.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

Insider Newsletter - BoA Launches Stablecoin and ETH Continues to Rise | 06-13-2025

Welcome to this week’s edition of our Insights Newsletter!

A summary of this week's highlights: Bank of America shook the market by announcing its own stablecoin, marking a major institutional move into crypto. RESOLV’s Binance debut turned sour with a 25% drop. U.S. inflation edged up but stayed below forecasts, while Bitcoin saw outflows and Ethereum gained traction. Trade tensions eased, but the Middle East conflict sparked fresh geopolitical risks, keeping markets on edge.

As for our weekly webinars, Ben and Roman backtested Smart Money strategies and analyzed Ethereum and Polkadot markets. And on Wednesday, they tested out another type of webinar, also focused on smart money.

Yesterday’s Q&A with Ben focused on live trading scalping strategies using the Quick Scanner.

Get all details below.

WHAT HAPPENED THIS WEEK

- Weekly Webinars: 2 live educational webinars with Ben & Roman, one time analyzing the Ethereum, Polkadot markets + a new kind of webinar. And Ben showcased again real, live scalping techniques complemented by Quick Scanner.

- Breaking News of the Week: Bank of America to Launch Its Own Stablecoin, CEO Confirms!

- Technical Analysis Highlight: RESOLV just listed on Binance and instantly plunged -25%!

- Crypto Trading Tools: Algo Trading in Crypto: How Bots and TWAP Shape the Market

- Tutorial: How to Use Oscillator Indicators

- Macro-Economic Update: U.S Inflation Creeps Up in May, But Stays Below Expectations

- Wallet Inflows & Outflows Report: Bitcoin Wallets See Outflows as Ethereum Attracts Fresh Capital

- Economic Trends Affecting Crypto Markets: Bitcoin and Ethereum React to CPI Data, Institutional Inflows and Regulatory Moves

- Key Macroeconomic Insights: Trade Talks Cool Tensions, But Geopolitical Risks Heat Up

Weekly Live Educational Webinars—Smart Money Backtesting + Scalping Strategies

In this week’s Smart Money webinar series, Ben and Roman broke down the latest trends in the Ethereum and Polkadot markets, plus other key insights.

In case you missed it, you can watch the recording here 👇

Plus, we kicked off the 1st episode of a different webinar series. Using smart money trading principles, Ben and Roman dissected the market from the highest timeframes down to the granular stuff – so you’re not just in the game, you’re front-running the crowd with precision.

Here’s what happened 👇

Yesterday, Ben demonstrated how to use Altrady’s Quick Scanner for effective scalping strategies. He put the tool to the test on crypto futures, breaking down position sizes across multiple entries while tracking chart patterns and key technical indicators.

For this one too, you can watch the recording here 👇

Breaking News: Bank of America to Launch Its Own Stablecoin, CEO Confirms!

One of the U.S.'s biggest investment banks is entering the stablecoin race. CEO Brian Moynihan has confirmed plans to issue a Bank of America stablecoin—signaling a major leap in TradFi’s crypto adoption.

Rumors of a joint launch with JPMorgan circulated last month but never materialized. Now, BoA may be going solo.

Amid rising institutional interest and Trump’s remarks on stablecoins securing dollar dominance, BoA’s move could reshape the crypto landscape.

Tell us what you think about this on X!

Technical Analysis Highlight

This week’s top technical analysis:

RESOLV just listed on Binance and instantly plunged -25%!

But signs of a strong support zone are emerging 👀

- First target: $0.336

- Second target: $0.369

Is this the bounce traders are waiting for? Chart’s heating up!

👉Let us know your opinions on Discord!

Algo Trading in Crypto: How Bots and TWAP Shape the Market

Forget gut instinct! Today’s smartest crypto traders let bots do the heavy lifting. From sniping arbitrage gaps in milliseconds to running high-speed DCA strategies on autopilot, algorithmic bots aren’t just a tool – they’re a full-on upgrade.

Want to know how non-coders are beating the market with algo power?

👉 [Read the full breakdown on crypto algorithmic trading.]

(If you’re still placing manual orders, you’re already behind.)

Tutorial: How to Use Oscillator Indicators

Struggling to time your trades with indicators like RSI or MACD? You’re not alone—and acting on the wrong signal can cost you.

In this quick video, we break down how oscillator indicators really work in crypto trading. Learn when to act, what overbought and oversold zones actually tell you, and how to avoid common mistakes.

Watch now and start using tools like RSI, MACD, and Stochastic with confidence—so your next trade isn’t a guess.

Macro-Economic Update

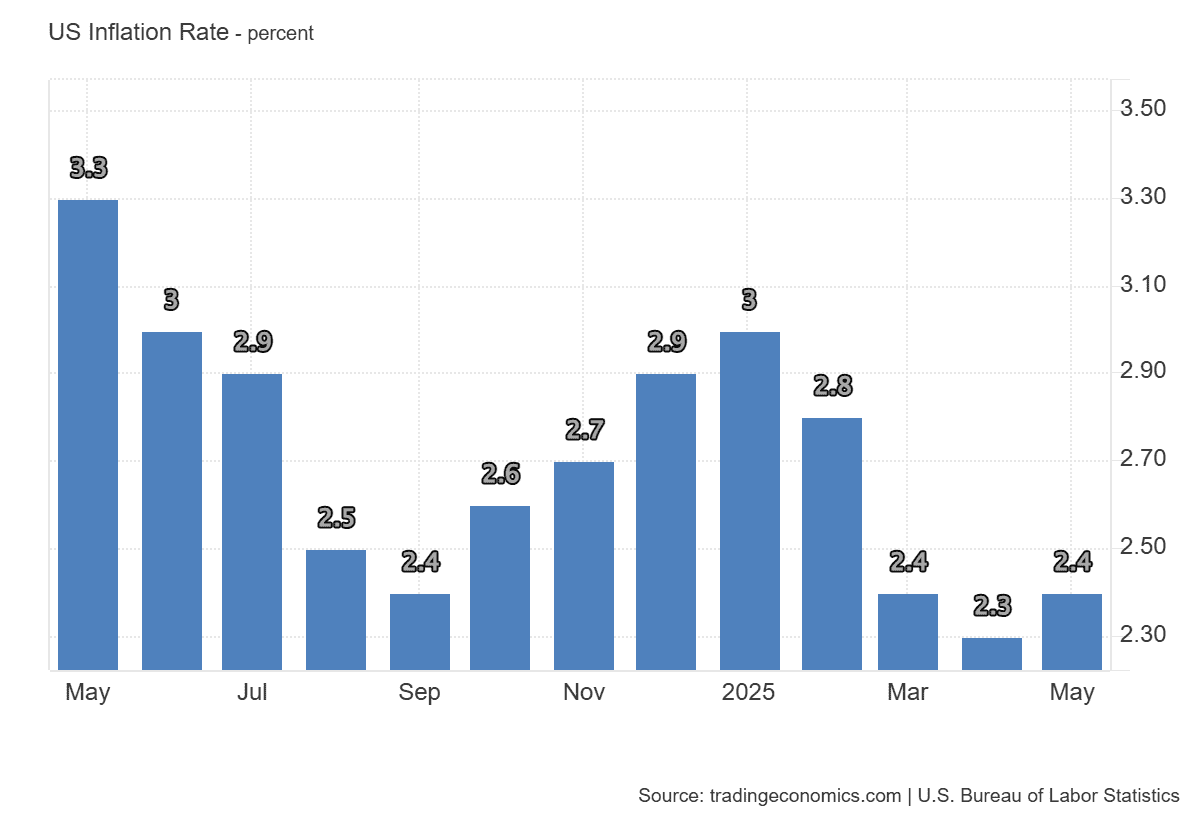

U.S Inflation Creeps Up in May, But Stays Below Expectations

U.S. inflation inched up to 2.4% in May, the first rise in four months, but still came in below the expected 2.5%. Prices rose for food, transportation, and used cars, while shelter costs eased and energy prices kept falling, especially gas and fuel oil. Core inflation stayed steady at 2.8%, signaling that underlying price pressures remain tame. Overall, inflation is rising just a bit, but not enough to worry markets or change the Fed’s cautious stance.

Event: US Cpi y/y

Date: 11/06/2025

Wallet Inflows & Outflows Weekly Report

Top 2 Cryptocurrencies (BTC, ETH)

Bitcoin Wallets See Outflows as Ethereum Attracts Fresh Capital

This week, Bitcoin wallets experienced steady outflows, with only two days showing inflows, suggesting profit-taking and a pause in new capital entering the market.

In contrast, Ethereum told a different story, registering multiple days of positive inflows. This divergence hints at a possible portfolio rotation, with investors shifting funds from Bitcoin to Ethereum, which is still trading at a relative discount.

Keep an eye on this trend: if the rotation gains momentum, it could reignite interest in altcoins just as Bitcoin starts to cool off.

Economic Trends Affecting Crypto Markets

Crypto Shows Resilience Amid Global Uncertainty

Crypto markets held steady amid shifting macro and geopolitical dynamics. Bitcoin traded between $104K and $110K, while Ethereum neared $2.8K before a modest pullback.

Cooler U.S. inflation data initially lifted sentiment, but rising Middle East tensions triggered volatility. Still, institutional inflows remained strong, especially into Ethereum, which saw $296M in new capital.

Progress on crypto regulation in the U.S. and the UK also supported market confidence, and investors are closely watching for signals that could drive the next big move in crypto.

Key Macroeconomic Insights

Trade Talks Cool Tensions, But Geopolitical Risks Heat Up

While Donald Trump celebrated a breakthrough in U.S.-China trade talks, including a deal to resume rare-earth magnet exports and ease student visa curbs, Xi Jinping quietly secured a strategic win, gaining time and lowering the risk of new tariffs or tech restrictions.

But markets were quickly jolted by fresh geopolitical tensions: Israel launched strikes on Iran’s nuclear and missile programs, raising fears of a broader Middle East conflict.

Oil futures spiked sharply, marking their biggest intraday gain since the early days of the Russian invasion of Ukraine. With key central bank meetings coming up next week, including the Fed, BoJ, and BoE, this surge in energy prices adds new uncertainty to the inflation outlook, especially if Iran retaliates.

Thanks for reading!

If you enjoyed this, share with friends who might be interested—and you can also share on your socials.

Got questions or special requests? Don’t think twice—reach out! Our team’s got your back and is always here to help.

DISCLAIMER: None of this is financial advice. This newsletter is here to educate, not to tell you where to put your money. It’s not investment advice or a sales pitch—just solid info to help you think smarter. Always do your homework and research carefully!