.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

Insider Newsletter: BTC Could Become an Inflation Hedge & ADA Shows Signs of Breakout | 07-04-2025

Welcome to this week’s edition of our Insights Newsletter!

A summary of this week's highlights: The U.S. Senate passed Trump’s $3.3T “Big Beautiful Bill,” sparking inflation fears and boosting Bitcoin’s appeal as a hedge. ADA shows signs of a Q4 bottom, hinting at a potential breakout. Jobless rates fell, but the labor force shrank, pointing to mixed economic signals. Crypto whales moved heavily into BTC, while ETH activity stalled.

Globally, inflation is easing, growth is slowing, and the dollar continues to slide as the euro hits a 3-year high.

This week’s Smart Money series delivered live crypto market analysis, real-time backtesting, and a rapid scalping session where Ben and Raffa used Altrady’s Quick Scan to lock in profits and automate multiple trades.

Get all details below.

WHAT HAPPENED THIS WEEK

- Weekly Webinars: Smart Money series featured live analysis of key crypto indicators and a real-time backtesting session. Ben and Raffa also led a fast-paced scalping session using Altrady’s Quick Scan and showed how to strategically manage multiple trades.

- Breaking News of the Week: Senate Passes $3.3T “Big Beautiful Bill” — Bitcoin Poised as Inflation Hedge?

- Technical Analysis Highlight: ADA on the Brink, Final Q4 Bottom Before the Bull Run

- Crypto Trading Strategies: Cross vs Isolated Margin

- Tutorial: How Market Orders Work in Crypto

- Macro-Economic Update: U.S. Jobless Rate Drops Unexpectedly, But Labor Force Shrinks

- Wallet Inflows & Outflows Report: Crypto Whales Move Big on BTC, While ETH Freezes

- Economic Trends Affecting Crypto Markets: Rate Cuts Loom, Eurozone Inflation Falls, Solana Soars, Ripple Strikes UK Deal

- Key Macroeconomic Insights: Dollar Dips, Euro Soars as Markets Unshaken by Mideast Tensions

Weekly Live Educational Webinars—Smart Money Backtesting and Overview + Scalping Strategies

In this week's Smart Money webinar series, Ben and Roman backtested Solana on weekly and daily time frames, and showed how backtesting builds emotional resilience.

In case you missed it, you can watch the recording here 👇

On Wednesday, they took another deep dive into the crypto market and reviewed DOGE, ETH, LINK for potential trade opportunities.

Here’s more on their talk 👇

Thursday, Ben and Raffa ran a live scalping session using Altrady's Quick Scan, managing multiple entries, and showed how to manage your portfolio on high time frames. They also discussed BTC’s evolution.

For this one too, you can watch the recording here 👇

Breaking News

Senate Passes $3.3T “Big Beautiful Bill” — Bitcoin Poised as Inflation Hedge?

U.S. Senate passes Trump’s $3.3T “Big Beautiful Bill” in 51–50 vote. The sweeping tax-and-spending package now heads to the House.

Crypto markets steady, but Bitcoin could benefit as the bill adds $3T+ to the national debt, stoking long-term inflation fears.

BTC is seen as a hedge vs. fiat devaluation. All eyes are on the House vote.

👉Tell us what you think about this on X!

Technical Analysis Highlight

ADA on the Brink, Final Q4 Bottom Before the Bull Run?

Is this the final ADA Q4 bottom before a major breakout?

Bottoming structure forming...

Could this be the breakout the bulls have been waiting for?

👉Let us know your opinions on Discord!

Cross vs. Isolated Margin: Which Strategy Suits Your Trading Style?

Ready to level up your futures trading game?

Whether you're hedging like a pro or controlling risk with surgical precision, choosing between cross and isolated margin trading isn't just a detail—it’s your first strategic move.

In this post, we break down how leverage, liquidation, and position control work across both modes so you can decide your edge.

Don’t let confusion cost you capital—get the clarity that could define your next win.

👉 [Read more here about cross margin and isolated margin]

Tutorial: Instant Trades, Zero Delay: How Market Orders Work in Crypto

Speed matters in crypto trading, and market orders give you the velocity you need. In this quick-hit video tutorial, we break down how market orders help you buy or sell assets at lightning speed, executing at the best available price on the exchange.

- Perfect for fast-paced markets

- Ideal for grabbing breakout opportunities or cutting losses

- Learn how buyers meet ask prices and sellers hit bid prices instantly

Whether you’re chasing momentum or escaping volatility, mastering market orders is step one. Watch now and learn how to trade with confidence—even when seconds count.

Watch now!

Macro-Economic Update

U.S. Jobless Rate Drops Unexpectedly, But Labor Force Shrinks

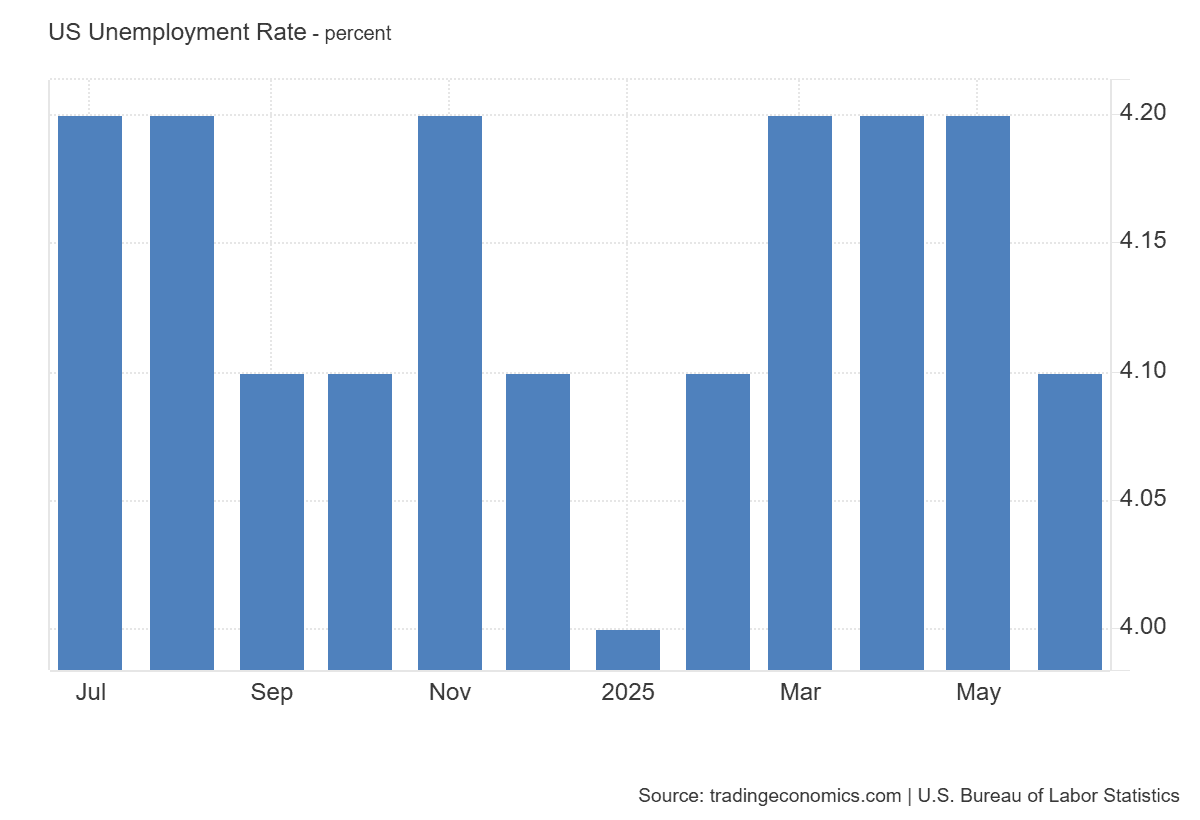

The U.S. unemployment rate dipped to 4.1% in June, beating forecasts of a rise to 4.3% and signaling continued labor market stability. However, the drop came as the labor force shrank by 130,000, pushing participation to 62.3%, its lowest since December 2022. While employment rose modestly (+93K) and the broader U-6 rate eased to 7.7%, the flat employment-population ratio (59.7%) highlights lingering weakness beneath the surface.

Event: US Unemployment Rate

Date: 03/07/2025

Wallet Inflows & Outflows Weekly Report

Top 2 Cryptocurrencies (BTC, ETH)

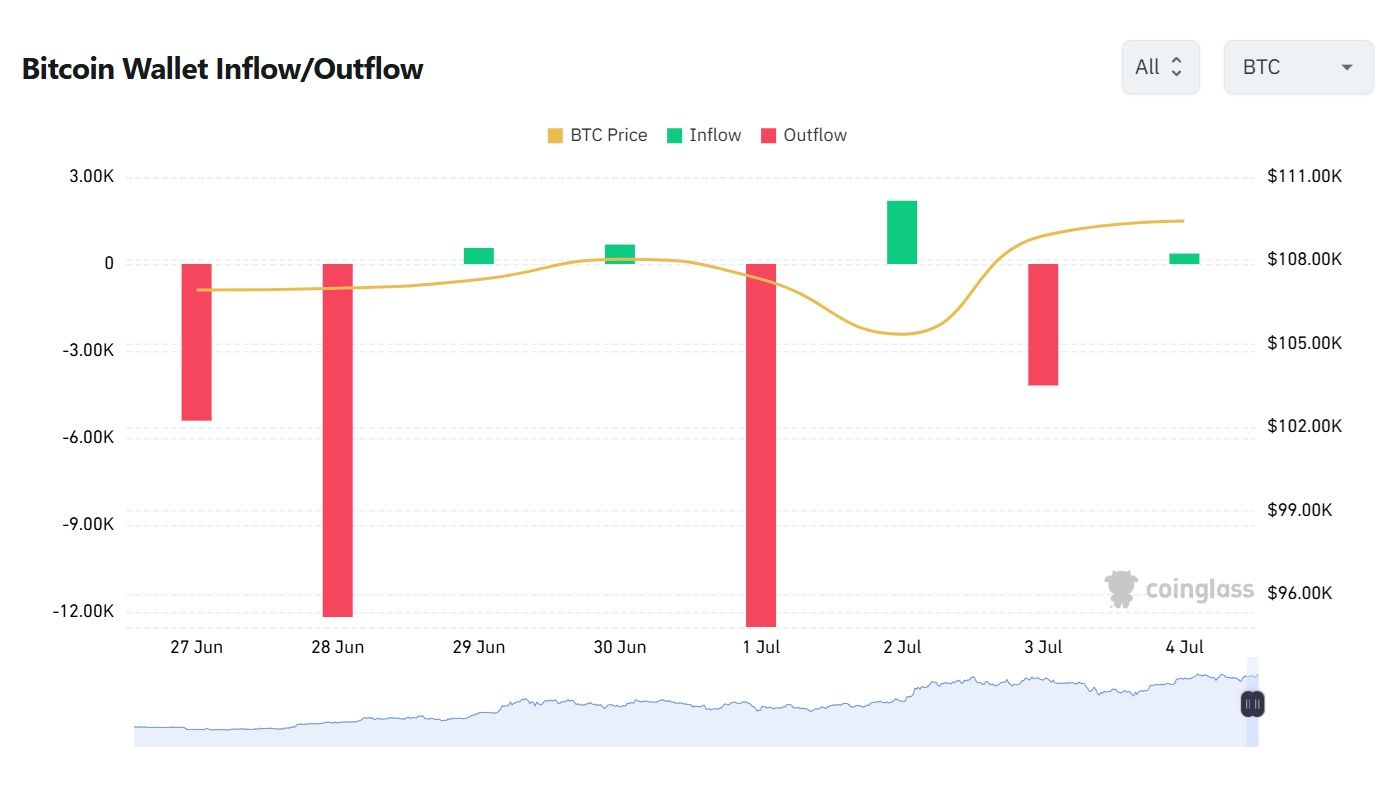

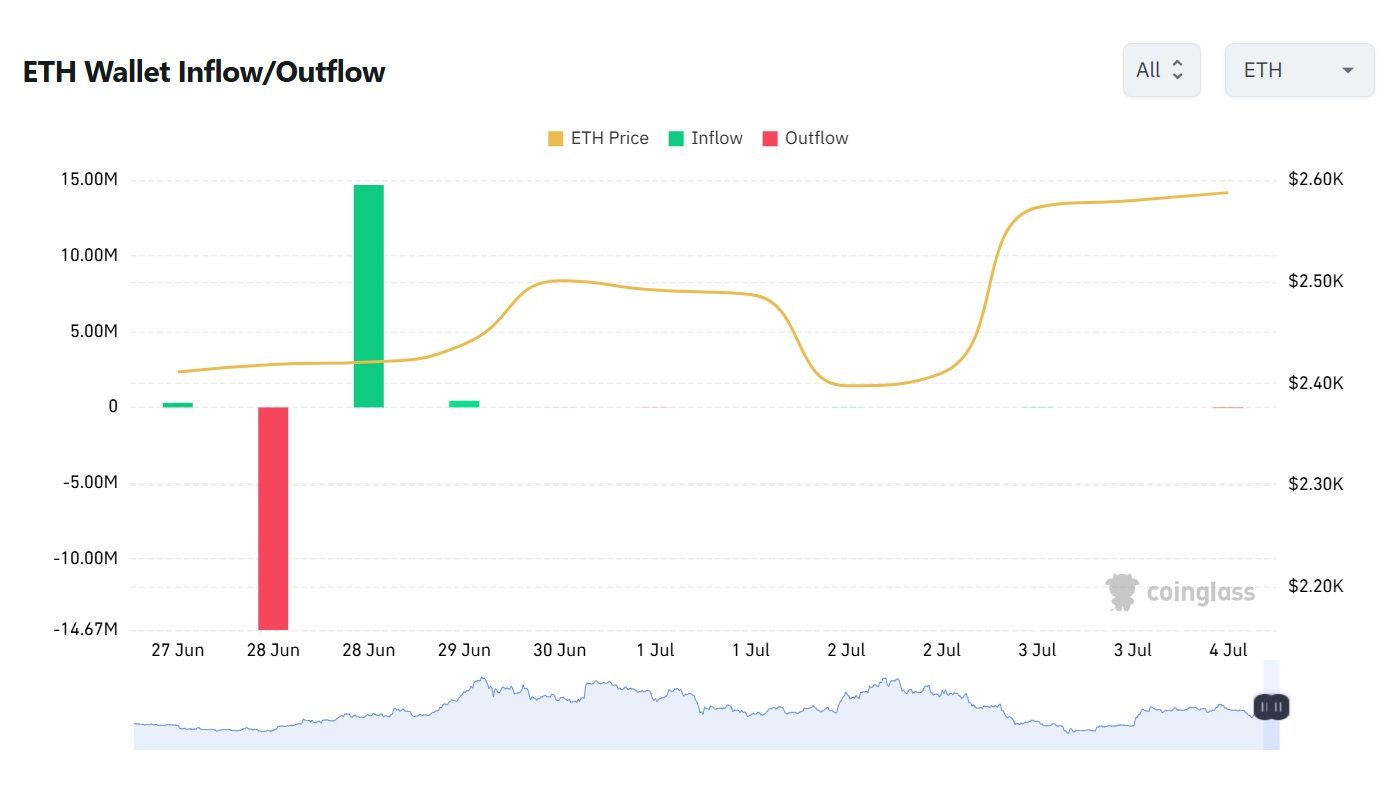

Crypto Whales Move Big on BTC, While ETH Freezes

A particularly tense week on the crypto whale front: Bitcoin saw heavy outflows with no signs of trend reversal, raising concerns among traders. In stark contrast, Ethereum flows flatlined, showing near-zero movement, as if the asset had frozen in place.

Economic Trends Affecting Crypto Markets

Rate Cuts Loom, Eurozone Inflation Falls, Solana Soars, Ripple Strikes UK Deal

Markets turned cautiously optimistic this week as Fed minutes signaled a likely rate cut by September, while Eurozone inflation dropped to 2.3%, reinforcing the case for continued monetary easing.

However, weak Chinese manufacturing data and sluggish global trade reminded investors of lingering growth concerns.

In the crypto space, Solana jumped over 15%, fueled by a spike in DeFi activity and renewed developer momentum. Meanwhile, Ripple made headlines with a major UK partnership, bolstering its position in real-world payments. Utility and ecosystem growth are emerging as key drivers, even as macro uncertainty persists.

Key Macroeconomic Insights

Dollar Dips, Euro Soars as Markets Unshaken by Mideast Tensions

The US dollar continued to weaken, with the euro hitting its highest level since 2021 amid rising concerns over US fiscal policy, soft economic data, and Fed independence. The dollar has dropped over 10% this year, its worst start since 1973.

Meanwhile, despite ongoing Israel-Iran tensions, markets remain steady as the conflict has yet to spill over regionally, keeping oil prices and risk sentiment relatively stable.

Thanks for reading!

If you enjoyed this, share with friends who might be interested—and you can also share on your socials.

Got questions or special requests? Don’t think twice—reach out! Our team’s got your back and is always here to help.

DISCLAIMER: None of this is financial advice. This newsletter is here to educate, not to tell you where to put your money. It’s not investment advice or a sales pitch—just solid info to help you think smarter. Always do your homework and research carefully!