Chapters

Crypto Exchange Hacks: The Biggest Breaches & What We Can Learn

Billions of dollars stolen. Entire exchanges collapsing. Traders waking up one morning to find their funds gone forever.

It’s not fear-mongering—it’s history. Crypto exchange hacks have shaped the way regulators, developers, and everyday traders think about security. And while blockchain itself is incredibly secure, the platforms where we trade and store crypto—exchanges—are often the weak links.

Find out more below about the biggest exchange hacks, how they happened, and the practical lessons every crypto trader should learn so you don’t become the next victim.

Some of the Biggest Crypto Exchange Breaches & What You Can Learn

1. Mt. Gox (2014) – $460 Million Lost

If crypto had its own version of “where were you when it happened,” Mt. Gox would be it.

At its peak, Mt. Gox handled over 70% of all Bitcoin transactions. Then in 2014, disaster struck: around $460 million worth of Bitcoin was stolen. Hackers exploited weak internal systems and allegedly used fake Bitcoin deposits to drain funds.

The fallout was massive: lawsuits, bankruptcies, years of litigation, and one of the biggest blows to Bitcoin’s early reputation.

Lesson: Don’t put all your trust in one exchange. Even the biggest names can collapse overnight. Use multiple exchanges if you trade actively, but store your long-term holdings in a hardware wallet, not online.

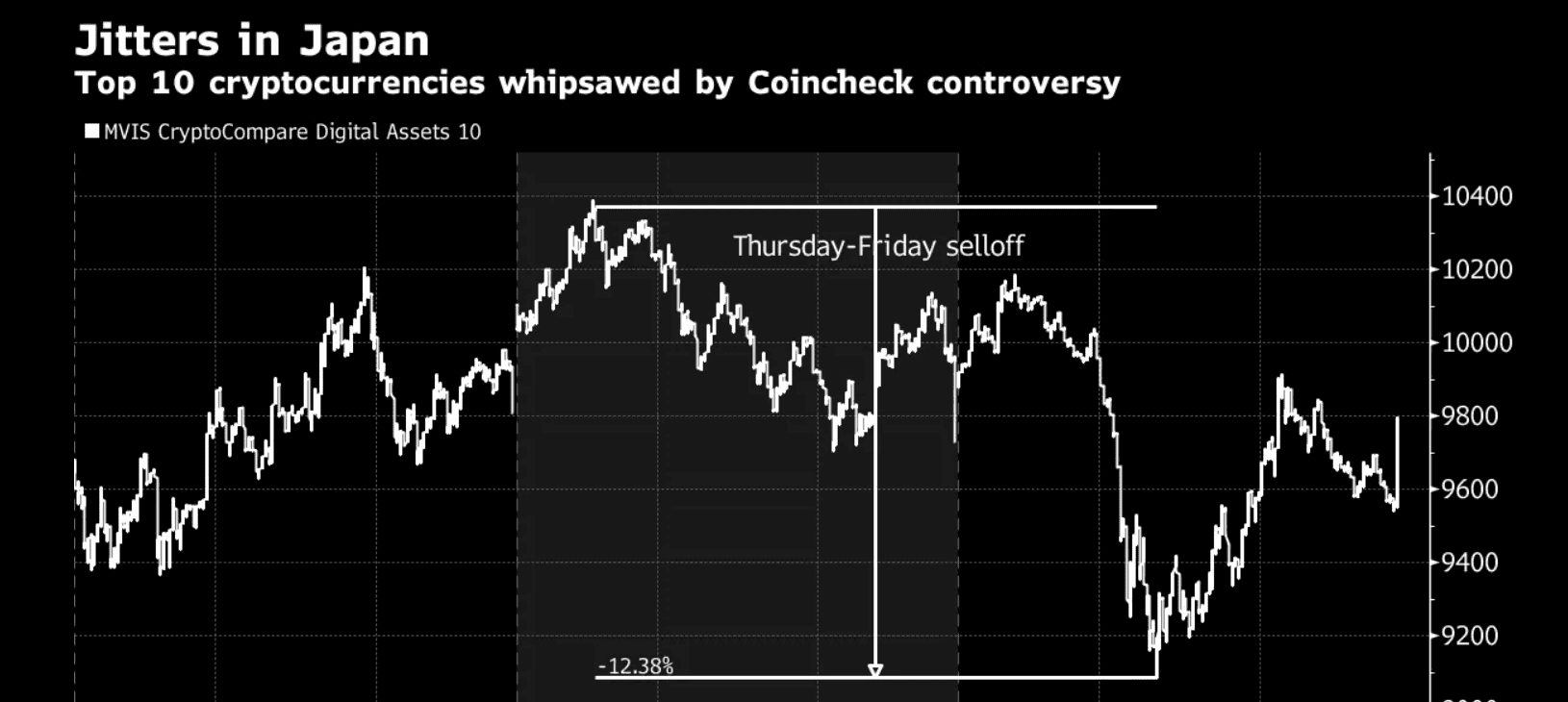

2. Coincheck (2018) – $532 Million in NEM Tokens

Japan’s Coincheck suffered one of the largest crypto exchange hacks in history, losing over $532 million worth of NEM tokens.

The reason was poor security practices. Coincheck kept most of its NEM tokens in a hot wallet without multi-signature protection. Once hackers gained access, it was like walking through an open door.

Lesson: Hot wallets are convenient but dangerous. As a trader, you can’t control how an exchange manages its funds—but you can control yours. Keep only what you need for trading on an exchange. Everything else belongs in cold storage.

Source: Bloomberg

3. KuCoin (2020) – $281 Million

In 2020, hackers stole about $281 million from KuCoin by compromising private keys to the exchange’s hot wallets.

The silver lining was that KuCoin worked with other exchanges and blockchain projects to freeze and recover a significant portion of the stolen assets. This was one of the first big hacks where cooperation across the crypto ecosystem played a crucial role in minimizing losses.

Lesson: Recovery is possible, but don’t count on it. KuCoin got lucky thanks to blockchain transparency and partnerships. Most victims of hacks aren’t made whole.

4. BitGrail (2018) – $170 Million in Nano

The BitGrail hack wasn’t just about money; it was also about trust. About $170 million in Nano tokens vanished, and instead of transparency, there was finger-pointing between the founder of BitGrail and the Nano Foundation.

Many victims felt abandoned, sparking lawsuits and endless community debates about responsibility.

Lesson: Transparency matters. Choose exchanges that publish proof of reserves and have a clear security track record. If an exchange avoids answering tough questions, it’s a red flag.

6. Poly Network (2022) – $611 Million

Poly Network made headlines with what was, at the time, the largest crypto hack ever: $611 million.

The twist? Much of the stolen money was later returned after the hacker claimed they did it “for fun” to expose vulnerabilities.

While it sounds almost comical, the hack highlighted how complex smart contracts and decentralized protocols can be vulnerable, even when billions of dollars are at stake.

Lesson: Don’t confuse “decentralized” with “invincible.” Smart contracts can and do get exploited. Always research platforms before locking your funds into them.

7. FTX (2022) – $415 Million (on Top of Everything Else)

When FTX collapsed in late 2022, the headlines focused on fraud, mismanagement, and bankruptcy. But amid the chaos, another blow landed: a hack drained around $415 million from the exchange.

Details remain murky, but the hack made a bad situation even worse for already devastated customers.

Lesson: Even regulated or heavily marketed exchanges can implode. The lesson here is bigger than hacks; it’s about self-custody. “Not your keys, not your coins” isn’t just a meme. It’s survival.

8. DMM Bitcoin (2024) – $308 Million

In 2024, Japanese exchange DMM Bitcoin was hacked for around $308 million in Bitcoin. Authorities traced the attack to the Lazarus Group, a North Korean hacking collective responsible for multiple crypto heists.

This was yet another reminder that crypto exchanges are prime targets for state-backed hacking groups with deep resources.

Lesson: Don’t underestimate the scale of the threat. Hackers aren’t just lone wolves in hoodies; they’re often highly organized operations. That’s why your personal best defense is minimizing your exposure.

9. Poloniex (2023) – $125 Million

Poloniex’s 2023 hack involved private key compromise, with hackers draining over $125 million. Recovery efforts are still ongoing.

Lesson: This hack, like many others, proves one thing: private keys are everything. If an exchange loses control of its keys, user funds are at risk. As a trader, owning your own keys via cold storage remains the safest bet.

10. AscendEx (2021) – $77 Million

In 2021, AscendEx was hacked for $77 million due to a hot wallet vulnerability. The exchange promised refunds, but compensation has been slow and incomplete.

Lesson: Promises don’t equal protection. Even if an exchange wants to do the right thing, it may not have the financial strength to fully cover losses. That’s why insurance coverage (where available) should be a factor in choosing where you trade.

11. Bybit (2025) – $1.4 Billion

The most recent and one of the largest: Bybit’s 2025 hack saw a staggering $1.4 billion in digital tokens stolen.

This hack was like a wake-up call. If a top-tier exchange can lose that much in one shot, it proves the crypto industry is still fighting an uphill battle when it comes to securing assets at scale.

Lesson: Scale doesn’t equal safety. Big exchanges are just bigger targets. Don’t be lulled into thinking “too big to fail” applies in crypto.

The Big Takeaways for Crypto Traders

So, after billions stolen and countless lessons learned, what should the everyday trader do? Here’s the short version:

- Not your keys, not your coins. Keep your trading funds on exchanges, but move your savings to a hardware wallet.

- Diversify your exposure. Don’t keep all your funds on a single platform.

- Do your homework. Check if the exchange has proof of reserves, insurance policies, or a history of transparency.

- Understand hot vs. cold wallets. Exchanges using mostly hot wallets are higher risk.

- Expect the unexpected. Even trusted platforms can get hacked. Only trade with money you can afford to lose.

- Stay updated. Follow news on exchange vulnerabilities, regulatory crackdowns, and market security trends.

Final Thoughts

Crypto exchange hacks aren’t going away. If anything, as the industry grows, hackers will only get bolder and more sophisticated.

But here’s the thing: every major hack has taught the crypto community something valuable: about security, accountability, and the importance of self-custody.

As a trader, you don’t need to live in fear, but you do need to trade smart. Protect yourself by owning your keys, spreading your risk, and never assuming any exchange is bulletproof.

Crypto is here to stay. The only question is whether your funds will stay with it or vanish in the next big headline.

.svg)