.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

Insider Newsletter - Solana Signs Web3 Deal with Kazakhstan & BTC Mirrors a Rally | 06-27-2025

Welcome to this week’s edition of our Insights Newsletter!

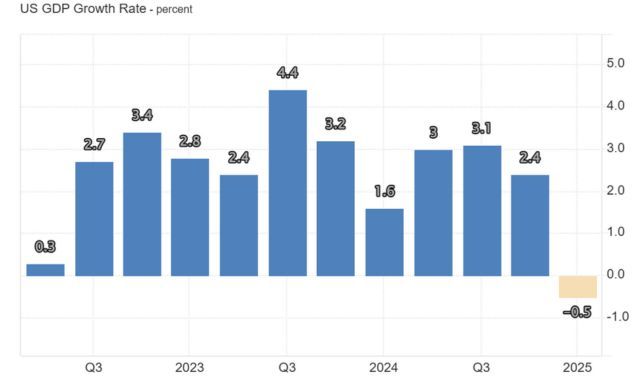

A summary of this week's highlights: This week, Solana’s Web3 deal with Kazakhstan made headlines, while Bitcoin tested the top of a descending flag pattern. Traders explored range strategies and candlestick reading tips. On the macro side, the U.S. economy shrank by 0.5%, Bitcoin outflows continued, and Ethereum gained ground. Geopolitical shifts, Middle East truce, NATO spending hike, and looming U.S. tariffs kept markets on edge.

This week’s Smart Money series delivered live crypto market analysis, real-time backtesting, and a rapid scalping session where Ben and Raffa used Altrady’s Quick Scan to lock in quick profits.

Get all details below.

WHAT HAPPENED THIS WEEK

- Weekly Webinars: Smart Money series featured live analysis of key crypto indicators and a real-time backtesting session. Ben and Raffa also led a fast-paced scalping session using Altrady’s Quick Scan, securing strong profits in under an hour.

- Breaking News of the Week: Web3 Revolution? Solana Strikes Landmark Deal With Kazakhstan

- Technical Analysis Highlight: Bitcoin coming on top band of descending flag!

- Crypto Trading Tools: Mastering Range Trading with 5 Pro Strategies

- Tutorial: How to Read Candlestick Charts

- Macro-Economic Update: The U.S. economy shrank by 0.5%

- Wallet Inflows & Outflows Report: Bitcoin Outflows Persist as Ethereum Quietly Gains Ground

- Economic Trends Affecting Crypto Markets: Inflation Cools, Growth Slows, Global Divergence

- Key Macroeconomic Insights: Truce in the Middle East, NATO defense to 5% of GDP, U.S. tariff deadline

Weekly Live Educational Webinars—Smart Money Backtesting and Overview + Scalping Strategies

In this week's Smart Money webinar series, Ben and Roman covered key global indicators such as the Dollar Index (DXY), Bitcoin Dominance, Ethereum Dominance, ETH-BTC chart and Stablecoin Dominance.

In case you missed it, you can watch the recording here 👇

Wednesday was the 10th backtesting session, where we decoded real-time price action, catching market moves before they happened. No theory, just practical, repeatable repetition.

Here’s what happened 👇

Thursday, Ben and Raffa ran a live scalping session using Altrady's proprietary tool Quick Scan, making some great profits in just under an hour.

For this one too, you can watch the recording here 👇

Web3 Revolution? Solana Strikes Landmark Deal With Kazakhstan

The Solana Foundation has signed a landmark MOU with the Government of Kazakhstan, its first nation-state deal in Central Asia.

This partnership launches the Solana Economic Zone, a blockchain innovation hub focused on Web3 tech, talent dev, and tokenized finance.

A major step in Solana’s global expansion.

👉 Tell us what you think about this on X!

Technical Analysis Highlight

This week’s top technical analysis:

Bitcoin coming on top band of descending flag!

BTC is heading toward a crucial level! The dynamic resistance of its current parallel channel.

Low volume? Expect a higher low next.

All eyes on the breakout zone!

👉 Let us know your opinions on Discord!

Mastering Crypto Range Trading: 5 Pro Strategies to Cash In on Sideways Markets

In crypto, markets often move sideways, stuck between support and resistance levels, creating what’s known as range-bound trading. While many traders find this frustrating, experienced pros see opportunity. Range trading allows for low-risk, repeatable strategies that work across various timeframes and tokens, including Bitcoin, altcoins, and even DEX assets. Since 60–70% of crypto price action happens in ranges, knowing how to trade them can unlock consistent profits in “boring” markets.

This guide breaks down five expert-level strategies to navigate sideways action:

- Buying at support and selling at resistance

- Fading fake breakouts

- Trading the midline

- Waiting for technical confluence

- Catching breakouts after confirmation.

Tools like VWAP, OBV, and Ichimoku Cloud help filter trades and avoid traps set by whales or sudden news events. Range trading isn’t risk-free, but with tight stop-losses and careful planning, it can turn flat charts into cash flow.

Want the full breakdown?

👉 [Read everything here about crypto range trading ]

Tutorial: How to Read Candlestick Charts – Quick Guide for Beginners in Crypto Trading

Candlestick charts show price movements and patterns to help predict market trends.

On Altrady, you can customize these charts, choose timeframes, and compare multiple markets for better trading decisions.

Watch now and take control before your next trade takes off without you.

Macro-Economic Update

Key Data This Week:

U.S. Economy Shrinks for First Time in 3 Years as Consumer Spending Falters

The U.S. economy shrank by 0.5% in Q1 2025, its first contraction in three years and worse than earlier estimates.

The drop was driven by weaker consumer spending and exports, with only modest gains in investment and a sharp fall in federal spending.

Event: US GDP q/q

Date: 26/06/2025

Wallet Inflows & Outflows Weekly Report

Top 2 Cryptocurrencies (BTC, ETH)

Bitcoin Outflows Persist as Ethereum Quietly Gains Ground

Bitcoin is still seeing money trickle out, mirroring last week’s trend, but Ethereum is quietly gaining traction with several days of modest inflows. Prices haven’t moved much, but behind the scenes, it looks like institutional interest is leaning toward ETH. This subtle shift could mark the beginning of a broader altcoin revival, especially if Bitcoin's grip on market momentum continues to slip

Economic Trends Affecting Crypto Markets

Inflation Cools, Growth Slows, Global Divergence

In Europe, both the services and manufacturing PMI indices remain below 50, indicating a persistent economic contraction. In contrast, the United States shows greater resilience, with values above 52, suggesting an economy still in expansion, though perhaps not for long.

Global inflation continues to cool, staying close to the 2% target, a factor that could ease pressure on central banks. However, new signs of a slowdown in the U.S. are concerning: jobless claims are rising, and Q1 GDP dropped by 0.5%, marking the first contraction in three years.

For crypto markets, this combination of stabilizing inflation and economic weakening could reignite expectations for more accommodative monetary policies.

Key Macroeconomic Insights

Truce in the Middle East, NATO defense to 5% of GDP, U.S. tariff deadline

This week, a temporary truce in the Middle East brought some relief to energy markets, while NATO raised defense spending to 5% of GDP, signaling long-term fiscal shifts.

Meanwhile, the clock is ticking on a major U.S. tariff deadline, stirring uncertainty in global trade.

Markets are bracing for turbulence as geopolitical and economic forces collide.

Thanks for reading!

If you enjoyed this, share with friends who might be interested—and you can also share on your socials.

Got questions or special requests? Don’t think twice—reach out! Our team’s got your back and is always here to help.

DISCLAIMER: None of this is financial advice. This newsletter is here to educate, not to tell you where to put your money. It’s not investment advice or a sales pitch—just solid info to help you think smarter. Always do your homework and research carefully!