Category List

Featured List

Insider Newsletter - Markets Soar due to Tech Tariffs Timeout

Welcome to this week’s edition of our Insights Newsletter!

A summary of this week's highlights: markets surged this week as tech tariffs were temporarily suspended, fueling broad investor optimism. Crypto felt the impact too, with Bitcoin and Ethereum seeing inflows not recorded in months. In this issue, we break down the key trends and what they signal for the weeks ahead.

As for our weekly webinars, Ben and Roman explored the smart money trading concept while analyzing the DOT/USDT market and discussing significant fair value gaps.

Plus, we have an important announcement: we’re heading to Consensus in Toronto on May 15th for our first-ever in-person workshop: The Better Traders Summit!

We’re teaming up with Aaron Dishner from The Better Traders to bring you a hands-on session packed with real trading strategies, automation tips, and powerful tools, including how to level up your trading with Altrady.

If you want to join, you can get early bird tickets from here.

WHAT HAPPENED THIS WEEK

- Weekly Webinars: Live educational webinar with Ben & Roman centered around the DOT/USDT market, analyzing market trends and potential trading strategies.

- Breaking News of the Week: Bitcoin Now Top 5 Asset Globally!

- Technical Analysis Highlight: Bitcoin Surged Past Our Target

- Crypto Paper Trading: A Beginner’s Guide to Options Paper Trading

- Tutorial: How to Build Reliable Crypto Signals with TradingView

- Macro-Economic Update: U.S. Manufacturing Shows Modest Growth, But Storm Clouds Loom

- Wallet Inflows & Outflows Report: Explosive Week for Bitcoin & Ethereum Inflows – Big Money Is Back

- Economic Trends Affecting Crypto Markets: Trump, Wall Street & a $900M Crypto Bet – What Just Shook the Market

- Key Macroeconomic Insights: Crypto Surges as Global Trade Tensions Ease, China Beats GDP Expectations, and Japan–U.S. Trade Talks Heat Up

Weekly Live Educational Webinars—Smart Money Backtesting Part III

In this week’s Smart Money webinar series, Ben and Roman ran another backtest, this time taking a closer look at the DOT/USDT market from the start of the year. They broke down key price movements, highlighted notable FVGs, and explored different trading setups.

In case you missed it, you can watch the recording here 👇

Bitcoin Now Top 5 Asset Globally!

Bitcoin just entered the top 5 most valuable assets in the world — overtaking Google, Silver, and Amazon!

📈 Market cap: $1.87T

📊 Now ranks behind only Gold, Apple, Microsoft, and Nvidia.

Leave your thoughts about this on X!

Technical Analysis Highlight

This week’s top technical analysis:

BITCOIN GOES BERSERK!

Massive breakout as $BTC obliterates our April 21 target – and goes beyond!

Volume’s fading... a retest is brewing!

Next moves could be explosive!

Let us know your opinions on Discord!

Test the Waters, Not Your Wallet: A Beginner’s Guide to Options Paper Trading

If you’ve been thinking about trading options, read this before you risk a dime.

Options can bring big rewards—or wipe you out faster than you can say “market volatility.” Before diving in, smart traders test the waters with paper trading.

You need to know how to practice high-stakes strategy with zero risk, what to look for in a paper trading platform, and how to build the skills that separate the lucky from the legendary.

The reason? Experience is cheaper when it’s simulated.

👉 Tap here to read more about options trading.

Tutorial: Build Reliable Crypto Signals with TradingView

Tired of drowning in charts and second-guessing every trade?

There’s a smarter way to read the market—without needing a PhD in Technical Overwhelm.

If you want to know how to turn crypto chaos into clarity using trading signals, we have a dedicated video tutorial. Altrady has TradingView integrated, which helps you:

✅ Automate your strategy

✅ Save time

✅ Trade like someone who meant to do that

That means no more guessing and no more screen-staring marathons. Just clear, actionable alerts that actually make sense.

Get all the details below:

Macro-Economic Update

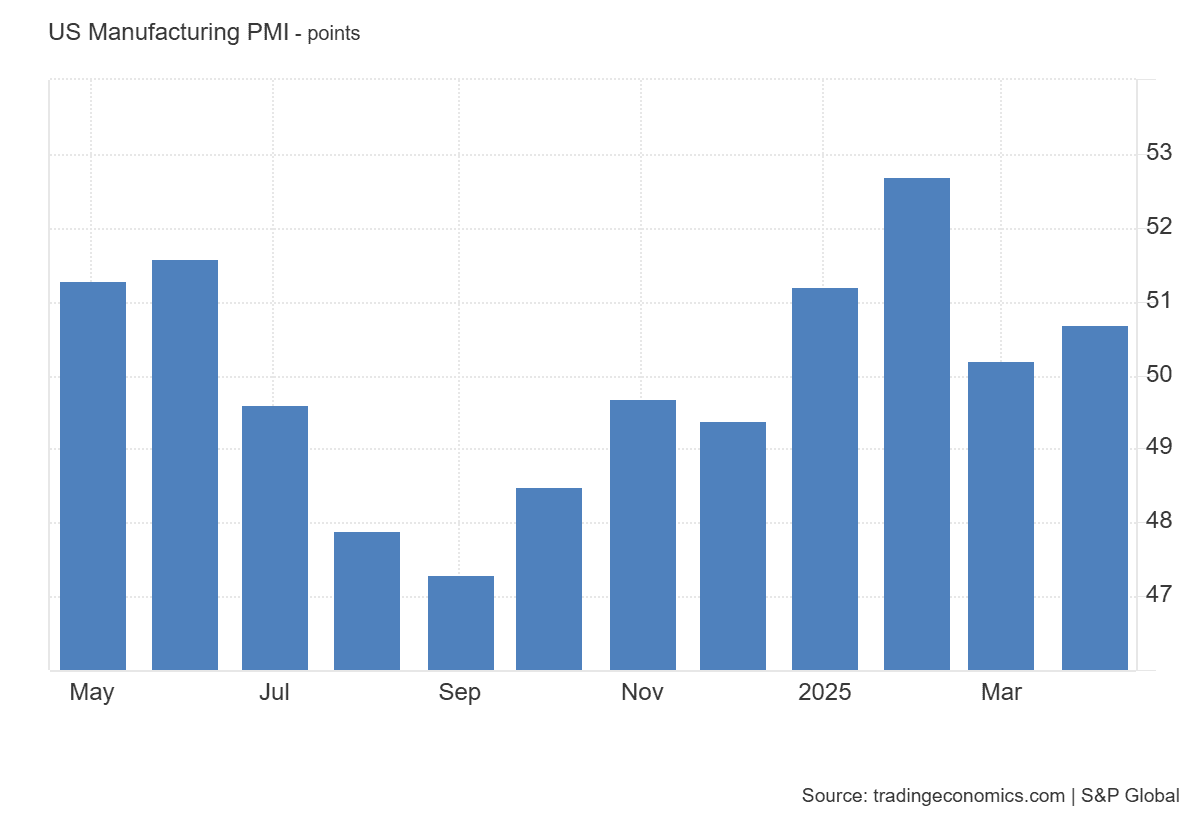

U.S. Manufacturing Shows Modest Growth, But Storm Clouds Loom

The S&P Global Manufacturing PMI hit 50.7 in April — beating expectations and marking a 4th month of expansion. Domestic orders rose slightly, but exports tumbled as tariffs and a weak dollar took their toll.

Jobs were cut for the first time since October, input costs surged, and inflation hit a 29-month high. Confidence? At its lowest since last August, with rising costs and weak global demand spooking businesses.

Event: Flash Manufacturing PMI

Date: 23/04/2025

Wallet Inflows & Outflows Weekly Report

Top 2 Cryptocurrencies (BTC, ETH)

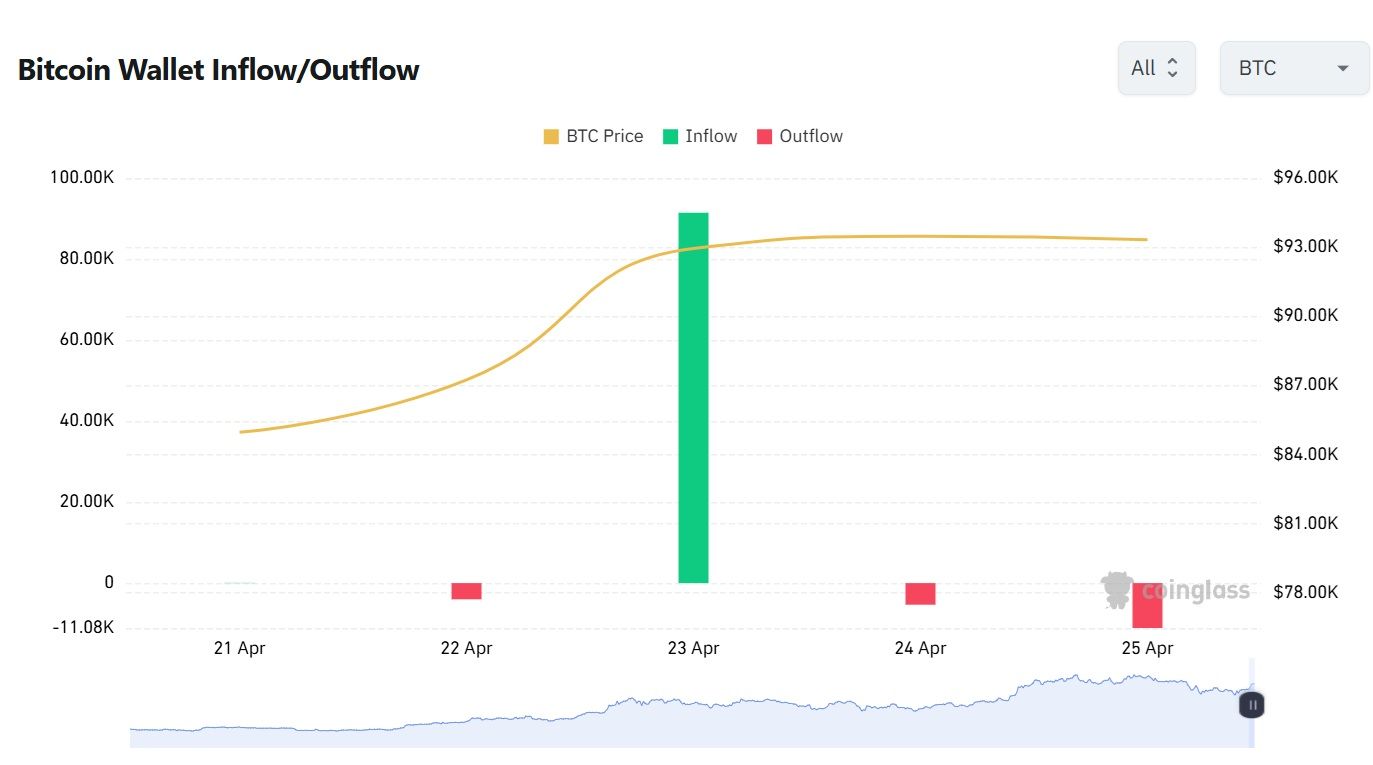

Explosive Week for Bitcoin & Ethereum Inflows – Big Money Is Back

This past week delivered one of the most explosive surges in capital inflows into major crypto wallets that we’ve seen in a long time.

Both Bitcoin and Ethereum recorded massive spikes in high-value wallet activity, signaling a strong wave of institutional or whale accumulation:

- Bitcoin: Over 91,000 BTC flowed into large wallets in just one single day

- Ethereum: Saw more than 550,000 ETH in daily inflows – a multi-month high

These inflows mark a renewed wave of confidence in the market. Big players are moving in again, and where the money goes, momentum often follows.

Economic Trends Affecting Crypto Markets

Trump, Wall Street & a $900M Crypto Bet – What Just Shook the Market

This week saw crypto collide with big finance and politics. SoftBank dropped nearly $900M into a new Bitcoin-focused firm backed by Tether and Bitfinex, while CME Group announced upcoming XRP futures, signaling deeper traditional market involvement.

Macroeconomic shifts like a weaker dollar and eased U.S.-China tensions boosted interest in digital assets. Meanwhile, Citi projected the stablecoin market could hit $4T in five years.

The wildest twist? Donald Trump invited top holders of his meme coin to a private dinner, proving once again that anything can happen in crypto.

Key Macroeconomic Insights

Crypto Surges as Global Trade Tensions Ease, China Beats GDP Expectations, and Japan–U.S. Trade Talks Heat Up

U.S. Tariff Twist Boosts Markets

The U.S. temporarily exempted smartphones and computers from the new 125% China import tariffs — a surprise move that sent equities and crypto climbing. Investors saw it as a sign of strategic flexibility amid rising trade tensions.

China’s Economy Holds Strong

Despite tariff pressure, China’s Q1 GDP grew 5.4% YoY, matching last quarter’s pace — the strongest growth since mid-2023 and beating expectations.

Japan–U.S. Trade Talks Heat Up

Japanese officials met with U.S. counterparts in Washington to discuss trade — and in a surprise move, President Trump personally joined the talks, signaling high-level urgency and commitment.

Thanks for reading!

If you enjoyed this, share with friends who might be interested—and you can also share on your socials.

Got questions or special requests? Don’t think twice—reach out! Our team’s got your back and is always here to help.

DISCLAIMER: None of this is financial advice. This newsletter is here to educate, not to tell you where to put your money. It’s not investment advice or a sales pitch—just solid info to help you think smarter. Always do your homework and research carefully!

In this post

- Weekly Live Educational Webinars—Smart Money Backtesting Part III

- Bitcoin Now Top 5 Asset Globally!

- Technical Analysis Highlight

- Test the Waters, Not Your Wallet: A Beginner’s Guide to Options Paper Trading

- Tutorial: Build Reliable Crypto Signals with TradingView

- Macro-Economic Update

- Wallet Inflows & Outflows Weekly Report

- Economic Trends Affecting Crypto Markets

- Key Macroeconomic Insights