.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

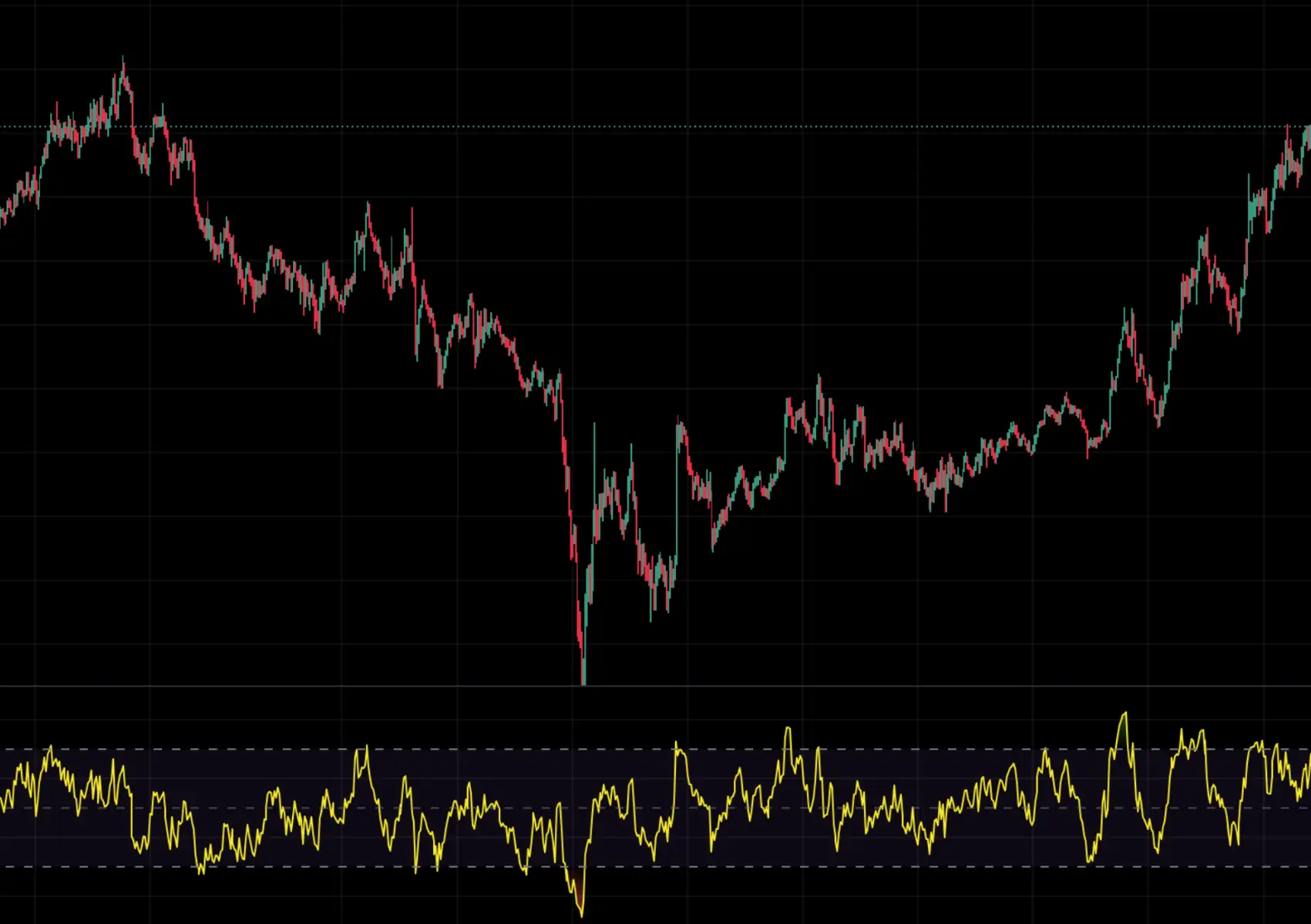

How to Use RSI to Time Your Crypto Trades Like a Pro

When it comes to crypto trading, timing is everything. Buying too late or selling too soon can turn a winning trade into a losing one. That’s why mastering simple technical tools like the Relative Strength Index (RSI) can give you a huge advantage.

In this guide, we’ll teach you how to use RSI to time your crypto trades like a pro, with clear, beginner-friendly strategies you can apply right away. We draw on insights from trusted sources like Binance Academy and Investopedia to ensure accuracy.

Let’s dive in!

Why RSI is Perfect for Crypto Trading

Crypto markets are extremely volatile, with coins often pumping or dumping by 10%, 20%, or more in a single day.

The Relative Strength Index (RSI) gives you a simple, visual snapshot of when prices are getting overheated or undervalued, helping you make smarter decisions based on momentum, not emotions.

Key reasons traders love RSI:

- Easy to read, even for beginners;

- Works well in fast-moving markets like crypto;

- Helps identify potential entry and exit points;

- Can be combined with tools like MACD for better accuracy.

How to Set Up RSI on Your Charts

Most trading platforms, like Altrady and Binance, offer the RSI indicator. Here’s how to set it up:

- Open your chart on a crypto trading platform;

- Look for “Indicators” or “Technical Tools;”

- Search for “Relative Strength Index (RSI)” and add it;

- Use the default 14-period setting—it’s ideal for most traders.

You’ll see a line oscillating between 0 and 100 below your price chart. For faster signals in crypto, some traders adjust to a 7- or 9-period RSI, but start with 14 to keep it simple.

How to Read RSI Like a Pro

Once RSI is on your chart, here’s what to watch for:

- Spot Overbought Levels (RSI Above 70): When RSI exceeds 70, buyers have pushed the price too high too quickly, signaling a potential pullback. Don’t sell immediately—look for confirmation, like a bearish candlestick or dropping volume.

- Spot Oversold Levels (RSI Below 30): When RSI falls below 30, sellers have dumped the coin heavily, suggesting it may be undervalued. Wait for confirmation, like a bullish reversal candle or rising volume, before buying.

Pro Tips for Using RSI Better

To trade like a pro, try these strategies:

- Watch for RSI Divergence:

Bullish Divergence: Price makes a lower low, but RSI makes a higher low, signaling a potential upside reversal;

Bearish Divergence: Price makes a higher high, but RSI makes a lower high, indicating a possible downturn. - Adjust RSI Settings for Crypto Volatility:

Use a 7- or 9-period RSI for volatile altcoins (e.g., Dogecoin) to get faster signals. Be cautious—shorter settings increase false alarms. Stick to 14 for major coins like Bitcoin. - Combine RSI with Other Indicators. Pair RSI with trend-following tools:

Use RSI to spot momentum extremes (e.g., below 30);

Use MACD or a 50-day Moving Average to confirm trend direction.

Example: Buy when RSI is below 30 and MACD shows a bullish crossover to avoid trading against the trend.

Step-by-Step RSI Trading Strategy

Here’s a beginner-friendly strategy to time crypto trades with RSI:

- Identify Momentum Extremes: Look for RSI below 30 (oversold) for buys or above 70 (overbought) for sells. Example: Ethereum at RSI 27 signals a potential buy.

- Confirm with Price Action and Volume: Ensure a bullish candle (for buys) or bearish candle (for sells) forms, with rising volume. Check support/resistance levels on TradingView.

- Check Trend Context: Use a 50-day Moving Average or MACD to confirm the trend. Only buy if the trend is bullish or neutral (e.g., price above 50-day MA).

- Manage Risk: Set a stop-loss (e.g., 5% below entry) and take-profit (e.g., at RSI 70 or resistance). Never risk more than 1-2% of your capital per trade.

Limitations and Risks of RSI

RSI is powerful but not flawless, especially in crypto’s wild markets:

- False Signals in Strong Trends: In bull markets, RSI can stay above 70 for weeks, misleading traders into selling early.

- Low-Liquidity Altcoins: RSI is less reliable for small-cap coins prone to pump-and-dump schemes, as manipulated volume can distort signals (CoinDesk, “Understanding Volume in Crypto Trading”).

- Lagging Nature: RSI relies on past price data, so it may miss sudden crypto moves like flash crashes (Investopedia, “RSI Indicator”).

Crypto Risks: Markets are vulnerable to manipulation (e.g., whale-driven pumps) and news-driven volatility. Always cross-check RSI with volume, news, and other indicators.

Risk Reminder: Crypto trading carries high risks, including total loss of capital. Use RSI as part of a broader strategy, and never invest more than you can afford to lose.

FAQs on Using RSI in Crypto Trading

Q: Can RSI be used for day trading crypto?

A: Yes, RSI is great for quick entries/exits (e.g., buying at RSI 30). Use a 7-period RSI for faster signals, but confirm with volume.

Q: Does RSI work for all cryptocurrencies?

A: It’s best for high-liquidity coins like Bitcoin and Ethereum. Low-liquidity altcoins may show false signals due to manipulation.

Q: How do I avoid false RSI signals?

A: Combine RSI with MACD, Moving Averages, or volume. Practice on Altrady’s paper trading to test strategies.

Final Thoughts: Should You Trust RSI for Crypto Trading?

RSI is one of the most powerful and easiest-to-use indicators for crypto traders. It helps you time better entries and exits, spot momentum extremes, and avoid emotional trading mistakes. But no indicator is perfect.

Use RSI alongside tools like MACD, Moving Averages, and volume, follow strict risk management (e.g., stop-losses), and stay aware of market conditions. Practice this step-by-step strategy on platforms like Altrady Paper Trading to build confidence without risking real money.

Mastering RSI is a key step toward trading crypto like a professional, even if you’re just starting out.

Disclaimer: This article is for educational purposes only and does not constitute financial advice. Crypto trading is highly volatile and risky. Always do your own research and consult a financial advisor before making any financial decisions.