Category List

Featured List

Insider Newsletter: PENGU Hits 6-Months High and Trump Takes Aim at the Fed

Welcome to this week’s edition of our Insights Newsletter!

A summary of this week's highlights: Pudgy Penguins (PENGU) hit a six-month high, reaching $0.046. While SOL experienced a pullback, it may be a temporary pause. In broader news, Trump took aim at the Federal Reserve, and a surge in Eurozone PMI suggests the region is gaining economic traction after a manufacturing slump. Easing inflation continues to support the European Central Bank’s outlook.

This week, we hosted 2 webinars: Ben and Roman took a deep dive into crypto markets but that was after they announced that BitMart exchange is now integrated within Altrady platform! The integration allows Altrady users to connect their BitMart Futures for now.

Yesterday’s Q&A with Ben and Cata focused once again on live trading scalping strategies using the Quick Scanner.

Plus, we’ve been working on a very special project you’ll soon enjoy: a course dedicated to beginner traders will be available on our website, completely FREE! It’s a course based on real, honest guidance that will help traders grow, step by step.

WHAT HAPPENED THIS WEEK

- Weekly Webinars: Crypto Market Overview and Scalping Strategies with Quick Scanner

- Breaking News of the Week: PENGU Hits All-Time High

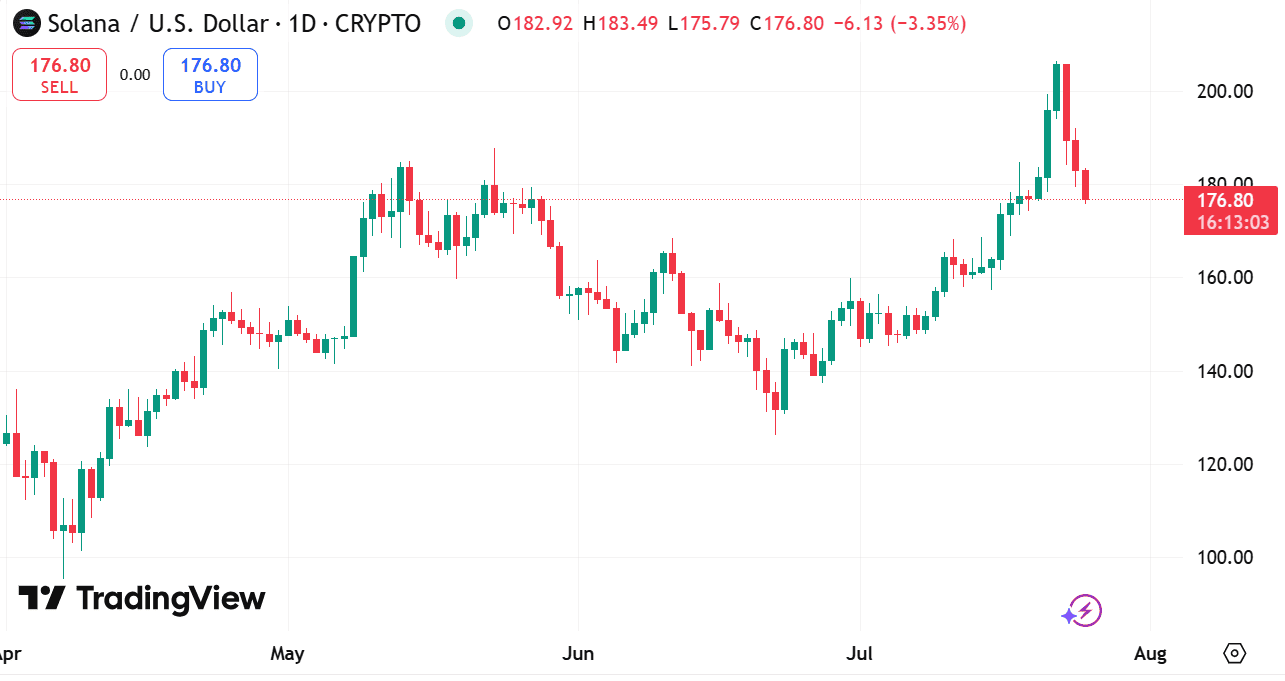

- Technical Analysis Highlight: Solana slips 9% Signaling A Potential Bearish Outcome

- Crypto Trading Strategies: The Technical Indicators Every Beginner Trader Should Know

- Tutorial: How to Backtest Your Trading Strategies More Efficiently

- Macro-Economic Update: U.S. Consumer Sentiment Goes Up in July

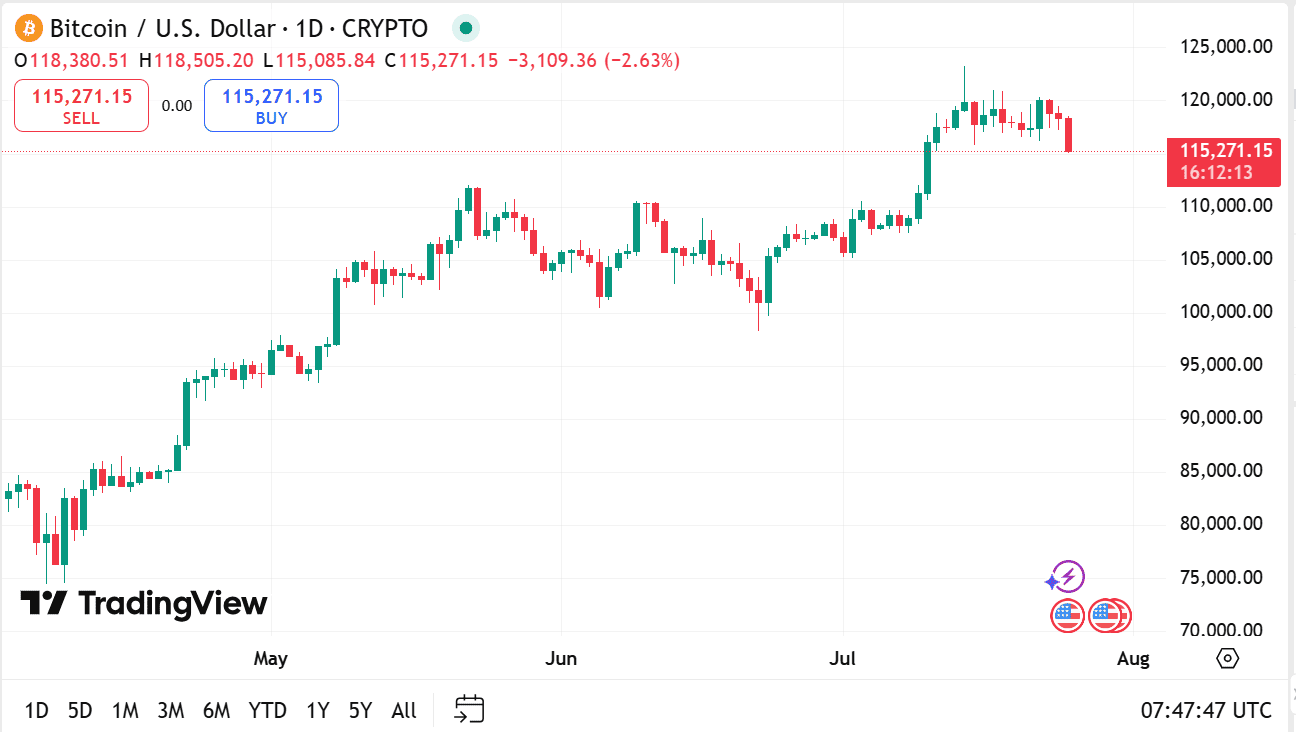

- Wallet Inflows & Outflows Report: Bitcoin Dipped to 117K and ETH is Under Pressure

- Economic Trends Affecting Crypto Markets: Trump Targets the Fed

- Key Macroeconomic Insights: U.S. and Europe Eye 15% Tariff Compromise & Eurozone PMI Surge

Weekly Live Educational Webinars—Crypto Market Overview + Scalping Strategies with Quick Scanner

On Wednesday, Ben and Roman took an in-depth look at the crypto landscape, breaking down key insights. Plus, they had a special guest and revealed the new Bitmart exchange as now part of Altrady's multiple exchanges list. That means you can now connect and trade directly on BitMart from your Altrady account. More details on how you can do that here.

Here’s everything that was discussed in the webinar 👇

Yesterday, Ben and Cata ran a live scalping session using Altrady's Quick Scan, introducing new strategies and testing new coins, and managing to lock in nice profit targets.

You can watch the recording here 👇

Breaking News

PENGU Hits All-Time High — Investor Exits Loom

Pudgy Penguins (PENGU) just tapped a new all-time high at $0.046 — its best in six months.

Despite the rally, gradual investor outflows hint at potential price pressure ahead.

Still, demand shows muscle. Open Interest in derivatives spiked 54% in two days, from $426M to $657M — signaling strong market engagement, with funding rates skewing bullish.

Rally fueled by both spot buying and leveraged bets.

Technical Analysis Highlight

SOL slips 9%, but is the reset just what the bulls ordered?

Solana pulled back 9.5% to $186, erasing recent gains and flirting with a bearish engulfing pattern. A close below $190 would mark its sharpest single-day loss since early March.

Longs took a hit — $30M in positions liquidated after open interest peaked at $12B. While SOL still trades 36% below its ATH, elevated OI hints at traders scaling out, not piling in.

Still, SOL’s up 56% over the past month. This drop may not be doom — just a breather. With $180 acting as key support, bulls might see this as the pullback that reloads the next leg up.

👉Let us know your opinions on Discord!

5 Powerful Technical Indicators Every Trader Should Know

What if you could spot trend shifts before they hit… or avoid buying into hype just before a drop?

The best crypto traders don’t guess—they use technical indicators to read the market like a map.

We’re breaking down 5 powerful tools that can help you:

- Spot overbought or oversold coins

- Catch trend reversals early

- Measure volatility with confidence

And more!

Learn how RSI, MACD, Moving Averages, Bollinger Bands, and Volume can change the way you trade.

👉 [Read the full guide on the 5 technical indicators]

Tutorial: Backtest Strategies With A Super-Efficient Tool from Altrady

We recently dropped a game-changing feature: Backtesting — and it’s built to sharpen your edge.

Whether you scalp, swing, or run bots, this tool lets you run your trading strategies against real historical market data — without risking a cent.

In this video, you’ll learn:

- How to start using Altrady’s Backtesting tool

- Why serious traders rely on backtesting to refine their edge

- The biggest mistakes traders make (and how to sidestep them)

If you're still trading on gut feel, it's time to level up. Watch the tutorial and see what data-backed trading really looks like.

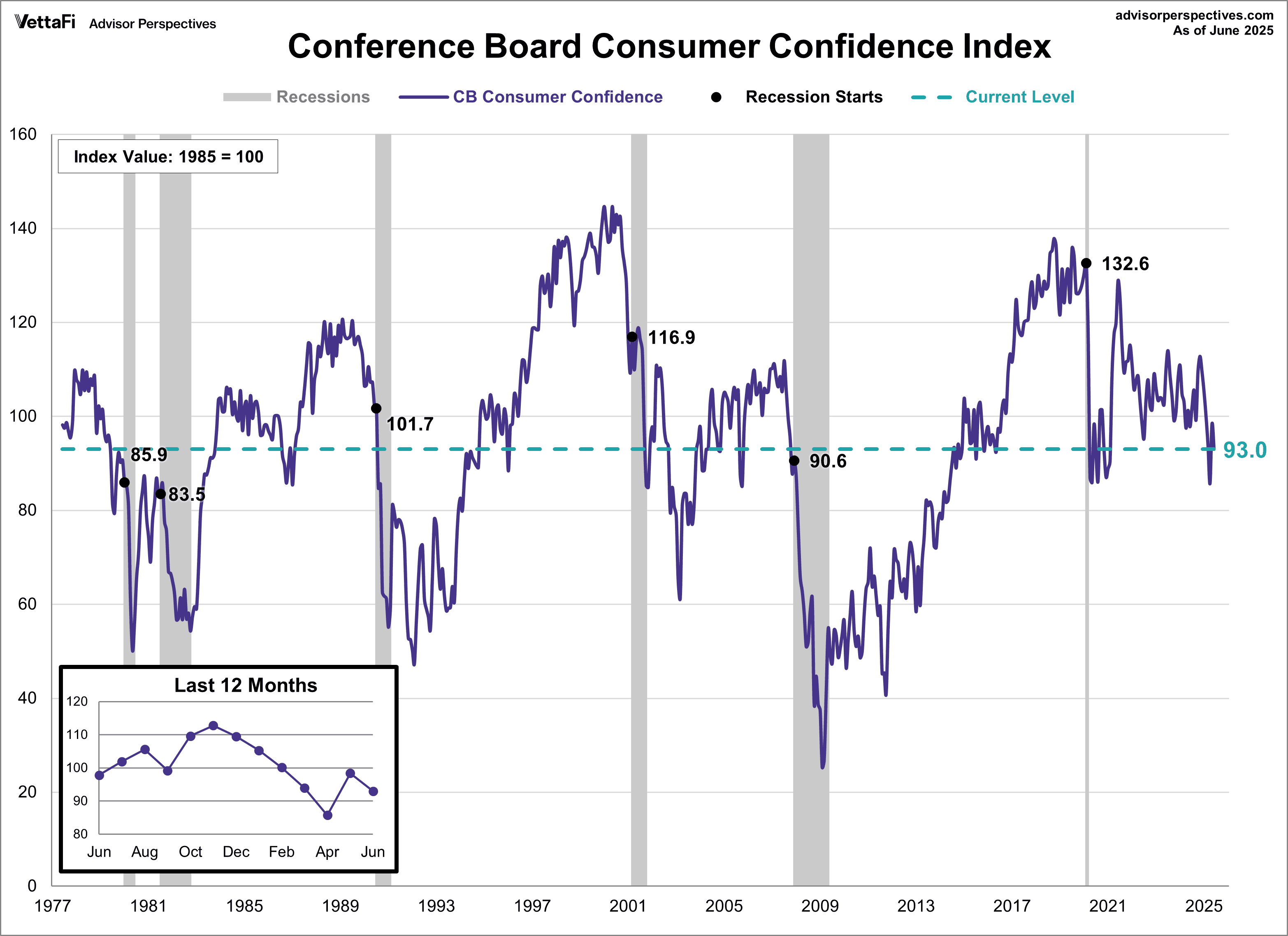

Macro-Economic Update

U.S. Consumer Sentiment Goes Up in July

U.S. consumer sentiment improved in July 2025, hitting a five-month high, according to preliminary data from the University of Michigan.

The Consumer Sentiment Index rose to 61.8 from 60.7 in June, showing modest optimism despite inflation and trade worries.

The Current Conditions Index climbed to 66.8, beating expectations, while the Expectations Index inched up to 58.6, suggesting cautious confidence about the future.

Wallet Inflows & Outflows Weekly Report

Top 2 Cryptocurrencies (BTC, ETH)

Bitcoin Holds Firm as Altcoins Slide; Ethereum Hit by Validator Exodus

Bitcoin slipped just 2.3% over the last two sessions, dipping to $117,142 before rebounding slightly. While not immune to market pressure, BTC’s limited drop highlights its role as a relative safe haven during broader crypto selloffs.

Price action suggests Bitcoin is consolidating below all-time highs, with support near $115,000. Its market dominance has ticked higher as investors rotate out of riskier altcoins.

Ethereum, meanwhile, is under heavier pressure. The network is facing its largest validator exit queue in over a year - over $2.3 billion worth of ETH is waiting to unstake. ETH fell 6% this week, breaking below key support at $3,515.

The validator exodus raises concerns: are whales prepping to sell, or just reallocating? Either way, ETH is clearly bearing the brunt of the latest market stress.

Economic Trends Affecting Crypto Markets

Trump Targets the Fed: Renovation Costs Spark Showdown Over Interest Rates

Donald Trump is ramping up pressure on the Federal Reserve, pushing for sharp interest rate cuts to boost economic activity. He's floated removing Fed Chair Jerome Powell, citing frustration over rate policy and cost overruns in a $2.5 billion headquarters renovation. The White House is also sending officials to inspect the site as part of its critique.

This continued tension has rattled markets, with analysts warning that political meddling could erode the Fed’s independence - a cornerstone of its credibility. Treasury Secretary Scott Bessent has called for a broader review of the central bank’s role, signaling deeper scrutiny ahead.

Key Macroeconomic Insights

U.S. and Europe Eye 15% Tariff Compromise & Eurozone PMI Surge Signals Economic Momentum

The U.S. is nearing a trade deal with the EU that may include a 15% tariff on European goods. Despite tensions over what President Trump calls unfair EU trade practices, both sides could ease tariffs on major imports. If finalized, the deal would resemble the U.S.-Japan agreement and help Europe dodge a possible 30% tariff hike.

On the macro side, European stocks are pulling ahead of U.S. markets this year, and Deutsche Bank sees lasting promise. Big investors are shifting more capital into Europe, citing policy changes and strong ETF inflows.

With a 4.2% equity risk premium over government bonds—versus zero for the S&P 500—European shares remain a value play. They could also be less exposed to tariffs if an EU trade deal materializes. Still, currency shifts and slower earnings growth pose hurdles.

Eurozone business activity rose notably in July 2025, with the composite PMI reaching an 11-month high of 51, beating forecasts. Manufacturing hit its strongest level in three years, and services expanded more than expected. The data suggests the region is emerging from a manufacturing slump, while continued disinflation offers relief to the ECB.

New orders stabilized for the first time in over a year, though foreign demand remains weak, extending a decline that began in March 2022.

Thanks for reading!

If you enjoyed this, share with friends who might be interested—and you can also share on your socials.

Got questions or special requests? Don’t think twice—reach out! Our team’s got your back and is always here to help.

DISCLAIMER: None of this is financial advice. This newsletter is here to educate, not to tell you where to put your money. It’s not investment advice or a sales pitch—just solid info to help you think smarter. Always do your homework and research carefully!

In this post

- WHAT HAPPENED THIS WEEK

- Weekly Live Educational Webinars—Crypto Market Overview + Scalping Strategies with Quick Scanner

- Breaking News

- Technical Analysis Highlight

- 5 Powerful Technical Indicators Every Trader Should Know

- Tutorial: Backtest Strategies With A Super-Efficient Tool from Altrady

- Macro-Economic Update

- Wallet Inflows & Outflows Weekly Report

- Economic Trends Affecting Crypto Markets

- Key Macroeconomic Insights