Chapters

How to Track Smart Money Wallets Using On-Chain Data

Tracking smart money wallets in crypto trading is like following the footsteps of the most sophisticated investors: whales, institutions, and seasoned traders, who often have deep market insights. If you monitor their moves, you can identify trends, anticipate market shifts, and potentially uncover profitable opportunities.

But how do you track smart money wallets effectively? The answer lies in on-chain data. Unlike traditional finance, where institutional trades are often hidden, blockchain transactions are transparent and publicly accessible. With the right tools and strategies, you can analyze these transactions and make informed trading decisions.

Let’s break down the best methods to track smart money wallets and how you can use them to your advantage.

Methods to Track Smart Money Wallets

1. On-Chain Analytics Platforms

On-chain analytics platforms provide structured insights into wallet activity, helping traders identify smart money movements. Here are some of the best tools available:

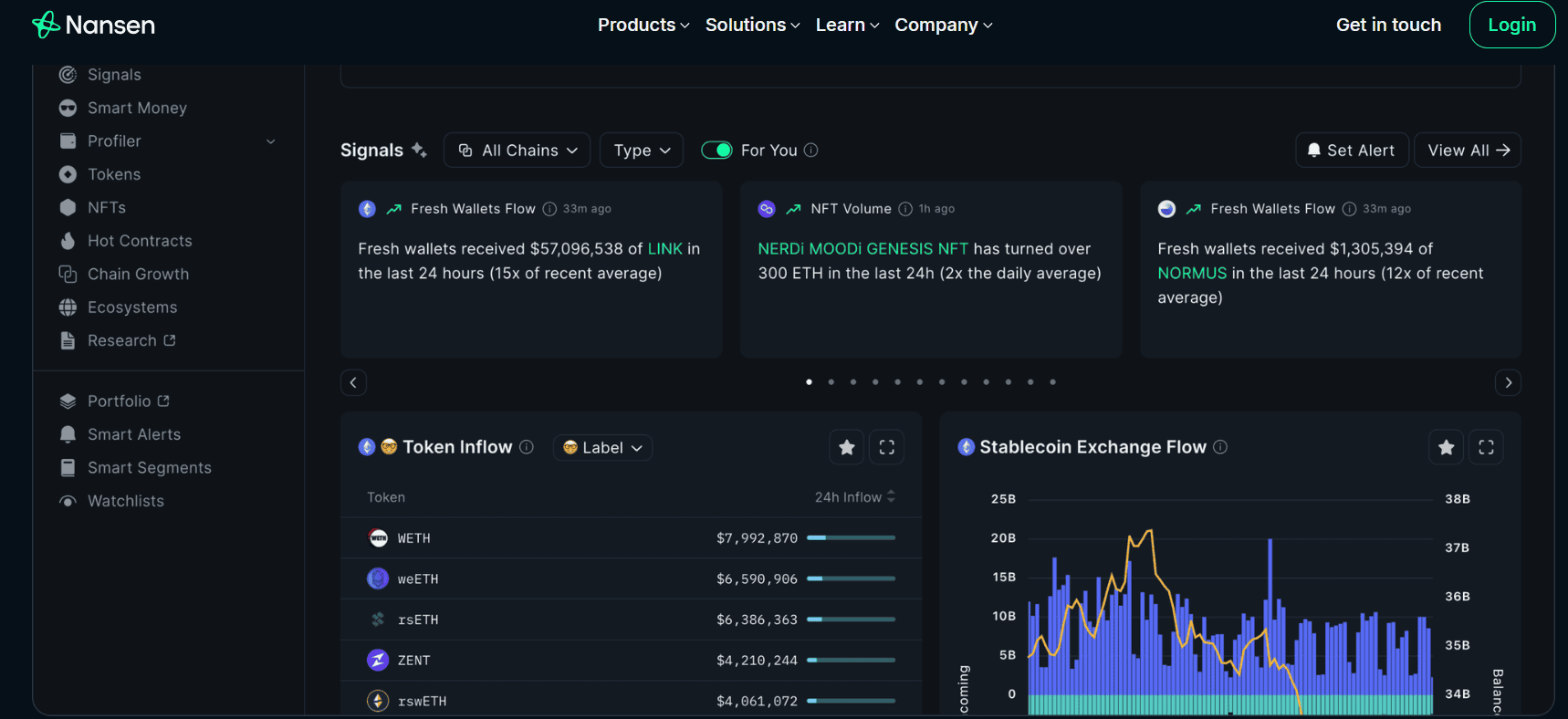

Nansen

Nansen is one of the most popular platforms for tracking smart money wallets. It labels wallets based on historical performance, allowing users to see which addresses belong to hedge funds, venture capitalists, and successful traders. Key features include:

- Smart Money Dashboards – Identify wallets with strong trading histories.

- Real-Time Alerts – Get notified when influential wallets buy or sell tokens.

- NFT Tracking – Monitor high-value NFT acquisitions by top investors.

Arkham Intelligence

Arkham Intelligence uses AI-powered analytics to tag wallets and visualize fund flows across exchanges and protocols. This tool is particularly useful for:

- Wallet Attribution – Identifying which wallets belong to major players.

- Cross-Chain Analysis – Tracking fund movements across multiple blockchains.

- Transaction Mapping – Understanding how assets move between wallets and exchanges.

Glassnode

Glassnode focuses on macro-level blockchain metrics, helping traders spot accumulation and distribution patterns. It provides:

- Exchange Inflows/Outflows – See when large amounts of crypto move in or out of exchanges.

- Whale Holdings – Track how much Bitcoin or Ethereum is held by large investors.

- Market Sentiment Indicators – Analyze trends in investor behavior.

2. Blockchain Explorers

If you prefer a hands-on approach, blockchain explorers like Etherscan and BscScan allow you to manually inspect wallet addresses. These tools provide:

- Transaction Histories – View every trade, transfer, and interaction a wallet has made.

- Token Balances – Check which assets a wallet holds.

- DeFi Interactions – See which protocols a wallet is using, such as lending platforms or liquidity pools.

If you track smart money wallets through blockchain explorers, you can gain direct insights into their trading strategies without relying on third-party analytics.

3. Portfolio Trackers

Portfolio tracking tools help traders monitor multiple wallets and assets across different blockchains. These platforms are useful for keeping an eye on smart money movements in real time.

Zerion

Zerion aggregates multi-chain wallet data, including DeFi positions and NFTs. It offers:

- Real-Time Alerts – Get notified when tracked wallets make significant moves.

- Multi-Chain Support – Monitor wallets across Ethereum, Polygon, and other networks.

- DeFi Portfolio Management – See how smart money is interacting with lending and staking protocols.

CoinStats

CoinStats combines portfolio tracking with tax reporting and asset management. Key features include:

- Exchange and Wallet Integration – Track assets across multiple platforms.

- Smart Money Insights – Identify trends in institutional holdings.

- Built-In Wallet – Manage assets directly from the app.

4. Whale Activity Alerts

Whale movements can significantly impact the market. Large transactions—especially when funds move to or from exchanges—often signal upcoming price volatility.

Whale Alert

Whale Alert monitors large crypto transactions and provides real-time notifications. It tracks:

- Bitcoin and Ethereum Transfers – See when large amounts move between wallets and exchanges.

- Stablecoin Movements – Identify liquidity shifts in USDT, USDC, and other stablecoins.

Market Impact Analysis – Understand how whale trades affect price action.

Lookonchain

Lookonchain specializes in tracking high-impact trades and wallet interactions. It frequently shares insights on Twitter/X, highlighting:

- Profitable Trades – Identifying wallets that consistently make successful moves.

- Token Accumulation – Spotting when whales are buying into specific assets.

- DeFi Strategies – Analyzing how smart money interacts with lending and staking protocols.

5. Social Media and Sentiment Analysis

While on-chain data is crucial, social media can provide additional context. Many smart money traders share insights on platforms like Twitter and Discord. Following key influencers and analysts can help you:

- Identify Emerging Trends – Spot new tokens or protocols gaining traction.

- Understand Market Sentiment – Gauge whether investors are bullish or bearish.

- Verify On-Chain Data – Cross-check wallet activity with expert opinions.

Key Tools Comparison

Tool |

Features |

Use Case |

| Nansen | Smart Money dashboards, real-time alerts | Institutional wallet tracking |

| Arkham | Wallet attribution, cross-chain analysis | Fund flow visualization |

| Zerion | Multi-chain DeFi/NFT tracking, alerts | Portfolio management |

| Glassnode | Exchange metrics, whale holdings | Market sentiment analysis |

Precautions When Tracking Smart Money

While tracking smart money wallets can provide valuable insights, it’s important to approach this strategy with caution. Here are some key considerations:

Avoid blind copying

Just because a smart money wallet makes a move doesn’t mean it’s the right trade for you. Institutional investors often have different risk tolerances and strategies compared to retail traders.

Cross-verify signals

On-chain data should be combined with technical analysis and broader market trends. A single wallet’s activity may not always indicate a reliable trading signal.

Monitor multiple wallets

Instead of focusing on individual addresses, look for clusters of activity. If multiple smart money wallets are accumulating the same asset, it’s a stronger signal than just one wallet making a trade.

Key Takeaways

Tracking smart money wallets using on-chain data is a powerful strategy for crypto traders. By leveraging analytics platforms, blockchain explorers, portfolio trackers, and whale alerts, you can gain valuable insights into market movements.

However, always remember to approach this data critically; smart money doesn’t always get it right, and blindly following large investors can be risky. Use these tools as part of a broader trading strategy, combining them with technical analysis and market research to make informed decisions.

.svg)