.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

Insider Newsletter - Your source for all things crypto | 03-14-2025

Welcome to this week’s edition of our Insights Newsletter!

A summary of this week's highlights: White House Crypto Summit signals measured progress on stablecoin regulations and Bitcoin trading volume remains low.

As for our weekly webinars, this week, we dove into liquidity in smart money trading, and for the live Q&A, Ben and Cata revealed everything you need to know about support and resistance.

Catch all the details below!

Plus, we invite you to put your trading instincts to the test with our brand-new puzzle feature!

WHAT HAPPENED THIS WEEK

- Weekly Webinars: Live educational webinar with Ben & Cata, sharing valuable tips about support and resistance+our Smart Money webinar focused on liquidity

- Breaking News of the Week: The highly anticipated White House Crypto Summit promised fireworks, but traders got a fizzle instead

- Technical Analysis Highlight: Crypto Liquidations skyrocket to $620 Million!

- Crypto Trading Tools – Choosing the Right Crypto Trading Platform: What Really Matters?

- Tutorial: Apply Trading Strategies Instantly with Presets

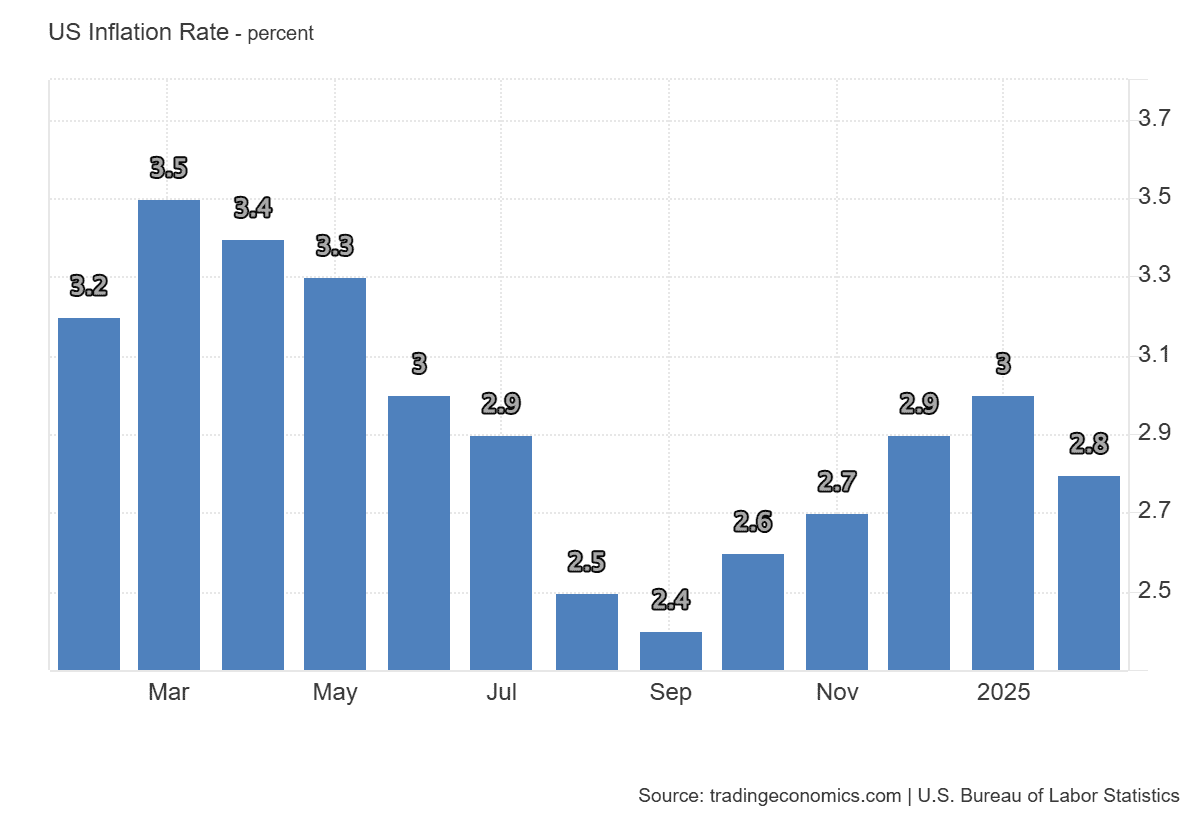

- Macro-Economic Update: Inflation in the U.S. eased to 2.8% in February 2025 from 3% in January, beating forecasts of 2.9%

- Wallet Inflows & Outflows Report: Bitcoin Outflows stay high despite constant Inflows, Ethereum stalls

- Economic Trends Affecting Crypto Markets: Regulatory Pressures and Liquidity fears shake up Sentiment!

- Key Macroeconomic Insights: Trade Turmoil, Europe’s Bold Move, and US Job Growth Surprise!

- A New Puzzle Feature —Test it out inside Altrady app and tell us what you think

Weekly Live Educational Webinars—Liquidity in Smart Money Trading+The Art of Support and Resistance

In this week’s Smart Money webinar series, Ben and Roman dove deep into liquidity and how it acts as a "price magnet," influencing price movements. Plus they also showed how liquidity directly links with Fair Value Gaps (FVG).

In case you missed it, you can watch the recording here 👇

Yesterday, Ben & Cata talked about support and resistance, from how to recognize these key levels to which indicators are the best for confirmation and how to avoid false breakouts.

For this one too, you can watch the recording here 👇

BTC, XRP, ADA, SOL Collapse as White House Crypto Summit Disappoints!

The highly anticipated White House Crypto Summit promised fireworks, but traders got a fizzle instead.

Hopes were sky-high for a U.S. strategic crypto reserve loaded with major altcoins like XRP, ADA, and SOL—especially after President Trump’s pro-crypto stance fueled excitement.

But instead of groundbreaking announcements, the summit delivered cautious steps toward stablecoin legislation and a promise of a lighter regulatory touch before August.

Even Trump’s bold statement—calling it "foolish" for the government to have sold so much of its seized Bitcoin—couldn’t save the day. He dropped a strong hint: "Never sell your Bitcoin!"

Result? XRP, ADA, and SOL took a nosedive, falling harder than BTC as investors bailed out in disappointment.

Are you buying the dip or staying on the sidelines? Let us know your thoughts on X!

Technical Analysis Highlight

Crypto Liquidations Skyrocket to $620 Million!

The crypto market kicked off the week with a brutal downturn, wiping out $620.5 million in liquidations over the past 24 hours. The crash was primarily triggered by lackluster statements made during the White House Summit, sparking a wave of panic selling.

Bitcoin $BTC took the hardest hit, plunging to $80,000 over the weekend before attempting a technical rebound today. However, the lack of trading volume reveals a weak and unconvincing recovery, indicating that the bounce lacks strong fundamentals and significant buying pressure.

The sudden drop unleashed a cascade of margin calls, forcing heavily leveraged traders to close positions and intensifying volatility across the entire market.

Is this just the beginning of a bigger crash?

Let us know your opinions on Discord!

Choosing the Right Crypto Trading Platform: What Really Matters?

The crypto market is full of opportunities—but also risks. The key to staying ahead? A powerful, multi-exchange trading terminal that goes beyond the basics.

🔹 Smart trading tools to lock in profits automatically

🔹 Seamless portfolio management across multiple exchanges

🔹 Automation & bots to execute trades with precision

🔹 TradingView integration for next-level analysis

Want to know how the right platform can level up your trades?

👉 Read more here about the top features for a crypto trading platform!

Tutorial: Apply Trading Strategies Instantly with Presets

Tired of manual trade setups slowing you down? Say goodbye to tedious configurations and hello to efficiency with Altrady's Trading Presets.

In this must-watch video, we uncover the incredible benefits of Trading Presets:

- The pitfalls of manual trade setups—and how Trading Presets solve them

- Altrady's secret sauce for streamlining your trading, so you can focus on what really matters: market analysis

- A simple, step-by-step guide to mastering Trading Presets on the Altrady platform

- Real-world examples showing how Trading Presets save time and enhance trade precision

Maximize your trading efficiency and dedicate more time to refining your strategies.

Watch our tutorial below:

Macro-Economic Update

Inflation in the U.S. eased to 2.8% in February 2025 from 3% in January, beating forecasts of 2.9%

Energy prices cooled off in February, with gasoline and fuel oil dropping while natural gas rose, contributing to an overall easing in inflation. Shelter and transportation costs also slowed, while food prices saw a slight uptick. Core inflation fell to its lowest level since 2021, signaling that price pressures are gradually softening.

This could prompt the Federal Reserve to reconsider aggressive rate hikes, potentially boosting investor confidence and driving liquidity back into the crypto market. Lower inflation generally favors risk assets like cryptocurrencies, so keep an eye on how Bitcoin and Ethereum react in the coming days.

Event: US CPI y/y

Date: 12/03/2025

Wallet Inflows & Outflows Weekly Report

Top 2 Cryptocurrencies (BTC, ETH)

Bitcoin Outflows stay high despite constant Inflows, Ethereum stalls

This week has been quite unusual when it comes to wallet inflows and outflows for Bitcoin and Ethereum.

Bitcoin continues to experience significant daily peaks of heavy outflows, followed by more frequent but smaller inflows, creating a dynamic but somewhat balanced trend.

Ethereum shows almost a zero net flow, as inflows and outflows have consistently matched over the past four days, as shown in the chart.

Overall, the situation remains fairly stable for both cryptocurrencies, with no major signals of a trend reversal from wallet movements at the moment.

Economic Trends Affecting Crypto Markets

Regulatory Pressures and Liquidity Fears Shake Up Sentiment!

Crypto market is reacting to several key trends. Regulatory pressure remains high as the US pushes for stricter crypto rules, raising uncertainty among investors. In contrast, the EU is moving forward with MiCA regulations, aiming to boost transparency and institutional adoption. Meanwhile, liquidity concerns are growing as major exchanges face increased scrutiny, impacting trading volumes.

Investor sentiment is also shifting as traditional markets experience turbulence, with some capital flowing back into safe-haven assets like Bitcoin. DeFi projects and altcoins remain volatile, as cautious sentiment prevails amid global economic uncertainties. Additionally, institutional interest in crypto continues, driven by expectations of long-term adoption despite short-term challenges. The market remains on edge as traders weigh regulatory risks against potential growth opportunities.

Key Macroeconomic Insights

Trade Turmoil, Europe’s Bold Move, and US Job Growth Surprise!

Financial markets are feeling the impact of recent US trade policy decisions, with tariff hikes raising inflation fears and dampening demand by reducing consumer purchasing power. As a result, US equity prices and crypto have pulled back to pre-election levels, and automotive stocks took a hit over concerns about disrupted supply chains.

Meanwhile, Europe is repositioning its policies in response to changing US stances, especially around defense spending, signaling potential economic shifts ahead.

In the US job market, employment growth slowed in February, with the unemployment rate ticking up slightly, surprising investors.

Our New Puzzle Feature

We’re rolling out a brand-new Puzzles Feature to bring you even more interactive challenges.

Designed to help you master market structure in smart money trading, these strategy-based challenges let you see if your decisions are on point—or need a little fine-tuning.

Dive in and let us know what you think!

Thanks for reading!

If you enjoyed this, share with friends who might be interested—and you can also share on your socials.

Got questions or special requests? Don’t think twice—reach out! Our team’s got your back and is always here to help.

DISCLAIMER: None of this is financial advice. This newsletter is here to educate, not to tell you where to put your money. It’s not investment advice or a sales pitch—just solid info to help you think smarter. Always do your homework and research carefully!