.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

Insider Newsletter: BTC Breaks Records while ETH Eyes A Gas Limit Cap | 07-11-2025

Welcome to this week’s edition of our Insights Newsletter!

A summary of this week's highlights: Bitcoin hit fresh all-time highs driven by institutional demand, ETF inflows, and favorable policy shifts. Ethereum grabbed attention with a major gas limit overhaul, while macro data showed falling jobless claims but slowing hiring.

Wallet flows stayed quiet as crypto continued to rise amid growing volatility and shifting global regulation.

This week’s backtesting webinar focused on LINK, recognizing the Impulse-Correction Pattern and spotting FVGs. During the scalping session, Ben and Raffa managed to get 6 wins using Altrady’s Quick Scanner.

Get all details below.

WHAT HAPPENED THIS WEEK

- Weekly Webinars: A real-time backtesting session focusing on LINK coin, while Ben and Raffa also led a fast-paced scalping session using Altrady’s Quick Scan, where they got 6 wins and 3 losses in 1 hour.

- Breaking News of the Week: Ethereum Overhauls Gas Limits with Massive 2²⁴ Cap

- Technical Analysis Highlight: Bitcoin Breakout Confirmed! Fresh All-Time Highs Just Hit the Charts!

- Crypto Trading Strategies: Simple Orders & How to Use Them

- Tutorial: How to Calculate Crypto Profits Easier

- Macro-Economic Update: U.S. Jobless Claims Drop Again, but Hiring Slows

- Wallet Inflows & Outflows Report: BTC and ETH Flows Stay Quiet

- Economic Trends Affecting Crypto Markets: Bitcoin Breaks Records as Institutional Demand, Policy Shifts, and Crypto's Dual Role in a Volatile Market

- Key Macroeconomic Insights: U.S. Jobs Data, Fed & Global Regulation Fuel Crypto Rally

Weekly Live Educational Webinars—Smart Money Backtesting + Scalping Strategies

In this week's Smart Money webinar series, Ben and Roman backtested LINK, showing how to enter Fair Value Gap trades with caution. Plus, find out why split targets are recommended for better wins.

In case you missed it, you can watch the recording here 👇

Thursday, Ben and Raffa ran a live scalping session using Altrady's Quick Scan, introducing a new strategy, combining Stop Loss and a risk ratio setup. Plus, they enjoyed some nice trades with quick wins.

For this one too, you can watch the recording here 👇

Breaking News

Ethereum sets a per-transaction gas cap at 16,777,216 (2²⁴) — a major protocol upgrade!

Why it matters?

- Prevents oversized txs from monopolizing block space

- Reduces DoS attack risks

- Enhances zkVM & parallel execution support

- Brings cost predictability & smoother scaling

This change ensures no single tx can exceed this gas limit, securing the network without stifling complex DeFi or dApp operations.

A key step in Ethereum's evolution: more stable, more efficient, more secure.

👉Leave your thoughts about this on X!

Technical Analysis Highlight

BTC Breakout Confirmed!

New highs just printed.

Are we finally on the launchpad ready to FLY? New all-time highs. $BTC at $116K!

You’ve seen it everywhere. But here’s the real question: Is this the breakout that reignites bullish momentum?

👉Let us know your opinions on Discord!

Simple Order Types: All You Need to Know

Should you hit ‘Market’ or play it slow with ‘Limit’?

Every order type tells a different story, and traders use them strategically. Rapid-fire market orders can spike volatility, but savvy traders know how to time their entries during trend reversals.

This blog dives into the hidden influence of the multiple types of orders and how they shape market moves.

👉 [Read more here about order types]

Tutorial: Crypto Profits, Zero Headaches – Meet the Smarter Way with Altrady

Still guessing when to sell your crypto? Let’s fix that.

Discover how Altrady’s Break-Even Calculator can sharpen your trading game in this quick video tutorial.

Learn to calculate profits accurately, factor in fees, and avoid the costly mistake of selling too late. It’s time to trade smarter and grow with confidence.

Watch now!

Macro-Economic Update

Key Data This Week:

U.S. Jobless Claims Drop Again, but Hiring Slows

U.S. initial jobless claims fell to 227K in early July — the lowest in 7 weeks and below forecasts. It’s the fourth straight decline, pointing to a still-resilient labor market.

But continuing claims rose to 1.965M, the highest since 2021, hinting that hiring may be cooling. Federal employee claims, after DOGE layoffs, edged down to 438.

Takeaway: Fewer layoffs, but hiring momentum could be fading.

Event: US Initial Jobless Claims

Date: 10/07/2025

Wallet Inflows & Outflows Weekly Report

Top 2 Cryptocurrencies (BTC, ETH)

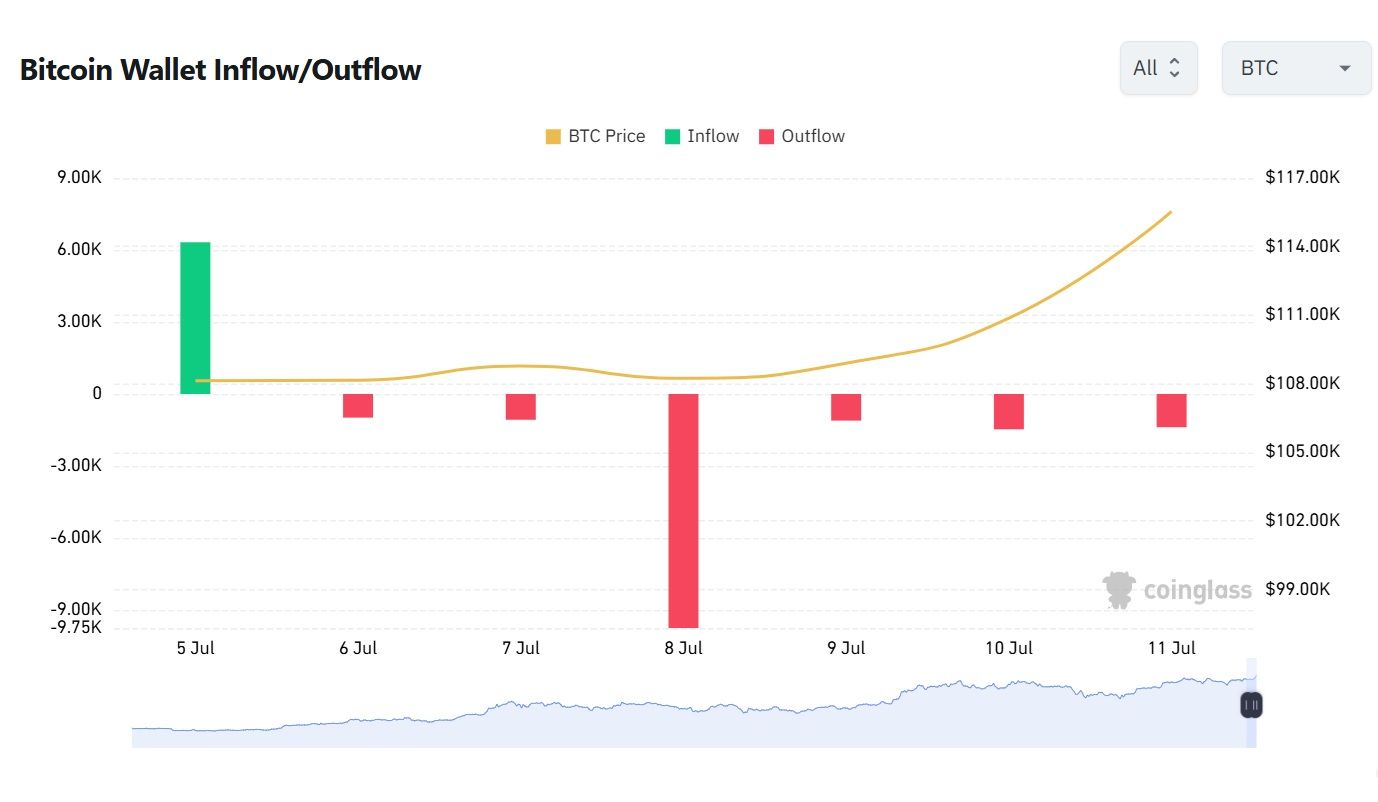

BTC and ETH Flows Stay Quiet

The past week has been notably flat in terms of crypto inflows and outflows.

Bitcoin didn’t show any significant movement, aside from a small spike on July 8 that was largely offset by the one on July 5, a sign of market indecision.

Ethereum, meanwhile, remains steady. Net flows are nearly unchanged but continue to lean positive, extending its recent streak of green inflows and hinting at quiet accumulation.

Takeaway: Low activity overall, but ETH is still drawing interest.

Economic Trends Affecting Crypto Markets

Crypto Soars as Bitcoin Hits $116K Amid Policy Shifts and Macro Tailwinds

Crypto markets surged as Bitcoin hit fresh all-time highs near $116K, fueled by institutional demand, growing ETF inflows, and favorable U.S. policy momentum.

Strong U.S. jobs data and a weaker dollar added macro tailwinds, while continuing jobless claims raised questions about hiring strength.

Ethereum held steady amid regulatory optimism, as the U.S. advanced bipartisan crypto legislation and global players like China and India hinted at policy shifts.

With volatility rising from trade tensions and regulatory developments, crypto is increasingly viewed as both a risk asset and a hedge.

Key Macroeconomic Insights

Tariffs, Jobs, and Fed Uncertainty as Key Macroeconomic Signals Rock Global Markets

This week’s economic landscape was dominated by rising trade tensions and central bank caution, as the U.S. flirted with new reciprocal tariffs while the Fed delayed rate cuts due to inflationary pressures from tariff uncertainty.

Robust job gains of 147K and a drop in unemployment to 4.1% underscored labor market strength, yet mixed business surveys signaled uneven growth that complicates the Fed's policy path.

In Europe, record highs in the FTSE 100 clashed with rising eurozone unemployment (6.3%) and tepid inflation, highlighting market optimism amid mounting global risks.

Meanwhile, U.S. yields climbed as rate-cut expectations diminished ahead of the release of FOMC minutes. With major tariffs, labor, and monetary policy data converging, markets face heightened volatility and divergent regional dynamics.

Thanks for reading!

If you enjoyed this, share with friends who might be interested—and you can also share on your socials.

Got questions or special requests? Don’t think twice—reach out! Our team’s got your back and is always here to help.

DISCLAIMER: None of this is financial advice. This newsletter is here to educate, not to tell you where to put your money. It’s not investment advice or a sales pitch—just solid info to help you think smarter. Always do your homework and research carefully!