.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

Insider Newsletter - Bitcoin’s Triple Top Forms Amid Record ETF Inflows and Fed Policy Shift | 10-10-2025

Welcome to this week’s edition of our Insights Newsletter!

A summary of this week's highlights: U.S. Bitcoin ETFs recorded their second-largest inflow in history as BTC surged to a new all-time high, signaling renewed investor enthusiasm. However, technical analysis revealed a potential triple top pattern, hinting at possible near-term resistance.

On the macro front, Fed minutes suggested a dovish shift, supporting risk assets, while crypto fund flows remained positive despite a brief market pause. Broader economic trends reflected stabilizing global growth amid inflation risks and political gridlock, creating a complex backdrop for digital asset performance.

In this week’s webinars, Ben and Roman hosted another backtesting session, where they backtested ATOM, showed how to use Fibonacci retracement for confirmation, among others.

In the market overview webinar, they analyzed the DXY, Ethereum, and altcoin market, and discussed about using AI tools for trading.

Yesterday, Ben tested new setups and coins with the Quick Scanner, setting up multiple targets and showing how to avoid overhyped or risky markets.

WHAT HAPPENED THIS WEEK

- Weekly Webinars: Ben and Roman held their usual backtesting session, where they analyzed ATOM/USDT. Ben and Raffa led another scalping session using Altrady’s Quick Scan.

- Breaking News of the Week: U.S. Bitcoin ETFs Record Second-Largest Inflow in History as BTC Hits New All-Time High!

- Technical Analysis Highlight: Triple Top for Bitcoin!

- Crypto Trading Strategies: Inside the Smart Money Mindset: Why Institutions Win and Retail Folds

- Tutorial: Altrady’s Secret to Automated Position Control

- Macro-Economic Update: Fed Minutes Reveal Dovish Shift

- Wallet Inflows & Outflows Report: Positive Momentum in Crypto Fund Flows Despite Market Pause

- Economic Trends Affecting Crypto Markets: Economic Pressures and Political Gridlock Weigh on Digital Assets

- Key Macroeconomic Insights: Global Growth Stabilizes Amid Policy Uncertainty and Inflation Risks

Weekly Live Educational Webinar—Backtesting, Market Overview+Scalping Strategies

In this week’s fresh backtesting walkthrough, Ben and Roman backtested ATOM, with overall making 3 trades, and getting a 66% win rate and 4.9% PnL.

Catch all the details below 👇

On Wednesday, Ben and Roman explored the performance of the U.S. Dollar Index (DXY), Ethereum, and the broader altcoin landscape, while also delving into how artificial intelligence can enhance trading decisions.

You can watch the recording here 👇

In yesterday’s live scalping session, Ben experimented with new trading configurations and coins using the Quick Scanner, outlining multi-level target strategies and offering tips on steering clear of overly hyped or high-risk market conditions.

For this one too, you check the recording here 👇

Breaking News

U.S. Bitcoin ETFs Record Second-Largest Inflow in History as BTC Hits New All-Time High!

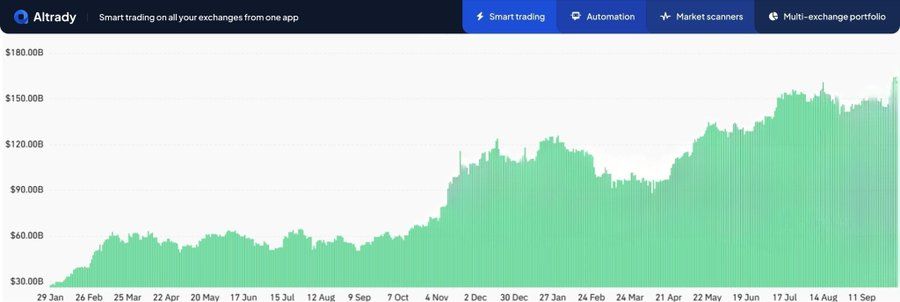

The 11 U.S. spot Bitcoin ETFs just posted $1.18 billion in net inflows on Monday, marking their second-biggest day ever, only behind Nov. 7, 2024, when Trump’s election victory ignited a $1.37B surge.

The timing couldn’t be more explosive — as Bitcoin smashed past $126,000, ETF demand roared back, pushing October inflows to $3.47B in just four trading days and total cumulative inflows near $60B since launch and a market cap over $150B.

Institutional appetite is clearly driving this bull market, while retail investors remain largely on the sidelines — for now.

👉 Leave your thoughts about this on X!

Technical Analysis Highlight

This week’s top technical analysis:

Triple Top for Bitcoin!

After an explosive start to October with over +13% gains, BTC printed new all-time highs at $126K — only to close below the key $123K resistance with a sharp -2% daily candle.

Current POC sits around $117K, a level where liquidity could be hunted before the next bullish leg ignites.

👉Let us know your opinions on Discord!

Want to Trade Crypto Like a Boss? Start with Your Mindset

Beyond charts and coins, crypto trading is a mental game. The traders who win at the game are those who think differently. While retail traders chase pumps and panic in dumps, smart money stays cool, sticks to the plan, and plays the odds.

We broke down 6 mindset hacks that separate winners from the herd, from dodging FOMO traps to mastering emotional control.

👉 [Read the full post on smart money psychology.]

Tutorial: Set It and Trade – Automate Your Crypto Entries & Exits

Imagine entering and exiting the market automatically: only when your price targets or time frames are perfectly aligned. No more missed opportunities. No more emotional trades. Just precision.

This is what Altrady’s Position Start and Expiration feature does, helping you with stress-free trading.

- Set multiple entry orders on the same coin

- Choose from Market, Limit, Stop, Trailing Stop, or Ladder orders

- Ride long-term trends while shielding yourself from short-term noise

- Use leverage to supercharge your position and maximize gains

Want to see it in action?

Watch our quick video tutorial and learn how to automate your trades in minutes.

Macro-Economic Update

Fed Minutes Reveal Dovish Shift

The Federal Reserve has just released the official minutes from its September meeting, and they’re shocking.

Nearly half of FOMC members now expect two more rate cuts by the end of 2025, signaling a clear dovish turn inside the Fed.

Markets are already reacting to the new tone. Could this ignite the next risk-on rally across stocks and crypto?

Event: FOMC Meeting Minutes

Date: 08/10/2025

Wallet Inflows & Outflows Weekly Report

Top 2 Cryptocurrencies (BTC, ETH)

Positive Momentum in Crypto Fund Flows Despite Market Pause

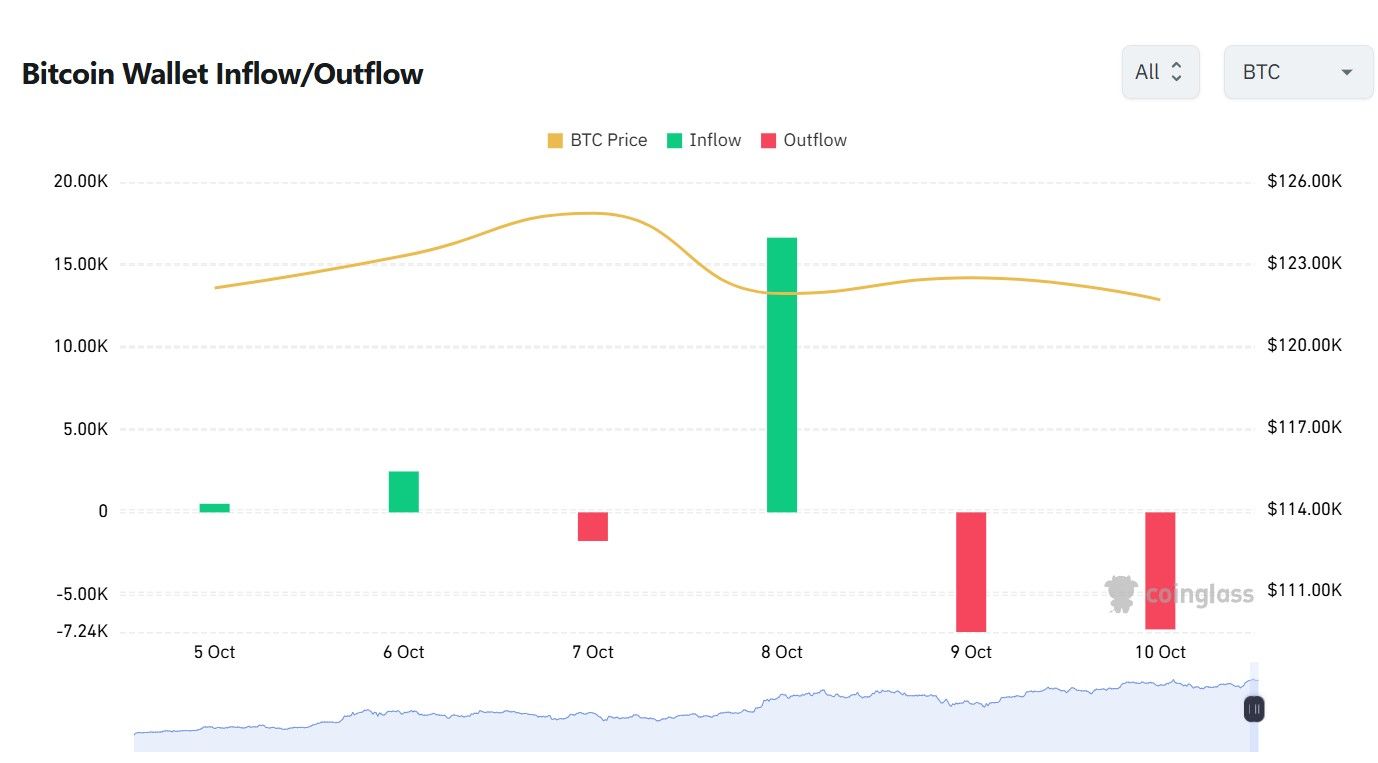

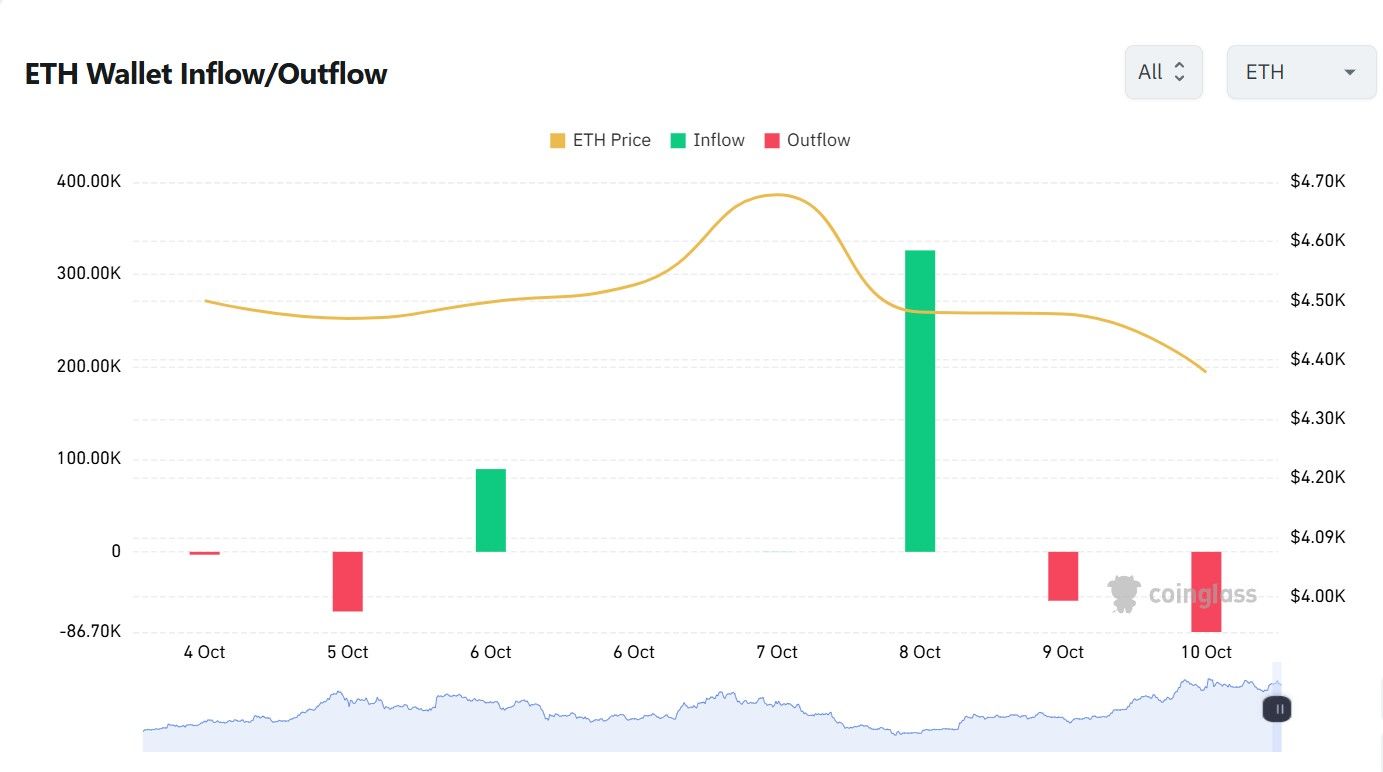

This week saw a broadly positive trend for crypto investment products, with both Bitcoin and Ethereum recording net positive inflows. Despite a temporary slowdown in market momentum, investor sentiment remains resilient.

Bitcoin continued to attract fresh capital even after reaching new highs earlier in the week. Following this rally, BTC experienced a mild pullback, returning to its average trading levels, yet maintaining a solid foundation of investor interest.

Meanwhile, Ethereum also posted positive net inflows, signaling continued confidence among institutional and retail investors alike. However, the asset’s price action remains largely range-bound, as ETH struggles to break out of its sideways consolidation phase.

Economic Trends Affecting Crypto Markets

Economic Pressures and Political Gridlock Weigh on Digital Assets

Markets were steered by macro uncertainty and geopolitical dynamics rather than fresh inflows. Bitcoin pushed past $125,000 early in the week, driven in part by safe-haven demand amid the ongoing U.S. government shutdown and a weakening dollar.

Meanwhile, broader market sentiment showed signs of emulating gold’s rally, as analysts pointed to a “FOMO meets greed” narrative across assets.

On the regulatory front, U.S. Senate crypto legislation faced renewed gridlock, with bipartisan talks stalling and the AFL-CIO publicly opposing the draft bill.

In Europe, the EU’s financial authorities signaled an expansion of oversight over exchanges and crypto firms, aiming to centralize supervision under ESMA.

Additionally, the largest fintech conference in India notably sidelined crypto topics entirely, illustrating continued global regulatory ambivalence toward digital assets.

Key Macroeconomic Insights

Global Growth Stabilizes Amid Policy Uncertainty and Inflation Risks

Global macroeconomic sentiment was shaped this week by a mix of fiscal uncertainty, central bank caution, and signs of resilience in major economies.

The U.S. government shutdown disrupted key data releases, clouding visibility on inflation and employment trends while investors weighed the impact on near-term monetary policy. In Europe, the ECB held rates steady but reiterated a cautious stance, balancing slowing growth with persistent price pressures. The eurozone Sentix index improved to –5.4 in October, hinting at gradually recovering confidence among investors.

Meanwhile, oil prices hovered near $82 per barrel amid renewed supply concerns, feeding inflationary risks and dampening risk appetite in global equities.

In Asia, China’s service-sector data showed modest expansion, supported by policy easing and infrastructure stimulus, though property-sector weakness continued to weigh on sentiment.

Overall, macro indicators suggested a fragile equilibrium—growth stabilizing, but inflation risks and policy uncertainty keep markets on alert.

Thanks for reading!

If you enjoyed this, share with friends who might be interested—and you can also share on your socials.

Got questions or special requests? Don’t think twice—reach out! Our team’s got your back and is always here to help.

DISCLAIMER: None of this is financial advice. This newsletter is here to educate, not to tell you where to put your money. It’s not investment advice or a sales pitch—just solid info to help you think smarter. Always do your homework and research carefully!