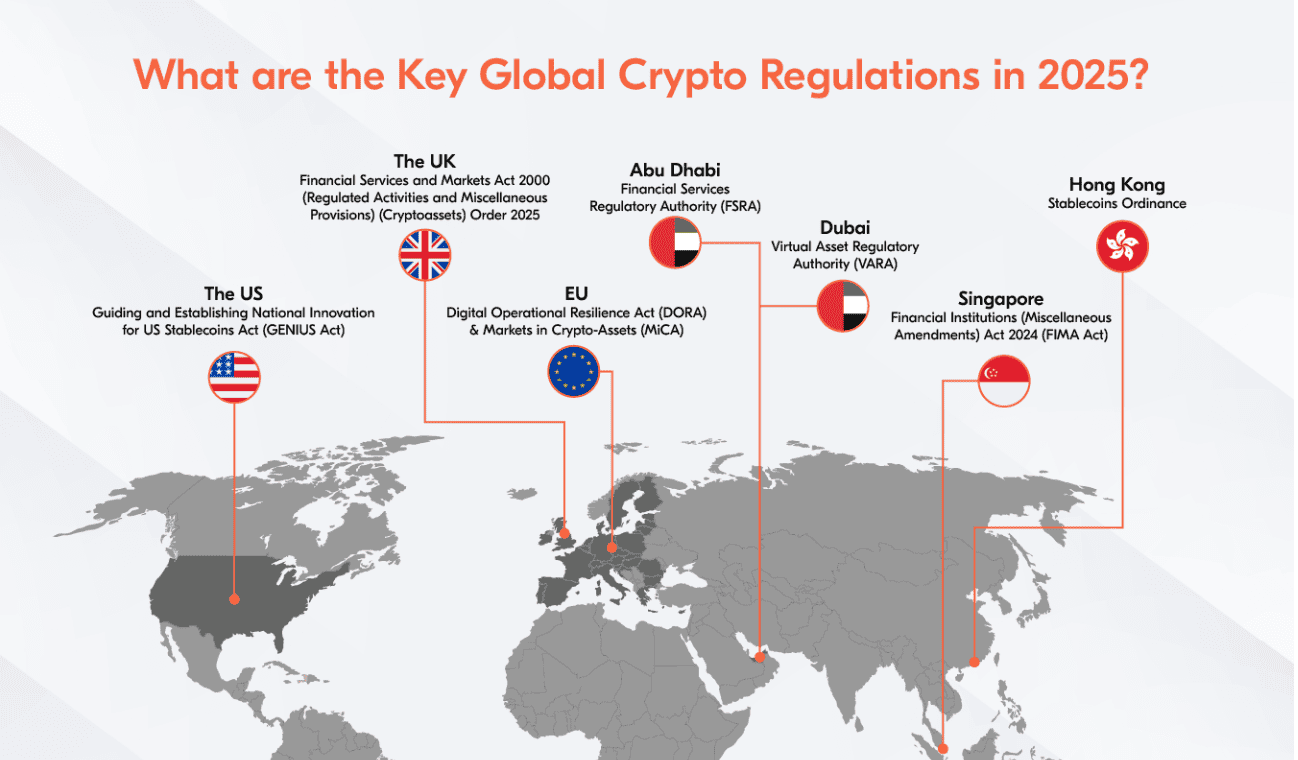

Here’s how it breaks down:

- United States: The SEC treats most IEOs as securities offerings. Exchanges facilitating them may need to register as a national securities exchange or operate under an exemption.

- European Union: The Prospectus Regulation and MiCA (Markets in Crypto-Assets Regulation) set rules for how tokens are classified, marketed, and disclosed. Projects offering IEOs to EU investors often need a compliant prospectus and proper authorization.

- Singapore: The Monetary Authority of Singapore (MAS) regulates token sales that resemble securities or derivatives. Exchanges must also hold proper licenses.

- Other regions: Countries like Japan, South Korea, and the UAE each have their own frameworks, some strict, some more open to innovation.

Source: Bolder Group

For investors, this means due diligence isn’t just about the token; it’s about where the IEO operates. A project may be perfectly legal in Singapore but non-compliant in the U.S.

If you’re trading globally, stay informed about the local laws that could affect your access, taxation, and investor rights.

Exchange and Token Utility Compliance: Where Exchanges Step Up

Initial Exchange Offerings differ from Initial Coin Offerings because they’re hosted directly on exchanges. That gives traders some peace of mind, at least, in theory.

But not every exchange is equally rigorous. A compliant IEO platform will:

- Vet projects carefully before launch.

- Classify tokens correctly (utility vs. security).

- Ensure legal documentation and disclosures are in place.

- Work with regulators or legal counsel to ensure compliance.

The classification part is crucial. Many projects claim to issue “utility tokens” to dodge securities laws, but if the token’s value depends on market speculation or team performance, regulators might still treat it as a security.

Top exchanges are aware of this risk. That’s why you’ll often see them require projects to go through legal reviews before an IEO listing.

If you’re an investor, pay attention to how much effort the exchange puts into compliance. The tougher their standards, the lower your risk exposure.

Transparency and Documentation: The Real Proof of Legitimacy

If an IEO project doesn’t clearly explain what it’s doing, how it’s doing it, and who’s behind it, walk away.

Transparency is a key regulatory requirement and one of the best investor protection mechanisms available.

At a minimum, every IEO should include:

- A detailed whitepaper explaining the project’s goals, tokenomics, and roadmap.

- Legal disclaimers outlining token rights, ownership, and jurisdiction.

- Technical documentation covering smart contract audits and cybersecurity practices.

- Disclosure of risks, including market volatility and potential loss of funds.

Projects that are vague about these details often turn out to be high-risk or even fraudulent.

As an investor, you should always treat the whitepaper like a business plan and the IEO platform like a compliance partner. If both check out, you’re in safer territory.

Why Regulations for IEO Matter More Than Ever

Crypto has evolved fast, and so have regulators. Gone are the days when token sales could fly under the radar. Now, compliance is a major part of whether a project succeeds or fails.

For traders, understanding Initial Exchange Offering regulation means:

- Avoiding platforms that might get shut down.

- Recognizing compliant exchanges with stronger investor protections.

- Identifying projects that actually have long-term potential, not just hype.

In the end, regulation doesn’t have to be a buzzkill, but a filter. It weeds out the bad actors and helps serious projects thrive in a market that’s finally maturing.

Key Takeaways

IEOs have made it easier for crypto traders to access early-stage projects without diving into the wild west of unregulated ICOs. But the flip side is that the regulatory bar is higher and for good reason.

Whether you’re investing in a new DeFi token or a gaming project, take the time to understand the regulations for the IEO framework behind it. Check for securities compliance, solid KYC/AML practices, transparent documentation, and jurisdictional clarity.

The best traders don’t just chase charts; they read the fine print. And in crypto, knowing the rules is actually profitable.

.svg)