Chapters

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

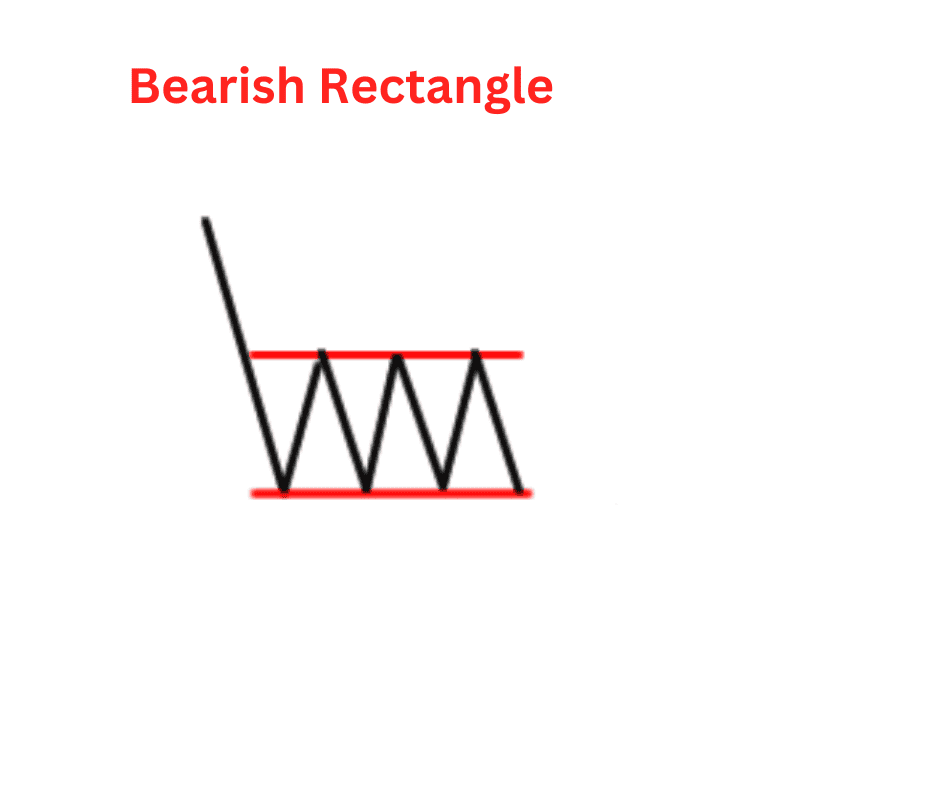

The Bearish Rectangle Pattern in Crypto Trading

Picture this: Bitcoin tanks hard, then suddenly stalls, bouncing between two price levels like it’s stuck in a holding pen. Most new traders see sideways action and get bored or overconfident.

Experienced traders, though, know this boxy formation often signals that the bears are just catching their breath before the next move down. That’s because they spotted the bearish rectangle chart pattern – not the kind of setup that screams for attention, but when it shows up, it often means trouble is brewing.

If you can spot it early and play it right, the bearish rectangle can be a serious profit tool in your trading arsenal.

What Is the Bearish Rectangle Pattern?

Crypto prices don’t just shoot straight up or down; they move in waves. And sometimes, after a strong move lower, the market seems to pause, bouncing between two price levels like it’s stuck in a box. That “box” is what traders call a bearish rectangle.

In simple terms, a bearish rectangle is a continuation pattern. The trend was bearish before the rectangle formed, and the pattern usually signals that the bearish trend will continue after the sideways chop is over. Think of it like the market catching its breath before continuing the marathon downhill.

It’s called rectangle because the price gets trapped between a horizontal resistance (the ceiling) and a horizontal support (the floor), creating a rectangle shape when you draw lines across the highs and lows.

Spotting this pattern early can be a way to ride the next leg of the downtrend instead of getting faked out by temporary sideways action.

How to Recognize It

Recognizing a bearish rectangle isn’t rocket science, but you need to know the pieces that make it up:

The Downtrend Before It

The bearish rectangle is a continuation pattern, which means you need a clear bearish move before the rectangle begins. If you don’t see the downtrend first, it could just be a random sideways range.

Two Horizontal Levels

- Resistance (top line): The upper boundary where price keeps getting rejected.

- Support (bottom line): The lower boundary where price keeps bouncing back up.

These levels should be fairly clean and tested at least twice each. The more touches, the more legit the rectangle.

The Range

Inside the rectangle, price bounces like a ping pong ball between support and resistance. The volume usually shrinks during this sideways phase, showing the market is in a holding pattern.

The Breakout

The real action happens when the price finally breaks down through the support level. That’s the signal traders look for to jump back into short positions or sell off holdings.

Quick Visual Breakdown

Step 1: Market dumps hard.

Step 2: Price moves sideways in a box.

Step 3: Price eventually cracks through the bottom.

Step 4: Bears keep control, and the downtrend continues.

Pros and Cons of the Bearish Rectangle Pattern

Pros

- Clear structure: The rectangle is easy to spot once you know what to look for. It’s not as subjective as some other patterns.

- Logical setup: The continuation idea makes sense: bearish momentum pauses, then continues.

- Defined risk: The resistance level provides a natural place to set a stop-loss if you’re trading the breakout.

- Works in volatile markets: Crypto’s wild swings actually make rectangles easier to see and trade than in slower markets.

Cons

- False breakouts: Crypto is notorious for fakeouts. Price might dip below support, then snap right back up, trapping shorts.

- Patience required: The sideways chop can take a while, testing your discipline.

- Not always bearish: Sometimes the rectangle breaks upward instead, flipping the pattern on its head.

- Volume confirmation is tricky: Volume analysis in crypto is less reliable than in traditional markets since not all exchanges report volume accurately.

How to Interpret the Bearish Rectangle

So, you’ve spotted a bearish rectangle. What’s next? The key is to interpret it within the bigger picture.

Wait for the Breakout, Don’t Guess

The market could break either way while it’s inside the rectangle. Guessing is gambling. The higher-probability play is to wait until price actually breaks support.

Measure the Target

A common way to estimate where the price could go after the breakout is by measuring the height of the rectangle (distance between support and resistance) and subtracting that from the breakout point.

Example: If resistance is at $20,000 and support is at $18,000, the rectangle height is $2,000. If price breaks support at $18,000, the target would be $16,000.

Watch Volume on the Breakout

A strong breakout usually comes with a surge in volume. If price drifts below support without volume backing it, it could be a trap.

Check the Bigger Trend

The bearish rectangle works best when the overall market trend is already down. In a bull market, a rectangle might just be consolidation before another push higher.

Trading Strategies Using The Bearish Rectangle Pattern

1. The Classic Breakout Short

Setup: Wait for price to break below support.

Entry: Enter a short trade on the breakout candle or just below support.

Stop-Loss: Place your stop slightly above the rectangle’s resistance.

Target: Use the measured move (rectangle height) to set your profit target.

This is the bread-and-butter way to trade a bearish rectangle. Simple and effective if you’re patient.

2. Retest Entry

Crypto loves to retest broken levels. Instead of jumping in right on the breakout:

- Setup: Wait for price to break below support.

- Entry: Enter short when price comes back up and retests the old support (now resistance).

- Stop-Loss: Place stop above the retest high.

- Target: Same measured move rule applies.

This method reduces false breakout risk but might mean missing the trade if no retest happens.

3. Intra-Rectangle Scalping

Some traders like to scalp while the rectangle is forming:

- Setup: Trade the range itself while waiting for the breakout.

- Entry: Buy near support, sell near resistance, rinse and repeat.

- Risk: This is risky if the breakout happens suddenly, but it can pay off in long, drawn-out rectangles.

4. Combining Indicators

Add extra layers of confirmation:

RSI/Momentum: Overbought signals near resistance strengthen the bearish case.

Moving Averages: If price is under key moving averages (like the 50 or 200 EMA), the bearish rectangle is more reliable.

Volume Spikes: Look for higher-than-normal sell volume at the breakdown.

5. Long-Term HODL Adjustments

Even if you’re not actively trading, bearish rectangles can be a warning to long-term holders. If you spot one on a higher time frame (daily or weekly), it might be time to trim exposure or hedge with options/futures.

Real-World Example in Crypto

Let’s take a hypothetical example:

Bitcoin dumps from $25,000 to $20,000.

After the drop, it chops between $20,000 (resistance) and $18,000 (support) for three weeks. Traders see this rectangle forming.

Finally, BTC breaks down below $18,000 with strong volume. Using the measured move ($2,000), the target is $16,000.

This kind of setup shows up all the time in crypto, especially after big news-driven selloffs when the market needs to “cool off” before deciding its next leg.

Bottom Line

The bearish rectangle is one of those patterns that looks simple on the chart but can be powerful when used correctly. It’s all about patience, discipline, and context. In crypto, where fakeouts are common and volatility is king, rectangles can give traders a structured way to navigate the chaos.

Summing up, it’s better you don’t rush into trades while the price is still bouncing inside the box. Wait for confirmation, manage your risk, and use the rectangle as one piece of the bigger puzzle. No pattern is a guarantee, but when you combine rectangles with sound risk management and broader trend analysis, they can be a reliable weapon in your trading arsenal.