.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

Spot Trading Basics: Mastering the Core of Crypto Investment

Cryptocurrency trading leans on different methods to participate in the market: first, you could buy and hold; second, you could speculate; third, you may want to predict the asset prices. Among these approaches, one figures as the basis for all the other, and that is spot trading.

Typically, spot trading is the primary process beginner crypto traders use to invest safely. Why? Discover it through this guide, which delves into the basics of crypto spot trading, its advantages and disadvantages, and how it works.

What is Spot Trading

Spot trading is the most straightforward method for participating in financial markets. This trading type is where transactions occur instantly, ensuring the immediate exchange between buyers and sellers, as follows:

- When a market participant on the buy side places an order, the participant expects to receive the financial instrument once the order matches a seller’s ask.

- Conversely, participants in the sell-side expect to be accredited promptly once their orders match a buyer’s bid.

It may seem at first sight that spot trading does not bear further intricacies beyond purchasing and selling an asset at a specific price. However, it revolves around critical investment concepts and crucial mechanisms that help grasp how the spot market works. Moreover, those mechanisms set the basis for other trading types (e.g., derivatives trading).

Spot trading is, above all, a mid-term to long-term approach. It caters to seasonal investors more than speculative traders. More often than not, spot market participants buy, hold, and accumulate assets based on fundamentals. In the crypto sphere, for example, the term HODL advocates for staying optimistic in long-term market growth even when it dips heavily.

Understanding The Crypto Spot Market: How it Works

Accessing the spot market for digital currencies is granted by cryptocurrency exchanges, platforms structured to process quoted transactions between buyers and sellers. Exchanges act as custodians of the traded digital currencies, meaning they are responsible for delivering the assets to buyers and crediting sellers.

The infrastructure to carry out such a task consists of the following:

- Order book: Aggregates all the orders spread across the bid and ask. It shows the quantity and price at which market participants are trading, matching the highest price buyers are willing to pay with the lowest price sellers offer to offload, birthing out the spot price.

- Limit order: This is the order type traders send to the market at a specific price and quantity. It remains in the order book till a counterparty order fills the bid or the ask.

- Market order: This order executes a trade immediately, regardless of the spot price. Typically, traders use it to enter a position quickly. Given such a characteristic, this order type does not remain on the order book.

What is Spot Price

The spot price of a crypto asset is the current quotation at which market participants can purchase or sell the underlying digital instrument. This price responds to existing bids and asks, providing a real-time market valuation.

The spot price differs from other forms of calculating an asset valuation, such as derivatives trading, which considers additional matters based on future prices.

What are Spot Rate and Forward Rate?

The first is the exchange rate for immediate transactions based on current market conditions, while the second settles a value for a future date according to market expectations.

The spot rate is for quick conversions at specific moments. For example, Binance allows you to exchange crypto pairs using its conversion feature. This way, users interact with the spot market since conversions depend on the spot rate.

Advantages

- Current asset valuation: This market trades on the spot, meaning traders can access real-time pricing, which helps make market analysis for effective asset management.

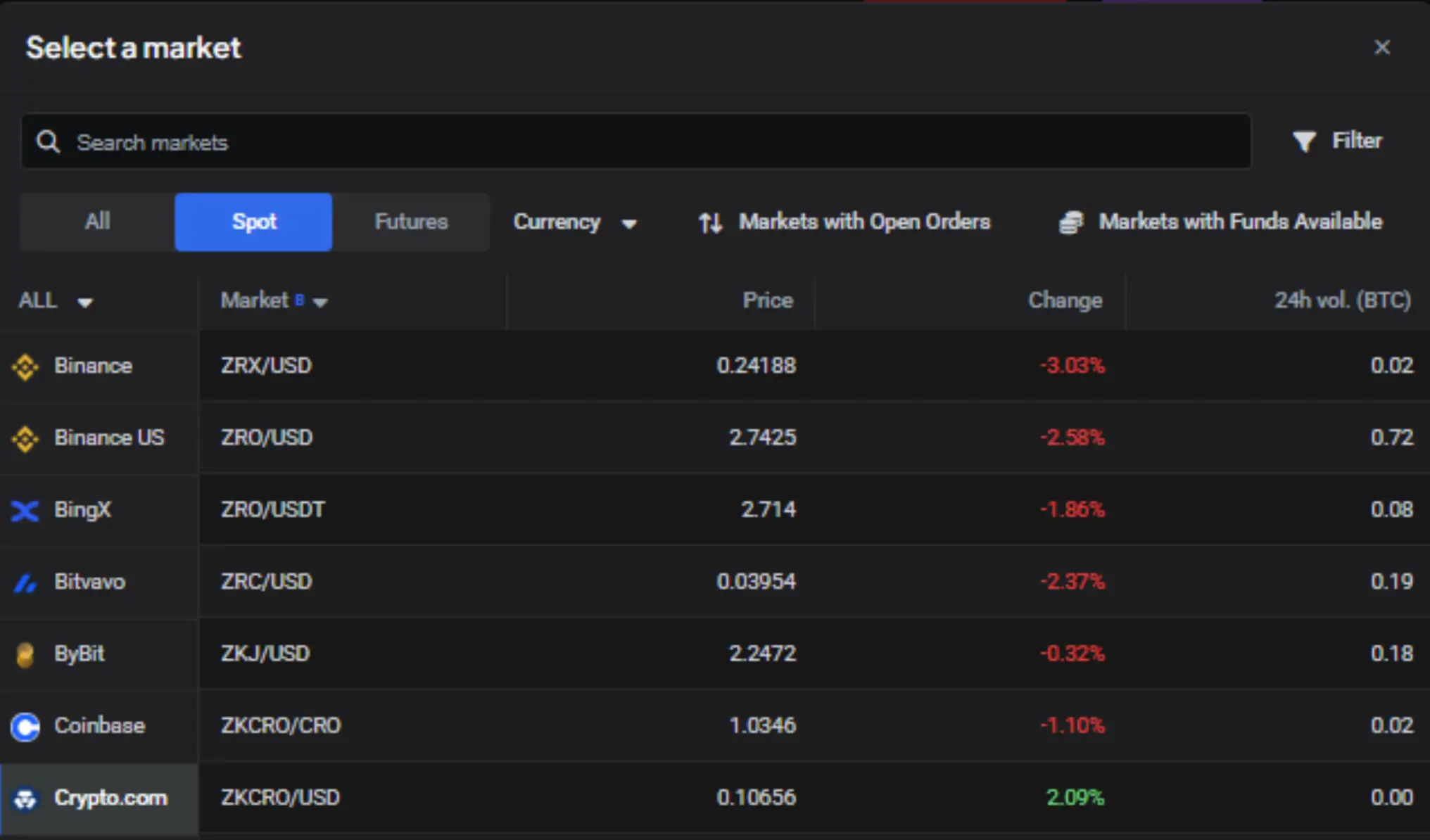

- Portfolio building and diversification: The spot market is the preferred way to trade and reallocate investments over time while diversifying across a broad range of assets. Crypto trading platforms like Altrady allow investors to manage portfolios across multiple spot markets offered by different exchanges.

- Safer than margin trading: The risks involved in spot trading are proportional to the precise capital amount allocated in a determined cryptocurrency or digital asset since it does not allow leverage or borrowing.

Disadvantages

- Limited strategies: Spot market strategies are limited to holding, buying low and selling high, differing from other markets, such as derivatives, which allow short-selling or hedging.

- Limited Profitability: Spot trading limits profits since it does not leverage trades. However, this is what makes it a less risky investment method.

Read: Crypto Trading Platforms with Leverage: What You Need to Know

Proper Risk Management for Profitable Spot Trading

Despite the appealing simplicity shown by this trading type, it is noteworthy to recognize the potential complexities involved. Given that buying and selling in the spot market implies an investment, thriving in such activity requires mastering other skills, such as the following:

- Market analysis: This process addresses two critical concerns about when and why. Technical analysis concepts, like price action and supply and demand, help determine when to buy and sell, meaning discovering the best spot prices according to every trading strategy and market condition. Fundamental analysis solves why an asset is worth holding amid potential volatility and setbacks it could suffer.

- Position management: Refers to setting the bounds at which an investor is willing to reinvest (accumulating more units of an asset) or entirely offload a trade. Technically speaking, a trade position leans on stop-loss and take-profit orders as protection to harvest either losses or profits, respectively. Depending on the market analysis, investors might enter a trade again after a loss or use the profits to increase the position size, buying at lower prices. The DCA strategy is highly popular for accomplishing such a goal dynamically and automatically.

Learn more about risk management with Altrady Trading Library.

Conclusion

Through spot trading, investors can directly acquire crypto assets. Limit or market orders are suitable depending on the prices and immediacy of the investment. The spot market reflects current supply and demand and transparent asset valuation, allowing traders to build portfolios. Nevertheless, the profits and strategies are limited.

Exchanges grant access to spot markets, while alternative crypto trading platforms, such as Altrady, offer access to multiple exchanges simultaneously. When you seize a free trial account, you also gain access to paper trading to practice spot trading without risks powered by position management features that most exchanges do not offer