.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

ORB Trading Strategy: A Practical Guide for Traders

Opening Range Breakout (ORB) is a structured way to trade momentum: you define the market’s opening range, then look for price to break above or below that range with a plan for entries, stops, and exits.

This guide walks through ORB rules that are simple enough to follow, plus filters and risk management that make the strategy more resilient.

Key takeaways

• ORB defines an Opening Range (first 5, 15, 30, or 60 minutes) and trades breakouts of that range.

• The best ORB trades usually show expansion after the breakout: clean candle closes and stronger follow through.

• Filters (trend and confirmation) help reduce false breakouts.

• ORB only works long term if risk is controlled through position sizing and disciplined stops.

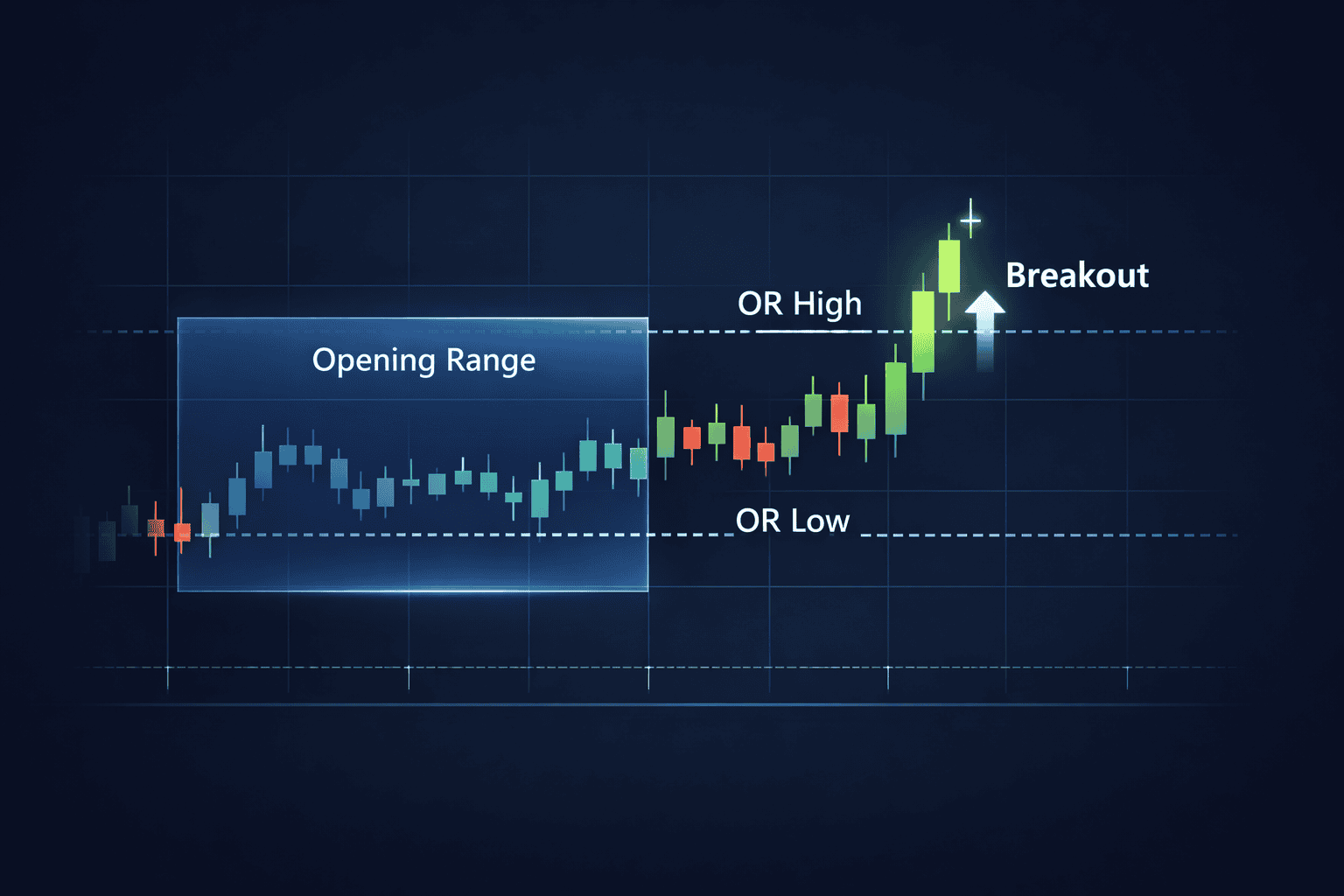

What is the ORB trading strategy?

ORB stands for Opening Range Breakout. The opening range is the high and low printed during the first X minutes of a chosen session window. After that window ends, you wait for a breakout:

• Bullish ORB: price breaks and holds above the Opening Range High (OR High)

• Bearish ORB: price breaks and holds below the Opening Range Low (OR Low)

The idea is to participate when the market shifts from early balance to directional movement.

Step 1: Choose a consistent opening range window

Pick one window and keep it consistent so your results are comparable.

Common ORB windows:

• 5 minute ORB: more signals, more noise

• 15 minute ORB: popular balance of structure and frequency

• 30 minute ORB: fewer trades, often cleaner levels

• 60 minute ORB: fewer signals, higher structure

ORB in crypto: what counts as “open”?

Crypto trades 24/7, so there is no single exchange open like equities. Most traders define “open” using one of these anchors:

• A major liquidity session window (London or New York)

• The daily reset (00:00 UTC)

• A consistent time window that matches your trading schedule

The key is not which anchor is “correct”, it is that you use one definition consistently.

Step 2: Mark OR High and OR Low

Once your opening window ends:

• OR High = highest high inside the opening window

• OR Low = lowest low inside the opening window

Optional: OR Midpoint (for context only).

Step 3: Define entry rules that prevent random trades

A clean ORB plan has three elements: trigger, confirmation, and entry style.

A simple trigger (recommended)

• Long trigger: candle closes above OR High

• Short trigger: candle closes below OR Low

This “close beyond the level” rule avoids entering on the first wick through the level.

Pick 1 confirmation filter

Choose one filter to keep the system simple.

Option A: trend filter

• Take longs only when the higher timeframe trend is up

• Take shorts only when the higher timeframe trend is down

Option B: breakout strength filter

• Only take breakouts where the breakout candle closes near its high (for longs) or near its low (for shorts)

This reduces trades on weak, wicky breaks.

Option C: volatility expansion filter

• Only take ORB when volatility clearly expands after the breakout

A practical proxy: the breakout candle is meaningfully larger than recent candles.

Step 4: Place your stop loss where the setup is invalid

ORB stops should be structural, not emotional.

Common stop placements:

1. Below OR High (long) or above OR Low (short)

Works when the breakout is clean and the range is not huge.

2. Below the breakout candle low (long) or above breakout candle high (short)

Tighter, improves reward to risk, but can stop out more often.

3. Opposite side of the opening range

Usually too wide unless the opening range is small.

A practical rule: if the opening range is too wide to fit your risk limits, skip the trade.

Step 5: Choose exits that match the ORB logic

ORB relies on momentum. Exits should reflect that.

Simple R multiple approach

• Take partial profit at 1R

• Move stop to breakeven after 1R (optional, not mandatory)

• Let the remainder aim for 2R to 3R or trail behind structure

Structure targets

• Prior day high or low

• Nearby resistance or support on a higher timeframe

Time stop

If price fails to expand after the breakout within a defined time window, exit. No expansion often becomes chop.

Risk management for ORB

ORB is simple, but the edge can be small without strong risk control.

A basic ORB risk framework:

• Risk a fixed percent per trade (for many traders: 0.25% to 1%)

• Limit the number of attempts per session window (often 1 to 2)

• Stop trading after a defined drawdown for that session window (example: 2 losses)

Position sizing rule:

• Position size = (risk per trade) / (stop distance)

If your stop distance doubles, your position size should halve.

Common ORB mistakes

• Trading every breakout without any filter

• Entering on wicks instead of waiting for a close

• Ignoring opening range width (risk becomes too large)

• Moving stops wider after entry

• No journal, so the strategy never improves

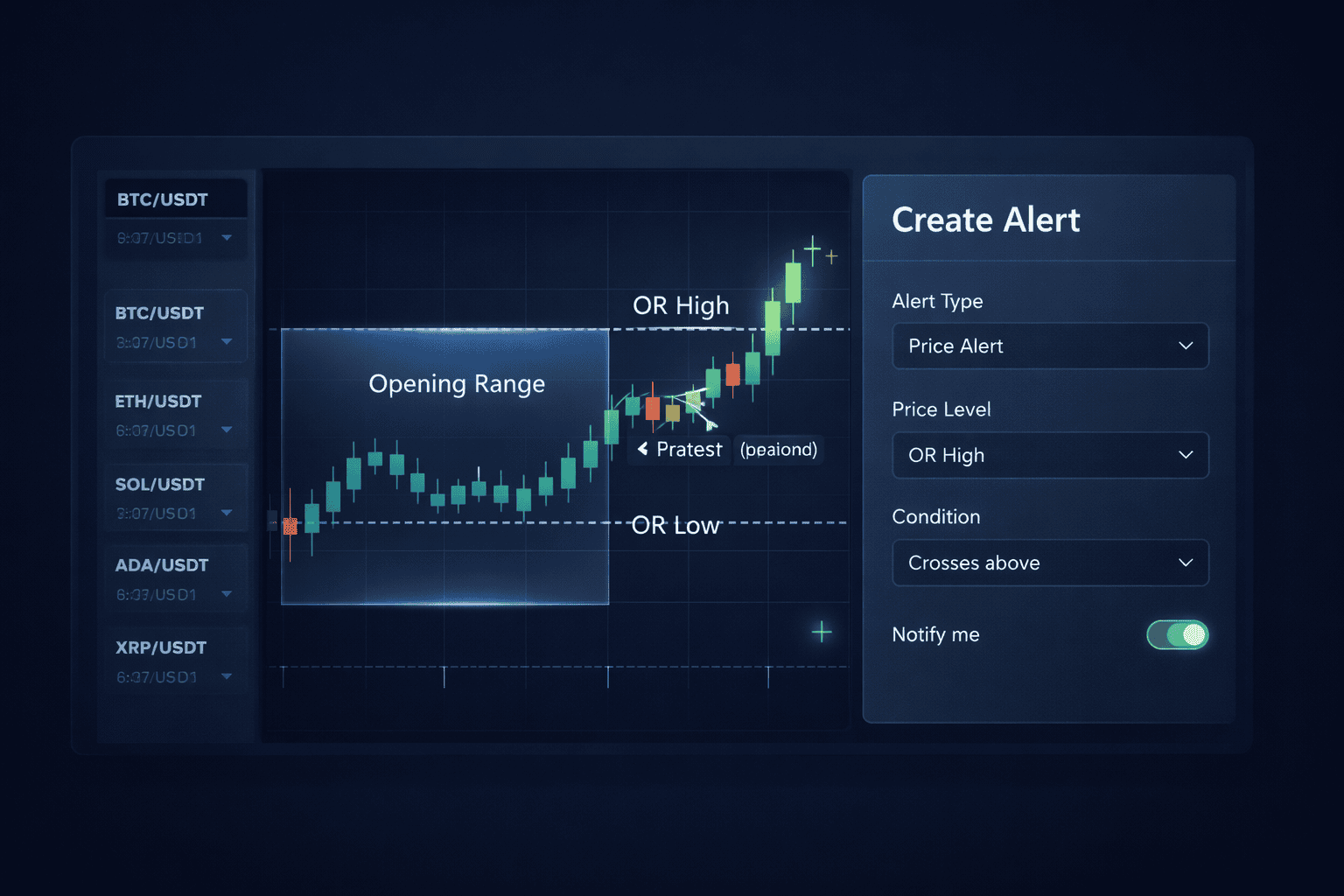

How to trade the ORB strategy using Altrady

ORB works best with a disciplined workflow: levels are specific, timing matters, and false breakouts are common. In Altrady, ORB is traded as a manual process: create a focused watchlist, draw the OR levels on your chart, set alerts at those levels, then journal the trade outcome.

Important note: this is not an “auto-ORB” feature that draws the opening range for you. The OR window definition and the OR High and OR Low levels come from your trading plan, then you plot them manually.

1) Build a focused ORB watchlist

Create a watchlist for a small set of liquid pairs you actually trade. Keeping the list short reduces rushed decisions and missed alerts.

2) Define the opening range window (manual rule)

Choose your ORB window (for example 15 minutes) tied to a session window or daily reset.

When the window ends, mark:

• OR High: the highest price during the opening range window

• OR Low: the lowest price during the opening range window

3) Plot OR High and OR Low, then set alerts

After drawing OR High and OR Low, set alerts so you get notified when price reaches those levels.

Practical setup:

• Price alert at OR High (potential long breakout trigger)

• Price alert at OR Low (potential short breakout trigger)

• Optional: trendline alert if you prefer attaching alerts to a drawn line

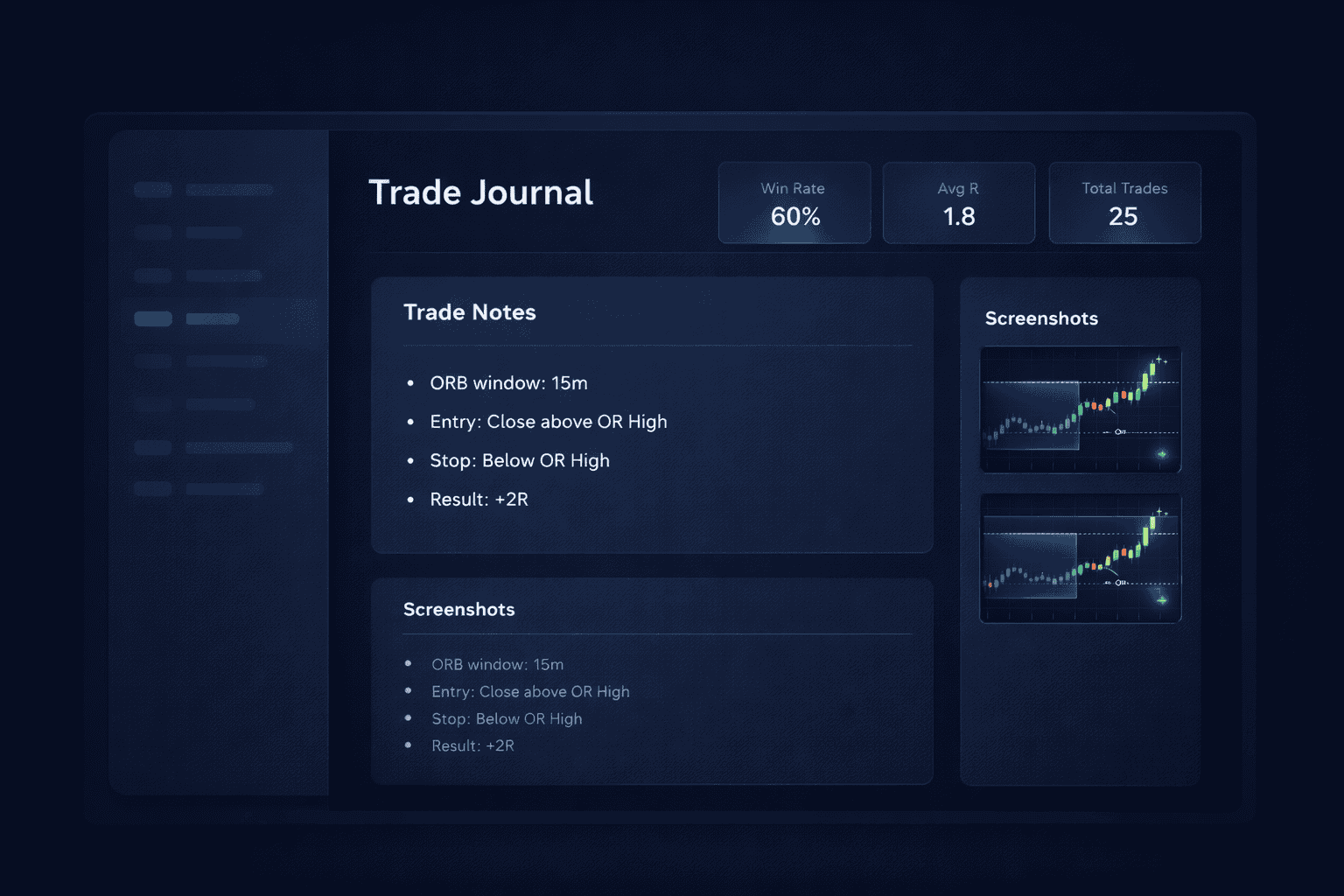

4) Journal the trade so you can improve the rules

After the trade, record:

• Your ORB window definition

• Entry style (close entry or retest entry)

• Stop placement method

• Outcome and notes (what you followed, what you broke)

A simple ORB ruleset you can test

If you want a starting system to backtest:

• Opening range: first 15 minutes of your chosen session window

• Trigger:

- Long if a candle closes above OR High

- Short if a candle closes below OR Low

• Filter: only trade in the direction of your higher timeframe trend

• Stop:

- Long stop below OR High

- Short stop above OR Low

• Exits:

- Take partial at 1R

- Let the rest target 2R or trail behind recent swing structure

Test it on one market and one session window first, then expand slowly.

FAQ

Is ORB trading strategy good for crypto?

It can be, especially during high-liquidity windows. The key is choosing a consistent “opening” definition and using alerts and risk rules so you do not overtrade.

What is the best timeframe for ORB?

Many traders start with 15 minutes or 30 minutes for the opening range. Shorter windows create more signals but often more noise.

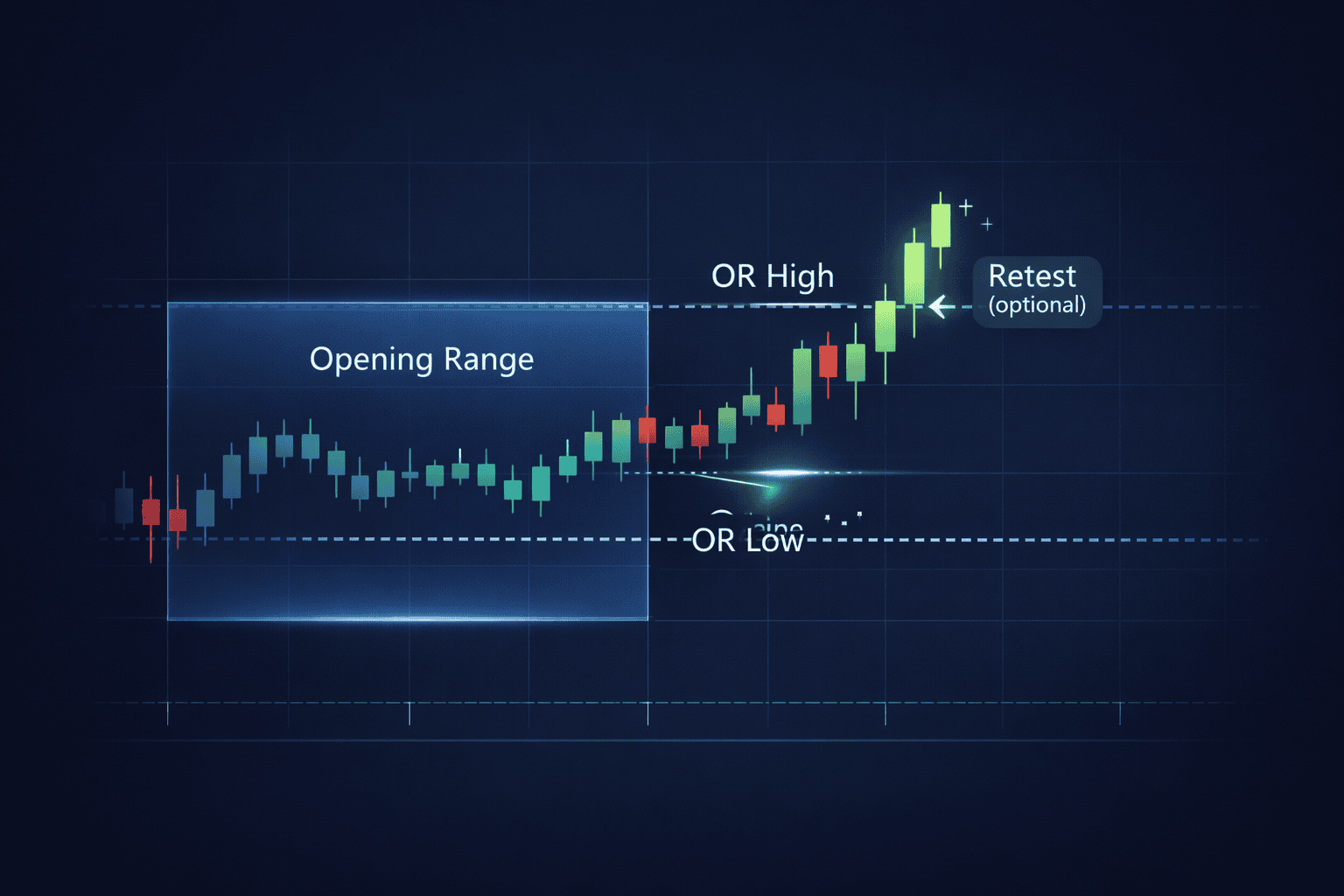

Should I enter on the breakout or the retest?

Breakout-close entries catch fast momentum but can get chopped. Retest entries can reduce false breakouts but may miss quick moves. Testing both on your market is the fastest way to choose.

Risk disclaimer

Trading is risky. Losses can happen quickly in volatile markets. ORB is not a guarantee of profit. Use position sizing, predefined stops, and testing before allocating meaningful capital. You can test your ORB strategies safely by starting a 14-day free trial of Altrady.