.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

Insider Newsletter - Thai's Crypto Tax Break Plus Geopolitical Risks Weaken Investments | 06-20-2025

Welcome to this week’s edition of our Insights Newsletter!

A summary of this week's highlights: Thailand will exempt capital-gains tax on crypto, boosting adoption prospects. Solana tests a key support level, while traders turn to top real-time tools and risk management strategies. The Fed held rates steady amid Trump policy uncertainty, as U.S. retail sales slump and China’s economy stays strong.

Stablecoin plans from major banks are gaining traction. Bitcoin outflows continued while Ethereum saw inflows, hinting at a shift. Geopolitical tensions and surging oil prices add to global market volatility, reinforcing crypto’s appeal as a hedge.

As for our weekly webinars, Ben and Roman backtested Smart Money strategies and analyzed the UNIUSDT market. And on Wednesday, they took a deep dive into crypto markets and analyzed Bitcoin, Solana, LINK, and other coins.

Yesterday’s Q&A with Ben and Raffa focused once again on live trading scalping strategies using the Quick Scanner.

Get all details below.

WHAT HAPPENED THIS WEEK

- Weekly Webinars: 2 live educational webinars with Ben & Roman, one time backtested UNIUSDT market + another webinar where they did a market overview (analyzed several coins including Bitcoin, Solana, LINK). And Ben and Raffa showcased again real, live scalping techniques complemented by Quick Scanner.

- Breaking News of the Week: Thailand to exempt capital‑gains tax on crypto

- Technical Analysis Highlight: SOL is at a critical moment — testing its second support trendline

- Crypto Trading Tools: Top 3 Tools to Track Technical Indicators in Real Time

- Tutorial: Your Quick Guide to Risk Management for Crypto Trading

- Macro-Economic Update: Fed Holds Rates Steady Amid Trump Policy Watch

- Wallet Inflows & Outflows Report: Shift in Crypto Flows, Ethereum Gains as Bitcoin Cools

- Economic Trends Affecting Crypto Markets: China’s Strength, U.S. Slowdown, and the Stablecoin Surge

- Key Macroeconomic Insights: Middle East Tensions, G7 Disarray, and Oil Price Spike

Weekly Live Educational Webinars—Smart Money Backtesting + Building a Winning Trading Plan

In this week’s Smart Money webinar series, Ben and Roman put Smart Money strategies to the test and examined the UNIUSDT market.

In case you missed it, you can watch the recording here 👇

On Wednesday, they took an in-depth look at the crypto landscape, breaking down key insights, and also discussed whether AI is a good idea when testing Smart Money concepts.

Here’s what happened 👇

Yesterday, Ben and Raffa led another Q&A session, showing how to use Altrady’s Quick Scanner for effective scalping strategies while also using technical indicators.

For this one too, you can watch the recording here 👇

Breaking News: Thailand to Exempt Capital‑Gains Tax on Crypto

Thailand to exempt capital‑gains tax on crypto (e.g., Bitcoin) from January 1st, 2025, to December 31st, 2029, so a first legislative adoption lasting exactly 5 years.

Deputy FM Julapun Amornvivat said: “A key step to cement Thailand as a global digital‑asset hub.”

Aims to attract investment, boost transparency & align with OECD/FATF standards.

Tell us your thoughts about this on X!

Technical Analysis Highlight

This week’s top technical analysis:

SOL is at a critical moment — testing its second support trendline

Price has already dipped into the discount zone.

Is this the buy-the-dip moment smart money is waiting for?

👉Let us know your opinions on Discord!

Top 3 Tools to Track Technical Indicators in Real Time

Real-time indicators aren’t just a nice-to-have; they’re the difference between catching a move and chasing it.

We’ve rounded up the top 3 free tools that help crypto traders react faster, trade smarter, and sleep better (well, almost):

- Altrady – Practice in peace with free paper trading and real-time charts, so you can test your strategy without burning your bankroll.

- TradingView – Get pro-level charting with indicators like MACD and RSI, plus custom alerts to catch market moves before they leave you in the dust.

- CoinMarketCap – Fast, mobile-friendly snapshots with the Crypto Fear & Greed Index and quick-glance RSI/MACD data for easy on-the-go decisions.

Want the full breakdown?

👉 [Read here about tools to track indicators ]

Tutorial: Risk Management That Doesn’t Slow You Down

Tired of fumbling with risk-reward math while the market sprints past you?

In this quick video, we’ll show you how to skip the spreadsheet stress and manage trades like a professional, without missing a beat.

See how Altrady’s real-time risk tools help you calculate, adjust, and execute with zero guesswork and zero delays.

Watch now and take control before your next trade takes off without you.

Macro-Economic Update

Fed Holds Rates Steady Amid Trump Policy Watch

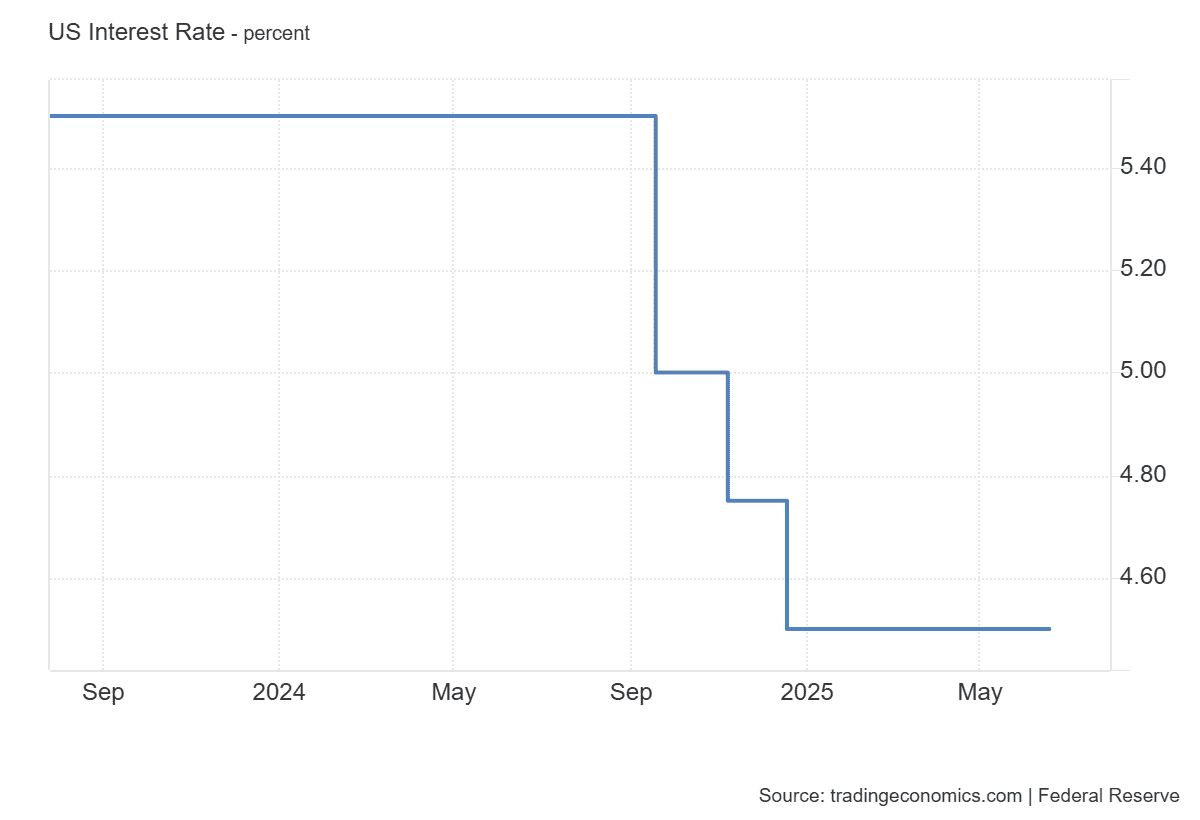

The Federal Reserve kept rates unchanged at 4.25%–4.50% for a fourth straight meeting in June, taking a measured stance as it assesses the economic impact of President Trump’s policies on tariffs, immigration, and taxes. While uncertainty has eased, the Fed remains cautious, signaling two possible rate cuts later this year. It also lowered GDP growth forecasts for 2025 and 2026 and expects inflation to fall more slowly than previously projected, highlighting a complex path ahead for monetary policy.

Event: Federal Funds Rate

Date: 19/06/2025

Wallet Inflows & Outflows Weekly Report

Top 2 Cryptocurrencies (BTC, ETH)

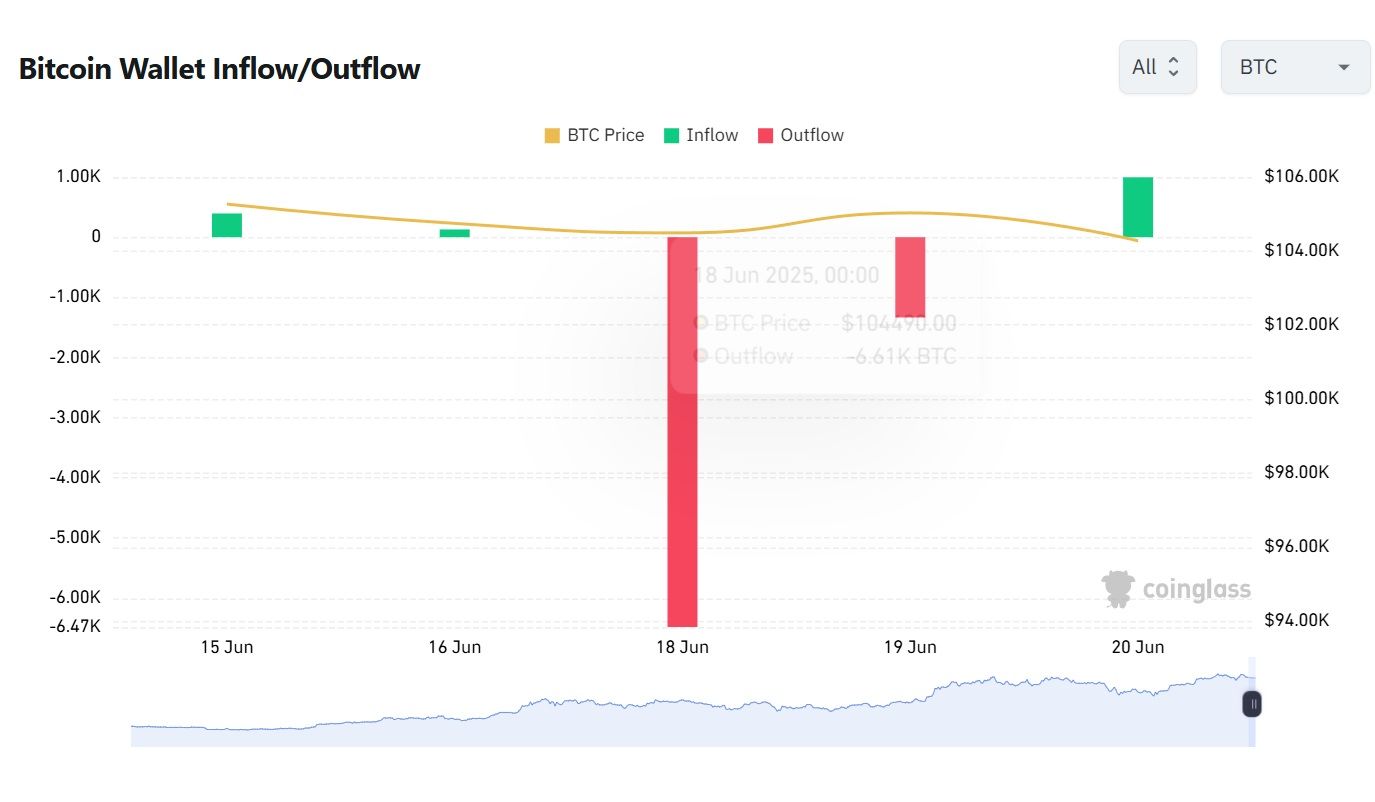

Shift in Crypto Flows, Ethereum Gains as Bitcoin Cools

Crypto wallet movements this week showed a familiar pattern, though with softer volumes: Bitcoin continued to see consistent outflows, while Ethereum attracted several days of positive inflows. This contrasting behavior may signal a strategic shift, with investors reallocating from Bitcoin to Ethereum, which remains undervalued relative to its recent highs. If this rotation builds, it could mark the beginning of renewed interest in the broader altcoin market as Bitcoin’s momentum begins to fade.

Economic Trends Affecting Crypto Markets

China’s Strength, U.S. Slowdown, and the Stablecoin Surge. Macro Moves Shaping Crypto

This week’s macro trends painted a mixed global picture with direct implications for crypto markets. China’s industrial production and retail sales remain robust, offering a rare pocket of strength that could support risk-on assets like crypto.

Meanwhile, Japan’s central bank left interest rates unchanged, reinforcing a dovish stance that continues to weaken the yen, potentially fueling regional demand for digital alternatives.

In stark contrast, U.S. retail sales plunged again, deepening fears of a consumer slowdown, while the Fed held rates steady, opting for caution amid policy uncertainty.

Adding to the momentum, a growing number of major banks and corporations are openly discussing plans to launch their own stablecoins, signaling a new phase of mainstream adoption that could redefine the digital asset landscape.

Key Macroeconomic Insights

Middle East Tensions, G7 Disarray, and Oil Price Spike

Global markets are on edge as key macro developments unfold with far-reaching implications. The conflict between Israel and Iran has reached a point of no return, intensifying geopolitical risk and fueling a surge in oil prices.

Meanwhile, the G7 summit ended in disarray, with President Trump leaving early and no meaningful progress made on tariffs or trade data further clouding the economic outlook.

These rising tensions and commodity shocks are stoking market volatility, pushing investors toward hard assets and potentially boosting interest in crypto as a hedge against instability.

Thanks for reading!

If you enjoyed this, share with friends who might be interested—and you can also share on your socials.

Got questions or special requests? Don’t think twice—reach out! Our team’s got your back and is always here to help.

DISCLAIMER: None of this is financial advice. This newsletter is here to educate, not to tell you where to put your money. It’s not investment advice or a sales pitch—just solid info to help you think smarter. Always do your homework and research carefully!