.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

Insider Newsletter - Your source for all things crypto | 03-07-2025

A summary of this week's highlights: Solana price went down 20%, and Trump reveals what seems to be a Bitcoin Reserve launch.

As for our weekly webinars, this week, we dove into market structure and chart patterns—how to correctly identify them and implement them into your strategy.

Catch all the details below!

WHAT HAPPENED THIS WEEK

- Weekly Webinars: Live educational webinar with Ben & Cata, sharing valuable tips on correctly identifying chart patterns+our Smart Money webinar focused on market structure

- Breaking News of the week to keep an eye on: Trump Confirms Bitcoin, Ethereum, Solana, Cardano & Ripple in U.S. Crypto Reserve!

- Technical Analysis Highlight: Solana Crashes 20% as Bullish Momentum Fades, Market Cap Sinks Below $70B Amid Heavy Sell-Off!

- Crypto Trading Tools – Crypto Trading Platforms with Leverage – What You Should Know about Them

- Tutorial: Keep Track of Real Time Crypto Prices with Watchlists

- Macro-Economic Update: ECB Cuts Interest Rates by 25bps, Eases Borrowing Costs Amid Slowing Growth!

- Wallet Inflows & Outflows Report: Massive Crypto Money Flows: Bitcoin & Ethereum Gearing Up for a Big Move!

- Economic Trends Affecting Crypto Markets: Trump Backs a U.S. Crypto Reserve, Reshaping Bitcoin’s Future and Market Dynamics

- Key Macroeconomic Insights: China’s Tariff Restraint, Japan’s Export Boom, and the Quantum Computing Race

- Quiz Winners - Plus, a new type of quiz game coming your way soon

Weekly Live Educational Webinars—Market Structure+How to Use and Identify Chart Patterns

In this week’s Smart Money webinar series, Ben and Roman showed how to use market structure to find strong trade opportunities (chart and graph examples included). Plus, they revealed common errors traders make when analyzing market structure.

In case you missed it, you can watch the recording here 👇

Yesterday, Ben & Cata took a deep dive into the most common and powerful chart patterns, how to confirm breakouts, and how to avoid false signals.

For this one too, you can watch the recording here 👇

Trump Confirms Bitcoin, Ethereum, Solana, Cardano & Ripple in U.S. Crypto Reserve—Market Surges!

Markets were expecting an official announcement on March 7 during the Crypto Task Force meeting. Instead, Donald Trump has just dropped a bombshell on Truth Social: the U.S. will establish strategic crypto reserves, including Ripple (XRP), Solana (SOL), and Cardano (ADA), alongside Bitcoin and Ethereum.

The market reaction was immediate:

📈 $ADA +72%

📈 $XRP +34%

📈 $SOL +24%

📈 $BTC +9.58%

📈 $ETH +9.7%

The crypto space is on fire!

You can leave your thoughts on the potential outcome on X!

Technical Analysis Highlight

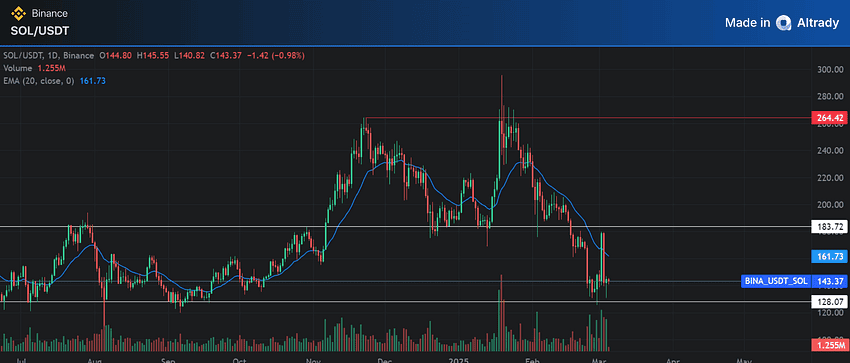

SOLANA UNDER PRESSURE!

$SOL fails to sustain its bullish momentum and plunges 20%, dragging its market cap below $70B as selling pressure intensifies! 📉🔥

The sharp drop comes after SOL’s rally to $178, fueled by its addition to the U.S. strategic crypto reserve. However, momentum quickly faded, leading to a deep correction back into the previous trading range.

🔍 Technical indicators suggest SOL remains in a weak bearish-lateral phase—without a shift in market sentiment, major rebounds seem unlikely.

Are you buying the dip or staying out? 🤔

Let us know your opinions on Discord!

Trading Platforms with Leverage – What You Should Know

Leverage in crypto trading is like a double-edged sword—exciting and dangerous in equal measure. You borrow capital, so you can supercharge your potential gains (from a modest 2x boost to a jaw-dropping 100x), but you’re also signing up for amplified risks.

The perks of relying on these platforms? Bigger profit potential, greater market access, and more strategic flexibility. The downsides? Increased exposure to market swings and the occasional inability to close your positions due to technical issues.

👉 Find out more about crypto trading platforms with leverage.

Tutorial: Keep Track of Real Time Crypto Prices with Altrady’s Watchlists

Smart trading isn’t just about luck—it’s about being organized and proactive. A well-crafted watchlist keeps you locked in on Bitcoin, Ethereum, or that hidden gem you’ve been stalking.

With Altrady, you can track real-time price movements, follow market trends, and catch opportunities before they slip away.

Want to see how it’s done?

Watch our tutorial and level up your trading game.

Macro-Economic Update

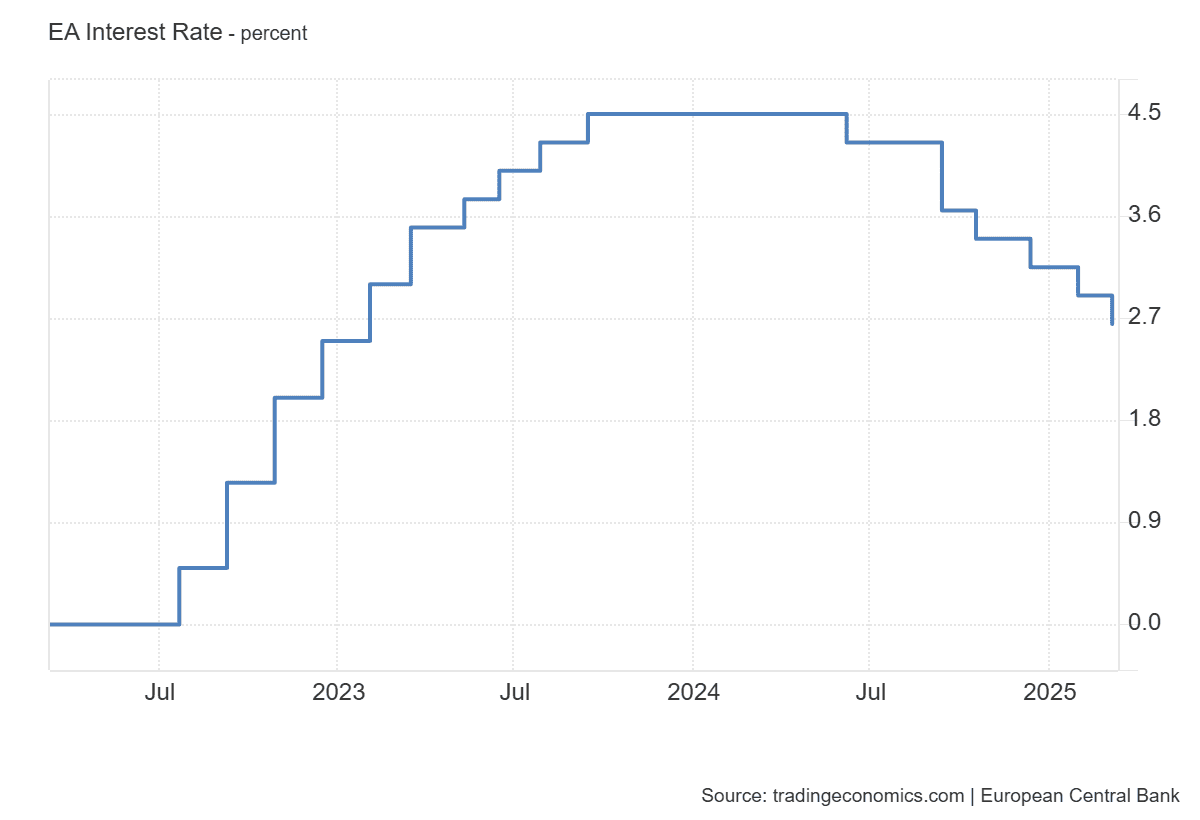

ECB Cuts Rates by 25bps – What It Means for Crypto!

The ECB lowered interest rates as expected, cutting the deposit rate to 2.50% and easing borrowing costs. While inflation is gradually declining, economic growth remains weak, with GDP forecasts downgraded for 2025-2026.

Why This Matters:

- Cheaper liquidity – Lower rates can boost risk appetite, potentially fueling capital inflows into Bitcoin and altcoins.

- Sluggish economy – Weak growth could limit investor confidence, tempering a full risk-on rally.

ECB’s next move? Markets will watch for further easing signals, which could impact crypto’s trajectory.

Event: Main Refinancing Rate

Date: 06/03/2025

Wallet Inflows & Outflows Weekly Report

Top 2 Cryptocurrencies (BTC, ETH)

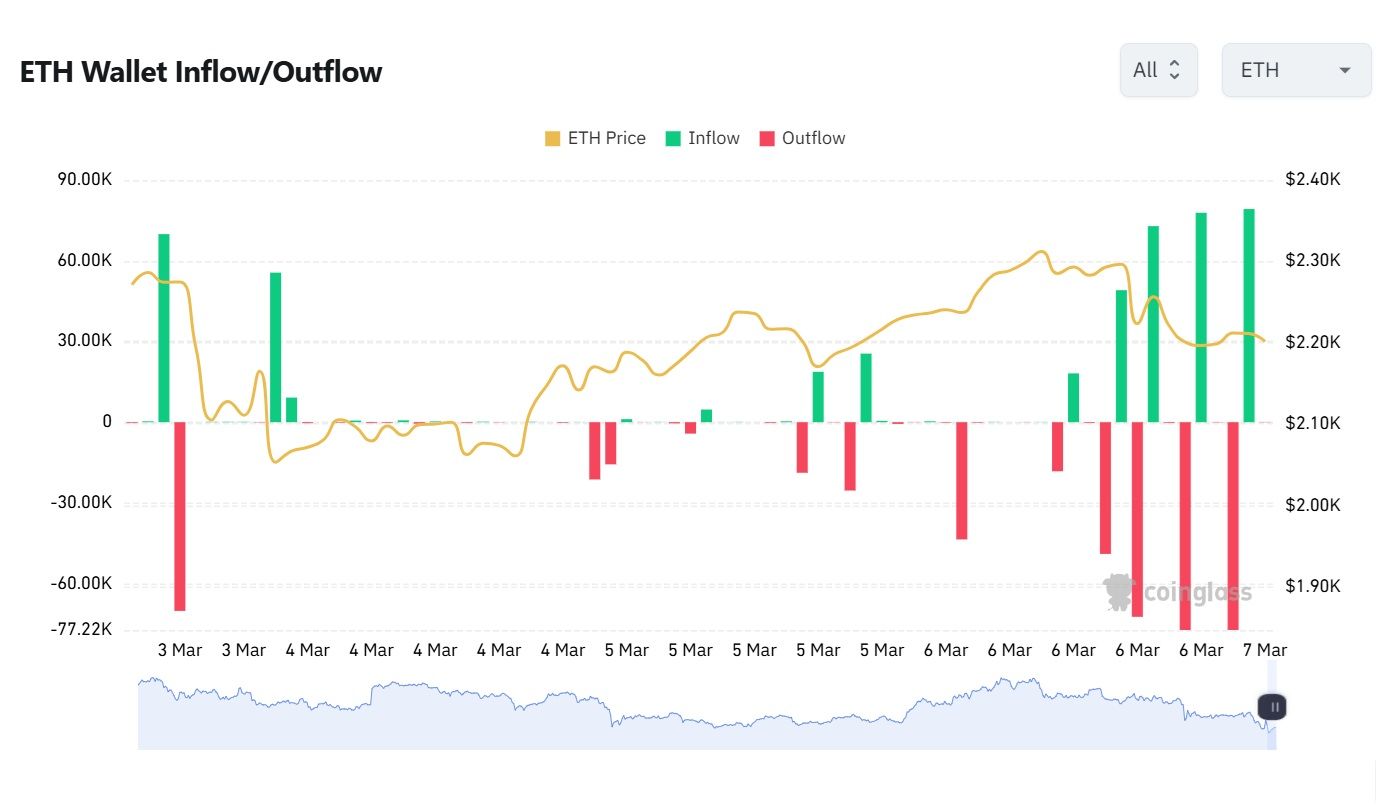

Massive Crypto Money Weekly Flows: Bitcoin & Ethereum Gearing Up for a Big Move!

This week saw high trading volumes for both Bitcoin (BTC) and Ethereum (ETH), with significant inflows and outflows balancing each other out. Such large capital movements suggest that investors are actively reallocating their portfolios, a potential signal of upcoming volatility in the market.

Key Data Insights:

- Bitcoin (BTC) – Strong inflows matched by outflows indicate institutional repositioning, possibly ahead of a major price move.

- Ethereum (ETH) – Similar balance in inflows and outflows suggests strategic accumulation or distribution, which could soon impact ETH’s price trajectory.

Economic Trends Affecting Crypto Markets

Trump’s Crypto Reserve Push & the US GDP Equation

Bitcoin surged after Trump voiced support for a federal “strategic crypto reserve”, sparking speculation about government-backed crypto holdings. If the U.S. were to invest in Bitcoin, the asset’s long-held independence from government influence—and its role as a hedge against fiat devaluation—could shift dramatically.

This move could also reshape financial markets, linking Bitcoin more closely to traditional economic policy and monetary decisions. Would this increase institutional confidence or undermine crypto’s decentralized appeal?

Meanwhile, U.S. GDP figures remain under scrutiny, with economic calculations increasingly politicized. These macro trends unfold what could dictate Bitcoin’s trajectory in the coming months.

Key Macroeconomic Insights

China’s Cautious Tariff Response & the Rise of Quantum Computing

China’s reaction to the latest U.S. tariff threats has been surprisingly restrained, with only limited new restrictions on select American goods. Facing economic headwinds, China is avoiding a full-scale trade escalation that could further strain its economy.

Beyond tariffs, quantum computing is emerging as a new battleground in the U.S.-China rivalry. With both nations racing to dominate this next-gen technology, the stakes extend far beyond trade—shaping the future of cybersecurity, finance, and global power.

Japan’s Economy Surges on Strong Exports

Japan’s economy expanded 2.8% annually in Q4 2024, marking the third consecutive quarter of strong growth. This export-driven expansion is a welcome rebound after previous contractions, reinforcing Japan’s resilience in global trade.

Quiz Winners

Congratulations to our top Altrady Quiz Challenge participants! 🎉

Here are this week’s top scorers:

🏆 1st Place: Roderikk with 106,646 points – Claiming 50 USDT! 💰

🥈 2nd Place: Dipupo with 106,144 points – Winning 30 USDT! 🎉

🥉 3rd Place: Milo with 102,764 points – Taking home 20 USDT!

FYI, this will be our final quiz for a while—but don’t worry, we’re not leaving you hanging!

We’re rolling out a brand-new Puzzles Feature to bring you even more interactive challenges.

👉Check out the details here.

Stay tuned—things are about to get even more exciting!

Thanks for reading!

If you enjoyed this, share with friends who might be interested—and you can also share on your socials.

Got questions or special requests? Don’t think twice—reach out! Our team’s got your back and is always here to help.

DISCLAIMER: None of this is financial advice. This newsletter is here to educate, not to tell you where to put your money. It’s not investment advice or a sales pitch—just solid info to help you think smarter. Always do your homework and research carefully!