Category List

Featured List

Insider Newsletter - Coinbase Joins the S&P 500 and US Inflation Goes Down

Welcome to this week’s edition of our Insights Newsletter!

A summary of this week's highlights: Coinbase made history this week as the first crypto company to join the S&P 500, signaling growing mainstream acceptance. U.S. inflation came in lower than expected, boosting investor confidence, while a surprising 90-day tariff truce between the U.S. and China added to global optimism and fueled the ongoing crypto rally.

And Ben and Cata had a blast at The Better Traders Summit in Toronto! Find more details below.

WHAT HAPPENED THIS WEEK

- The Better Traders Summit at Consensus: Ben and Cata joined an amazing crypto event

- Breaking News of the Week: Coinbase becomes the FIRST crypto-focused company to join the S&P 500

- Technical Analysis Highlight: As we predicted, $ETH just entered a minefield!

- Crypto Trading Tools: What You Need to Know about the Sentiment Analysis

- Tutorial: Automatic Take Profit Orders – How They Help

- Macro-Economic Update: US Inflation Dips Again – Hits 3-Year Low

- Wallet Inflows & Outflows Report: After the Surge, Bitcoin Pulls Back and Ethereum Maintains Balance

- Economic Trends Affecting Crypto Markets: Risk-On Sentiment Ignites Crypto Rally as U.S.-China Truce and Peace Talks.

- Key Macroeconomic Insights: US Inflation Cools, Trump Heads to Saudi Arabia for Debt Deal

The Better Traders Summit

Ben and Cata joined the Better Traders Summit from Toronto, Canada – a fun and energizing crypto event!

This summit focused on practical, strategy-driven, and actionable insights, along with showcasing smart trading tools.

Ben held a workshop built around real trading strategies. This included hands-on trading setups (including bots), live workflows, real-time market insights, and a deep dive into Altrady’s pro tools, backed by unfiltered advice.

Thanks to all participants who contributed thoughtful questions and helped shape a productive, no-nonsense experience.

Breaking News

Coinbase becomes the FIRST crypto-focused company to join the S&P 500!

Replacing Discover Financial, $COIN will be officially included before markets open on Monday, May 19.

Following the announcement, Coinbase shares surged over 7% in after-hours trading.

This is a landmark moment for crypto’s integration into traditional finance.

Leave your thoughts about this on X!

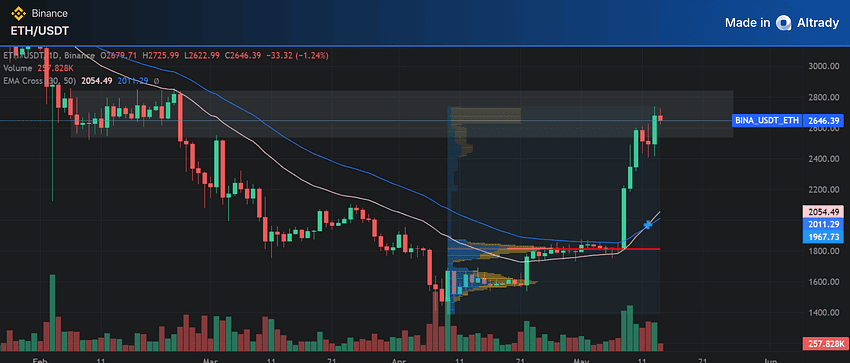

Technical Analysis Highlight

This week’s top technical analysis:

As we predicted, $ETH just entered a minefield!

Volume gaps now clashing with major open interest.

This is the moment of truth! All eyes on Ethereum!

👉Let us know your opinions on Discord!

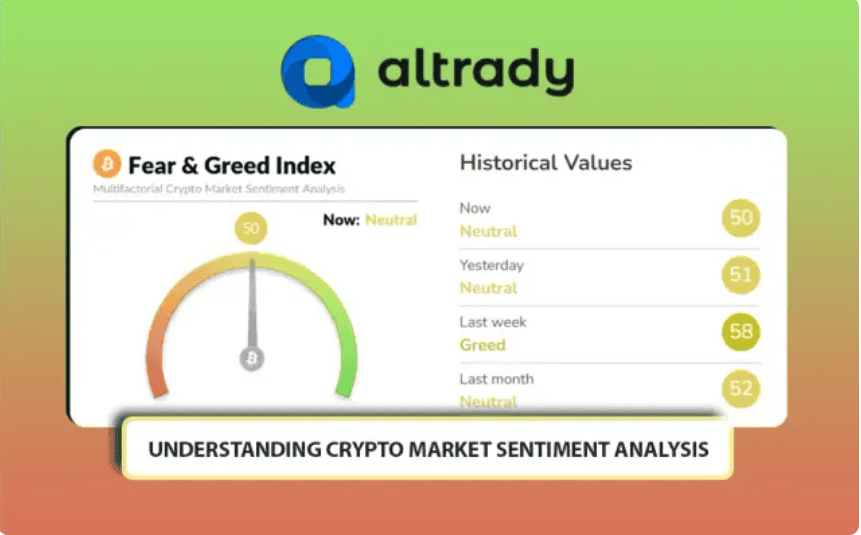

What is The Crypto Market Sentiment Analysis

Think the charts tell the full story? Think again.

In crypto trading, market sentiment can move prices just as much as technicals—sometimes even more. From social media buzz to expert takes and algorithmic analysis, understanding how the crowd feels can give you a serious edge.

Most traders use sentiment tools to anticipate market moves and platforms like Altrady are making it easier than ever to trade smarter.

You gain a clear snapshot of overall market mood, giving you insights that can signal potential trend changes and help anticipate market movements with confidence.

👉Get all the details about crypto market sentiment analysis.

Tutorial: Automatic Take Profit Orders

Crypto markets move fast, and if you’re not ready, gains can vanish just as quickly.

But if you use automatic take-profit orders with Altrady, you can secure profits at multiple price targets without watching the charts all day.

Learn how this smart feature helps you maximize returns, manage risk, and trade more confidently even when you’re offline. Perfect for busy traders who want more control with less stress.

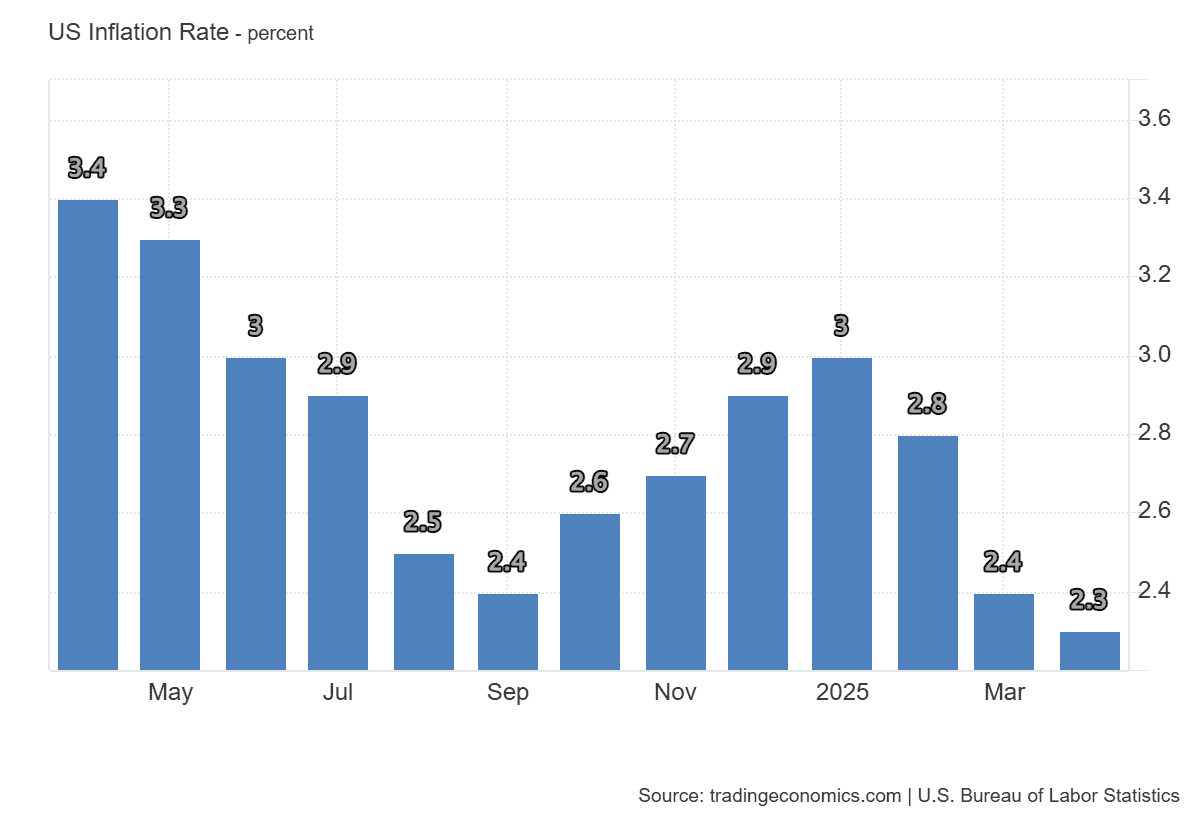

Macro-Economic Update

US Inflation Dips Again – Hits 3-Year Low

Good news on the inflation front: Prices rose just 2.3% in April compared to last year, the lowest rate since early 2021 and slightly below expectations.

Energy costs dropped 3.7%, with gas prices down nearly 12%. Food inflation also cooled (2.8%), and transportation costs eased up. Natural gas prices did jump, though, up over 15%. Shelter costs held steady at 4% year-over-year but drove over half of the modest 0.2% monthly CPI increase. Used car prices ticked up, along with new vehicles.

Core inflation (excluding food and energy) stayed at 2.8%, right on target.

Overall: Inflation’s cooling, but a few areas, like natural gas and cars are still heating up.

Event: CPI y/y

Date: 13/05/2025

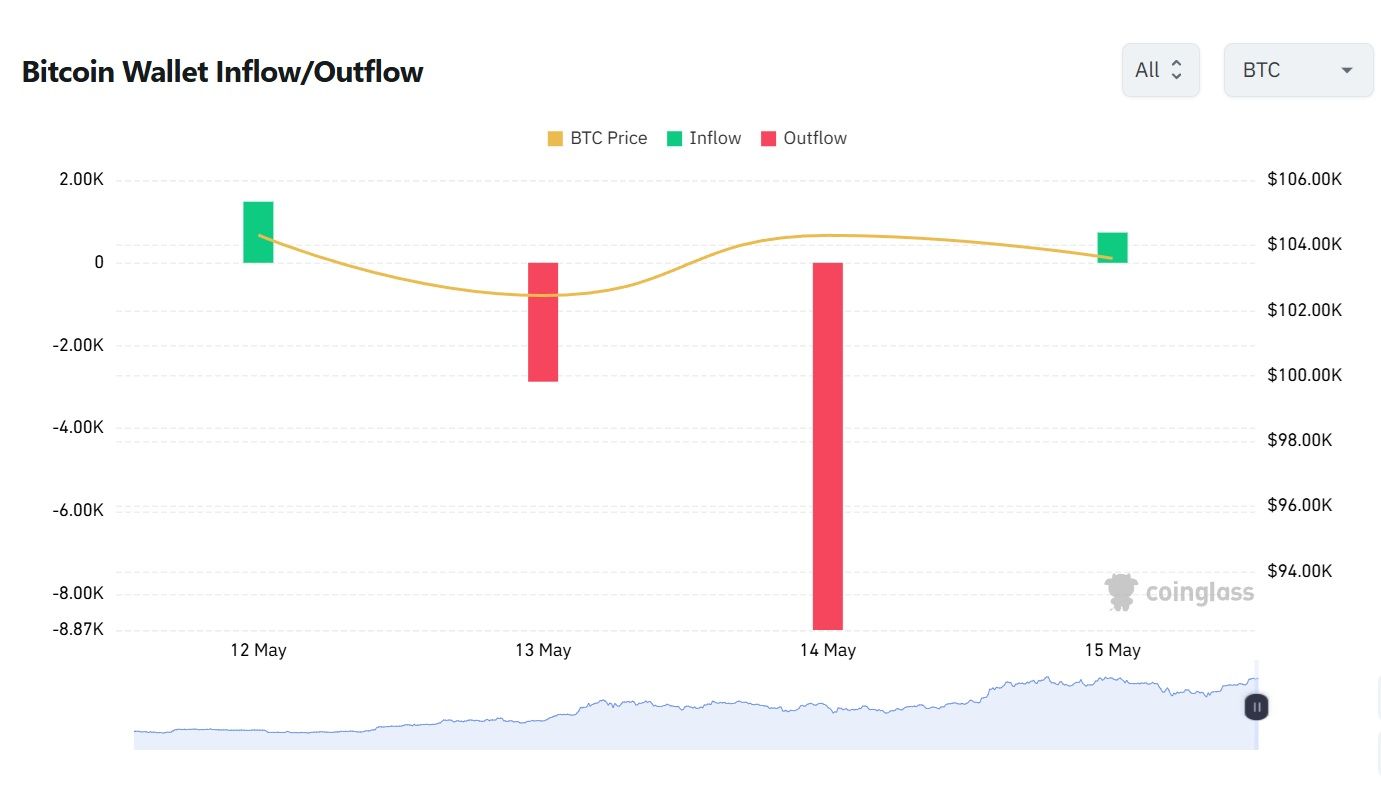

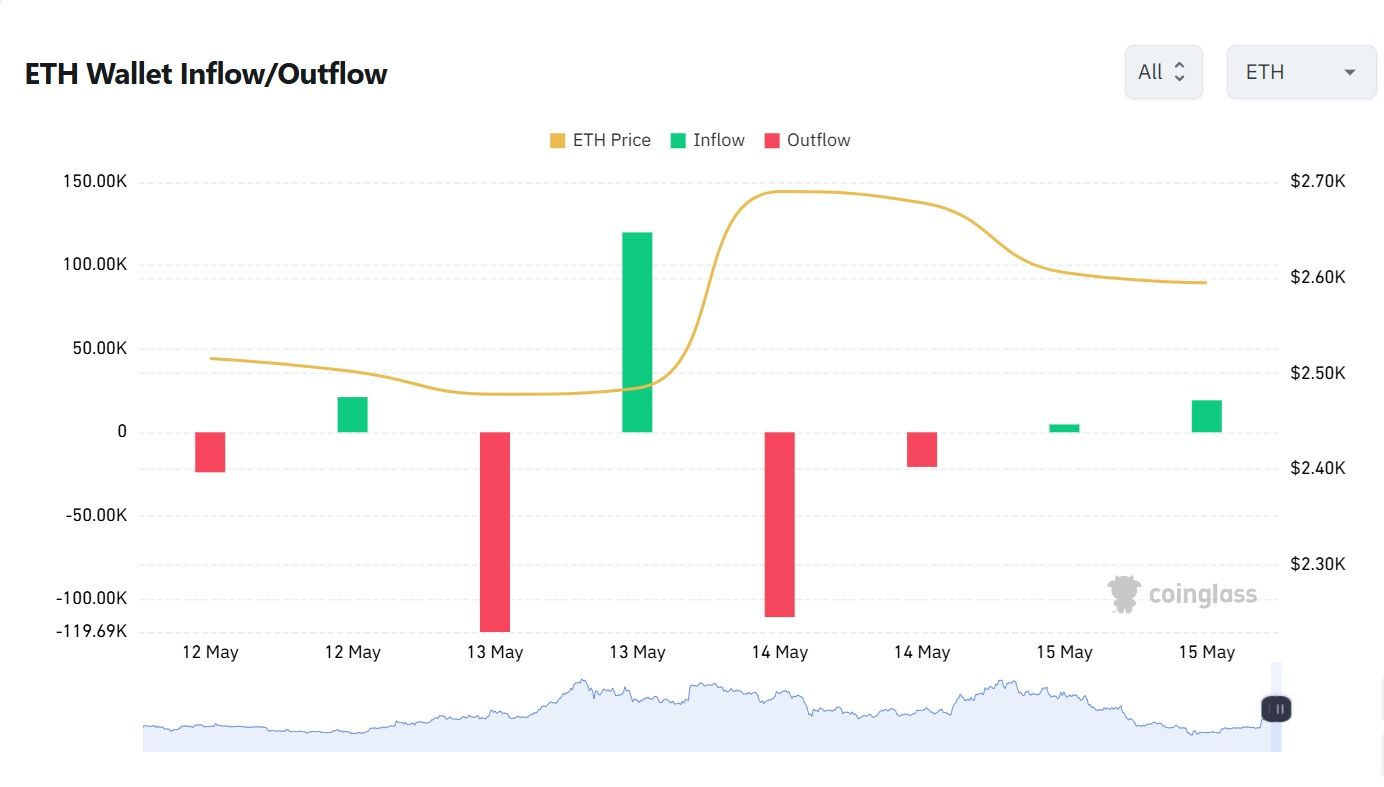

Wallet Inflows & Outflows Weekly Report

Top 2 Cryptocurrencies (BTC, ETH)

Bitcoin Slows, Ethereum Holds Steady: Market Takes a Breather

Bitcoin records another week of outflows, signaling that investors are taking profits after the recent rally, while Ethereum wallets remain more balanced and stable. Following weeks of strong momentum, both assets appear to be in a consolidation phase. The recent slowdown doesn't reflect panic—rather, it's a sign that market participants are strategically repositioning without abandoning their positions.

This shift to a more sideways, low-volatility environment suggests confidence, not concern. The bullish momentum may be taking a pause, but investor behavior indicates trust in the broader trend. As we await new catalysts, such as macroeconomic data or ETF inflows, the market may continue to move sideways, setting the stage for the next significant breakout.

Economic Trends Affecting Crypto Markets

Risk-On Sentiment Ignites Crypto Rally as U.S.-China Truce and Peace Talks.

Crypto Rally Heats Up as Geopolitics Cool Down.

It’s been a red-hot week for crypto: Bitcoin has surged past $105,000, and Ethereum is up over 12%. The rally is riding a wave of global optimism, most notably the surprise truce between the U.S. and China, which agreed to suspend tariffs for 90 days. That move lit a fire under risk assets, with crypto leading the charge.

On top of that, a potential peace deal between Russia and Ukraine is reportedly in the works, and tensions between India and Pakistan seem to have fizzled out before escalating.

Geopolitical calm is back on the menu, and crypto is eating it up.

Key Macroeconomic Insights

US Inflation Cools, Trump Heads to Saudi Arabia for Debt Deal

U.S. inflation continues to ease, beating analyst expectations and fueling hopes for a less aggressive monetary policy. Meanwhile, President Trump traveled to Saudi Arabia to negotiate a multi-billion-dollar deal with the Sultan aimed at financing U.S. debt.

Between positive data and high-stakes geopolitics, markets remain in “wait and see” mode.

Thanks for reading!

If you enjoyed this, share with friends who might be interested—and you can also share on your socials.

Got questions or special requests? Don’t think twice—reach out! Our team’s got your back and is always here to help.

DISCLAIMER: None of this is financial advice. This newsletter is here to educate, not to tell you where to put your money. It’s not investment advice or a sales pitch—just solid info to help you think smarter. Always do your homework and research carefully!