Chapters

On-Chain Trading Strategies: How to Use Whale Movements to Your Advantage

In the crypto world, big players (aka whales) can make waves that ripple through the entire market. Their massive trades can trigger price shifts, spark trends, or signal major opportunities before the broader market catches on. But instead of fearing these deep-pocketed traders, savvy investors can use whale movements to their advantage.

Analyze on-chain data, spot transaction patterns, and understand how whales position themselves, and you can gain powerful insights that help refine your own trading strategy. Whether you’re looking to ride the waves or avoid the turbulence, mastering whale tracking can give you an edge in the ever-evolving crypto landscape.

Let’s dive in!

1. Follow the Whales with Smart Tools

Use whale trackers

Platforms like Whale Alert, Lookonchain, and Telegram bots give you a heads-up when big players move crypto. These real-time alerts show when large transfers hit the blockchain—usually to or from exchanges—which can mean price action is coming.

When it comes to analytics dashboards, tools like Nansen, Arkham, and Debank go deeper. They label wallets, break down holdings, and let you see how whale portfolios shift across DeFi and tokens.

Want to get hands-on? Use block explorers like Etherscan or BTC.com to dig through wallet activity yourself. It’s slower and takes some know-how, but it’s free and unfiltered.

2. Watch What’s Happening On-Chain

Analyze exchange moves

When whales dump coins into exchanges, they’re likely prepping to sell. Big withdrawals? That usually signals accumulation or cold storage (aka long-term holding).

Keep an eye on lending, staking, and liquidity shifts in platforms like Aave, Compound, and EigenLayer. Big whale moves in DeFi often ripple into related token prices.

3. Track Token Flows and Cross-Chain Moves

Analyze accumulation vs. distribution: when whales are quietly buying during dips, that’s often a bullish long-term sign. If they’re offloading after a run-up, a pullback might be around the corner.

Take a look at cross-chain transfers: large transfers between blockchains or into cold wallets usually mean strategic repositioning. These moves can precede trades that shake up the market.

The steps you can take:

- Choose a blockchain explorer like Etherscan to track major wallets or specific addresses.

- Follow Whale Alert or Lookonchain on Twitter/X or Telegram to stay updated with live notifications.

- Leverage advanced tools such as Nansen or Arkham for in-depth wallet analysis and tracking.

- Keep an eye on DeFi platforms and centralized exchange wallets to spot significant, unusual transactions.

- Look at broader transaction trends rather than isolated movements to gain insight into whale strategies and their market influence

4. Let Whale Moves Shape Your Strategy

Dig into volume spikes & order books: sudden surges in trading volume or big orders in the book can tip you off to whale activity. If you catch it early, you can ride the wave instead of getting caught in it.

Study how prices react after big whale transactions. If they’re buying during dips, that could be your cue to start accumulating. If they’re dumping, it might be time to tighten up your stops.

Other on-chain strategies:

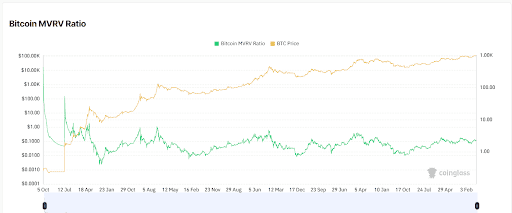

MVRV Ratio and Profitability Analysis

The Market Value to Realized Value (MVRV) ratio helps determine whether a cryptocurrency is trading above or below its fair value. A high MVRV suggests overvaluation and potential price peaks, while a low ratio signals undervaluation and possible buying opportunities.

Traders rely on these insights to optimize entry and exit points, aiming to acquire assets at lower prices and sell when they appear overvalued.

Smart Contracts and DeFi Activity Monitoring

On-chain trading involves engaging with decentralized exchanges (DEXs) and liquidity pools via smart contracts. Popular strategies include liquidity provision, yield farming, and arbitrage between platforms.

Additionally, traders keep an eye on smart contract activity to spot emerging trends or potential security risks.

Liquidity Aggregation and DEX Optimization

Decentralized aggregators enable traders to execute transactions across multiple DEXs, ensuring the best pricing and reducing slippage.

This approach is especially useful for high-volume trades or markets with scattered liquidity, improving efficiency and cost-effectiveness.

Additionally, don’t overlook the sentiment layer. Use social media and news sentiment to back up the on-chain signals. If both point the same way, there’s probably momentum behind it.

5. Don’t Skip the Risk Management

- Custom Alerts & Automation: Set up alerts for specific wallets, token sizes, or transactions. Some tools even let you automate trades based on whale triggers—just be smart with it.

- Mix with technical analysis: Whale tracking isn’t a standalone strategy. Combine it with technical analysis and smart risk controls—like stop-losses and defined profit targets.

- Stick to Liquid Markets: Low-liquidity tokens are easy for whales to manipulate. Focus on high-volume assets where price moves are more legit.

6. Real-World Whale Watching

Whales scooping up assets (buying the dip) during downturns has historically led to strong rebounds.

In terms of pre-upgrade activity, before major network changes, accumulation usually hints at bullish expectations.

Patterns like spoofing or triggering stop-losses aren’t random. Learning to recognize them can help you avoid getting shaken out.

Case Study: How Whales and Sentiment Signaled an Ethereum Rally

The Setup

Before Ethereum’s EIP-1559 upgrade, the market was divided. Some were bullish on the reduced fees and new deflationary model; others weren’t sure it would move the needle right away.

Whale Behavior

Big wallets were quietly loading up on ETH. On-chain data showed a steady accumulation, suggesting that whales were betting on long-term gains from the upgrade.

Sentiment Shift

As the upgrade date got closer, social media chatter and news coverage grew more positive. Crypto influencers highlighted the potential upside, pushing the overall tone bullish.

Investor Play

Traders tracking whale moves and sentiment saw the signs and bought in early. The logic? When whales buy and sentiment turns, momentum usually follows.

The Outcome

Ethereum’s price jumped after the upgrade. Those who positioned early rode the wave and profited from the rally.

Key Takeaways

Whale tracking serves as an early indicator rather than a definitive market predictor, so it’s best used alongside thorough research and risk management.

While many platforms provide free basic features, deeper analytics often come with a subscription. Keep an eye on emerging tools and AI-powered trackers, as the industry is evolving at a rapid pace.

Integrate these strategies so you can effectively follow on-chain whale activity and extract valuable insights into potential crypto market trends.

.svg)