.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

Insider Newsletter: US Banks Allow Custody Over Crypto & XRP Sees All Time High | 07-18-2025

Welcome to this week’s edition of our Insights Newsletter!

A summary of this week's highlights: U.S. regulators greenlit banks to custody crypto, paving the way for institutional adoption.

Meanwhile, $XRP gained momentum and is eyeing new all-time highs, while Bitcoin saw sharp volatility with inflows followed by a major outflow. Ethereum posted its 12th straight week of positive inflows. U.S. inflation dropped to 2.7%, and the passing of the GENIUS Act is expected to reduce rates, fueling potential crypto market momentum.

This week, we hosted just one webinar with Cata and Raffa, where they tested out new coins, like FIS, ZEN, or ACH.

Get all details below.

WHAT HAPPENED THIS WEEK

- Weekly Webinars: Cata and Raffa led a fast-paced scalping session using Altrady’s Quick Scan, rapidly scanning fresh coins and experimenting with sharp, tactical setups.

- Breaking News of the Week: U.S. Regulators Greenlight Banks to Custody Crypto

- Technical Analysis Highlight: Watch Out, $XRP is Gaining Momentum and Eyeing New All-Time Highs

- Crypto Trading Strategies: What Exactly Is Spot Trading

- Tutorial: How to Correctly Interpret Bollinger Bands

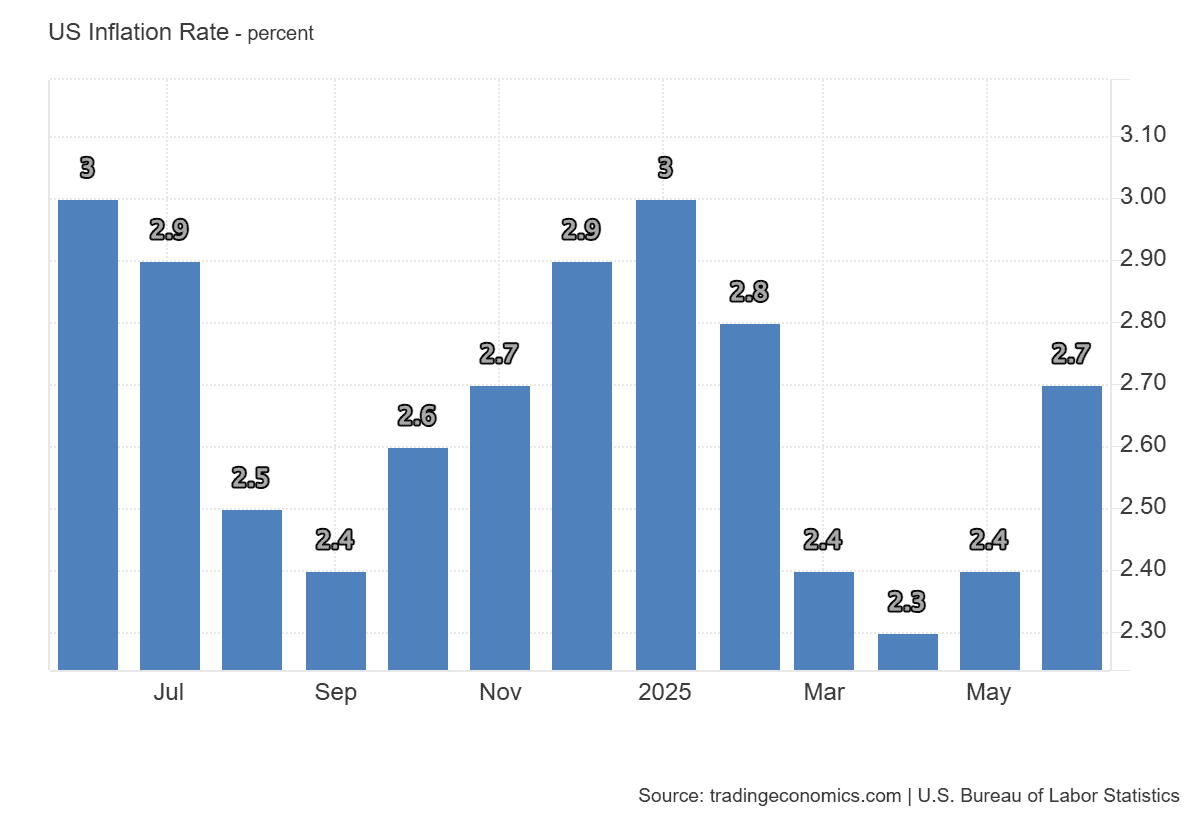

- Macro-Economic Update: U.S. Inflation Hits 2.7% in June

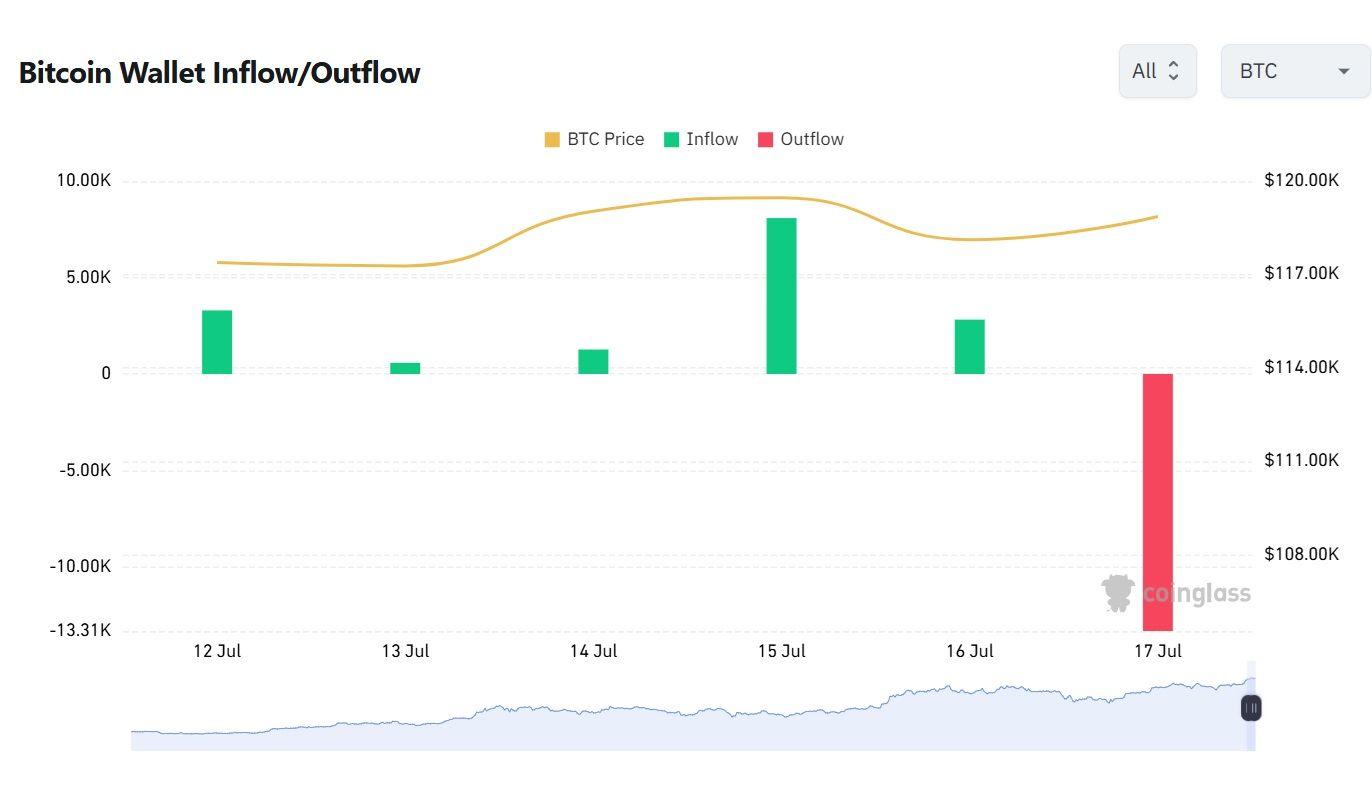

- Wallet Inflows & Outflows Report: Bitcoin's Sharp Reversal and Ethereum's Strongest Week Yet

- Economic Trends Affecting Crypto Markets: GENIUS Act Passes, Rates to Drop and Momentum Surge as Crypto Rally

- Key Macroeconomic Insights: Tariff Battles, China’s Slowdown, and Surging US Retail Sales

Weekly Live Educational Webinars—New Scalping Strategies

Yesterday, Cata and Raffa ran a live scalping session using Altrady's Quick Scan, introducing new strategies and testing new coins, and managing to lock in nice profit targets.

You can watch the recording here 👇

Breaking News

Major U.S. regulators — the OCC, FDIC, and Federal Reserve — have officially confirmed they can now hold crypto assets on behalf of their customers.

This unified stance brings long-awaited clarity to the crypto, TradFi relationship.

For the first time, these agencies explicitly permit banks to hold crypto, but under strict conditions:

- Banks must retain full control of private keys

- Customers can’t directly access or self-custody their assets

- Institutions are fully responsible as custodians

To safeguard users, banks must also:

- Maintain cybersecurity protocols

- Conduct regular audits

- Ensure compliance with all financial and crypto-specific regulations

It’s crypto custody, with serious guardrails. This marks a significant shift in the federal approach to digital assets.

While past efforts were fragmented, today’s joint statement signals broader regulatory support for integrating crypto into the traditional banking system.

Notably, the SEC didn’t join the statement, but echoed similar views in January.

Crypto is entering a new regulatory phase in the U.S., where banks can participate, as long as they play by the rules.

👉Leave your thoughts about this on X!

Technical Analysis Highlight

$XRP is A Dark Horse Charging Toward New All-Time Highs!

While other Altcoins sleep on it, XRP is quietly positioning itself for a breakout.

- Regulatory clarity

- Ecosystem growth

- Whale activity

Are you watching the race or riding the horse?

👉Let us know your opinions on Discord!

What is Spot Trading & How it Works

Have you ever wondered why spot trading is the go-to for most beginners?

This fast-paced, no-leverage trading style is built for simplicity and long-term strategy. Think instant exchanges, real ownership, and a safer way to grow your stack.

Curious if it's the right move for you?

👉 [Read the full guide on the basics of spot trading]

Tutorial: Stop Misreading Bollinger Bands

Bollinger Bands aren’t magic, but they can give you a serious edge if you know how to use them right. Too many traders panic at every touch or break. Don’t be one of them.

In this quick video, you’ll learn:

🔹 What Bollinger Bands really tell you

🔹 How to avoid common mistakes

🔹 Smart combos with RSI, MAs & more

Watch now!

Macro-Economic Update

U.S. Inflation Hits 2.7% in June, Driven by Food and Transport Costs

U.S. inflation rose to 2.7% in June 2025, the highest since February and up from 2.4% in May, matching forecasts. Price increases were seen in food (3.0%), transportation services (3.4%), and used vehicles (2.8%), while energy costs declined more slowly (-0.8%), with gasoline and fuel oil still down but natural gas remaining high (14.2%).

Shelter (3.8%) and new vehicle (0.2%) inflation eased slightly. Monthly CPI rose 0.3%, the biggest jump in five months, while core inflation edged up to 2.9% annually and 0.2% monthly - both below expectations.

Event: US. CPI y/y

Date: 18/07/2025

Wallet Inflows & Outflows Weekly Report

Top 2 Cryptocurrencies (BTC, ETH)

Bitcoin's Sharp Reversal and Ethereum's Strongest Week Yet

This week stood out for unusual Bitcoin and Ethereum wallet flows:

Bitcoin saw consecutive daily inflows to large wallets early in the week, only to end Thursday with a sharp outflow spike that erased nearly all net inflows, leaving weekly totals roughly neutral.

Meanwhile, Ethereum remained subdued until a dramatic Tuesday inflow surge locked in a 12th straight week of net positive flows, marking one of its strongest weeks yet .

Economic Trends Affecting Crypto Markets

GENIUS Act Passes, Rates to Drop, Momentum Surge as Crypto Rally

The U.S. passed the GENIUS Act, bringing landmark legislation for stablecoins, backed reserves, AML compliance, and institutional clarity, which have boosted confidence in dollar-pegged coins.

Meanwhile, the Bill debate extended into “Crypto Week”, with the Clarity Act and Anti-CBDC provisions fueling Bitcoin’s surge past $120K–$123K.

Deutsche Bank notes that such clarity, alongside heavy ETF inflows, is helping crypto integrate more deeply into traditional finance.

On the macro side, Fed Governor Waller called for a rate cut amid cooling economic indicators, a dovish tone that supported risk assets after the U.S. CPI print of 2.7% briefly jolted markets.

Ethereum also benefited from the stablecoin boom (many built on ETH) and broader infrastructure tailwinds.

In short: legislation + central bank pivot + institutional flows = a bullish cocktail fueling crypto momentum mid-July.

Key Macroeconomic Insights

Tariff Battles, China’s Slowdown, and Surging US Retail Sales

Geopolitical and macroeconomic factors are impacting the market: Europe’s new 10% tariff on certain goods is causing ripple effects across global trade, while China's GDP growth for Q2 2025 was slightly below expectations at 5.1%, raising concerns about slower growth in the world's second-largest economy.

Meanwhile, US retail sales came in stronger than expected, signaling a robust consumer sector despite inflationary pressures.

As regulatory scrutiny intensifies, particularly with European crypto platform regulations, and institutional interest continues to rise, the outlook for digital assets remains a mix of cautious optimism and volatility.

Thanks for reading!

If you enjoyed this, share with friends who might be interested—and you can also share on your socials.

Got questions or special requests? Don’t think twice—reach out! Our team’s got your back and is always here to help.

DISCLAIMER: None of this is financial advice. This newsletter is here to educate, not to tell you where to put your money. It’s not investment advice or a sales pitch—just solid info to help you think smarter. Always do your homework and research carefully!