Chapters

What Happens When a Crypto Exchange Goes Bankrupt – Lessons from FTX

You’ve probably heard horror stories of exchanges collapsing overnight. From FTX to Voyager to Celsius, the past few years have proven that even the biggest names in crypto aren’t bulletproof. When a crypto exchange goes bankrupt, it’s almost always bad news for the average investor.

Let’s break down exactly what happens when an exchange collapses, why customers usually end up at the back of the line, and what you can do to protect yourself from being the next victim.

Why Do Crypto Exchanges Go Bankrupt?

At its core, bankruptcy happens because an exchange can’t meet its financial obligations. Maybe they took risky bets with customer funds, got hacked, or just mismanaged money. Once debts pile up higher than assets, the exchange has no way out but to seek legal protection.

In the U.S., this usually happens under Chapter 7 (liquidation) or Chapter 11 (reorganization). Other countries have their own rules, but the big picture is the same: the exchange is broke, and now the courts have to decide who gets what’s left.

The Role of the Bankruptcy Trustee

When a crypto exchange files for bankruptcy, a trustee is appointed. Think of this person as the referee who steps in to make sure the process is handled fairly (at least in theory). The trustee oversees liquidation or restructuring, manages assets, and ensures creditors are paid in the proper order.

This might sound good for customers, but here’s the catch: you’re not first in line.

Why Customers Get the Short End of the Stick

In bankruptcy law, creditors are divided into different categories. The order of repayment looks something like this:

- Secured creditors – banks, lenders, or anyone with collateral backing their loans.

- Priority creditors – those legally entitled to early repayment due to the nature of their claims.

- Unsecured creditors – bondholders, suppliers, and, yes… customers.

Equity holders – shareholders of the exchange itself.

That means if you had Bitcoin sitting on a bankrupt exchange, you’re legally treated like an unsecured creditor. Unlike money in a bank account, which is insured up to a certain amount, crypto sitting on an exchange usually has no safety net.

In other words, secured creditors get first dibs, and customers are left fighting over whatever crumbs remain.

Filing Claims: Can Customers Recover Anything?

Even though you’re at the back of the line, you’re not completely out of luck. Customers can file claims in bankruptcy court. The amount you recover depends on:

- How many assets are left after secured creditors are paid.

- Whether the exchange had proper records of your balances.

- The legal framework of the bankruptcy case.

But here’s a detail many investors miss: your recovery isn’t always based on the future value of crypto. Instead, it’s usually pegged to the value of your coins on the date of the bankruptcy filing.

So if you had 1 BTC on the exchange when it went under at $20,000, and Bitcoin later shoots to $60,000, the extra gain doesn’t go to you; it goes to the estate or other creditors.

What Happens to the Crypto Itself?

A lot of people assume the coins they left on an exchange are still “theirs.” Unfortunately, in bankruptcy law, that’s rarely the case.

When you deposit crypto into an exchange wallet, the legal relationship often shifts from ownership to debtor-creditor. That means the crypto you thought you owned is technically an asset of the exchange. Once the bankruptcy is filed, those assets become part of the bankruptcy estate—a pool that gets divided among creditors.

Adding to the pain, bankruptcy law includes something called the automatic stay. This halts all withdrawals and redemptions. Even if you’re staring at your account balance, you can’t just pull your crypto out once bankruptcy is declared.

Can Exchanges Claw Back Pre-Bankruptcy Withdrawals?

Here’s a kicker most investors don’t see coming. If you managed to withdraw funds shortly before the bankruptcy filing, those assets may not be safe either.

Bankruptcy law allows trustees to claw back transactions if they’re considered “voidable preferences.” Basically, if you got your money out within a certain window (usually 90 days before the filing), the trustee can demand it back to distribute more “fairly” among all creditors.

So, ironically, being quick to withdraw before a collapse doesn’t always mean you’re in the clear.

Different Countries, Different Rules

One of the biggest headaches in crypto bankruptcies is the regulatory gray area. Unlike traditional finance, where laws are fairly clear, crypto still exists in a patchwork of regulations.

In the U.S., crypto bankruptcies generally fall under existing bankruptcy law, which wasn’t designed with digital assets in mind.

In other jurisdictions, courts may treat crypto more like property, which could slightly improve customer claims.

Some countries still lack any real framework at all, leaving customers at the mercy of long, drawn-out court battles.

This legal uncertainty is part of why cases like FTX are so complex and slow-moving.

Case Study: Lessons from FTX

FTX’s downfall was beyond just another crypto exchange bankruptcy story; it was a global financial scandal that exposed just how fragile the industry’s foundations can be.

At its peak, FTX was the second-largest exchange in the world, handling billions in daily trading volume. Founded by Sam Bankman-Fried (better known as SBF), the company projected an image of stability, innovation, and legitimacy. Celebrities endorsed it, Super Bowl ads promoted it, and regulators were even engaging with its leadership. To the average customer, FTX looked bulletproof.

But in November 2022, it all came crashing down. Within days, the exchange went from industry leader to bankrupt shell, leaving millions of customers locked out of their accounts.

How the FTX Collapse Happened

The root cause of the collapse was a toxic relationship between FTX and its sister company, Alameda Research, a trading firm also founded by SBF. Court documents later revealed that FTX customer funds were being funneled to Alameda to cover risky bets and losses.

When a CoinDesk article exposed weaknesses in Alameda’s balance sheet, showing it was heavily reliant on the FTT token (issued by FTX itself), confidence evaporated. Rival exchange Binance announced it would dump its FTT holdings, sparking a liquidity crisis.

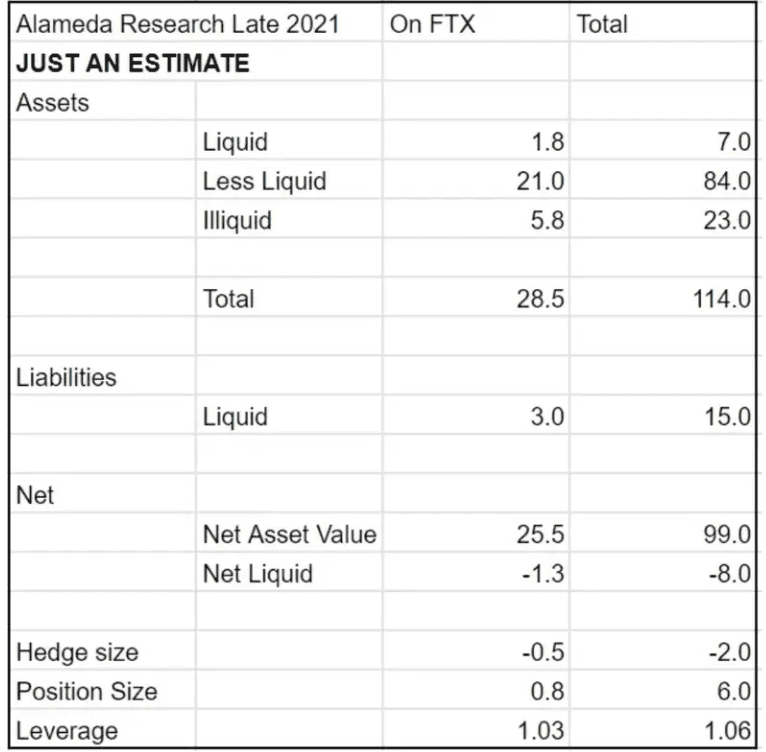

The image below shows Bankman-Fried’s projected balance sheet from 2021:

Source: Business Insider

In just a few days, a flood of withdrawal requests hit FTX. With billions already missing, the exchange couldn’t cover redemptions. On November 11, 2022, FTX, Alameda, and dozens of related companies filed for Chapter 11 bankruptcy protection in the U.S.

The Fallout: Customers as Creditors

For FTX customers, the bankruptcy meant instant paralysis. Accounts were frozen, and balances became numbers on a screen with no guarantee of recovery. Like in most bankruptcies, customers were classified as unsecured creditors.

That meant they had to stand in line behind secured creditors and institutional lenders. To make matters worse, FTX’s recordkeeping was chaotic—court filings described it as a “complete failure of corporate controls.” In many cases, there wasn’t even a clear ledger of who owned what.

Billions in customer deposits were missing, and the estate’s new CEO, John J. Ray III (who previously handled the Enron collapse), called it “unprecedented” mismanagement in his decades of bankruptcy experience.

The Recovery Process

The FTX bankruptcy process is still ongoing, but here are some of the key issues customers face:

- Asset Recovery – Trustees and lawyers are working to claw back money from various sources, including executives, political donations, and even customers who withdrew large sums before the collapse.

- Crypto Valuation – Customer claims are generally valued at the price of crypto on the bankruptcy filing date (November 11, 2022). That means if you had 1 BTC on FTX when Bitcoin was worth ~$16,800, your claim is locked at that value—even if Bitcoin later rises to $60,000.

- Litigation Against Insiders – Former executives, including SBF, face criminal charges and civil lawsuits. While criminal cases don’t directly repay customers, successful asset seizures could boost the bankruptcy estate.

- Global Complexity – FTX operated across multiple jurisdictions, making the case incredibly complex. Different countries have different bankruptcy rules, and some foreign subsidiaries are undergoing separate proceedings.

What FTX Customers Can Expect

So, how much are customers likely to recover? FTX has recovered approximately $18 billion in assets, including cash, crypto, and other liquid holdings.

FTX customers are expected to recover a substantial portion of their claims, but the exact amount varies depending on the type and size of the claim. About 98% of all creditors are expected to receive 119% of their allowed claim amount, including interest, representing claims up to $50,000.

The bigger lesson, however, is that recovery will take years. Customers still haven’t seen full payouts, and legal fees continue to eat into the estate. Even best-case scenarios involve long waits and complicated distribution processes.

Why the FTX Case Matters

FTX’s bankruptcy isn’t just about one exchange failing; it set a precedent. It showed regulators how dangerous the lack of oversight in crypto exchanges can be, and it forced investors to rethink custody.

The collapse also demonstrated the brutal reality of bankruptcy law: customers don’t really “own” their crypto once it’s deposited on an exchange. Instead, they become unsecured creditors fighting for scraps.

How to Protect Yourself from Exchange Bankruptcies

The hard truth is that once your funds are stuck in a bankrupt exchange, there’s little you can do except wait and hope. The real strategy is prevention.

Here are the best ways to protect yourself:

- Use non-custodial wallets – If you don’t hold the private keys, you don’t truly own your crypto. Hardware wallets and software wallets give you direct control.

- Spread out your risk – Don’t keep all your crypto on one exchange, even for trading.

- Stay alert – Keep an eye on news, audits, and financial health indicators of the platforms you use.

- Withdraw often – Only keep funds on an exchange when you’re actively trading.

The common phrase “not your keys, not your coins” is more than just a meme; it’s survival advice.

Bottom Line

When a crypto exchange goes bankrupt, it’s rarely the exchange itself that suffers the most. The real victims are small investors and customers who trusted the platform to safeguard their money.

Between being treated as unsecured creditors, frozen withdrawals, clawback risks, and unclear regulations, the odds of fully recovering your assets are slim.

That doesn’t mean you should avoid crypto altogether, but it does mean you need to be smart about custody. Keep long-term holdings in your own wallet, use exchanges only for active trading, and always assume that any exchange, no matter how big, can fail.

In crypto, the difference between security and disaster often comes down to a single decision: who holds your keys.

.svg)