.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

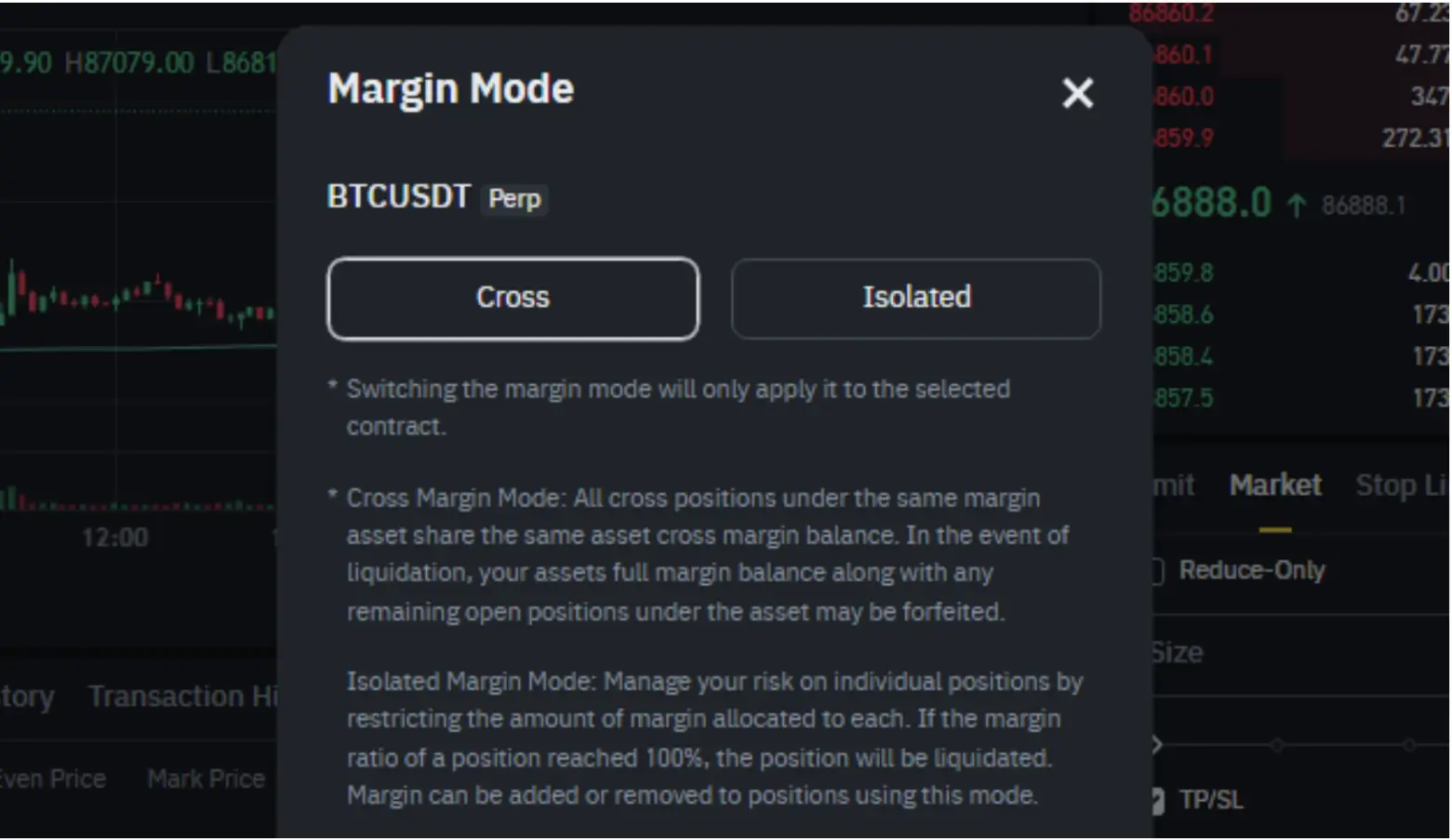

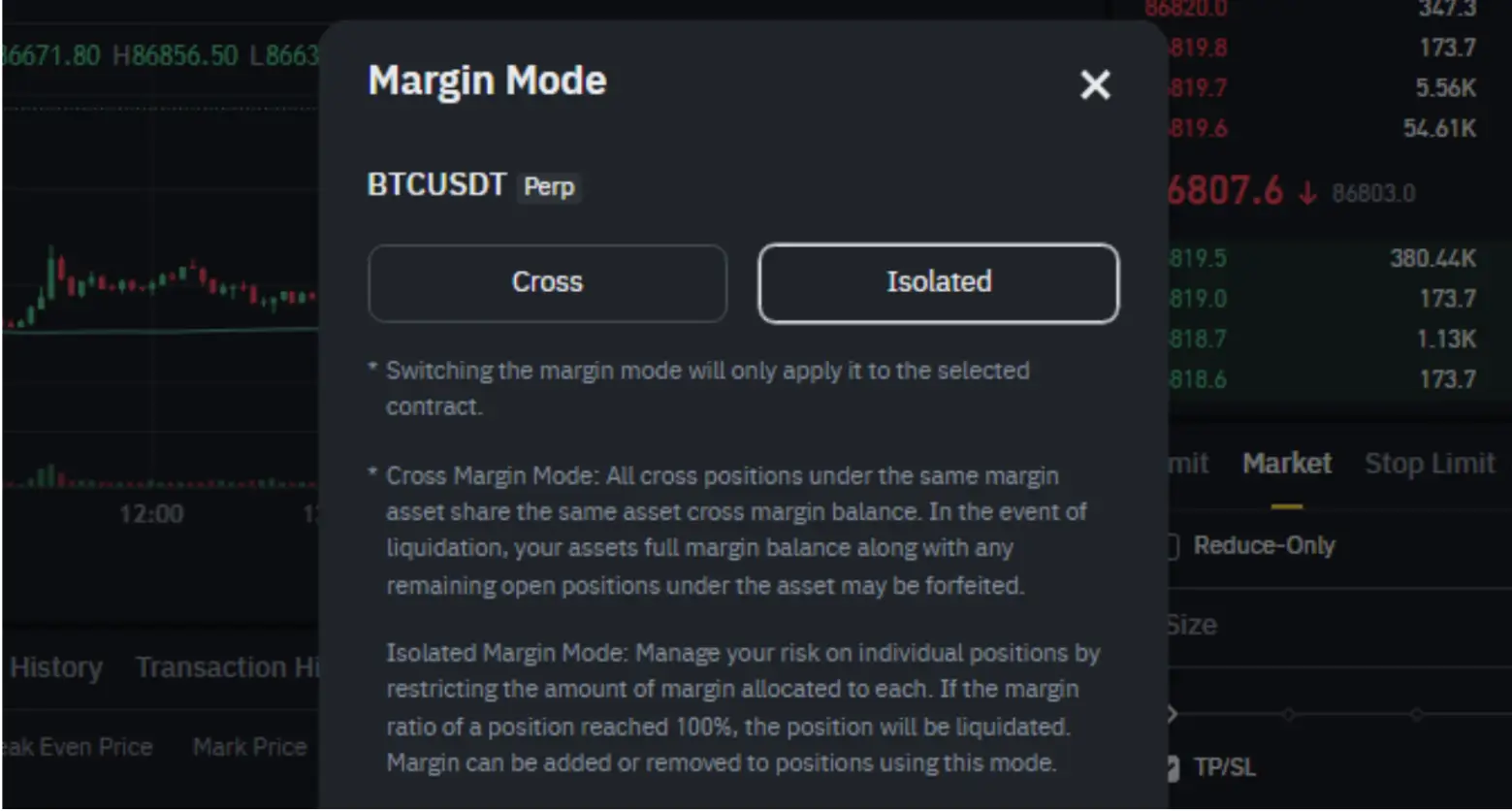

Cross Margin vs Isolated Margin

Cryptocurrency margin trading bears two vital options to approach the market: cross and isolated. The first allows traders to exploit hedging strategies, while the second gives them more control over the balance and risks assumed per trade. Both represent a critical prior choice to get involved in speculative trading markets, like futures.

Altrady's team has found key differences among each mode that will help you grasp concise knowledge on opening and holding positions effectively. This guide delves into comprehensible definitions and examples, plus a necessary overview of futures trading.

Key Takeaways

- Choosing between cross-margin and isolated margin depends on traders' risk tolerance and strategy.

- Traders seeking total risk control would prefer to limit losses on individual trades with Isolated Margin.

- Experienced traders may take higher risks with cross-margin for potentially higher profits, avoiding quick liquidations.

Futures Trading: Overview

Understanding cross and isolated margins requires addressing how the futures market works, especially perpetual trading. Unlike spot trading, this modality does not trade factual but contractual quantities of an underlying asset, meaning that a trader's position in this market is subject to a liquidation price and an expiration date.

Furthermore, futures trading employs leverage, amplifying the position size, hence the risk and profit potential. The amount of margin and leverage is strictly related to how a contract determines a liquidation price level:

- A high amount of leverage with a low margin leads to a narrowed liquidation price (near the entry price).

- A low amount of leverage with a high margin leads to an expanded liquidation price (afar the entry price).

- A proper balance between the leverage and the margin results in a fitting liquidation level.

Cross-margin and isolated margin have access to leverage. However, the impact of leverage on both modes is subject to substantial differences regarding how each one triggers liquidation levels and uses the overall balance.

Your path to success: Advanced Crypto Futures Trading Techniques

| Quick Note: Another form of margin trading is available for spot trading, where traders borrow money (leverage) to amplify the position size. Unlike futures, margin trading in the spot market generates interest over the borrowed money. Both spot trading with borrowed money and futures trading with leverage are forms of margin trading. |

Understanding Cross Margin

When using cross-margin, you expose your entire available balance to hold one or multiple positions. Traders often prefer this method to operate hedge strategies due to the shared margin employed. To better grasp the cross-margin mode, let's break down some examples.

Hedging Strategy

Imagine that Bitcoin (BTC) may experience a short-term decline, but you remain bullish for the long term.

You decide to open two positions:

- A long position on BTC, expecting a price increase.

- A short position on BTC to hedge against potential short-term price drops.

In this case, two alternative outcomes would emerge:

- If the BTC price slides, the short position profits, which helps offset the unrealized losses from the bullish position.

- If the BTC price rises as anticipated, the long position profits and by closing both positions, the balance ends up with an overall gain.

This operation involves risks to consider:

- If the BTC price moves significantly against the trader's overall prediction, both positions could incur substantial losses, potentially leading to the entire account liquidation.

- Both position sizes should be consistent with each other. If one is significantly larger than the other, the expected reward over the risk assumed would be meaningless.

Multiple Positions

In another situation, you have contracts going long in Ethereum (ETH) and Ripple (XRP) in the cross-margin account. However, suppose:

- The ETH trade is performing well.

- The XRP trade is experiencing losses.

In this case, three alternative outcomes would emerge:

- The profits in the ETH position can help offset the losses from the XRP position.

- The cross-margin system uses the trader's entire account balance as collateral, so the profitable ETH position provides a margin to keep the losing XRP position open, potentially allowing it to recover.

- If both ETH and XRP positions start incurring significant losses, the trader's entire account is at risk of liquidation.

Learn more about Position Sizing and Leverage.

Understanding Isolated Margin

When using an isolated margin, you use just a portion of the available balance to open one or multiple positions. For instance, if the balance is 10000 USDT and you open a position with 50% of it, only that portion would be at risk, ergo 5000.

Traders often prefer this method to allocate a specific margin amount per trade while operating in a determined direction. Let's break down some examples to understand the isolated margin mode.

Trading ETH with Isolated Margin

Imagine trading Ethereum (ETH) with leverage amid concerns of potential high volatility. By using an isolated margin, you can limit the underlying risk.

To achieve that:

- Allocate 5000 USDT to an ETH trade. It is the "isolated margin" with 10x leverage, which means your exposure is worth 50000 USDT (5000 x 10).

- Open a long position on ETH since the price can rise.

Now, let's consider two potential outcomes:

- If the ETH price rises, you make a profit. This profit goes to the isolated margin.

- If ETH falls, the position incurs losses. Given that you allocated an isolated margin, the maximum loss it can incur is 5000 USDT (in case ETH reaches the liquidation price).

The remaining 50% balance (5000 USDT) is unaffected.

Master the art of preserving balance with Introduction to Risk Management.

Key Differences

Cross-margin

- Cross margin uses the entire account balance as collateral. The risk of total account liquidation is higher with cross-margin.

- Profitable positions can help offset losses from losing positions.

Isolated margin

- The traders' risk is limited to the allocated amount in a position instead of the overall balance.

- The isolated margin mode allows traders to calculate risk. It provides a safer way to control the exposure of individual trades.

Conclusion

The cross-margin system prevents immediate liquidation during temporary losing positions by employing the entire traders' account balance as collateral. The isolated margin uses an allocated amount of an overall margin account, implying it only risks a determined portion of the balance per trade.

These trading modes are available across multiple exchanges and crypto trading platforms. Altrady can provide additional risk management tools through Smart Trading features. Moreover, you can test trading strategies with paper trading by signing up for a free trial account today.