Chapters

Mining Difficulty & Hash Rate: What It Means for Traders

With cryptocurrencies that use a proof-of-work (PoW) system like Bitcoin, two technical terms carry enormous weight: mining difficulty and hash rate. These metrics don’t just matter to miners and developers — they have real implications for investors, traders, and anyone involved in the crypto ecosystem.

If you want to understand how blockchain networks operate, stay secure, and react to market forces, you need to grasp how these two elements function and interact.

What Is Mining Difficulty?

Mining difficulty is a dynamic metric that determines how hard it is for miners to find a valid hash — a unique string of characters that meets specific criteria — for the next block in a PoW blockchain. In simple terms, it defines how much work is required to mine a new block.

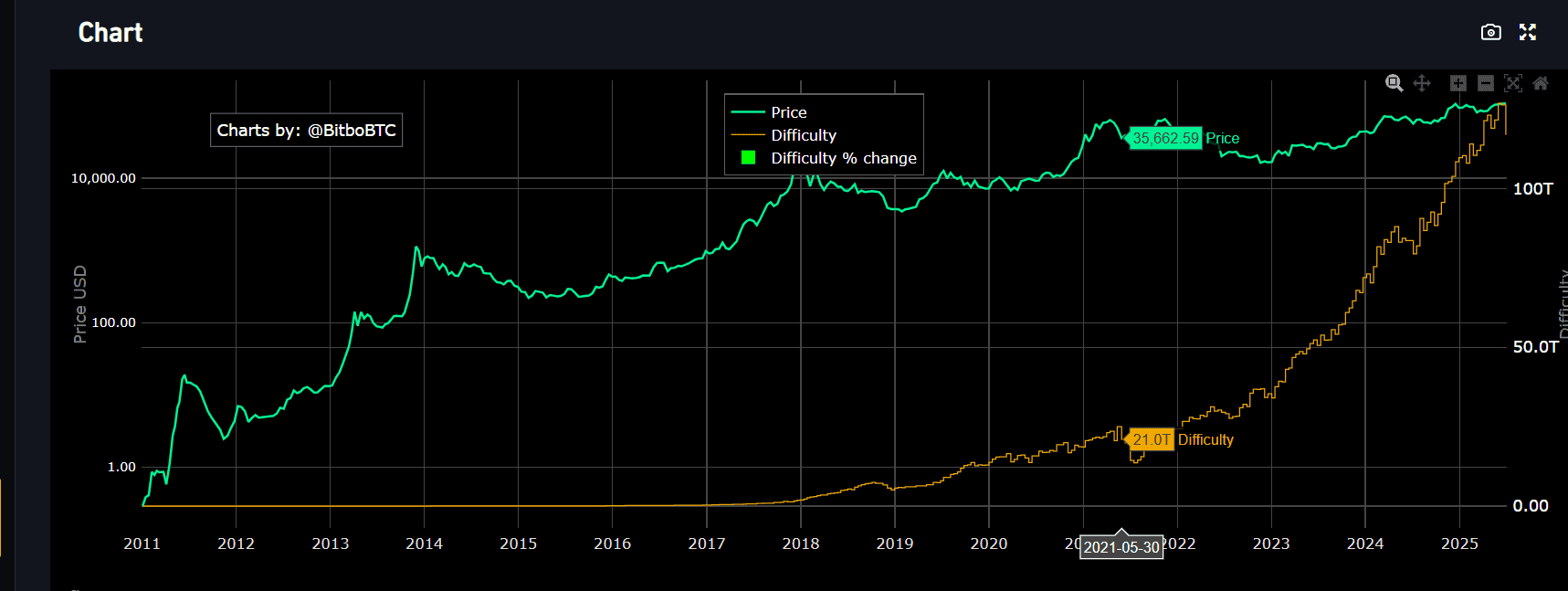

Bitcoin, for example, is programmed to add a new block approximately every 10 minutes. However, because the number of miners and the computational power they bring to the network can fluctuate, the protocol adjusts the difficulty every 2,016 blocks (roughly every two weeks) to maintain that consistent block time. If blocks are being found too quickly due to increased hash power, the difficulty goes up. If blocks are taking too long, the difficulty decreases.

Source: Bitbo Charts

This auto-balancing mechanism ensures the network remains stable and predictable, regardless of external conditions like new miners joining or exiting the network.

What Is Hash Rate?

Hash rate refers to the total amount of computational power being used by all miners in the network to perform hash functions. It’s essentially a measure of how many guesses miners can make per second to find the correct block hash.

Hash rate is typically expressed in hashes per second (H/s), and given the enormous number of calculations involved, more common units include terahashes per second (TH/s) or exahashes per second (EH/s). A network with a hash rate of 400 EH/s, for instance, means 400 quintillion hash attempts are being made every second across all miners.

A high hash rate generally indicates that many miners are active and that significant computing power is being dedicated to securing the blockchain. It’s a sign of network strength and resilience, which makes it more resistant to attacks or manipulation.

Mining Difficulty and Hash Rate: A Symbiotic Relationship

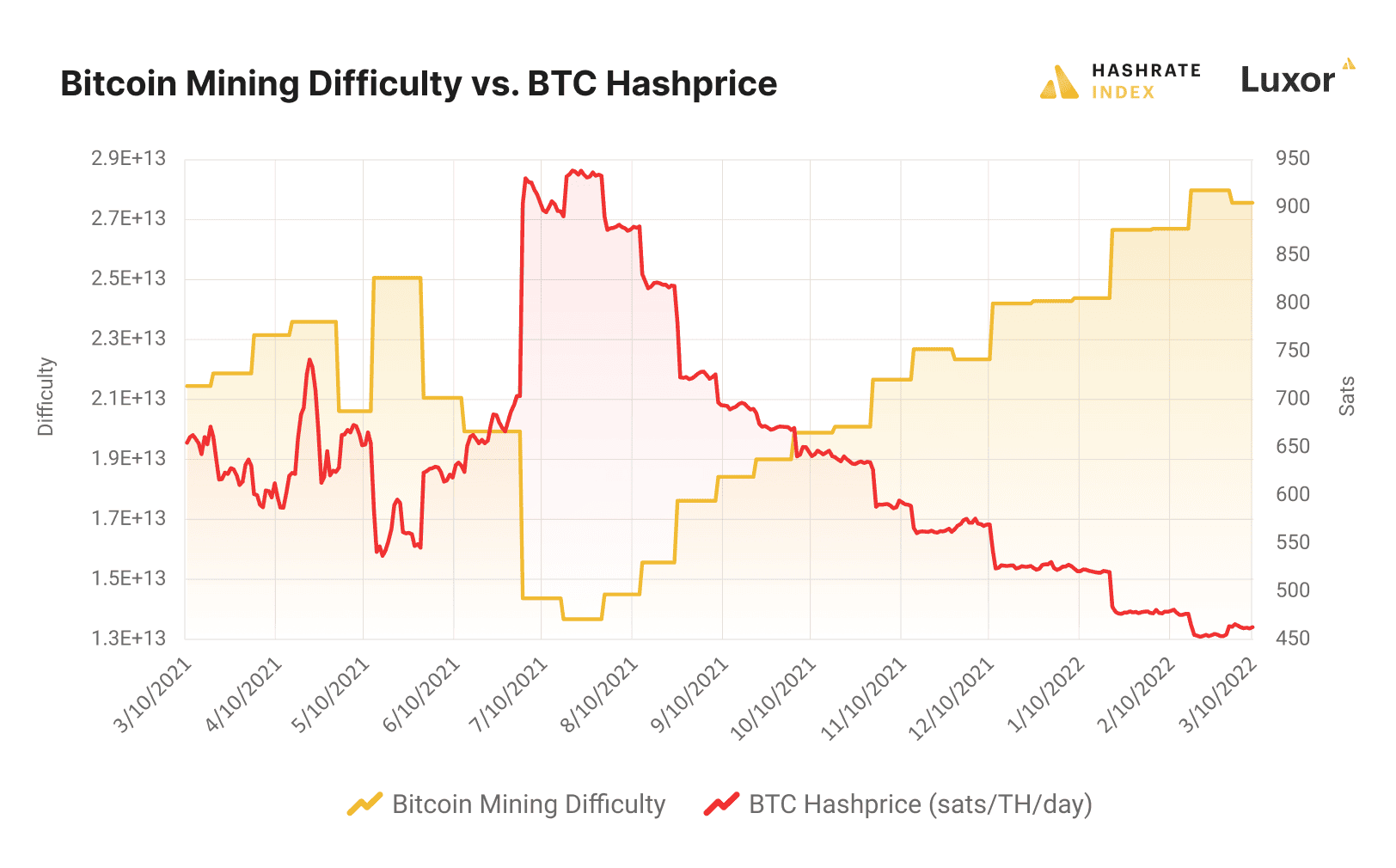

These two metrics are closely connected. As more miners join the network and contribute additional computing power, the hash rate increases. The Bitcoin protocol responds by raising the mining difficulty to keep block production steady. Conversely, if miners exit due to falling profits or rising energy costs, the hash rate drops, prompting the system to lower the difficulty.

This back-and-forth keeps the blockchain functioning efficiently while also ensuring a level playing field over time. But the impact of this relationship goes far beyond just the technical mechanics—it directly affects the crypto market and the decisions of traders and investors.

Source: Hashrate Index

Impact on Crypto Traders and the Market

Mining Profitability and Market Supply

Mining difficulty has a direct impact on the cost and profitability of mining operations. When difficulty rises, miners must expend more resources—electricity, hardware, and time—to earn the same block rewards. For miners with tight margins, especially after halving events that reduce block rewards by 50%, rising difficulty can squeeze profits or even make operations unviable.

When mining becomes less profitable, miners may sell off more of their cryptocurrency holdings to stay afloat, which can increase short-term selling pressure in the market. If enough miners do this at once, it can depress prices, at least temporarily.

On the flip side, if difficulty drops, mining becomes more accessible. This may invite new miners to join the network or encourage existing ones to ramp up operations. The result? A potential increase in the rate at which new coins are introduced into circulation, which could nudge prices downward if demand doesn't keep up.

Traders monitoring these shifts can better anticipate changes in market supply and react accordingly.

Network Security and Investor Confidence

A high hash rate makes a blockchain network much harder to attack. The most common concern in PoW systems is the so-called 51% attack, where a single entity gains control of the majority of the network's mining power and can potentially reverse transactions or double-spend coins. The higher the hash rate and difficulty, the more impractical—and expensive—such an attack becomes.

For investors and institutional players, a robust hash rate is a vote of confidence in the network’s security. It signals a high level of miner participation and a lower risk of manipulation or technical failure. In contrast, a falling hash rate may trigger concerns about declining miner interest or network vulnerabilities, potentially shaking investor sentiment.

Traders who track these indicators often use them as signals of longer-term market stability or as red flags pointing to upcoming turbulence.

Transaction Speed and Fees

Hash rate doesn’t just influence security—it also affects how quickly transactions are confirmed. When hash rate is high and blocks are being found at or near the target interval, transaction confirmations happen swiftly, keeping the network flowing smoothly.

If hash rate drops and blocks take longer to mine, the backlog of unconfirmed transactions can grow. This can drive up transaction fees as users outbid each other to get priority placement in the next block. During periods of high congestion, fees can spike dramatically, affecting the cost of using the network.

For traders making time-sensitive moves—like arbitrage opportunities or stop-loss strategies—delays and elevated fees can be a serious disadvantage. Understanding the current state of the hash rate can help anticipate whether the network is likely to experience congestion or whether fees will remain manageable.

Market Sentiment and Price Volatility

Mining difficulty and hash rate aren’t just technical figures—they’re also psychological signals. Sharp movements in either can trigger speculation, fear, or excitement in the market. A sudden drop in hash rate might suggest that miners are exiting en masse, possibly due to a price crash or regulatory disruption. This could lead to panic selling or doubts about the network’s long-term viability.

Conversely, a rapid rise in hash rate could indicate growing miner confidence, potentially preceding a price rally as the market interprets it as a bullish sign.

Because these metrics often change ahead of price movements, seasoned traders use them as leading indicators. Changes in difficulty and hash rate can foreshadow shifts in supply dynamics, security posture, or miner sentiment—all of which can contribute to price volatility.

Algorithmic trading models and sentiment analysis tools often incorporate hash rate and difficulty data as inputs, allowing traders to build strategies that react to changes in network fundamentals, not just price action alone.

Bottom Line

Mining difficulty and hash rate are key indicators of a cryptocurrency network’s stability, security, and economic dynamics.

Together, they shape the cost and effort required to validate transactions, directly impacting miner incentives and the resilience of the blockchain against attacks. Fluctuations in these metrics also affect how quickly transactions are processed and can signal shifts in network activity.

For traders and investors, tracking difficulty and hash rate offers insights into potential supply changes, market behavior, and price trends, making them essential tools for spotting risks and uncovering opportunities in real time.

.svg)