Chapters

How Miner Capitulation Affects Bitcoin Market Cycles

Bitcoin is built on mining. It’s not just a feature, it’s the foundation. Miners validate transactions, secure the network, and keep everything running through proof-of-work. And because of that, they also play a big role in shaping Bitcoin’s market cycles.

But what would happen if miners just… stopped? What if the machines went dark, the rigs shut down, and mining came to a complete halt?

The short answer: the Bitcoin network would break down. And with it, the entire pattern of boom-and-bust market cycles that traders and investors have come to expect.

Let’s break it down.

The Role of Miners in Bitcoin

Miners are the backbone of Bitcoin. They compete to solve complex cryptographic puzzles and add new blocks to the blockchain. This process does three key things:

- Processes transactions: Every Bitcoin transaction has to be confirmed in a block. No miners = no blocks = no transactions.

- Secures the network: The combined computational power of miners defends the network against tampering and attacks.

- Releases new Bitcoins: Mining is the only way new Bitcoin enters circulation, through block rewards that halve roughly every four years.

Because of all this, miners don’t just keep Bitcoin running—they also shape how its market behaves.

Source: Global X

How Miners Influence Bitcoin Market Cycles

Bitcoin’s market cycles—the big waves of price surges and crashes—are tightly connected to mining. Here’s why:

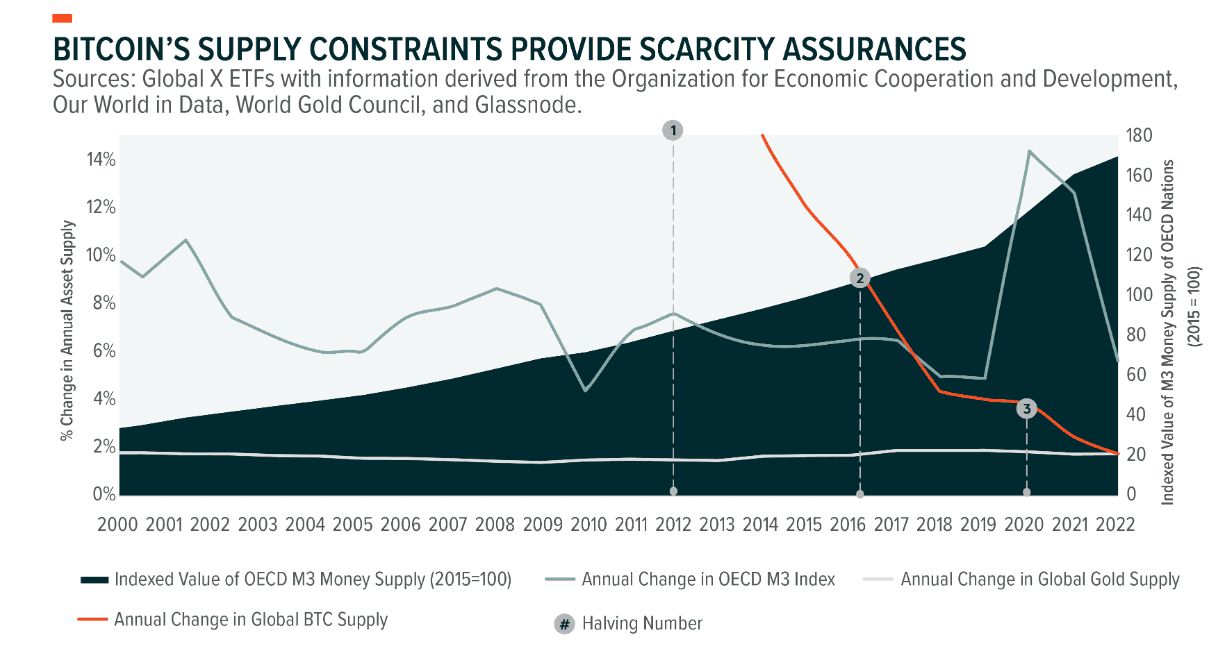

- Halving events: Every four years, the reward for mining a block is cut in half. This reduction in new supply typically sets the stage for a price increase due to basic supply and demand dynamics.

- Miner profitability: When Bitcoin is expensive, mining is profitable, and miners hold onto coins or sell strategically. When it drops, they sell more to cover costs, which can push prices down further.

- Selling pressure: Big mining operations often have to sell Bitcoin to pay bills. Their behavior adds or removes liquidity from the market and can influence price direction.

So miners don’t just support the network; they also help drive its boom-bust cycles.

What If Miners Stop Mining?

Now let’s get to the heart of the question: what happens if miners walk away entirely?

1. Transaction Processing Halts

The moment miners stop mining, no new blocks can be added. That means no new transactions get confirmed. Your Bitcoin wallet might say a payment was sent, but it won’t ever complete. The network would be frozen in time.

Bitcoin would essentially become a read-only ledger—no one could add to it.

2. Network Security Collapses

Mining is what keeps Bitcoin safe. It’s what prevents someone from rewriting history or double-spending coins. Without miners, Bitcoin would be wide open to attacks. Anyone with enough computing power could wreak havoc.

A 51% attack—where a malicious actor controls most of the network’s power—would be trivial. The trust in the system would vanish overnight.

3. Market Confidence Takes a Hit

With no way to use Bitcoin for payments or store value securely, users and investors would panic. The price would nosedive as people rushed to offload their worthless tokens. Exchanges might halt trading. Liquidity would dry up. Confidence would evaporate.

What Happens to Bitcoin Market Cycles?

Bitcoin’s market cycles are driven by mining dynamics, especially the halving. If mining stops, here’s what happens:

-

The End of Market Cyclicality

No mining = no new blocks = no halvings. That’s the end of the four-year cycle that has driven Bitcoin’s price history. The predictable patterns disappear. Price action becomes chaotic or irrelevant. -

Extreme Price Volatility

With the backbone of the network gone, panic selling would kick in. Bitcoin could swing wildly, or crash completely, as traders try to make sense of a broken system. -

No New Supply – But It Doesn’t Matter

Technically, without miners, no new Bitcoin would enter circulation. But this is meaningless if no one can use or transfer Bitcoin in the first place. Scarcity only matters when there’s demand. In this case, there likely wouldn’t be.

Why Miners Are Unlikely to Stop Completely

Fortunately, this doomsday scenario is almost impossible in practice. Here’s why:

-

Incentives Still Exist

Bitcoin’s protocol is designed to keep miners in the game. As long as Bitcoin has value, mining is rewarded: first through block rewards, then increasingly through transaction fees as rewards shrink. -

The Most Efficient Survive

Even if mining becomes unprofitable for many, the most efficient miners with access to cheap electricity or next-gen hardware will stay online. Mining will consolidate but not vanish. -

Total Collapse Means Bitcoin Itself Failed

The only way miners would all walk away is if Bitcoin itself lost all value. That would mean widespread rejection of Bitcoin as a concept—an event so catastrophic it wouldn’t just affect miners; it would end the network entirely.

Key Takeaways

If all Bitcoin miners stopped mining tomorrow, the whole system would implode. Transactions would freeze. Security would vanish. Prices would collapse. And the market cycles we’ve seen for over a decade, driven by halvings and miner behavior, would cease to exist.

But this scenario is highly unlikely. Bitcoin was designed to keep miners around through a smart incentive structure. As long as Bitcoin has value, someone will be mining it. And as long as mining continues, market cycles will live on: volatile, dramatic, and very much alive.

So the next time you’re watching Bitcoin’s price surge or crash and wondering what’s going on, remember: miners are always part of the story. Without them, there is no story.

.svg)