Category List

Featured List

Insider Newsletter - Bitcoin Crash, El Salvador’s Big Move & Red September Fears

Welcome to this week’s edition of our Insights Newsletter!

A summary of this week's highlights: El Salvador will host the world’s first government-backed Bitcoin conference. Bitcoin tumbled to $108k, its lowest in two months, while Ethereum held steady despite ongoing outflows. U.S. job openings hit a 10-month low, fueling recession concerns. With Fed rate cut bets and potential SEC shifts, fears of a “Red September” loom, as global economic forces from Europe to Asia reshape markets.

In this week’s webinars, Ben and Roman went all greedy on a backtesting setup using smart money concepts and analyzed Bitcoin CME futures and price gaps.

Yesterday, Ben and Raffa did another scalping session using Altrady’s Quick Scanner, sharing insights on Fair Value Gap setups and how to align multiple strategies.

WHAT HAPPENED THIS WEEK

- Weekly Webinars: Ben and Roman went all in on a backtesting setup with smart money concepts, and broke down Bitcoin CME futures and spotting price gaps. Ben and Raffa led another fast-paced scalping session using Altrady’s Quick Scan.

- Breaking News of the Week: El Salvador to Host World’s First Government-Backed Bitcoin Conference

- Technical Analysis Highlight: Bitcoin Bloodbath Continues, crashed to $108k, its lowest in 2 months

- Crypto Trading Strategies: Why Most ICT Traders Fail

- Tutorial: How to Catch Fast-Moving Markets with Quick Scanner

- Macro-Economic Update: U.S. Job Openings Sink to 10-Month Low, Miss Market Expectations

- Wallet Inflows & Outflows Report: Bitcoin Outflows Weigh on Prices as Ethereum Holds Steady

- Economic Trends Affecting Crypto Markets: Crypto Markets Face “Red September” Fears Amid Fed Rate Cut Bets and SEC Policy Shift

- Key Macroeconomic Insights: From Europe to Asia - Key Forces Reshaping the Global Economy

Weekly Live Educational Webinar—Backtesting, Market Overview+Scalping Strategies

During the backtesting webinar, Ben and Roman explained in depth the multi-time frame strategy and executed a greedy trade setup; you’ll have to check it out to see what happened.

You can watch the recording here 👇

On Wednesday, the same Ben and Roman reviewed Bitcoin CME futures and price gaps, while also sharing their outlook for the crypto market in September.

You can watch the recording here 👇

In yesterday’s live scalping session, Ben and Raffa did another demonstration of the Quick Scanner, showing how to make a Fair Value Gap setup and how to align multiple strategies.

For this one too, you can watch the recording here 👇

Breaking News

El Salvador to Host World’s First Government-Backed Bitcoin Conference

On Nov 12–13, San Salvador will stage Bitcoin Histórico, a milestone event organized by the National Bitcoin Office.

Speakers include billionaire Ricardo Salinas, Jeff Booth, Max Keiser, Stacy Herbert, Jack Mallers & more.

The nation that first made $BTC legal tender is once again making history.

👉 Leave your thoughts about this on X!

Technical Analysis Highlight

This week’s top technical analysis:

Bitcoin Bloodbath Continues!

BTC just crashed to $108k, its lowest in 2 months.

Since Aug. 14, ATH, the king of crypto, has plunged nearly 14%.

To make things worse, spot #Bitcoin ETFs ended the week with -$126.64 M net outflow, showing investor appetite is drying up fast.

👉Let us know your opinions on Discord!

Think You’re Trading Like Smart Money? Think Again

The ICT method is powerful, but over 90% of crypto traders still fail using it. Why? It’s not the strategy. It’s the mindset.

In our post, we break down 5 crypto-specific traps ICT traders fall into: from chasing patterns to over-risking in chaos, and how to flip your psychology for consistent wins in Bitcoin, altcoins, and DeFi.

👉 Read more about the reasons ICT traders fail.

Tutorial: Quick Scanner – Catch Crypto Breakouts Before the Crowd

Altrady’s Quick Scanner is your secret weapon. In this fast-paced tutorial, Ben shows you how to scan markets in real-time, filter by exchange or pair, and instantly react to price action across multiple platforms.

Whether you're scalping or chasing the next altcoin moonshot, this tool helps you move faster than volatility itself.

🎥 Watch the video now and start trading with precision.

Your edge is just one click away.

Macro-Economic Update

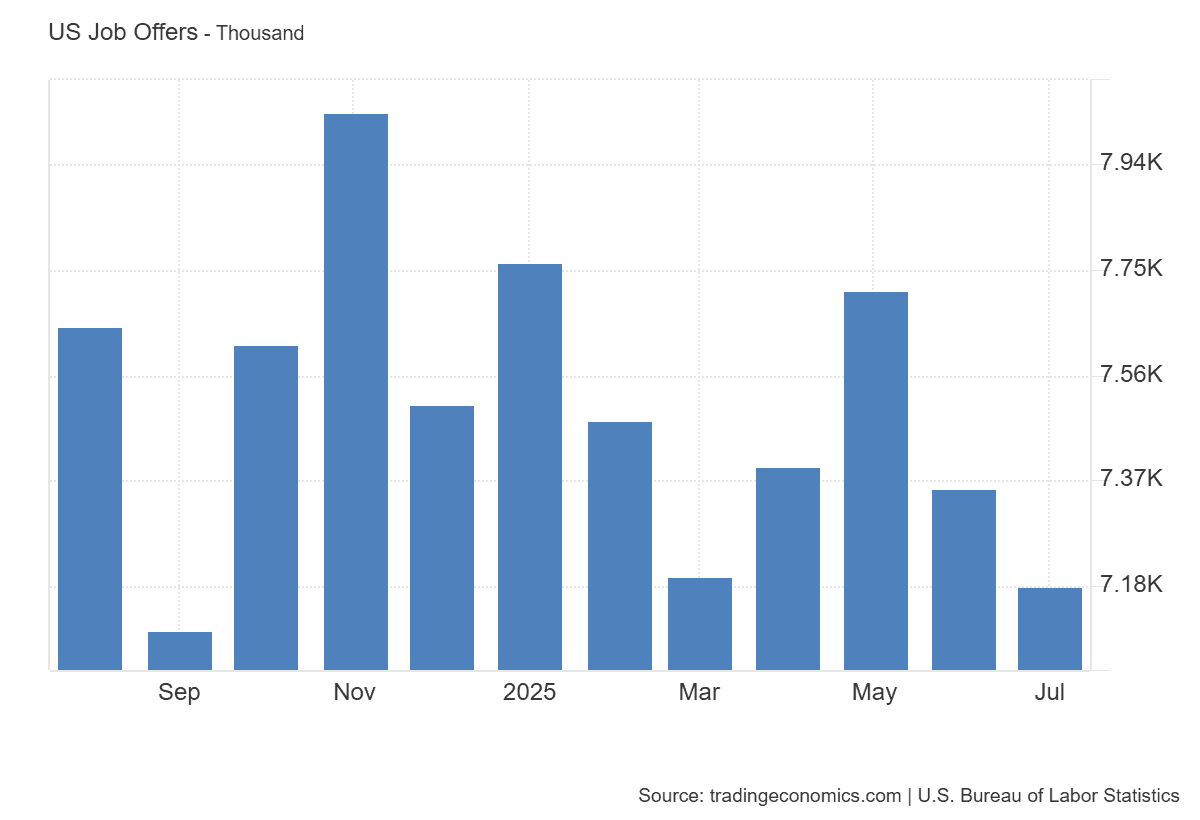

U.S. Job Openings Sink to 10-Month Low, Miss Market Expectations

U.S. job openings fell sharply in July 2025, dropping by 176,000 to 7.18 million, the lowest level since September 2024 and well under the 7.4 million expected, according to the Bureau of Labor Statistics.

The steepest declines came from health care and social assistance (-181,000), arts and entertainment (-62,000), and mining (-13,000). Regionally, the South led the pullback (-161,000), followed by the Northeast (-101,000) and Midwest (-27,000), while the West stood out as the only bright spot, adding 113,000 openings.

Event: JOLTS Job Openings

Date: 03/09/2025

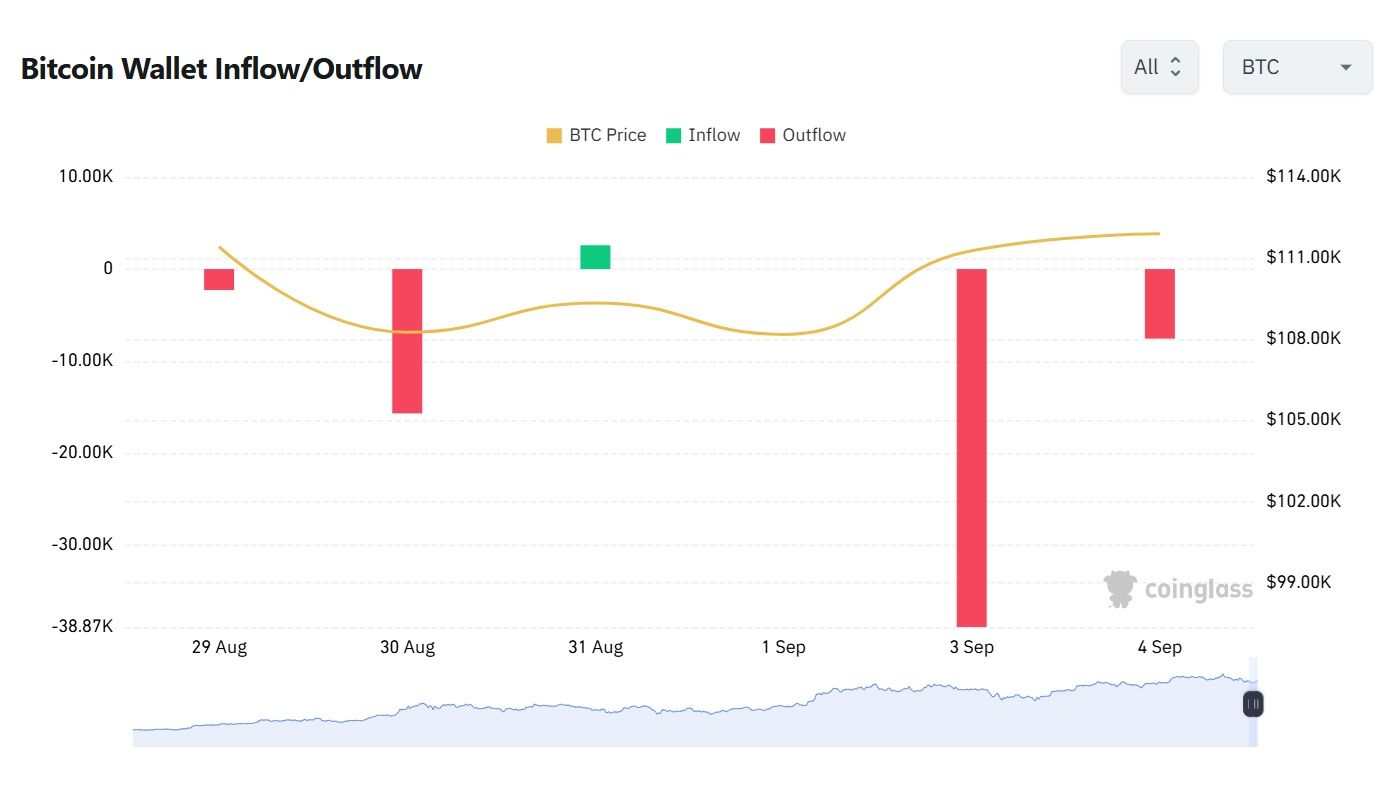

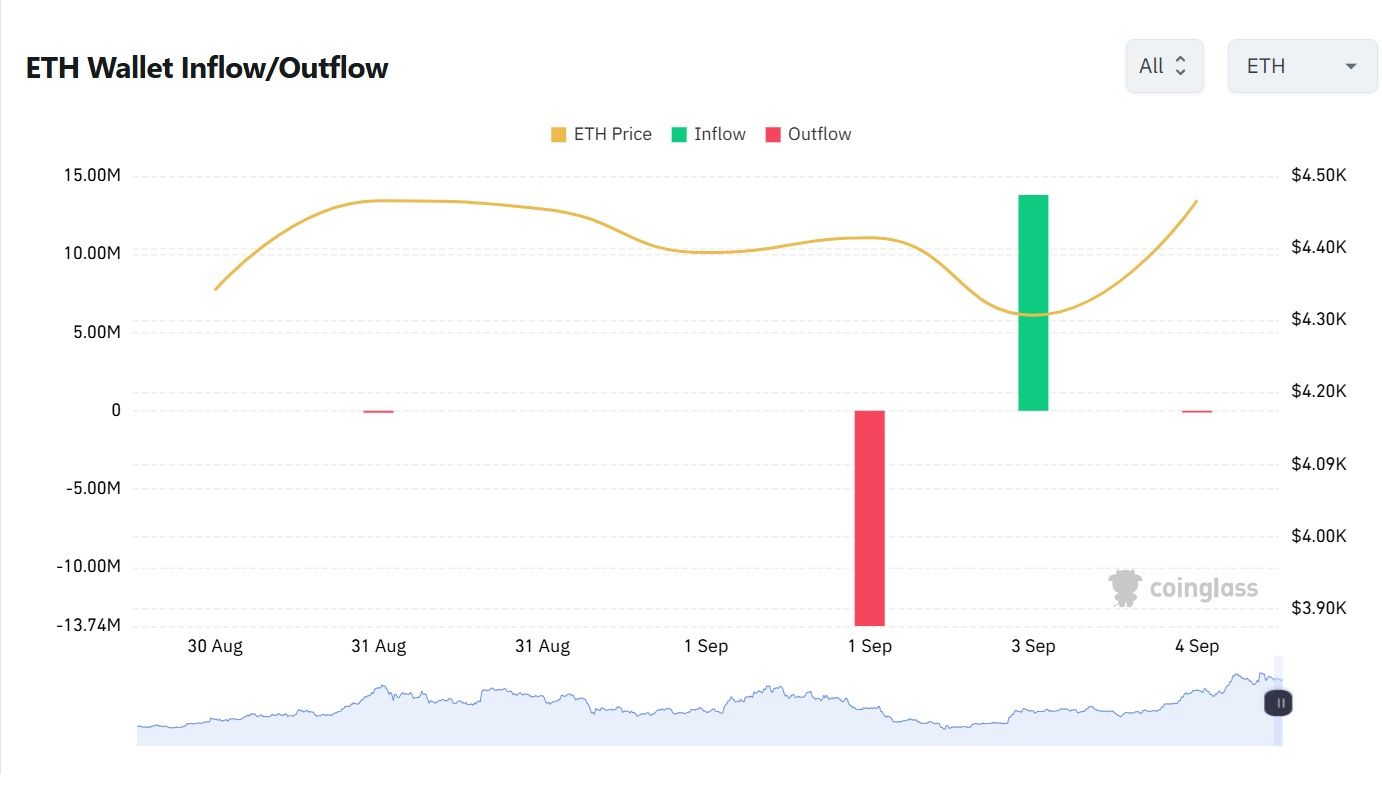

Wallet Inflows & Outflows Weekly Report

Top 2 Cryptocurrencies (BTC, ETH)

Bitcoin Outflows Weigh on Prices as Ethereum Holds Steady

This week, Bitcoin continues to face significant outflows from large wallets, marked by sharp red spikes that have pressured prices lower in recent days.

Ethereum, on the other hand, shows a more balanced picture: while no major inflows have been recorded, neither have there been notable outflows, with a red spike and a green spike essentially canceling each other out.

The outlook remains negative for BTC, while ETH holds steady in a more stable position.

Economic Trends Affecting Crypto Markets

Crypto Markets Face “Red September” Fears Amid Fed Rate Cut Bets and SEC Policy Shift

As September opened, markets continue to position for what’s being dubbed a potential "Red September," with Bitcoin under pressure yet holding key support just above $110K amid technical caution and modest institutional inflow.

Ethereum, meanwhile, shines brighter, buoyed by renewed institutional demand and ETF optimism, as reflected in robust inflows and a rebound toward the $4.4K–$4.5K range.

Driving forces behind market sentiment include the Federal Reserve’s highly anticipated rate cut, priced in at around 95–98% probability, which is fueling expectations for fresh liquidity and risk-on flows.

Meanwhile, regulatory momentum gains traction with the SEC unveiling plans to streamline crypto rules, potentially easing digital assets’ integration into traditional finance frameworks.

Key Macroeconomic Insights

From Europe to Asia - Key Forces Reshaping the Global Economy

Global markets shifted as central banks signaled new directions: the ECB looks set to pause rate cuts amid steady inflation and growth, while U.S. bonds proved resilient despite global turmoil, aided by tariff-driven fiscal buffers.

In contrast, U.S. job growth slowed, layoffs ticked higher, and the UK construction sector fell into its longest slump since 2020.

Geopolitically, China used the SCO summit to push an “electro-yuan” for regional energy trade, underscoring its bid to challenge dollar dominance, as UK borrowing costs hit a 27-year high, weighing on the pound but still drawing demand for gilts.

Thanks for reading!

If you enjoyed this, share with friends who might be interested—and you can also share on your socials.

Got questions or special requests? Don’t think twice—reach out! Our team’s got your back and is always here to help.

DISCLAIMER: None of this is financial advice. This newsletter is here to educate, not to tell you where to put your money. It’s not investment advice or a sales pitch—just solid info to help you think smarter. Always do your homework and research carefully!

In this post

- WHAT HAPPENED THIS WEEK

- Weekly Live Educational Webinar—Backtesting, Market Overview+Scalping Strategies

- Breaking News

- Technical Analysis Highlight

- Think You’re Trading Like Smart Money? Think Again

- Tutorial: Quick Scanner – Catch Crypto Breakouts Before the Crowd

- Macro-Economic Update

- Wallet Inflows & Outflows Weekly Report

- Economic Trends Affecting Crypto Markets

- Key Macroeconomic Insights