Chapters

How to Pick a Secure Crypto Exchange: Red Flags to Watch Out For

High-profile hacks, exchange collapses, and phishing scams remind us that not every platform is built to keep your money safe. That’s why choosing a secure crypto exchange is essential.

Whether you’re new to crypto or an experienced trader, understanding the core security features that protect your assets can save you from costly mistakes. This guide breaks down the critical factors to evaluate before you trust an exchange with your funds.

Why Security Matters in Crypto Exchanges

Unlike traditional banks, cryptocurrencies are decentralized and irreversible. Once your coins are stolen or transferred out of your wallet, recovering them is nearly impossible. A secure crypto exchange acts as a protective gatekeeper, using advanced security tools, compliance standards, and monitoring systems to shield your assets and personal data.

Unfortunately, not all exchanges operate at the same standard. Some prioritize speed and low fees while overlooking key safeguards. The result means weak links that hackers can exploit. That’s why security must be the number-one filter when evaluating where to trade.

Key Security Features to Look For

When evaluating a platform, here are the must-have features that separate a secure crypto exchange from a risky one.

1. Regulatory Compliance

Exchanges that comply with strict financial regulations provide a stronger layer of protection. Look for platforms that enforce Know Your Customer (KYC) and Anti-Money Laundering (AML) policies.

These protocols help:

- Prevent fraud and identity theft.

- Reduce unauthorized account access.

- Ensure the exchange is accountable to legal frameworks.

An exchange that operates in compliance with regulators not only protects users but also signals transparency. If a platform avoids regulation altogether, it’s a red flag.

2. Strong Security Measures

A reliable exchange should implement multiple safeguards to protect both accounts and funds. Key measures include:

- Multi-Factor Authentication (MFA): Two-factor authentication (2FA) or biometric authentication ensures that even if your password is compromised, unauthorized access is far more difficult.

- Cold Storage: The majority of user funds should be stored offline, beyond the reach of hackers. Leading exchanges keep 90% or more of assets in cold wallets.

- SSL Encryption: Secure Sockets Layer (SSL) ensures all data transfers—such as logins and transactions—are encrypted against interception.

- Withdrawal Whitelists: This feature allows users to specify trusted wallet addresses. Even if hackers gain access, they cannot redirect funds to unauthorized wallets.

Without these safeguards, an exchange cannot honestly call itself secure.

3. Regular Security Audits

Even the best systems need constant testing. A secure crypto exchange undergoes frequent third-party security audits and vulnerability assessments.

These audits identify weaknesses before attackers can exploit them. Transparency is key—trustworthy platforms publish summaries of their audit results, proving they actively manage risks instead of reacting only after a breach.

4. Data Encryption

Your personal data is as valuable as your crypto. A secure exchange uses end-to-end encryption:

At rest: Passwords, wallets, and sensitive information are encrypted while stored.

In transit: All transmissions between your device and the exchange are encrypted to block interception.

Without strong encryption, attackers can hijack login credentials or monitor transactions in real time.

5. Fraud and Phishing Protection

Phishing scams are one of the most common attack vectors in crypto. A secure crypto exchange integrates multiple anti-fraud tools, such as:

- Anti-phishing codes: Personalized verification codes that confirm exchange emails are authentic.

- Real-time monitoring: Systems that flag unusual activity, like logins from new locations or large withdrawals.

- Login alerts: Notifications that let you react quickly if someone else tries to access your account.

Together, these features help protect users against scams that often bypass basic account security.

Additional Considerations Beyond Security Features

While technical safeguards form the foundation of a secure crypto exchange, other practical factors also matter.

Reputation and Track Record

Before signing up, research the exchange’s history. Has it suffered breaches in the past? If so, how did it respond? Some exchanges have been transparent and compensated users, while others vanished with customer funds.

A positive reputation, verified reviews, and a history of safe operations are strong indicators of trustworthiness.

User Experience

Security should never come at the expense of usability. A secure crypto exchange combines strong safeguards with a smooth, intuitive interface. Look for:

- Easy-to-navigate dashboards.

- Clear instructions for enabling 2FA or withdrawal whitelists.

- Responsive customer support available for security-related issues.

Even the most advanced features are useless if users can’t figure out how to activate them.

Insurance Coverage

Some top-tier exchanges provide insurance for customer funds. While insurance policies vary, they generally cover losses due to breaches or theft within the exchange’s control.

This extra safety net doesn’t eliminate risk, but it adds confidence that your assets are protected even if the unexpected happens.

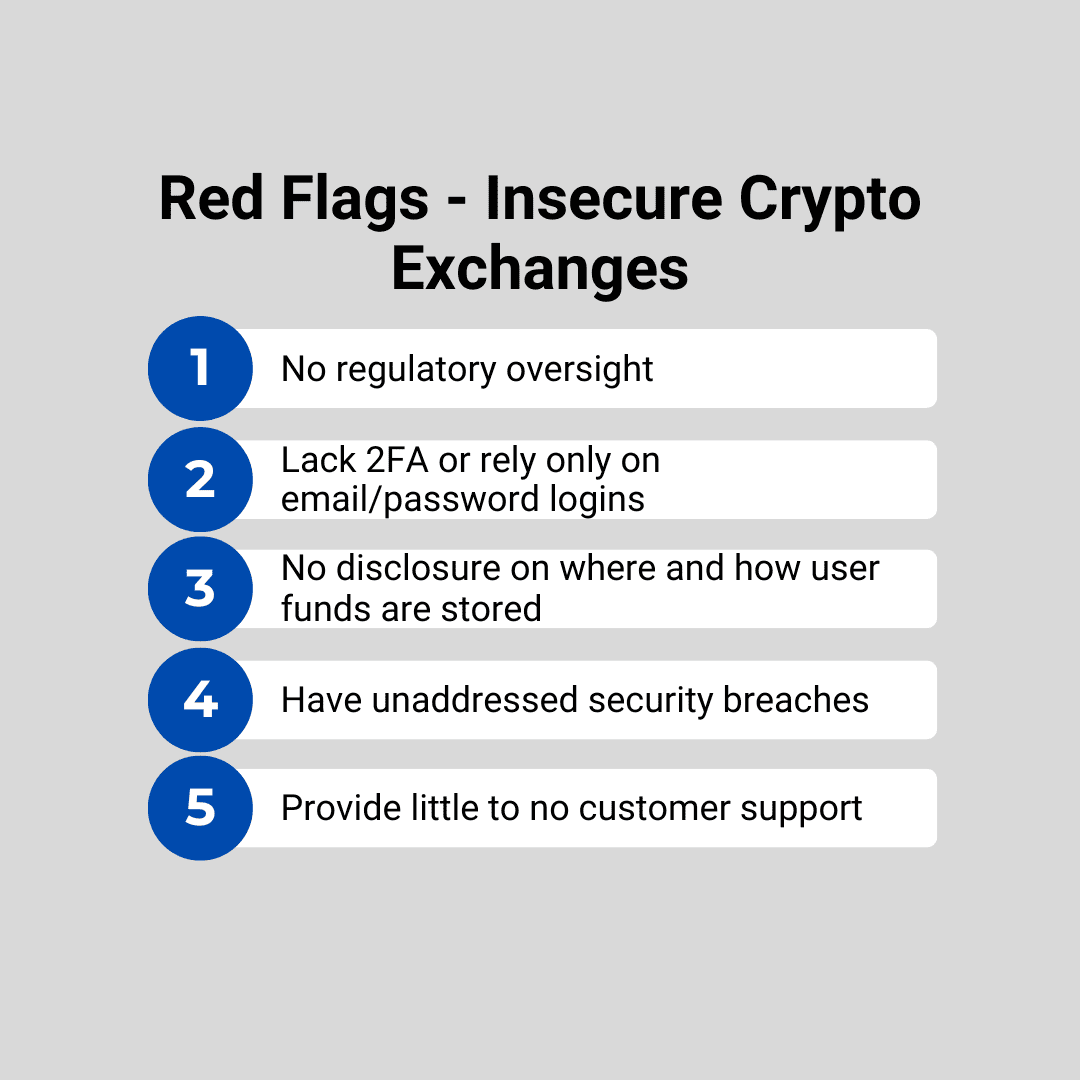

Red Flags That Signal an Insecure Exchange

When evaluating a crypto trading platform, watch out for these critical red flags:

-

No Regulatory Oversight

Trustworthy platforms operate under financial regulations, adhering to anti-money laundering (AML) and know-your-customer (KYC) protocols. Exchanges lacking official licenses or oversight are more prone to fraudulent behavior and offer little protection for users. - Hidden or Vague Leadership

Transparent companies proudly share details about their executives and operations. If the team behind an exchange is anonymous or hard to trace, it may be avoiding accountability or concealing unethical practices. - Weak Security Infrastructure

A platform that doesn’t implement essential safeguards. like two-factor authentication, encrypted data, cold wallet storage, or independent security audits, is far more susceptible to breaches and theft. -

Too-Good-To-Be-True Offers

Promises of guaranteed profits, zero risk, or ultra-low fees are classic hallmarks of scams. These tactics are designed to entice unsuspecting users into unsafe environments. -

Opaque Business Practices

If an exchange fails to disclose its physical headquarters, ownership structure, fund custody methods, or legal standing, that lack of clarity should raise serious concerns. -

Artificial Trading Activity

Some platforms inflate their trading volume using fake transactions to appear more active and trustworthy than they really are. This masks liquidity issues and misleads potential users. -

Unresponsive or Nonexistent Support

Reliable exchanges provide timely help through multiple channels. If customer service is unreachable or consistently unhelpful, it’s a red flag. -

No Identity Verification

Skipping KYC procedures not only facilitates illegal activity but also makes it harder for users to recover assets if something goes wrong. -

History of Frozen Withdrawals

If users have previously faced delays or blocks when trying to withdraw funds, it may point to financial instability or internal mismanagement. -

Unprofessional Web Presence

A poorly designed website riddled with typos, broken links, or lacking social media engagement may indicate a hastily assembled operation with questionable intentions. -

Unsolicited Social Media Outreach

Random messages offering investment deals or crypto tips, especially from unknown accounts, are often phishing attempts or scams.

If an exchange shows even one of these warning signs, your assets could be at serious risk.

How to Evaluate an Exchange Before Signing Up

Here’s a step-by-step checklist to help you assess whether a platform qualifies as a secure crypto exchange:

- Check licenses and compliance: Verify whether the exchange operates under any financial authorities.

- Enable security features: Ensure 2FA, withdrawal whitelists, and anti-phishing codes are available.

- Review audit reports: Look for public evidence of security testing.

- Test the platform: Create a small account and test deposits/withdrawals.

- Research the community: Read independent reviews and user feedback about the exchange’s security track record.

Doing this due diligence up front can save you from headaches later.

Key Takeaways

The crypto space will always attract bad actors, but you can dramatically reduce your risk by choosing the right trading platform. A secure crypto exchange isn’t just about convenience—it’s about protecting your money, your identity, and your peace of mind.

Prioritize platforms with:

- Strong regulatory compliance.

- Multi-layered security measures.

- Transparent audits and operations.

- A proven track record of protecting users.

With these safeguards in place, you can trade with greater confidence, knowing your digital assets are as safe as possible.

.svg)