.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

Altrady, The Leading MEXC Alternative for Advanced Crypto Traders

Enthusiasts new to the trading field may experience excitement as they explore specialized platforms that offer automation, copy trading, and bot implementation, among other features.

Cryptocurrency exchanges perform a crucial role by offering a platform for the purchase and sale of digital currencies with various blockchain-related products.

MEXC stands out as one of the most regarded exchanges among the numerous crypto trading platforms available. However, there are alternatives.

Within the most popular exchanges, we find the following alternatives:

- Binance

- Kucoin

- ByBit

- MEXC

Most of them provide trading terminals, but instead of going into what each platform is better to trade, let's take a closer look at Altrady as an alternative trading platform strictly optimized for cryptocurrencies that goes beyond a marketplace since it focuses on trading performance.

All-in-one and Muti-Exchange Crypto Solution: Altrady

Altrady emerges as an exemplary all-in-one crypto trading platform, combining a wide array of features that cater to both novice and seasoned traders.

The phrase "all-in-one" may sound appealing for those with more advanced expertise who are in search of a multi-exchange integration that allows for seamless management of multiple wallets from a single interface.

Altray not only encompasses the functions mentioned above but also addresses the sophisticated requirements of experienced users. Moreover, this platform provides a comprehensive trading terminal that rivals the initial trading experiences of most beginners when engaging with exchanges directly for cryptocurrency transactions.

Similarly, more adept traders will discover an extensive suite of tools that enable them to approach their crypto trading as a legitimate financial enterprise, effectively managing risks and rewards to withstand market challenges and achieve sustained success over the mid to long term.

Equipping diverse tools with advanced features for day trading, swing trading, scalping, and long-term portfolio management, we can summarize Altrady's proposal into four key elements.

Advanced Automation

Altrady offers a comprehensive suite of automated trading solutions, encompassing quantitative market analysis and algorithmic trade execution, while ensuring position protection through predefined stop-loss and take-profit orders.

Paper Trading

Easy and potent, paper trading allows traders to test new trading strategies while conquering the application of current ones. Altrady focuses on providing a risk-free environment where to learn and gain experience.

Short-term and Mid-term Trading

The platform acknowledges the significance of day trading for achieving consistent profits and provides a streamlined terminal for intraday strategies. Additionally, swing traders can easily identify mid-term trading opportunities through seamless options.

Long-term Investment and Portfolio Management

Experienced users can leverage the Portfolio Manager to develop investing strategies while connecting several exchange accounts and managing sub accounts simultaneously. This tool makes the integration of multiple exchange accounts easy and simultaneous, assessing the performance value across asset distributions and providing analytical insights regarding the overall growth and health of the entire portfolio. This capability allows them to create tailored management solutions for their clients.

Altrady's Features for Crypto Trading Styles

Day trading represents a market strategy that this platform recognizes as vital for traders. Altrady has developed a trading terminal designed to enhance the trading experience by offering various tools for managing position sizes, selecting from multiple order types, and utilizing technical indicators through its integration with Tradingview.

The mid-term strategies, including swing trading and, more specifically, various investor profiles, are closely aligned with the pursuit of an efficient feature such as the Portfolio Manager.

For Day Trading

We can highlight the following features for day trading:

- Real-time positions PNL and order book.

- Signal Bot and Grid Bot trading.

- Watchlists and alerts.

- Tradingview charting tools and indicators.

For Mid-Term and Long-Term

We can highlight the following features for the long term:

- Portfolio manager powered by advanced analytics.

- Multi-chart analysis.

- DCA Bot Trading.

- Multi-exchange connection and sub-accounts management.

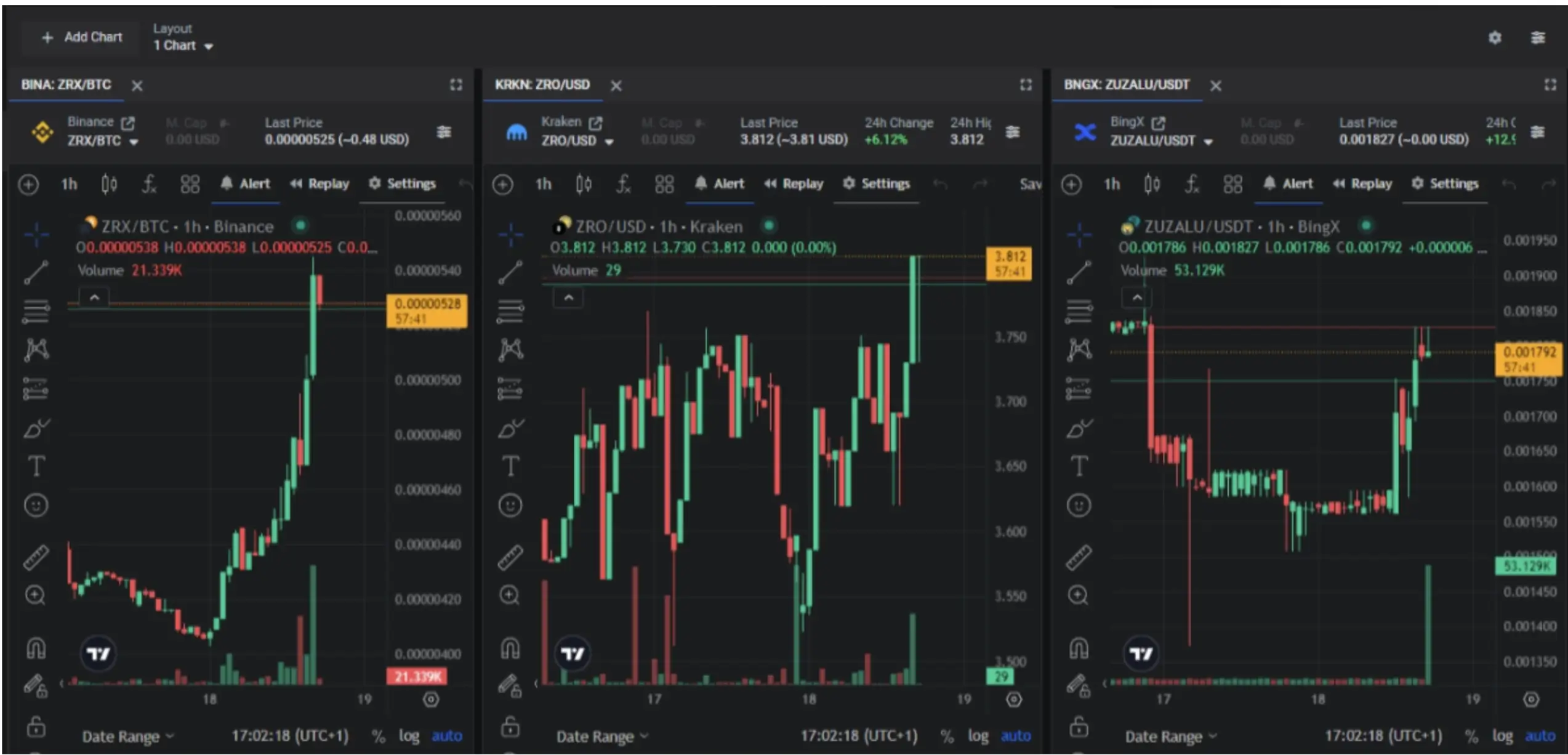

Multi-Chart Analysis

The ability to monitor market fluctuations across a range of assets is an essential skill for traders, especially those employing intraday strategies. The Altrady terminal streamlines multi-chart analysis, which enhances traders' responsiveness to price variations among different assets.

Additionally, this capability enables traders to discover correlations and inconsistencies in the broader market dynamics, thereby aiding in the refinement of strategies that leverage confluences and techniques such as arbitrage or spread trading.

Smart Trading

In summary, Smart Trading allows the following:

- Establishing several take-profit orders with a trailing mechanism.

- Implementing stop-loss orders equipped with features like Cooldown to mitigate common stop-hunt wick movements.

- Incorporating Protection to minimize risks by automatically adjusting a stop-loss order in line with a position as it continues to yield profits.

- Automatically determining the appropriate position size based on a specified risk percentage.

Broader Prospects with Altrady

From professional trading charts to standard functions, using an all-in-one platform, such as Altrady, brings countless advantages:

- Quick Scanner designed for Fat Finger strategies and scalping.

- Crypto Base Scanner (CBS) that identifies market bases and seizes opportunities on subsequent price bounces.

- Signal Bot that allows automated trading by opening trades based on algorithms with signals from the CBS.

- QFL Signal is based on the Quick Finger Luc strategy. It employs the signal bot to automate market entries with a likelihood of potential bounces.

Bot Automation and Algorithms

Altrady is making strides in this area as well. Traders can set up automated strategies by configuring entry and exit points.

Essentially, this involves establishing a bot that fetches signals from an algorithm that analyzes crypto markets daily.

Other features related to this functionality include:

- Real-time updates to track the progress of automated trades and allow for necessary adjustments.

- Performance analytics.

- Support for webhooks and TradingView.

Education with Altrady

Altrady not only offers the features mentioned above but also includes a comprehensive library dedicated to a range of educational subjects. Additionally, it maintains an active blog that discusses technical indicators, fundamental analysis, strategies, and market forecasts.

Conclusion

It is crucial for investors to concentrate on tools specifically designed for trading, strategy testing, automated model development, and the implementation of trading systems. This approach is increasingly necessary in the face of the dynamic changes occurring within the cryptocurrency exchanges and the overall sector.

Altrady is a crypto trading platform with multi-exchange integration features where beginners and professional investors manage assets across multiple accounts simultaneously, seizing algorithmic, automation, and bot functionalities. Sign up for a free trial account today.