Category List

Featured List

Insider Newsletter - BTC Drops to $80K and Tariff Turmoil Rattles Markets

Welcome to this week’s edition of our Insights Newsletter!

A summary of this week's highlights: Trump’s surprise 90-day tariff pause flipped market sentiment overnight, turning fear into a FOMO-fueled rally. Crypto soared, with Bitcoin blasting past $80K and Wall Street logging its biggest weekly gains in months.

As for our weekly webinars, Ben and Roman demonstrated practical applications of the PD Array matrix along with insights into market structure analysis, risk management, and trade execution, while our Q&A webinar focused on mastering breakout trading.

Catch all the details below!

WHAT HAPPENED THIS WEEK

- Weekly Webinars: Live educational webinar with Ben & Cata, sharing valuable tips on breakout trading and how to avoid fakeouts+our webinar with Ben & Roman centered around backtesting using smart money strategies, including the PD Array strategy.

- Breaking News of the Week: Tariff Twist! Trump Hits Pause for 90 Days — Markets Surge as Fear Turns to FOMO

- Technical Analysis Highlight: Bitcoin Soars After Trump’s Tariff Pause Sparks Market Frenzy

- Crypto Paper Trading: How to Test Out the Best Strategies for Your Trading Style

- Tutorial: How to Read and Interpret Candlestick Charts

- Macro-Economic Update: U.S. Inflation Cools More Than Expected

- Wallet Inflows & Outflows Report: Balanced Flows - Bitcoin Gains Interest, Ethereum Still Out of Favor

- Economic Trends Affecting Crypto Markets: Market Plunge - Trade Tensions & Regulatory Heat Stir Uncertainty

- Key Macroeconomic Insights: Trade Shockwaves - Tariff Chaos Triggers Market Jitters and Fed Uncertainty

Weekly Live Educational Webinars—Smart Money Backtesting +Trading Breakouts

In this week’s Smart Money webinar series, Ben and Roman hosted a live walkthrough of the PD Array Strategy (Premium Discount Zone Array) showcasing how it works in real market conditions. The session also covered real-time market structure analysis, smart risk management, and clean trade execution.

In case you missed it, you can watch the recording here 👇

Yesterday, Ben & Cata focused on breakouts, and breakout trading along with the risk management techniques that should go with this strategy. They showed how to spot real momentum, dodge fakeouts, and trade like you actually planned it.

For this one too, you can watch the recording here 👇

Trump Pauses Tariffs for 90 Days — Says People Were 'Yippy' and 'Afraid'!

In a shock move early Wednesday, Trump hits the brakes on reciprocal tariffs for all countries except China — saying he acted because the public was "yippy" and "afraid."

“We decided to pull the trigger and we did it today... we’re happy about it.”

Markets SURGED on the news!

Crypto, stocks, and commodities all spiked after the announcement.

Leave your comments about this on X!

Technical Analysis Highlight

Markets stunned as President Trump hits the brakes on reciprocal duties — crypto takes off like a rocket.

🟢 BTC +8.3%

🟢 XRP +13.2%

🟢 SOL +13.5%

Altcoins flying as global trade tensions ease!

Is the bull BACK?

Let us know your opinions on Discord!

Popular Crypto Trading Strategies–Which One Fits Your Inner Genius?

From blink-and-you-miss-it momentum trades to slow-burn swing setups that last longer than most New Year’s resolutions—there’s a strategy for every trader.

Trend trading focuses on identifying and following trends either formed during the current session or carried over from the previous day.

Momentum trading is a high-risk/high-reward approach where trades last 5 to 15 minutes, while the scalping approach takes advantage of small, frequent market movements to generate profits.

If you want to test out strategies before risking real money, Altrady offers free paper trading, including automation tools, like signal bots for spot and futures trading. Plus, you can set price alerts in charts to monitor the price movements of crypto assets.

Here’s a breakdown of the most popular crypto trading strategies, the tools to pull them off without losing your shirt, and how Altrady makes it all ridiculously easier (yes, even for scalpers with commitment issues).

Tutorial: How to Read Candlestick Charts

Ever wish you could actually see what the market’s thinking? Candlestick charts get you pretty close.

In this quick video, we’ll show you how to spot patterns, pick the right timeframes, and customize your view like a professional trader—all inside Altrady.

From 1-minute candles to full-day trendspotting, this tutorial is your fast track to smarter, sharper trades.

Watch this video to learn more 👇

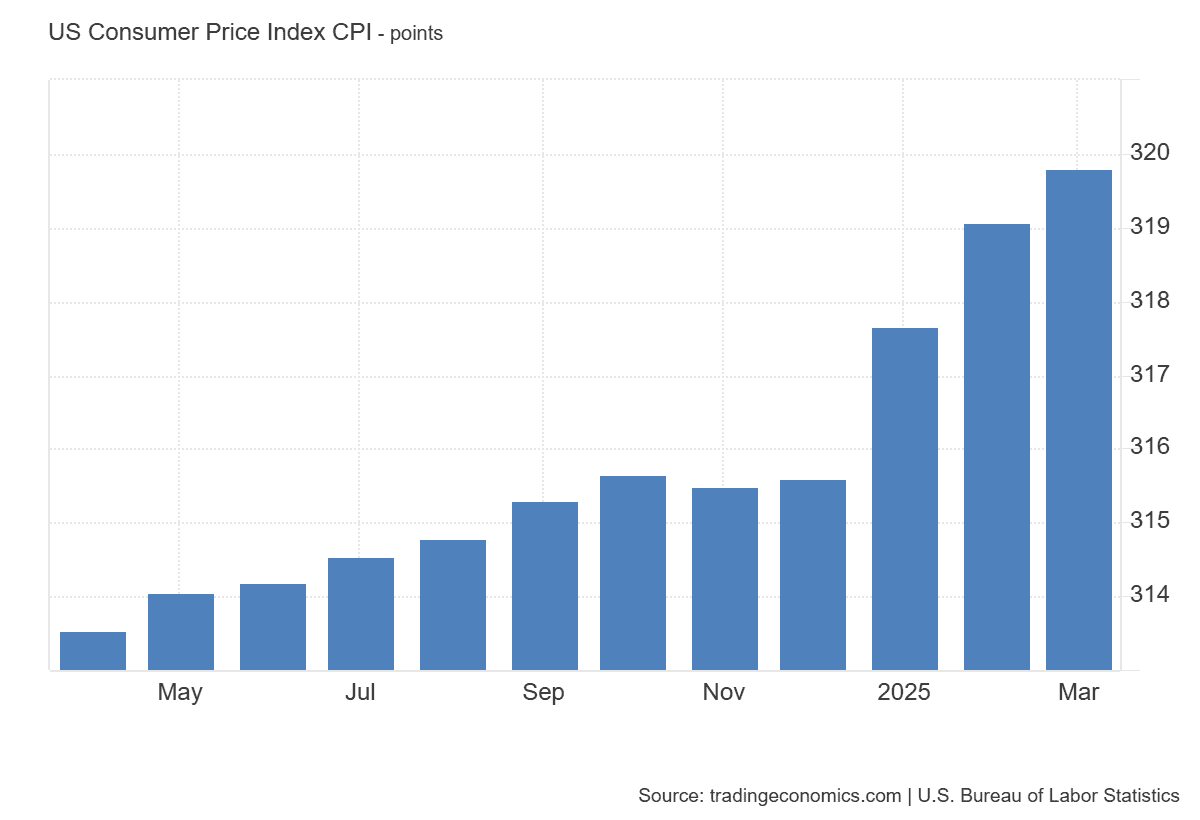

Macro-Economic Update

U.S. Inflation Cools More Than Expected

The latest CPI numbers are in—and they surprised the markets. In March, the Consumer Price Index ticked up to 319.799 from 319.082, but the annual inflation rate dropped to 2.4%, down from 2.8% and below the 2.6% forecast.

Even more surprising? Monthly CPI fell by 0.1%, defying expectations of a 0.1% increase.

Event: CPI y/y

Date: 10/04/2025

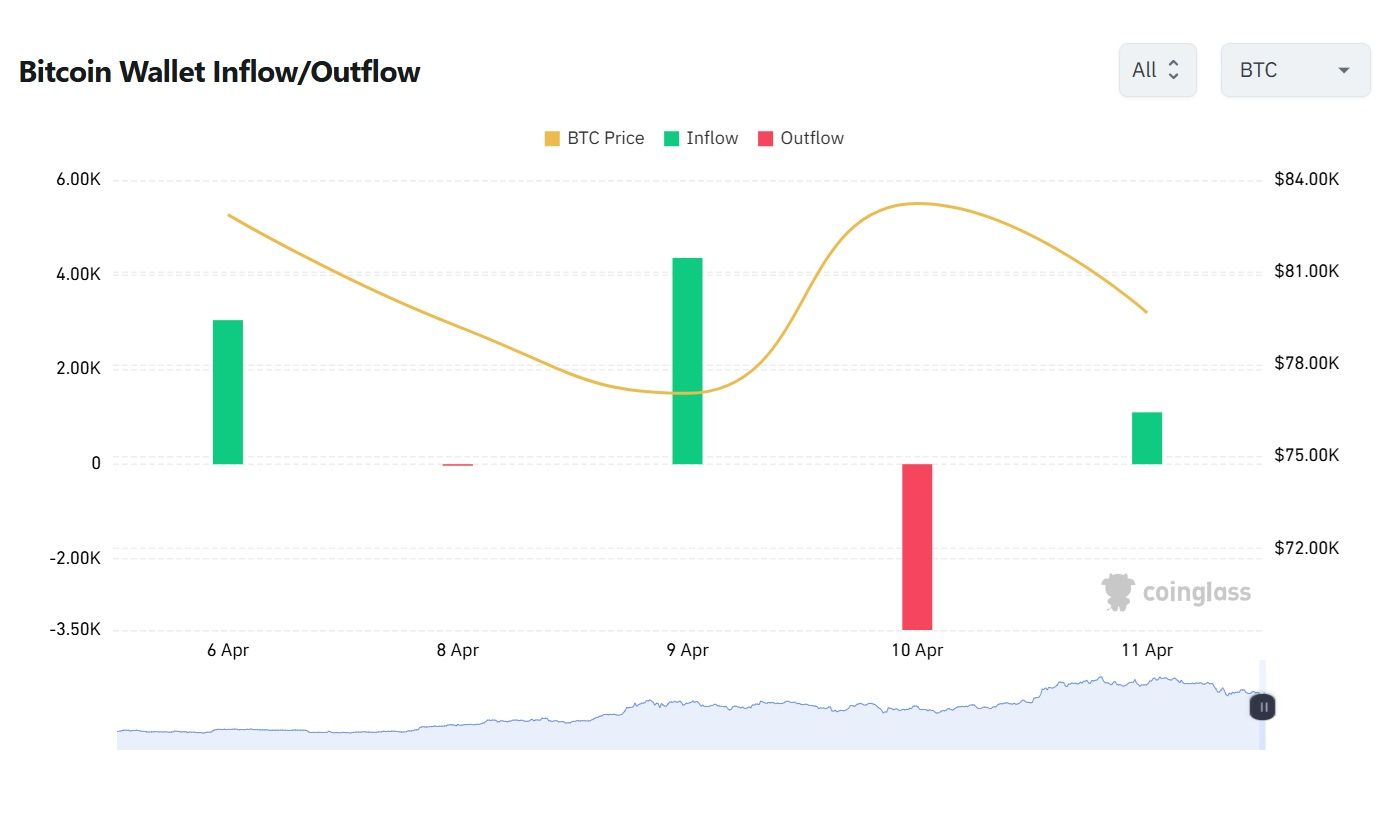

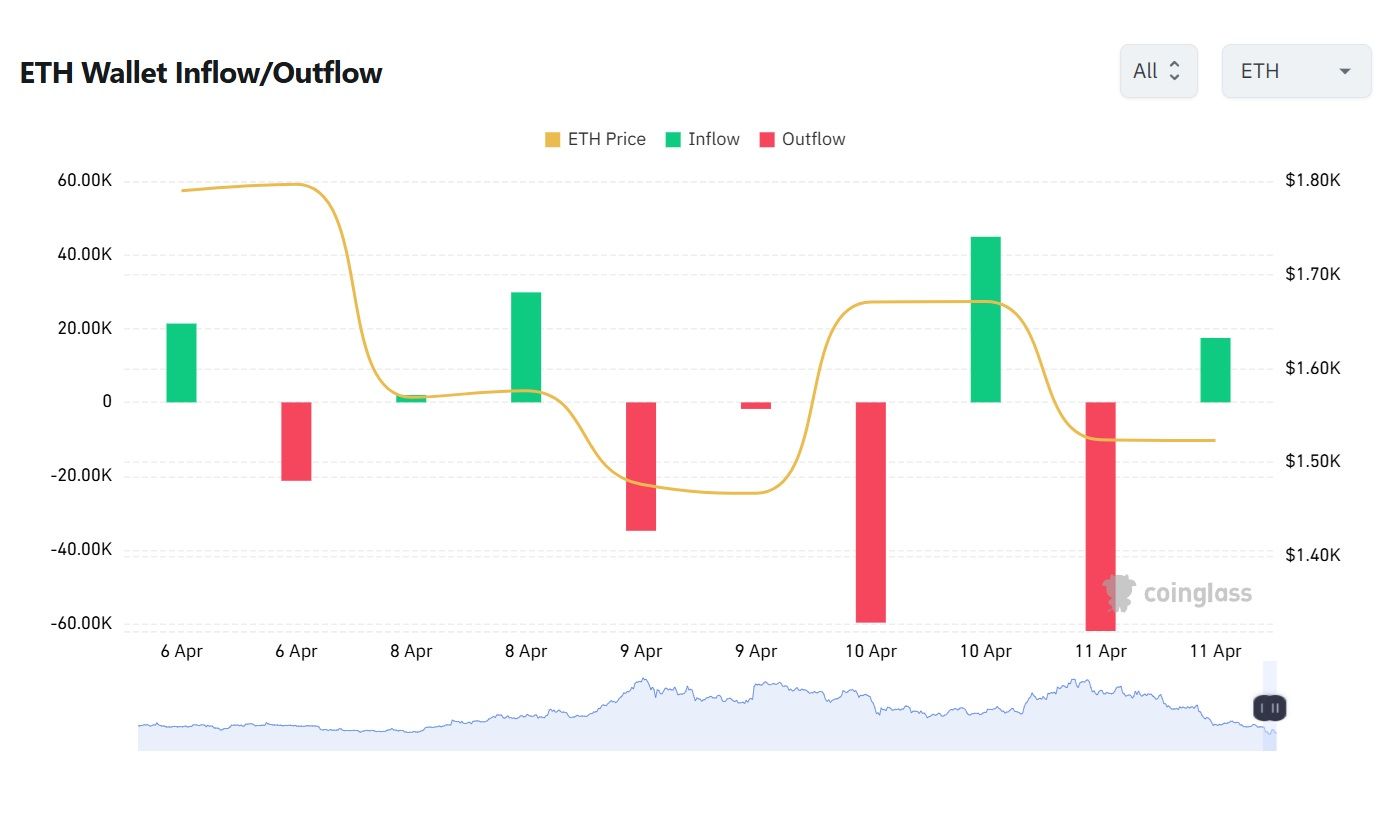

Wallet Inflows & Outflows Weekly Report

Top 2 Cryptocurrencies (BTC, ETH)

Balanced Flows: Bitcoin Gains Interest, Ethereum Still Out of Favor

The crypto market is showing a balanced flow pattern when it comes to Bitcoin and Ethereum movements among large wallets.

- Bitcoin inflows are rising, with steady increases since last week, signaling growing interest and accumulation by major players.

- On the flip side, Ethereum continues to see consistent outflows, as big holders appear to be avoiding ETH for now.

This divergence hints at a shift in sentiment: BTC is regaining favor, while ETH faces persistent caution.

Keep an eye on this trend—it could influence short-term price action and broader market dynamics.

Economic Trends Affecting Crypto Markets

Crypto on the Edge: Market Plunge, Trade Tensions & Regulatory Heat Stir Uncertainty

It’s been a turbulent week for the crypto market, with macroeconomic tensions and regulatory signals shaking up investor sentiment.

Bitcoin dropped nearly 8%, trading around $80K, while Ethereum slid over 15% to just above $1,500. The pressure wasn’t isolated to crypto, U.S. stock markets also took a hit, largely driven by renewed concerns over global trade conflicts and uncertainty around U.S. tariffs.

Adding to the mix, the European Securities and Markets Authority (ESMA) issued a warning about the potential risks crypto could pose to financial stability, reminding markets that regulatory oversight isn’t going away anytime soon.

Despite the dip, many analysts remain cautiously optimistic, suggesting that if the Federal Reserve leans toward interest rate cuts at its next meeting in early May and if the U.S. avoids a recession, crypto could see a strong rebound.

For now, though, markets remain cautious, with traders keeping a close eye on macro signals and policy moves.

Key Macroeconomic Insights

Trade Shockwaves: Tariff Chaos Triggers Market Jitters and Fed Uncertainty

Big moves on the global trade front this week: Trump announced new tariffs, then hit pause with a 90-day suspension, stirring uncertainty across markets. The shift signals a broader reordering of global trade, impacting not just goods but also massive service sectors like finance, tourism, and logistics.

The U.S. may run a goods deficit, but it holds a surplus in services, balancing out the overall current account.

Still, Fed Chair Jerome Powell warned that tariffs could lead to higher inflation and slower growth, and with so much uncertainty around duration and retaliation, the Fed is holding off on any policy shifts, for now.

In short, the 90-day tariff pause offers a brief reprieve, but rising uncertainty and shifting trade dynamics could weigh on global growth and inflation. Markets, crypto included, should brace for more volatility ahead.

Thanks for reading!

If you enjoyed this, share with friends who might be interested—and you can also share on your socials.

Got questions or special requests? Don’t think twice—reach out! Our team’s got your back and is always here to help.

DISCLAIMER: None of this is financial advice. This newsletter is here to educate, not to tell you where to put your money. It’s not investment advice or a sales pitch—just solid info to help you think smarter. Always do your homework and research carefully!

In this post

- WHAT HAPPENED THIS WEEK

- Weekly Live Educational Webinars—Smart Money Backtesting +Trading Breakouts

- Trump Pauses Tariffs for 90 Days — Says People Were 'Yippy' and 'Afraid'!

- Technical Analysis Highlight

- Popular Crypto Trading Strategies–Which One Fits Your Inner Genius?

- Tutorial: How to Read Candlestick Charts

- Macro-Economic Update

- Wallet Inflows & Outflows Weekly Report

- Economic Trends Affecting Crypto Markets

- Key Macroeconomic Insights