.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

Insider Newsletter - Fed's Rate Cut and PENGU Breaks Out, Signaling More Upside | 09-19-2025

Welcome to this week’s edition of our Insights Newsletter!

A summary of this week's highlights: Markets reacted to Powell’s first Fed cut of 2025, while PENGU surged with a cup-and-handle breakout. U.S. jobless claims dropped, signaling labor strength, as whales kept taking profits with Bitcoin outflows leading.

Regulatory momentum grew with Dogecoin and XRP ETF approvals, against a backdrop of U.S. strains, rising UK prices, and fresh stimulus in Asia.

In this week’s webinars, Ben and Roman hosted another backtesting session and managed to get a 70% win rate! They also discussed what’s expected from BTC after the big news from the Fed.

Yesterday, Ben and Raffa tested new trade setups with Altrady’s Quick Scanner, including ones that included meme coins.

And as a quick update from our side: token summary and news section are officially being retired from the Altrady app.

We decided to do that so we can pour all our energy into what you count on most: a fast, reliable, and seriously powerful trading platform. The good part is that we’ll deliver an even smoother, sharper experience built around your needs.

Thanks for rolling with us! We’re excited for what’s ahead, and we think you will be too.

WHAT HAPPENED THIS WEEK

- Weekly Webinars: Ben and Roman held their usual backtesting session, where they analyzed market structure and liquidity manipulation. Ben and Raffa led another scalping session using Altrady’s Quick Scan.

- Breaking News of the Week: Powell Slashes Rates, First Fed Cut of 2025

- Technical Analysis Highlight: PENGU Unleashes Legendary Cup-and-Handle Breakout

- Crypto Trading Strategies: Don't Fall for These 5 Crypto Traps Smart Money is Trying to Set

- Tutorial: Why Your Stop Loss Protection is Not Just for Risk But Also for Profits

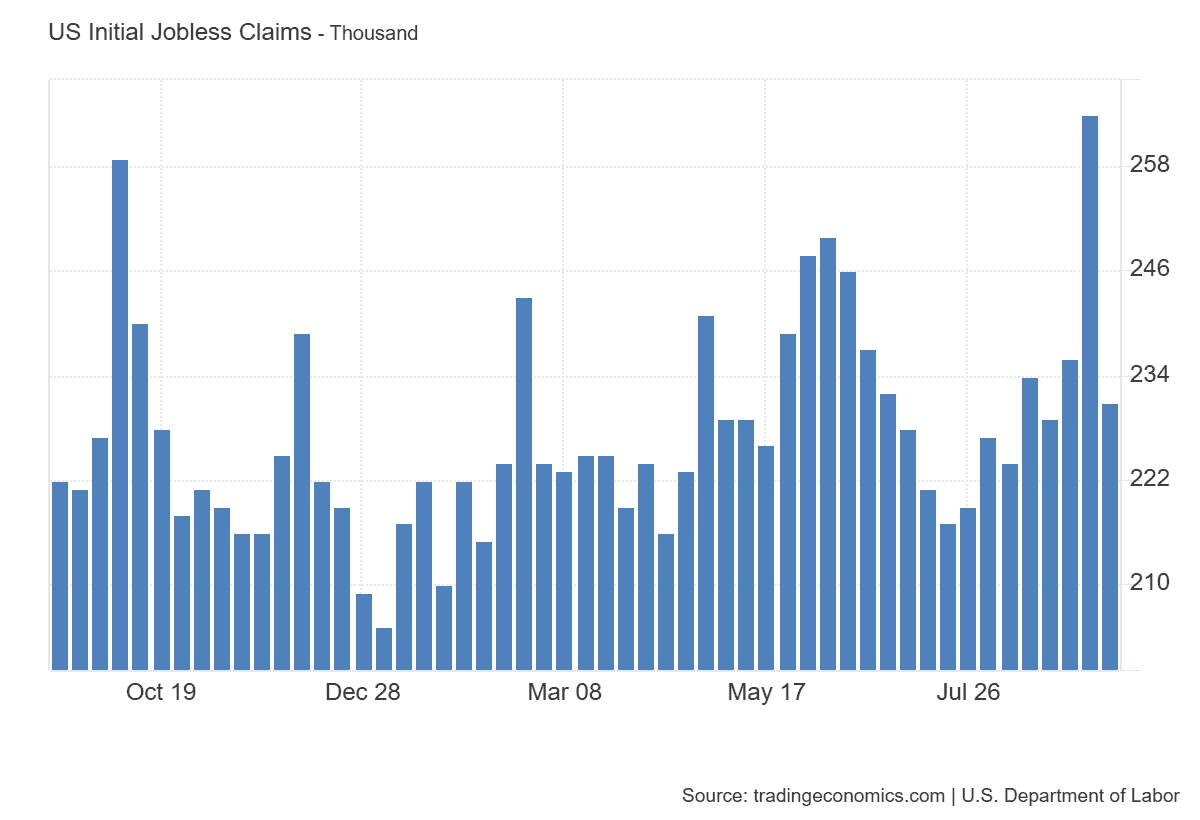

- Macro-Economic Update: U.S. Jobless Claims Dropped Sharply, Signaling Resilience in the Labor Market

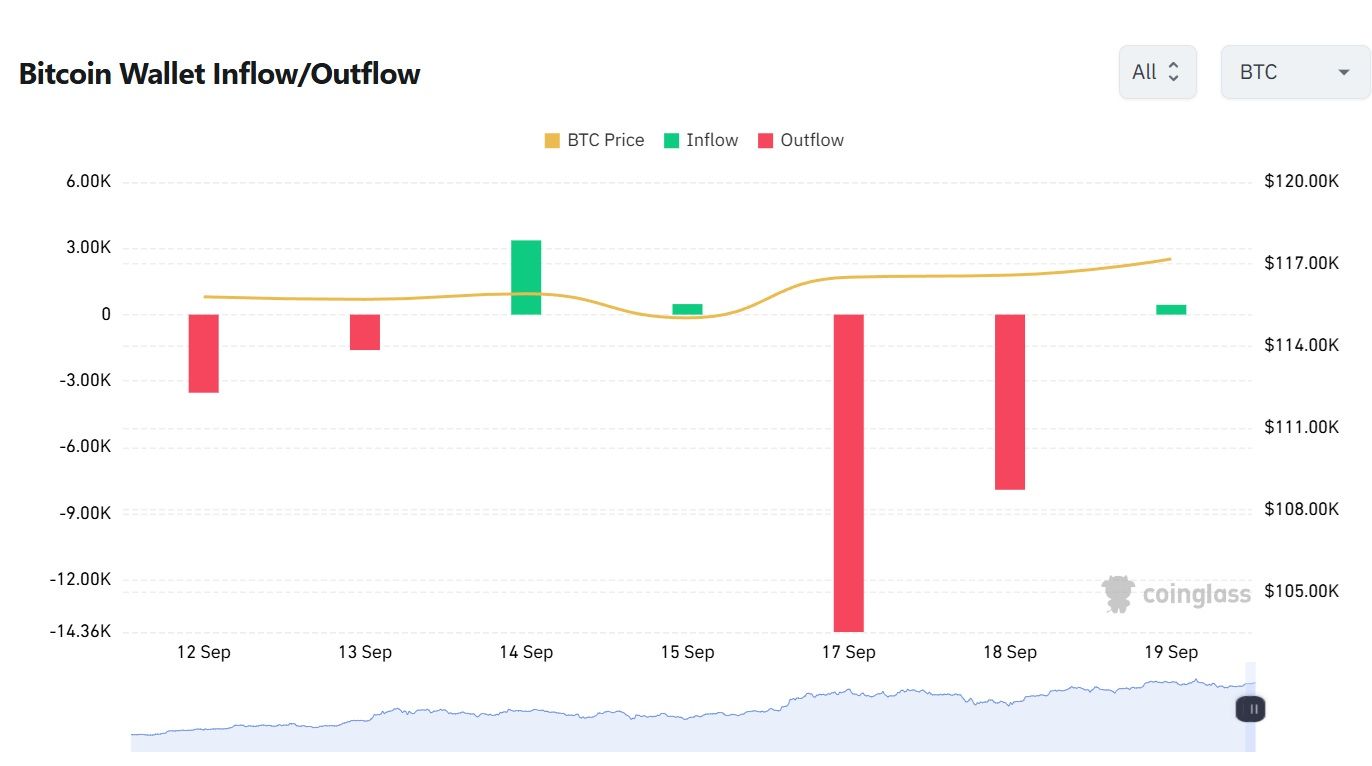

- Wallet Inflows & Outflows Report: Whales Keep Taking Profits as BTC Outpaces ETH in Outflows

- Economic Trends Affecting Crypto Markets: Regulation Shifts Spark Momentum, Dogecoin and XRP ETFs Approved

- Key Macroeconomic Insights: Strains in the US, Rising UK Prices, and Asia's Economic Stimulus

Weekly Live Educational Webinar—Backtesting, Market Overview+Scalping Strategies

During the backtesting webinar, Ben and Roman backtested Aave. The result was: a 70% win rate with a PnL of 10.3% out of 4 trades.

Catch all the details below:

On Wednesday, Ben and Roman ran another lively session, where they performed a Dollar Index breakdown and several trading scenarios. They also explained why trading before big news (like the Fed’s announcement) is risky.

You can watch the recording here 👇

In yesterday’s live scalping session, Ben and Raffa did another demonstration of the Quick Scanner, analyzing breakout opportunities, including a “Broccoli” setup.

If you’re curious to see how that looks, check the recording here 👇

Breaking News

Powell Slashes Rates, First Fed Cut of 2025

The Federal Reserve cuts rates for the first time in 2025 — lowering to 4.00%-4.25% and signaling 2 more cuts this year.

Powell says it was “the right time to act,” but markets are split on whether the Fed is moving too late.

What does this mean for Bitcoin & Crypto? Cheaper money = more liquidity.

Could this be the spark for the next rally?

👉 Leave your thoughts about this on X!

Technical Analysis Highlight

This week’s top technical analysis:

PENGU Unleashes Legendary Cup-and-Handle Breakout

PENGU is about to unlock the legendary cup-and-handle pattern — on the 1Y chart.

Rare to see so much technical perfection in a single chart.

Are the penguins about to fly?

👉 Let us know your opinions on Discord!

Smart Money’s Sneakiest Moves: 5 Crypto Traps You Must Dodge

The saying “not everything is as it seems” can be very well applied in crypto.

Behind those perfect setups may lurk traps laid by whales, exchanges, and bots designed to profit from your losses.

Our post exposes 5 advanced manipulation tactics used by smart money—and shows you how to dodge them like a pro. From fake news spikes to algorithmic stop hunts, it’s time to trade with eyes wide open.

👉 Read more about smart money manipulation.

Tutorial: Stop Loss Isn’t Just for Risk – It’s Your Profit Guardian Too

Think stop loss is only for cutting losses? Think again.

Altrady’s Stop Loss Protection lets you lock in gains while targeting multiple take profits, so even if the market turns, your profits stay safe.

🎥 In this video, we’ll show you how to use Smart Stop Loss like a pro, combine it with advanced order types, and trade confidently, even in low liquidity zones.

👉 Watch now and upgrade your exit strategy!

Macro-Economic Update

U.S. jobless claims dropped sharply last week, signaling resilience in the labor market despite Fed concerns.

Initial claims fell by 33,000 to 231,000, well below expectations of 240,000, while continuing claims dipped to 1.92 million, the lowest since May. The surge seen the week before was partly tied to fraudulent filings in Texas, suggesting labor weakness may have been overstated. Still, claims by federal workers ticked slightly higher, keeping attention on the White House’s push to trim government jobs.

Event: US Unemployment Claims

Date: 18/09/2025

Wallet Inflows & Outflows Weekly Report

Top 2 Cryptocurrencies (BTC, ETH)

Whales Keep Taking Profits as BTC Outpaces ETH in Outflows

This week is shaping up much like the last one: inflows and outflows in Bitcoin and Ethereum continue to balance each other out, ultimately leaving a slightly negative overall result.

Wallet flow volumes, however, remain lower compared to the previous week. Bitcoin still faces heavier outflows than Ethereum, which appears more evenly balanced. Large wallets persist in taking profits, signaling a cautious stance from major holders.

Economic Trends Affecting Crypto Markets

Regulation Shifts Spark Momentum, Dogecoin and XRP ETFs Approved as ETFs Expand Beyond Bitcoin

The U.S. Federal Reserve delivered its first rate cut of 2025 (25 bps), fueling hopes for further easing and sending Bitcoin up toward ~$116,000. At the same time, the SEC introduced new listing rules for spot crypto ETFs, making it much faster to launch such products, and approved the first ETF for Dogecoin and XRP, broadening the ETF universe beyond just Bitcoin and Ethereum.

In the UK, the FCA proposed exempting crypto firms from certain “consumer duty” standards under its expanded regulatory remit, while instability in EU rules, especially in France, posed risks to firms relying on cross-border “passporting” under the MiCA framework.

On price forecasts, Citi projected Ethereum’s year‐end target at $4,300, citing growing institutional demand and real‐use adoption.

Key Macroeconomic Insights

Strains in the US, Rising UK Prices, and Asia’s Economic Stimulus

The IMF flagged signs of strain in the US economy, citing moderating domestic demand and slower job growth amid elevated tariff-related inflation risks.

Across the Atlantic, the European Central Bank raised its growth outlook for the euro-area in 2025 to 1.2% (up from 0.9%), while forecasting inflation close to targets in the medium term.

And in the UK, inflation held steady at 3.8%, with food price inflation climbing sharply, pushing concerns about cost pressures at the household level.

Meanwhile, policy easing across Asian emerging markets: Indonesia, Thailand, the Philippines, and South Korea, helped lift equity sentiment, as central banks gain confidence to lower rates without spooking currencies.

Thanks for reading!

If you enjoyed this, share with friends who might be interested—and you can also share on your socials.

Got questions or special requests? Don’t think twice—reach out! Our team’s got your back and is always here to help.

DISCLAIMER: None of this is financial advice. This newsletter is here to educate, not to tell you where to put your money. It’s not investment advice or a sales pitch—just solid info to help you think smarter. Always do your homework and research carefully!