Category List

Featured List

Insider Newsletter - Cboe Announces Bold Futures and DOGE Rallies

Welcome to this week’s edition of our Insights Newsletter!

A summary of this week's highlights: Cboe unveils plans for 10-year “continuous futures” on Bitcoin and Ethereum, while DOGE surged on ETF rumors. U.S. inflation hit 2.9%, Bitcoin flows eased, and Ethereum faced profit-taking. On the macro front, highlights included Do Kwon’s guilty plea, Nasdaq’s tokenization push, ECB’s China swap extension, U.S. labor softness, and UK stagnation.

In this week’s webinars, Ben and Roman analyzed and backtested SUI, DOGE, and other coins.

Yesterday, Ben and Raffa did another scalping session using Altrady’s Quick Scanner and explained the difference between smart positions and manual orders, among others.

And we wanted to remind you once again about our new trading course dedicated to beginner traders on the Altrady website. It’s totally FREE and totally practical!

You get straightforward, hands-on advice to help you build your trading skills gradually. Whether you're new to trading or revisiting the fundamentals, it provides a solid starting point.

👉 [Check out the beginner trader course]

WHAT HAPPENED THIS WEEK

- Weekly Webinars: Ben and Roman hosted another fun session where they talked and showcased liquidity trading, and tested entry positions on the shift. Ben and Raffa led another fast-paced scalping session using Altrady’s Quick Scan.

- Breaking News of the Week: Cboe to Unleash 10-Year “Continuous Futures” for Bitcoin & Ethereum

- Technical Analysis Highlight: DOGE Breaks Out as ETF Rumors Explode. Is the Meme King About to Moon Again?

- Crypto Trading Strategies: How to Trade Crypto Without FOMO

- Tutorial: Catch Every Crypto Swing with Altrady’s Price Alerts

- Macro-Economic Update: U.S. Inflation Accelerates to 2.9% in August, Driven by Food, Autos, and Energy

- Wallet Inflows & Outflows Report: Crypto Flows Stabilize as Bitcoin Eases and Ethereum Sees Profit-Taking

- Economic Trends Affecting Crypto Markets: From Do Kwon’s Guilty Plea to Nasdaq’s Tokenized Push

- Key Macroeconomic Insights: ECB Extends China Swap, US Labor Market Softens, UK Faces Stagnation

Weekly Live Educational Webinar—Market Overview+Scalping Strategies

On Wednesday, Ben and Roman ran another lively session, walking through liquidity trading and testing entry setups during the shift. They also analyzed SUI, NEAR, and DOGE.

You can watch the recording here 👇

In yesterday’s live scalping session, Ben and Raffa did another demonstration of the Quick Scanner, breaking down the differences between smart positions, manual orders, and more.

For this one too, you can watch the recording here 👇

Breaking News

Cboe to Unleash 10-Year “Continuous Futures” for Bitcoin & Ethereum

Cboe Global Markets has announced plans to launch “Continuous Futures” for Bitcoin and Ethereum in the United States on November 10, subject to regulatory approval.

These innovative contracts, designed as long-term single positions with a 10-year horizon, aim to eliminate the need for constant rollovers while mirroring the structure of perpetual futures widely used in DeFi and offshore markets.

Settled in cash and benchmarked to spot BTC and ETH prices, the product could mark a major milestone in bridging traditional finance with digital asset markets.

👉 Leave your thoughts about this on X!

Technical Analysis Highlight

This week’s top technical analysis:

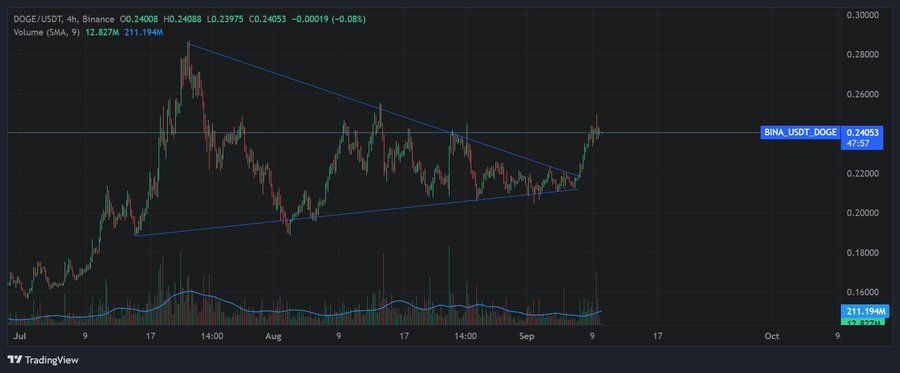

DOGE Breaks Out as ETF Rumors Explode. Is the Meme King About to Moon Again?

DOGE just broke out of its technical triangle while ETF approval rumors are heating up!

The king of meme coins might be gearing up for a comeback — will it reclaim glory and push to new highs?

The setup looks increasingly favorable… but will hype turn into a real breakout?

👉 Let us know your opinions on Discord!

Don’t Let FOMO Drain Your Crypto Gains

Every crypto trader has felt FOMO. That rush to buy when Bitcoin pumps or when a memecoin starts mooning. But more often than not, FOMO ends with late entries and heavy losses.

But you don’t have to trade on impulse. With the right strategies, you can keep your head clear even when the market swings 20% overnight.

In this post, we break down 7 practical steps to outsmart FOMO using technical tools like VWAP, OBV, and on-chain data, plus the habits pro traders rely on to stay disciplined.

👉 [Read the guide: How to Avoid FOMO in Crypto Trading]

Tutorial: Never Miss a Move – Get Real-Time Crypto Price Alerts on Altrady

If you want to escape the tiring habit of staring at charts all day, we’ve got just the right fix!

Altrady’s price alerts can do the work for you. You get real-time updates from multiple markets straight to your app, phone, or email, so you never miss a move. Plus, you can even send webhook signals to automate your trades.

In this video tutorial, we’ll show you exactly how to set up crypto price alerts using real-time CoinMarketCap data.

Watch the tutorial now ⬇️

Macro-Economic Update

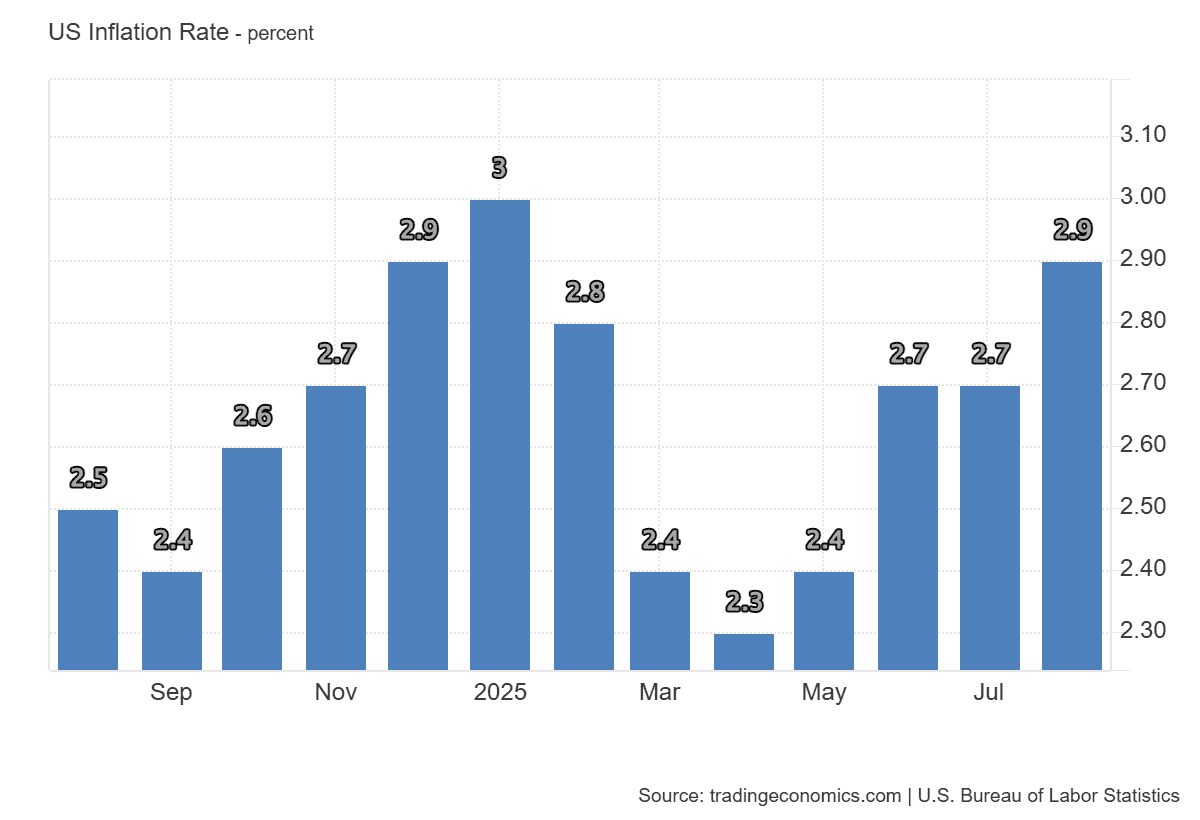

U.S. Inflation Accelerates to 2.9% in August, Driven by Food, Autos, and Energy

U.S. inflation ticked higher in August, with the annual rate climbing to 2.9%, its fastest pace since January and in line with forecasts. The pickup was driven by stronger price gains in food (+3.2%), used cars and trucks (+6%), and new vehicles (+0.7%), while energy costs rose for the first time in seven months (+0.2%). Gasoline and fuel oil prices still fell but at a slower pace, and natural gas costs remained elevated at +13.8%. On a monthly basis, the CPI jumped 0.4%, its biggest gain since January, with shelter (+0.4%) continuing to be the largest contributor.

Core inflation held steady at 3.1% year-over-year, matching July and February’s peak, while monthly core CPI increased 0.3%, exactly as expected. These figures reinforce the view that inflationary pressures, while moderating compared to prior years, remain sticky in key categories.

Event: CPI y/y

Date: 11/09/2025

Wallet Inflows & Outflows Weekly Report

Top 2 Cryptocurrencies (BTC, ETH)

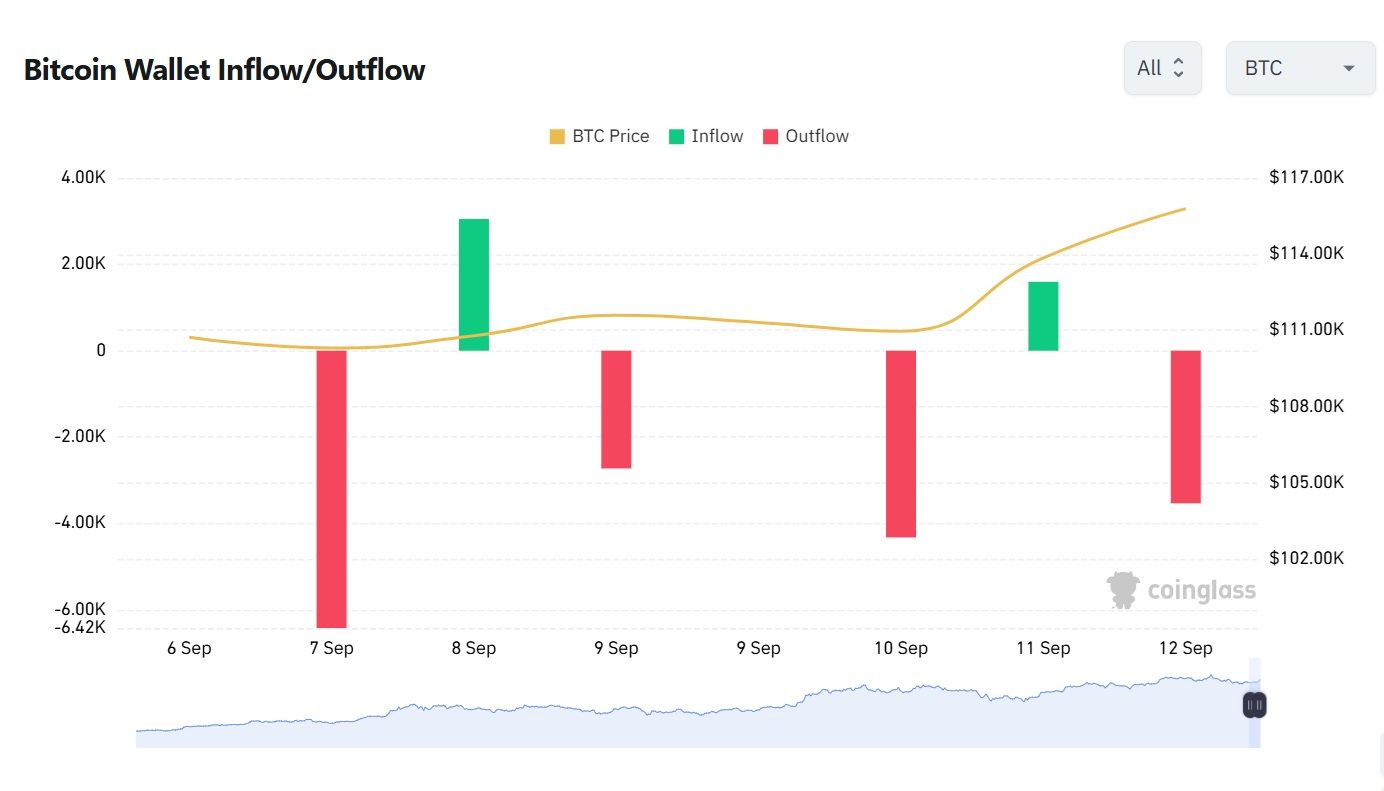

Crypto Flows Stabilize as Bitcoin Eases and Ethereum Sees Profit-Taking

This week showed a more balanced trend in inflows and outflows for both Bitcoin and Ethereum: large BTC wallets continued their negative streak, though with less pronounced spikes than in recent weeks, suggesting easing pressure; meanwhile, ETH saw its positive streak come to an end as profit-taking emerged. Overall, price movements remain relatively stable for the world’s two leading cryptocurrencies, highlighting a phase of consolidation rather than strong directional moves.

Economic Trends Affecting Crypto Markets

From Do Kwon’s Guilty Plea to Nasdaq’s Tokenized Push

Crypto markets stayed range-bound with Bitcoin around $110K–$112K and Ethereum near $4.3K, while regulatory and legal headlines dominated sentiment:

Nasdaq moved to launch tokenized securities trading, Senate Democrats unveiled a new digital asset framework, and Do Kwon pled guilty to fraud in a Manhattan court.

In India, authorities resisted adopting a full crypto framework over systemic risk concerns, while U.S. academic voices warned that Bitcoin’s growing role could challenge the dollar’s global dominance.

Meanwhile, stocks of crypto-heavy companies slipped as investor euphoria cooled, underscoring market caution amid a tense “Red September” backdrop.

Key Macroeconomic Insights

ECB Extends China Swap, US Labor Market Softens, UK Faces Stagnation

Global economic forces are shifting again. In Europe, the ECB holds rates after inflation ticked up to 2.1% in August, with core inflation steady. Sluggish but stable growth and low unemployment reduce the urgency for cuts. The ECB also extended its €45 billion / 350 billion CNY currency swap line with China through 2028, bolstering cross-border liquidity.

In the U.S., data shows cooling momentum: a softening labor market, closely watched inflation expectations, and markets bracing for potential dovish Fed signals.

In the UK, construction remains in contraction, adding to concerns of stagnation amid high borrowing costs.

Geopolitical and trade risks, especially U.S.-China tensions, continue to cloud the outlook for inflation and global trade.

Thanks for reading!

If you enjoyed this, share with friends who might be interested—and you can also share on your socials.

Got questions or special requests? Don’t think twice—reach out! Our team’s got your back and is always here to help.

DISCLAIMER: None of this is financial advice. This newsletter is here to educate, not to tell you where to put your money. It’s not investment advice or a sales pitch—just solid info to help you think smarter. Always do your homework and research carefully!

In this post

- WHAT HAPPENED THIS WEEK

- Weekly Live Educational Webinar—Market Overview+Scalping Strategies

- Breaking News

- Technical Analysis Highlight

- Don’t Let FOMO Drain Your Crypto Gains

- Tutorial: Never Miss a Move – Get Real-Time Crypto Price Alerts on Altrady

- Macro-Economic Update

- Wallet Inflows & Outflows Weekly Report

- Economic Trends Affecting Crypto Markets

- Key Macroeconomic Insights